Want to be a money master? Find the simple monthly budget template excel free to help! Track your spending, set savings goals, and take charge of your money with over 10 different templates to choose from.”

What is a Monthly Budget Template?

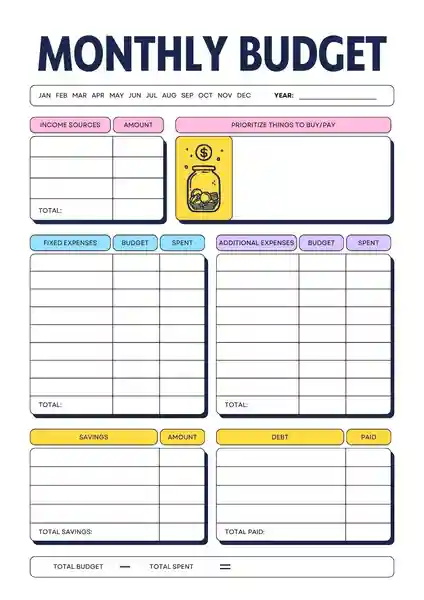

A monthly budget template is a special sheet in Excel that helps you track how much money you earn, how much you spend, and how much you save. It’s like a money diary that keeps all your money secrets safe and helps you make smart choices.

“Think of a monthly budget template like a special Excel sheet that shows you where your money goes. It’s a secret money diary that helps you make smart choices!”

What should included in the Monthly Budget?

Your Monthly Budget should include:

1. Income

- Primary Income: This is your main source of income, typically from a job or business.

- Secondary Income: Any additional income you receive, such as from a part-time job, freelancing, or side gigs.

- Passive Income: Money earned from investments, rental properties, or other sources that don’t require active work.

- Gifts or Windfalls: Occasional income, like gifts, tax returns, or lottery winnings.

2. Fixed Expenses

- Housing: Mortgage or rent payments.

- Utilities: Fixed monthly payments for services like electricity, water, gas, and internet.

- Insurance: Payments for health, car, life, or home insurance.

- Loan Payments: Regular payments for loans such as student loans, car loans, or personal loans.

- Subscriptions and Memberships: Recurring costs for services like streaming platforms, gym memberships, or clubs.

3. Variable Expenses

- Groceries: Money spent on food and household supplies.

- Transportation: Costs associated with commuting, including gas, public transportation fares, parking fees, and maintenance.

- Entertainment and Leisure: Spending on movies, dining out, hobbies, and other recreational activities.

- Healthcare: Out-of-pocket expenses for doctor visits, medications, and any unplanned medical expenses.

- Personal Spending: Money spent on clothing, personal care items, and other miscellaneous expenses.

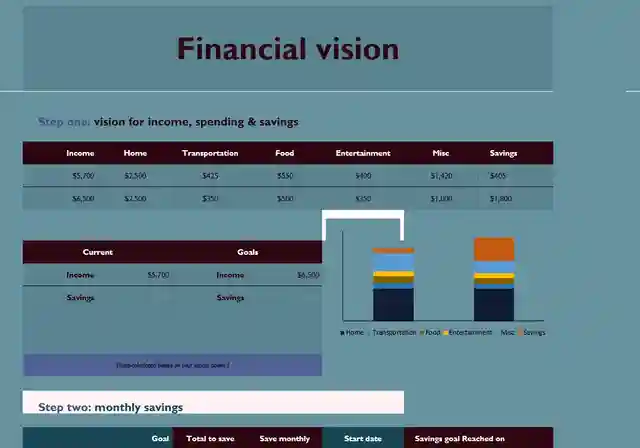

4. Savings

- Emergency Fund: Savings for unexpected expenses, like car repairs or medical emergencies.

- Retirement Savings: Contributions to retirement accounts such as a 401(k), IRA, or other pension plans.

- Specific Goals: Savings for short-term or long-term goals, including vacations, home improvements, or large purchases.

- Investments: Money set aside to invest in stocks, bonds, mutual funds, or other investment vehicles.

5. Miscellaneous/Unexpected Expenses

- Gifts and Donations: Spending on gifts for birthdays, holidays, and donations to charities.

- Unexpected Expenses: Unplanned costs that don’t fit into the above categories.

Why Use Simple Monthly Budget Template Excel Free?

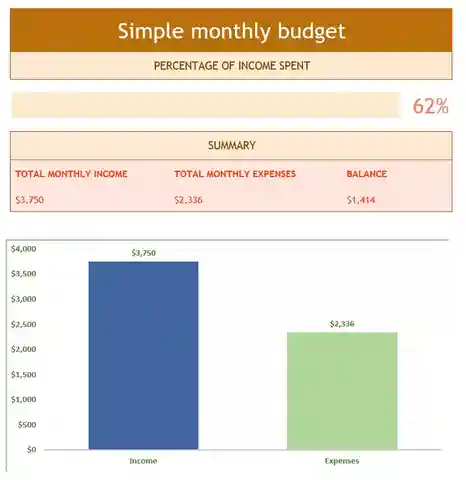

A monthly budget template is like a treasure map for your money. It helps you see where your money goes and how you can be smarter. Here’s why to use it:

Understanding How You Spend

- Keep Track of Every Dollar: This shows how much monthly money you use. You might be surprised how much goes to snacks, games, or fun outings.

- Notice Spending Habits: You might find out you spend more on certain days, like weekends. Knowing this helps you think about how to use your money better.

Planning and Controlling Your Money

- Set Spending Limits: After seeing where your money goes, you can decide how much to spend on different things.

- Change Plans as Needed: If you spend too much in one area, you can spend less there and maybe more elsewhere.

Saving More Money

- Stop Spending on Unneeded Things: When you look at your spending, you can find things you don’t need to spend money on, like apps you don’t use or things you buy just because.

- Grow Your Savings: The money you don’t spend on those unneeded things can go into your savings. This can add up and help you save for something big or have a safety net.

Making Your Money Goals Happen

- Make Goals: With a budget, you can plan for things you want, like a new toy, a cool trip, or school savings.

- Choose Wisely: Having a budget means you think more about how you use your money. It helps you choose between spending it now or saving for something later.

A monthly budget template excel free helps you see your money in a new way. It’s like having superpowers for saving and spending!

How to Make a Monthly Budget in Excel

Making a monthly budget template excel free is like creating a money plan on your computer or tablet. Here’s how you can do it step by step:

1. Start Excel

- Open Excel: First, open Excel on your computer or tablet.

2. Make a New Sheet

- Create a New Sheet: Click on ‘New’ and pick a blank sheet to start fresh.

3. Name Your Columns

You need places to write down different types of money stuff:

- Income: This is the money you get, like from chores, birthday money, or small jobs.

- Expenses: This is the money you spend on fun stuff, snacks, or toys.

- Savings: This is money you keep safe for big things you want later or just in case.

4. Add Your Money Details

- Fill in Your Numbers: Write down how much money you get and how much you spend in each part.

5. Do the Math

- Calculate: Let Excel add up your money, what you spend, and show you how much you can save.

6. Check If You’re Spending Too Much

- Adjust: If you see you’re spending a lot, think about how you can spend less.

7. Finding a Budget Sheet for Free

- Free Download: You can find free budget sheets online that are ready to use. Download one, open it in Excel, and start planning your money!

Printable Simple Monthly Budget Template Excel Free

Finding a Printable Monthly Budget Template Excel Free

You can find free budget sheets online that are ready to use. With so many Monthly Budget Template Excel Free resources online, you’re sure to find one that suits your style and needs. Download one, open it in Excel, and start planning your money!

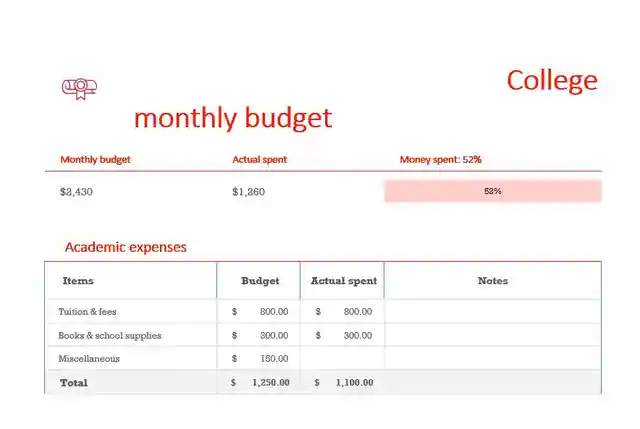

How to Start Using a Monthly Budget Template

Choose from 10+ Monthly Budget Template Excel Free designs and start tracking! Here’s a step-by-step guide to help you begin:

Download a Template from a Reliable Source

- Find the Right Template: Look for a budget template that suits your needs.

- Choose a Reliable Source: Download your template from a reputable website to ensure it’s safe and virus-free.

Open the Template in Excel

- Launch Excel: Once you have downloaded your template, open Excel.

- Open the Template: Go to the ‘File’ menu, select ‘Open’, and navigate where you saved your downloaded template. Double-click the file to open it in Excel.

Customize It

- Personalize Your Categories: Your budget should reflect your unique financial situation. Customize the categories to match your specific income sources (like jobs, side gigs, or allowances) and expenses.

- Add or Remove Categories: If the template doesn’t fit your requirements, you can add new categories or remove ones that don’t apply to you. This might include adding a category for savings goals or debt payments.

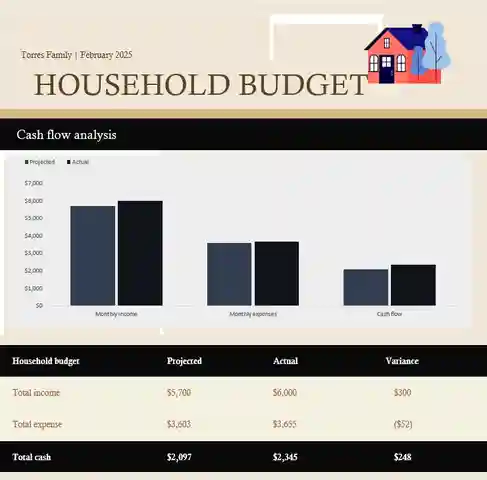

Fill in Your Monthly Income and Expenses to Start Tracking

- Enter Your Income: Enter all your monthly income sources in the designated area.

- Log Your Expenses: Fill in your expenses under the appropriate categories. It’s helpful to refer to bank statements or receipts to ensure accuracy.

- Update Regularly: Your budget is a living document. Update it as you spend and as new income comes in.

Tips for Success

- Review and Adjust Monthly: Review your budget at the end of each month to see how well you stuck to it.

- Set Up Alerts: Consider setting reminders to update your budget regularly. Consistency is key to successful budget management.

The Best Way to Save Money Using a Monthly Budget Template

Saving money is a crucial aspect of financial health and achieving your long-term goals. A monthly budget template excel free can be a powerful ally in this journey. Here’s how to maximize its potential for savings:

Track Your Spending Closely

- Record Every Expense: The first step to saving money is knowing where it goes. Keep a detailed record of every purchase, no matter how small.

- Review Regularly: Make it a habit to review your spending at least once a week.

Identify Areas Where You Can Cut Back

- Analyze Your Spending: Once you have a few weeks or a month’s worth of data, analyze where your money is going. Look for patterns or categories where your spending is higher than expected.

- Find Alternatives: For high spending areas, look for ways to cut back. This could mean opting for more affordable entertainment options, using public transportation instead of driving, or cooking at home more often instead of eating out.

Set Savings Goals

- Be Specific: Determine what you’re saving for, whether it’s an emergency fund, a vacation, retirement, or a big purchase.

- Make It Measurable: Assign a dollar amount to each goal and a timeline for achieving it.

Stick to Your Budget as Closely as Possible

- Prioritize Your Spending: Understand the difference between wants and needs. Always cover your needs first (housing, food, utilities, etc.) and then evaluate how much of your remaining budget can go towards wants.

- Adjust as Necessary: Life is unpredictable, and sometimes expenses arise that you hadn’t planned for. When this happens, adjust your budget accordingly. If you overspend in one category, try to under-spend in another to compensate.

- Use Tools and Resources: Utilize the features of Excel to set up alerts for when you’re nearing your budget limits in any category. Explore apps or tools that can sync with your budget template to automate some of the tracking.

Updating Your Monthly Budget

Maintaining an up-to-date Monthly Budget is crucial for effective financial management. Here’s a deeper look into why and how often you should update your budget:

When to Update Your Budget

- Every Month: At least once every month, take a look at your budget.

- After You Spend: If you spend a lot on something big, update your budget right away.

- Every Week: Checking your budget every week is a smart idea. It helps you fix any money mistakes before they get big.

Making Changes to Your Budget

- When You Make More or Less Money: If you start making more money (like getting a raise) or less money (maybe fewer work hours), change your budget to show this.

- Surprise Costs: Sometimes, things happen that we don’t expect, like needing to fix something that broke. If this happens, it’s okay to change your budget to help pay for it.

- Big Life Stuff: When big things happen in your life (like moving to a new place, getting married, or having a baby), your money needs will change. Make sure your budget changes too.

Using a Monthly Budget Template with Irregular Income

Managing a budget with an irregular income presents unique challenges but is entirely possible with a bit of planning:

Estimating Average Income

- Calculate Average Income: Look at your income from the past six months to a year. Calculate the average to get a baseline for your monthly budget. This approach gives you a starting point, even if your income fluctuates.

- Adjust Monthly: Since your income is irregular, revisit this average each month. Update it based on your most recent earnings to keep your budget aligned with your actual financial situation.

Tracking Income and Expenses More Frequently

- Weekly or Bi-Weekly Tracking: This frequent check-in allows you to adjust your spending in real-time, based on how much you’ve earned so far.

- Flexible Spending Categories: Create flexible spending categories within your budget.

Building a Buffer

- Emergency Fund: An essential strategy for irregular income is building a robust emergency fund. Aim to save enough to cover several months of living expenses. This fund acts as a buffer during leaner months, ensuring you can cover your basics without dipping into debt.

Conclusion

Creating a simple monthly budget template excel free is a smart move. It helps you keep track of your money, make better spending decisions, and save up for things that matter.

“Ready to take control of your finances? Choose from simple Monthly Budget Template Excel Free options and start your money mastery journey today!

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.