Free Risk Analysis Template – Running a project or an activity means you will have the risk to face, especially when you run a business. You should know that every step you take in your business obviously has risks you should take into account. Before taking a step, a calculation of potential risk should be done in order to avoid or at least minimize the loss you may have. That is why risk analysis will help you to calculate that thing. However, you need to know some things first before making a risk analysis.

Internal Factors

Risk analysis does not only involve the potential risks for your business but also involve the impact of the risks to your business or project. The analysis can be both in qualitative or quantitative. There several internal and external factors you should put into your analysis. For internal factors, the example of the potential risks is the number of people who handle the project.

If the people who handle the project are too much though the task seems quite easy, it will lead to conflict in the regarding the task. In addition, there may be people who work hard while the rest will do nothing because of the poor organization. The other example of the risk is having not enough participant for your project. Having too many people in a project is a bad thing, the same goes for having not enough people. The lack of participant in a project means the person assigned the project will work harder.

External Factors

You can easily identify the internal factors as well as controlling them in project management. However, identifying external factors will be harder. In some cases, external factors can be predictable and unpredictable. Therefore, you still have to account for the external factors since they will still impact your business.

You can identify the external factors by conducting researches and accessing information. While listing them down, you also have to record the probability of the impact of each external factor you have found.

Doing this, you can make your analysis based on what you have found in your research. Inflation, social changes, environmental changes are things you should take into account for. After knowing what you should put into your analysis, you can find a template to help you conduct the analysis. It also can be a guide to make sure that you have not missed anything in your analysis.

Risk Analysis Methods

Risk analysis can be performed using various methods, each offering a unique perspective and focus. Here’s a closer look at some of the most commonly used methods:

SWOT Analysis

The SWOT analysis is a strategic planning tool for Strengths, Weaknesses, Opportunities, and Threats. It’s designed to help organizations understand their internal and external environments and formulate strategies accordingly.

- Strengths: These internal attributes give an organization an advantage over others. They could include strong brand recognition, a dedicated team, proprietary technology, or a robust distribution network. Recognizing these strengths allows a business to leverage them to their full potential.

- Weaknesses: Internal factors might hinder an organization’s performance or growth. They could include needing more expertise, limited resources, poor location, or outdated technology. Identifying these weaknesses gives a business a chance to address them and improve.

- Opportunities: These are external factors that an organization could exploit to its advantage. They could include things like market growth, a competitor’s misstep, technological advancements, or changes in the regulatory environment. Spotting these opportunities can help a business to expand, diversify, or gain a competitive edge.

- Threats: These are external factors that could negatively impact an organization. They could include new competitors, changing consumer behavior, economic downturn, or new regulations. Awareness of these threats enables businesses to mitigate risks and prepare for potential challenges.

Organizations can comprehensively understand their current position and their growth potential. It helps them build on their strengths, rectify their weaknesses, seize opportunities, and guard against threats, aiding in strategic decision-making and planning.

PESTLE Analysis

This method helps companies determine possible options and dangers from these external factors.

- Political: This guides the result of an institution’s government policies, laws, and political strength. It could contain tax policies, trade restrictions, or political reforms. Understanding the political environment helps companies anticipate changes affecting their functions or market position.

- Economic: This involves examining the economic situations that affect an institution’s performance. Aspects could include economic development, inflation, exchange, or unemployment. Understanding the economic environment can help businesses plan for economic shifts and manage economic risks.

- Sociocultural: This examines the societal and cultural aspects affecting demand for an institution’s services. It could include aspects like demographics, buyer perspectives, or lifestyle. Comprehending the sociocultural environment can assist corporations in tailoring their offerings to meet changing buyer needs and preferences.

- Technological: This guides the impact of technical progress and creation on an institution. It could include emerging technologies, R&D activity, or technology incentives. Maintaining up with the technology can help businesses remain competitive and seize new possibilities.

- Legal: This involves the impact of regulations and restrictions on an association. It could contain employment laws, health and protection laws, or data security regulations. Understanding the legal environment can help businesses ensure compliance and avoid legal issues.

- Environmental: This concerns the environmental aspects that can affect an institution. It could include climate change concerns or waste disposal laws. Understanding the conditions can assist companies in enhancing their sustainability practices and responding to environmental challenges.

Businesses can achieve a comprehensive knowledge of the macro-environment in which they operate. It can assist them in determining possible opportunities and dangers, informing their strategic planning, and ensuring their business is aligned with external factors.

Scenario Analysis

Scenario analysis is a strategic planning method allowing organizations to explore and prepare for multiple scenarios.

It involves creating detailed narratives about different ways a situation could unfold, each based on assumptions. The aim is to examine potential impacts and outcomes under various circumstances.

Here’s a closer look at how scenario analysis works:

- Identifying Scenarios: These scenarios cover a range of possibilities, from the most likely to the most extreme. They could be established on factors such as differences in demand, technological advancements, shifts in consumer behavior, or regulatory changes.

- Developing Narratives: the next step is to develop a clear narrative for each. This narrative should describe how the scenario could unfold, what events would lead, and the outcomes.

- Analyzing Impacts and Outcomes: This could interest setting the monetary implications, the impact on operations, or the strategic options and threats that could arise.

- Planning and Preparation: It could involve preventing negative outcomes, preparing contingency plans, or identifying actions that could exploit potential opportunities.

Risk Analysis Tools

Risk analysis tools are instrumental in streamlining the process, making it more efficient and effective. These tools range from sophisticated software solutions to simple templates with unique features and benefits.

- RiskLens: This is a comprehensive risk quantification and management platform. It uses the Factor Analysis of Information Risk (FAIR) model to quantify cyber risk in financial terms. It’s particularly useful for businesses looking to understand their cybersecurity risks and make data-driven decisions on risk management.

- Palisade’s @RISK: This is risk analysis and simulation software for Microsoft Excel. It uses Monte Carlo simulation to show possible outcomes in a spreadsheet and allows for risk assessment and decision-making under uncertainty. It’s widely used across industries for risk assessment and modeling.

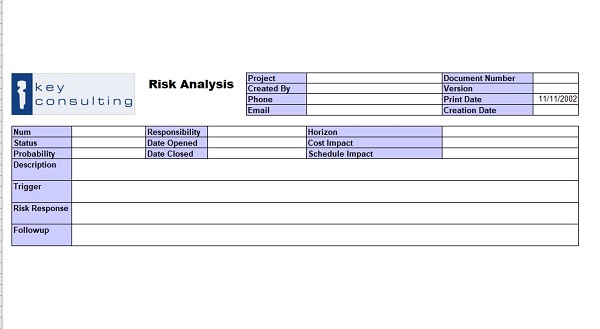

- Microsoft Excel Templates: For those looking for a more straightforward and cost-effective solution, Microsoft Excel offers various risk analysis templates. These templates provide a structured format for conducting and documenting. They can be customized to suit the specific needs of a project or business. While they lack the advanced features of dedicated risk analysis software, they can be a good starting point for small businesses or simple projects.

- Risk Matrix: A risk matrix is a simple tool used to assess the level of risk by considering the likelihood of an event occurring and the severity of its potential impact. It’s a visual tool that can help teams understand and prioritize risks.

- Bowtie Analysis: This risk evaluation method visualizes complex risks understandably and comprehensively. It visualizes and manages health, safety, and environmental risks.

Each tool has strengths and is best suited to different risk analysis tasks. The choice of tool depends on the complexity of the risk analysis, the resources available, and the specific needs of the business or project.

The Role of Risk Analysis in Decision Making

It plays a pivotal role in the decision-making process within any organization. Businesses can make informed decisions considering the potential outcomes by identifying risks and assessing their possible impact.

Here’s how risk analysis informs decision-making:

- Informed Risk Assessment: Provides a structured way to identify and assess potential risks. This process involves evaluating the likelihood of each risk and its potential impact. The results of this assessment can then inform decisions about whether to proceed with a project, what resources to allocate, and what mitigation strategies to implement.

- Strategic Planning: The insights gained from risk analysis can be instrumental in strategic planning. By understanding the potential risks associated with various strategic options, decision-makers can choose the strategies that best balance potential rewards with acceptable levels of risk.

- Risk Mitigation: Once potential risks have been identified and assessed, businesses can develop plans to mitigate those risks. It might involve reducing the likelihood of a risk, planning responses to potential risks, or allocating resources to manage risks.

- Enhanced Communication: It can also enhance communication within an organization. By documenting potential risks and discussing them openly, all stakeholders can have a shared understanding of the risks involved in a project or decision. It can lead to more effective collaboration and decision-making.

It is a tool that aids in making decisions that are not only informed but also strategic, ensuring that potential risks are considered and managed effectively.

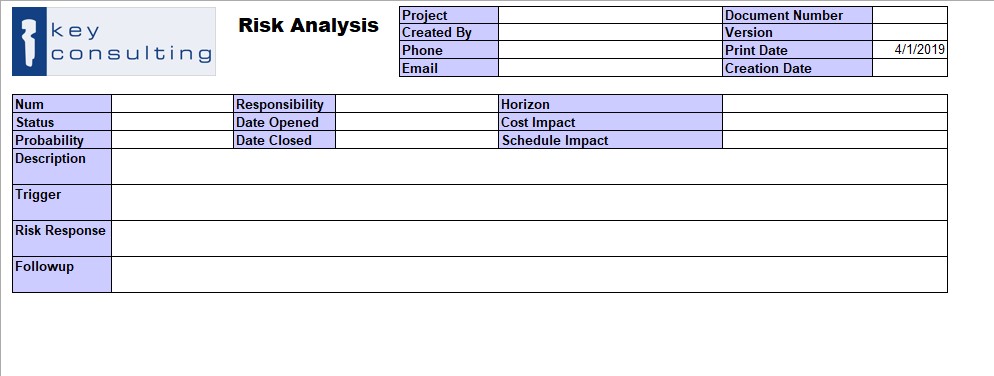

Risk Analysis Template

- Risk Analysis Template Excel: Excel templates for risk analysis can be quite detailed, allowing for inputting a wide range of data, including risk description, probability, impact, mitigation strategies, and more. These templates often include formulas that automatically calculate risk levels based on the input data.

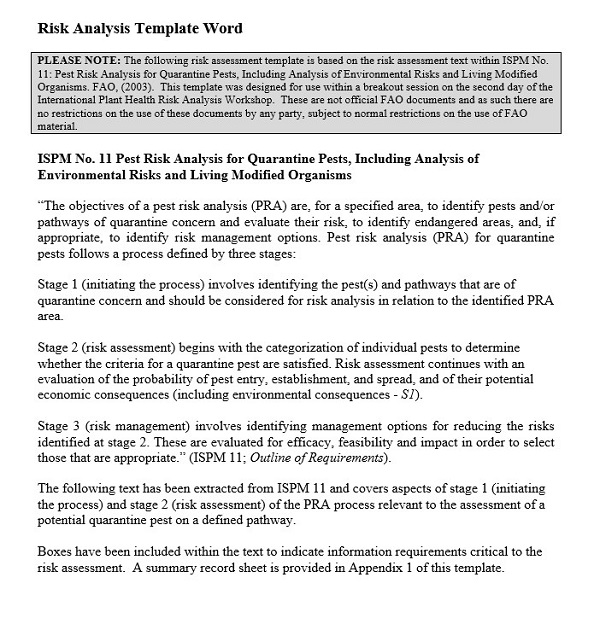

- Risk Analysis Template Word: typically more narrative and may be used to describe risks and their mitigation strategies more qualitatively. These templates may include sections describing the risk, potential effect, and intended reaction.

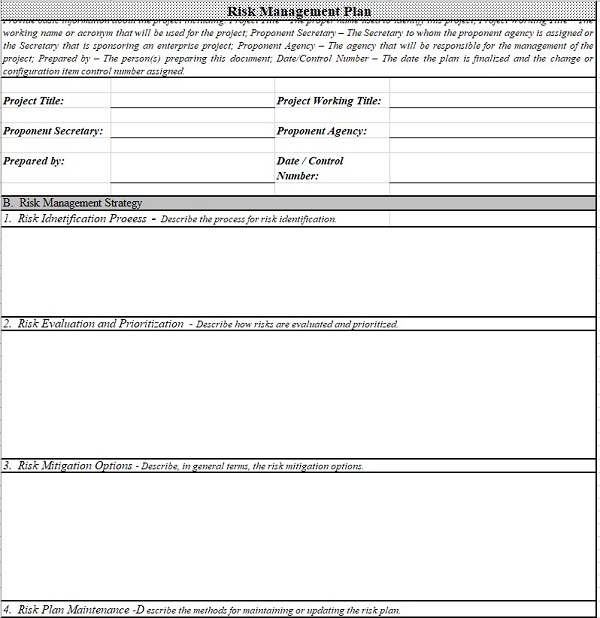

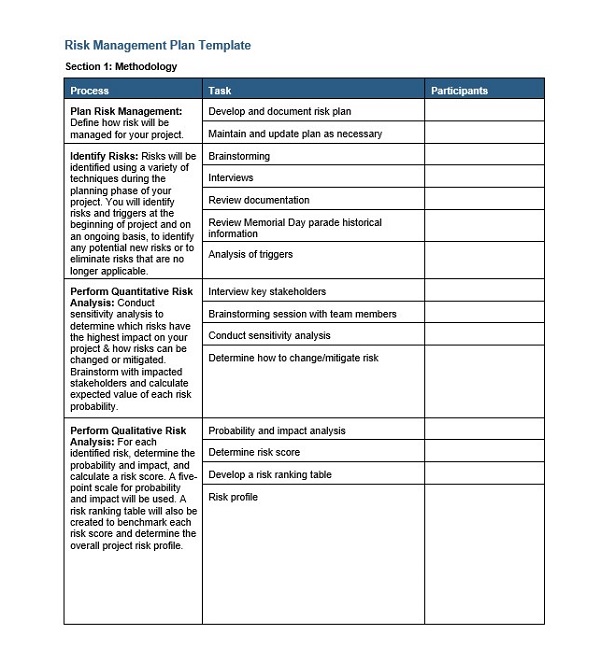

- Risk Analysis Template Project Management: It is used to determine and evaluate potential threats to the project.

- Risk Analysis Template Excel Free: Free Excel templates are available for risk analysis. While less comprehensive than paid versions, these templates can still provide a useful framework for identifying and assessing risks.

- Risk Analysis Template Free: Free risk analysis templates, available in various formats, can provide a cost-effective way for businesses to incorporate risk analysis into their processes. These templates may include only some of the features of paid versions, but they can still be a useful starting point.

- Risk Analysis Template PPT: PowerPoint templates for risk analysis can be useful for presenting risk analysis results to stakeholders. These templates can include slides describing identified risks, their possible effects, and suggested relief techniques.

- Risk Analysis Template Medical Device: This template is designed for the medical device industry. It helps determine and evaluate the associated with developing and using medical devices, considering product functionality, user safety, and regulatory compliance.

- Risk Analysis Template HIPAA: This template is used to conduct risk analyses in compliance with the Health Insurance Portability and Accountability Act (HIPAA). It allows healthcare institutions to determine and control risks to the privacy and protection of covered health information.

- Risk Analysis Template for Business: Any company can utilize this general-purpose business risk analysis template to determine and evaluate possible risks. It typically includes sections describing the risk, considering its possible impact and probability, and preparing risk mitigation techniques.

- Project Risk Analysis Template: This template identifies and assesses risks affecting a specific project. It allows project managers to prepare for issues impacting project timelines, budgets, or outcomes.

- Business Risk Analysis Template: This template identifies and assesses risks that could affect a business’s operations or profitability. It may also include sections for strategic planning and risk mitigation.

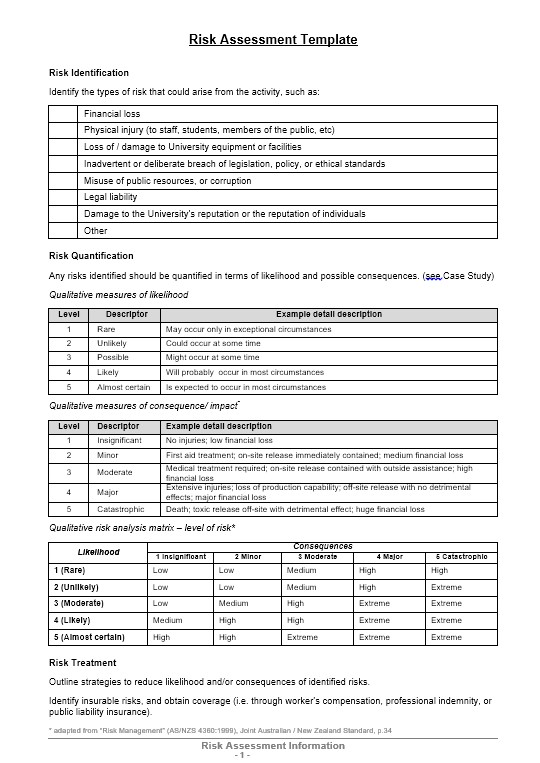

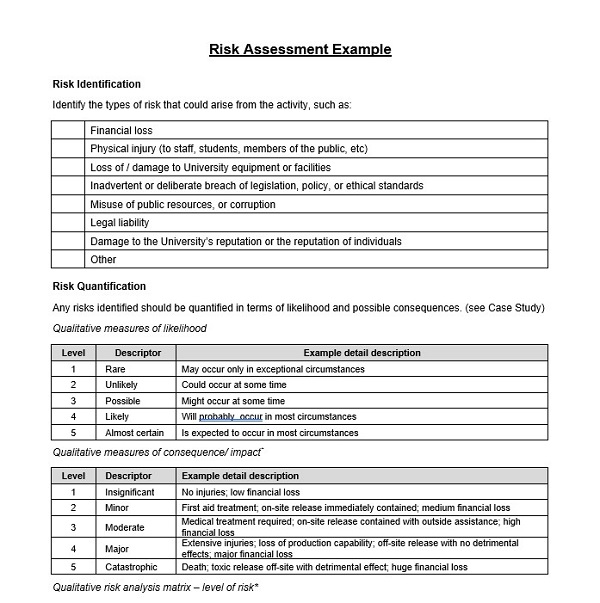

- Qualitative Risk Analysis Template: This template is used for qualitative risk analysis, which involves assessing risks based on their potential impact and likelihood without using numerical measures. This type of analysis can be useful when numerical data is not available.

- Cost Benefit-Risk Analysis Template: This template is used for cost-benefit risk analysis. This analysis involves comparing a decision or action’s potential costs and benefits while considering the associated risks.

- Benefit-Risk Analysis Template: This template is used to conduct a benefit-risk analysis, which involves comparing an action’s or decision’s benefits against its potential risks. It can help decision-makers understand the trade-offs involved and make more informed decisions.

- Quantitative Risk Analysis Template: This template is used for quantitative risk analysis, which involves using numerical measures to assess the potential impact and likelihood of risks. This type of analysis can provide more precise risk estimates but requires reliable numerical data.

- Hazard Risk Analysis Template: This template is designed for identifying and assessing hazards that could pose risks to health, safety, or the environment. It is often used in manufacturing, construction, and chemical processing industries.

- Product Risk Analysis Template: This template identifies and assesses risks associated with a specific product. It could include product development, manufacturing, distribution, and use risks. The goal is identifying potential product quality, safety, or performance issues.

- Safety Risk Analysis Template: This template is used to identify and assess risks to safety in a particular context. It could include workplace safety, product safety, or public safety. The template helps organizations identify potential safety hazards, assess their potential impact and likelihood, and plan appropriate safety measures.

- Risk Gap Analysis Template: This template is used to identify gaps between current risk management practices and desired or required practices. It can help organizations identify areas to improve their risk management efforts.

- Risk Reward Analysis Template: This template assesses the potential rewards of a decision or action against the potential risks. It can help organizations make decisions that balance risk and reward effectively.

- Risk Assessment Analysis Template: This template is used to conduct a comprehensive risk assessment. It can help organizations identify potential risks, assess their impact and likelihood, and plan appropriate mitigation strategies.

- Risk Impact Analysis Template: This template assesses the potential impact of identified risks. It can help organizations understand the potential consequences of risks and prioritize their risk management efforts.

- Risk Assessment Gap Analysis Template: This template determines gaps in an organization’s risk assessment practices. It can support associations in improving their ability to determine and evaluate possible threats.

- Risk and Opportunity Analysis Template: This template is employed to determine and consider both risks and opportunities. It can enable organizations to balance the need to mitigate risks with the possible uses of pursuing opportunities.

- Risk Scenario Analysis Template: This template makes and analyzes different risk scenarios. It can assist organizations in preparing for possible outcomes and making flexible risk management strategies.

While templates provide a useful starting point, they should be customized to fit each business or project’s needs and context.

Benefits of Using a Risk Analysis Template

Templates can be an invaluable tool for any organization. It provides a structured format for identifying and assessing potential risks, making the process more efficient and thorough. Here are some key benefits:

- Consistency: Using a template ensures that risk analysis is conducted consistently across different projects or decisions. It can make it easier to compare risks and make informed decisions.

- Efficiency: A template can streamline the risk analysis, saving time and resources. It provides a clear framework for identifying and assessing risks, reducing the likelihood of overlooking important factors.

- Comprehensiveness: A well-designed template will guide you to consider all relevant aspects of risk, from the likelihood of occurrence to the potential impact. It can help ensure that your risk analysis is comprehensive and accurate.

- Documentation: Using a template can also help with documentation. It records the risk analysis process and findings, which can be important for audit purposes or future reference.

- Learning and Improvement: Over time can help organizations learn and improve their risk management processes. It can highlight areas where the organization’s risk analysis is strong or where there might be room for improvement.

It promotes consistency, efficiency, comprehensiveness, and learning, which can contribute to more effective risk management.

Risk Analysis in Different Industries

It is a universal tool that can be applied across various industries. Each sector faces unique risks, and risk analysis can help identify and mitigate these risks. Here’s how risk analysis is used in different industries:

- Healthcare: In the healthcare industry, risk analysis can be used to identify potential risks to patient safety and develop strategies to mitigate these risks. It could include risks related to medical errors, patient data privacy, or the spread of infectious diseases.

- Finance: Financial institutions use risk analysis to assess the potential risks of different investments or lending decisions. It could include market risks, credit risks, or operational risks. Risk analysis helps these institutions make informed decisions and manage their risk exposure.

- Manufacturing: In the manufacturing sector, risk analysis can be used to identify potential risks to production processes or supply chains. It could include risks related to equipment failure, supply chain disruptions, or quality control issues.

- Technology: It often focuses on cybersecurity risks in the tech industry. Companies can use risk analysis to identify vulnerabilities in their systems and develop strategies to protect against cyber threats.

- Construction: Construction companies use risk analysis to identify potential risks associated with different projects, such as safety risks, project delays, or cost overruns. Risk analysis helps these companies plan their projects more effectively and manage potential risks.

Risk analysis provides a structured way to identify and assess potential risks in these industries. By understanding these risks, businesses can develop mitigation strategies and make more informed decisions.

Common Mistakes

Conducting a risk analysis is a critical process for any business. However, businesses often need to correct several common mistakes during this process. Understanding these mistakes can help businesses avoid them and conduct a more effective.

- Overlooking Certain Risks: One of the most common mistakes is failing to identify all potential risks. It can happen when businesses focus too much on the most obvious risks and overlook less apparent ones that could still have a significant impact.

- Underestimating the Impact of Risks: Another common mistake is underestimating the potential impact of identified risks. It can lead to inadequate preparation and leave a business vulnerable if the risk materializes.

- Not Regularly Updating the Risk Analysis: It is a process that takes time. The business environment is constantly changing, and new risks can emerge anytime. Therefore, updating the risk analysis to reflect these changes regularly is important.

- Not Involving the Right People: It should involve people from different business parts with diverse perspectives. Failing to involve the right people can lead to a narrow view of risks and can result in important risks being overlooked.

- Not Using a Structured Approach: It requires a structured approach that systematically identifies and assesses risks. The risk analysis can become more organized and effective with a structured approach.

Tips to Avoid These Mistakes

- Use a systematic approach to identify all potential risks. Consider using risk identification tools and techniques involving people from different business parts.

- When assessing the impact of risks, consider both the likelihood of the risk occurring and the potential impact on the business.

- Regularly review and update the risk analysis to reflect changes in the business environment.

- Involve diverse people in the risk analysis to ensure a wide range of perspectives.

- Use a structured approach to risk analysis. It could involve using a risk analysis framework or methodology or risk analysis software or tools.

Risk management strategies

Risk management strategies could include:

- Risk Avoidance: This strategy involves identifying risk and deciding not to engage in the activity that gives rise to it. It’s about changing plans or strategies to avoid the risk completely. For example, a business might avoid investing in a new project if the risk analysis shows that the project could lead to significant financial loss.

- Risk Reduction: This strategy involves taking steps to reduce the likelihood or impact of the risk. It could involve implementing safety measures, improving operations, or investing in training and development. For instance, a manufacturing company might implement stricter quality control measures to reduce the risk of product defects.

- Risk Sharing: This strategy involves sharing the risk with other parties. It could be done through insurance, partnerships, or outsourcing. For example, a business might take out an insurance policy to share the financial risk of potential damage or loss. Alternatively, a company might enter into a partnership for a project, thereby sharing the risk with the partner organization.

- Risk Acceptance: This strategy involves acknowledging and accepting the risk as part of the business. In this case, the focus is on developing contingency plans to manage the risk if it occurs. For example, a company might accept the risk of a new product failing in the market but prepare a contingency plan to manage the potential financial and reputational damage.

Each of these strategies has its place and can be effective depending on the specific risk and the context of the business or project. The key is understanding the risk thoroughly and choosing the most appropriate management strategy.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.