We do know that a financial plan is important in our lives. One can hardly survive in this tough and rough world without making a financial plan. No matter your job, lawyer, doctor, businessman, or architect, you need personal financial statement examples as your financial plan to secure your life. In this era, professional workers are drowning in debt. It is because they are prepared in their academic or business field, but they need to prepare to manage their finance.

What is a Personal Financial Statement?

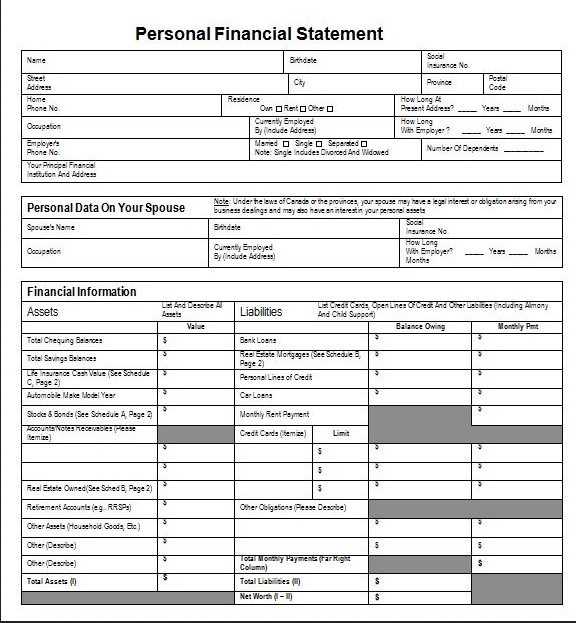

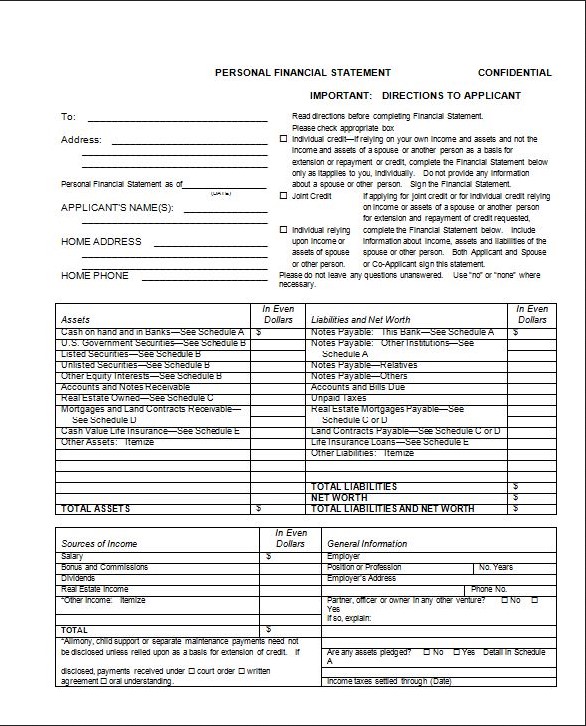

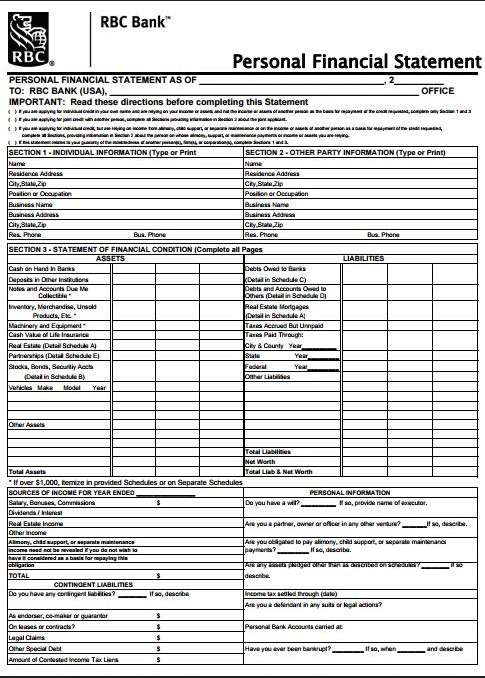

You may have heard or have been familiar with the term financial statement. Many companies use financial statements to list what the companies’ assets are. It is a statement depicting the related companies’ current financial standing. However, the financial statement is not only for companies; a person can also have his financial statement or a financial statement. It is mainly used when the person is looking for a loan.

The statement, or you can call it a document, helps the bank or the credit officer to see how strong your finances are. So they can decide what credit limit you should have. Look for the personal financial template online to make your financial statement. Choose one template that suits you best.

The Use of Personal Financial Statement

As stated, one of the uses of the personal financial statement is when you are looking for or applying for a loan. Whether you are a college student, a person running a small business, or even a professional worker, you will need a loan.

It is an ugly fact that everybody needs a loan unless you are born rich and inherit quite some assets. Hence, you need to make your financial statement.

In addition to seeing how strong your finances are, a statement also can be used for financial planning and saving purposes.

By knowing your financial is, you can make a plan based on your current finances. Knowing what assets you have and how much debt you owe, you also can make a saving plan to secure your finances even more.

Key Components of a Personal Financial Statement Template

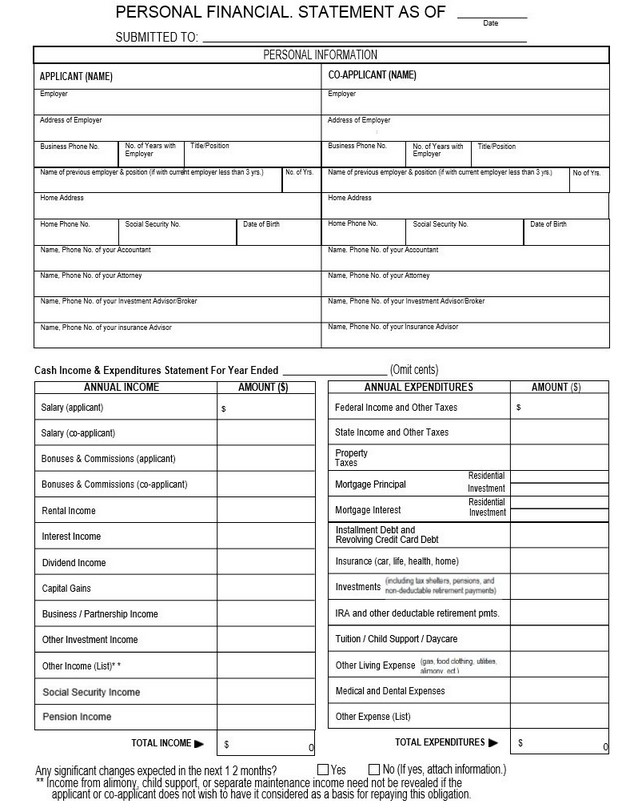

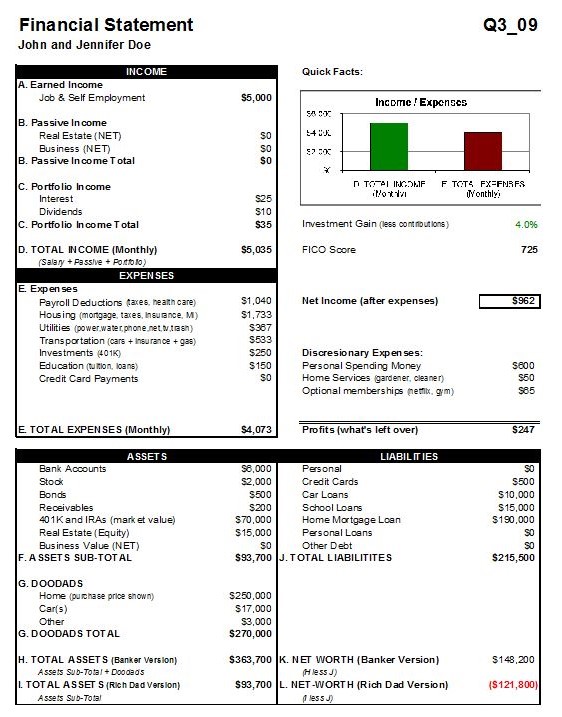

A personal financial statement can make better spending, saving, and investing decisions. Below are the essential parts of this important document.

Personal Information

- Your Name: Just like writing your name on your school books.

- Where You Live: Your home address.

- How to Contact You: Phone number and email, too.

Assets (What You Own)

- Cash and Money in the Bank: Think of this like your money jar or piggy bank.

- Things You’ve Invested In: Like when you try to grow your money by buying things that might be worth more later.

- Houses or Land: Any place you can call your own.

- Things You Can Drive or Ride: Cars, bikes, scooters, or boats.

- Special Stuff: Toys, games, jewelry, or anything else valuable.

- Money for When You’re Older: A special savings for your older days.

Liabilities (What You Owe)

- Home Money: If you borrowed money to buy a house.

- Loans: Money you borrowed for school or to buy stuff.

- Credit Card Money: If you used a card to buy stuff and have to pay it back.

- Other Money You Owe: Maybe you borrowed from a friend or owed for other things.

Income (Money Coming In)

- Job Money: Money you earn by working.

- Rent Money: If someone pays you to use something you own, like a room in your house.

- Growth Money: Money you make from things you’ve invested in.

- Gift Money: Money you get as a gift or from doing small jobs.

Expenses (Money Going Out)

- Home Costs: Money for where you live.

- For the House: Paying for lights, water, or heat.

- Getting Around: Money for gas, bus rides, or your bike.

- Food Stuff: Money for snacks, meals, or eating out.

- Fun Things: Going to movies, buying toys or games.

- Staying Healthy: Doctor visits, medicine, or health stuff.

- Other Stuff: Anything else you spend money on, like gifts or treats.

Net Worth Calculation

- Total of Stuff You Have: Add up all your assets.

- Total Money You Owe: Add up all your liabilities.

- Your True Money Value: This is the assets minus liabilities. It’s like looking at your whole money picture in one number.

Types of Personal Financial Statements

There are different types of personal financial statements. Let’s explore these:

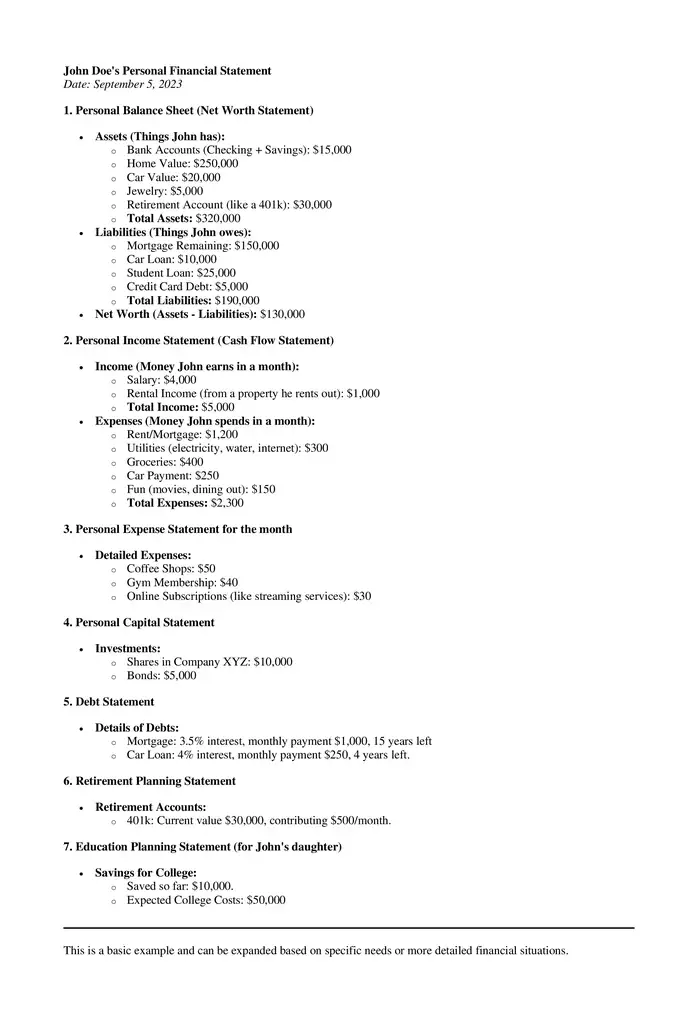

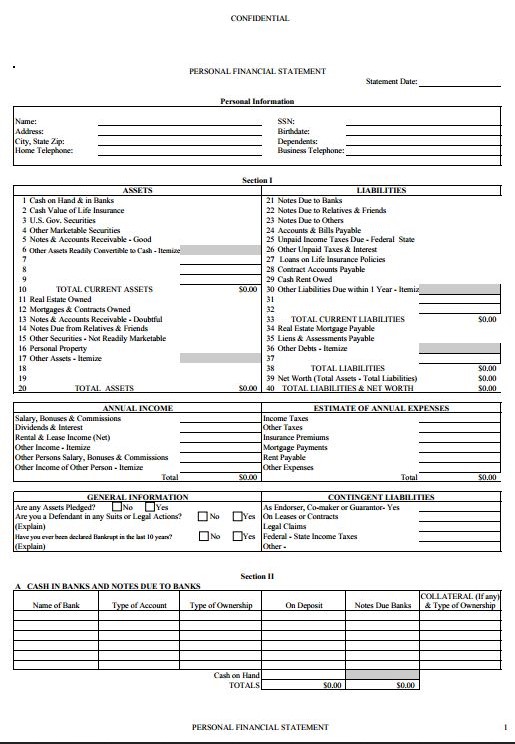

1. Personal Balance Sheet (Net Worth Statement)

This tells us what we have and owe at once.

- Things we have: This can be money in the bank, houses, cars, jewelry, and savings for when we’re older.

- Things we owe: This includes house payments, car payments, school loans, and money owed on credit cards.

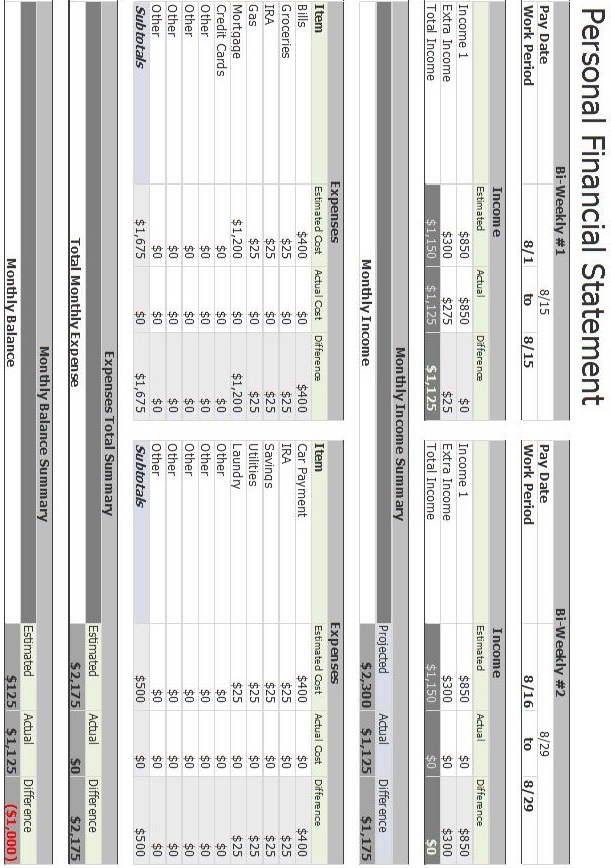

2. Personal Income Statement (Cash Flow Statement)

This shows the money we earn and how we spend it over some time.

- The money we earn: This is from jobs, money from renting out homes, or money made from investments.

- Money we spend: This includes our house rent, bills, food, fun activities, and travel.

3. Personal Expense Statement

This paper focuses on all the money we spend. It helps us see where our money is going and how we might save.

4. Personal Capital Statement

We see all our investments, like company shares or bonds. It helps us know how our investments are doing.

5. Debt Statement

This is for keeping track of money we need to pay back. It shows all our loans, their interest, and how much is left to pay.

6. Retirement Planning Statement

This is for thinking about the future, for when we stop working. It shows how much we’ve saved for those days and how it grows.

7. Education Planning Statement

This is for planning school or college costs. It helps us see how much we’ve saved for school and how much school might cost.

Why do You Need a Personal Financial Statement?

For Getting Loans

Understanding How Banks See You:

When you want money, banks must know if you can repay it. A personal financial statement is like a report card of our money habits. It shows if we spend wisely or owe too much money. Banks look at it to decide if they can trust us with a loan.

How Much Can You Borrow?

This statement doesn’t just help banks decide if they should give us money. They look at what we own (like cars or houses) and what we owe (like other loans or credit card bills). It helps them give us the right amount to pay back without trouble.

Planning Our Money Better

A Map of Our Money:

Think of a personal financial statement as a money map. It shows where our money comes from and where it goes. It helps us see if we spend too much and where to save more.

Making Good Money Choices:

You can make better choices when you know what you have and owe. We may find out we’re spending too much on toys and can save that money for a bigger treat later. Or you might see that we owe too much money and need to pay some back before buying new things.

Saving for Bigger Things in the Future

Saving the Smart Way:

When you look at your money map often, you can see how we’re doing. This map shows where you can save money for bigger things you want later, like a bike or video game.

Getting Ready for Bigger Goals:

You all have dreams, like going to college, traveling, or having a fun day out. To do these things, we need money. Our money map helps us plan and save for these big goals. It shows us if we’re on the right path or must save more to make our dreams come true.

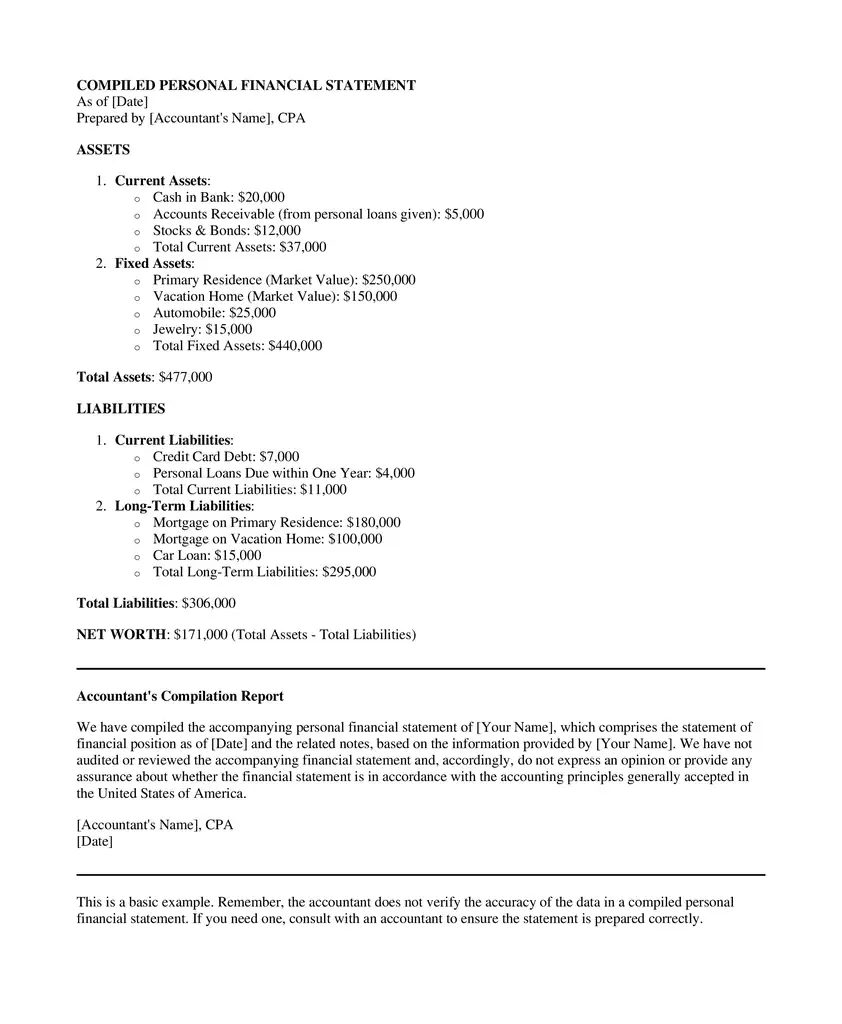

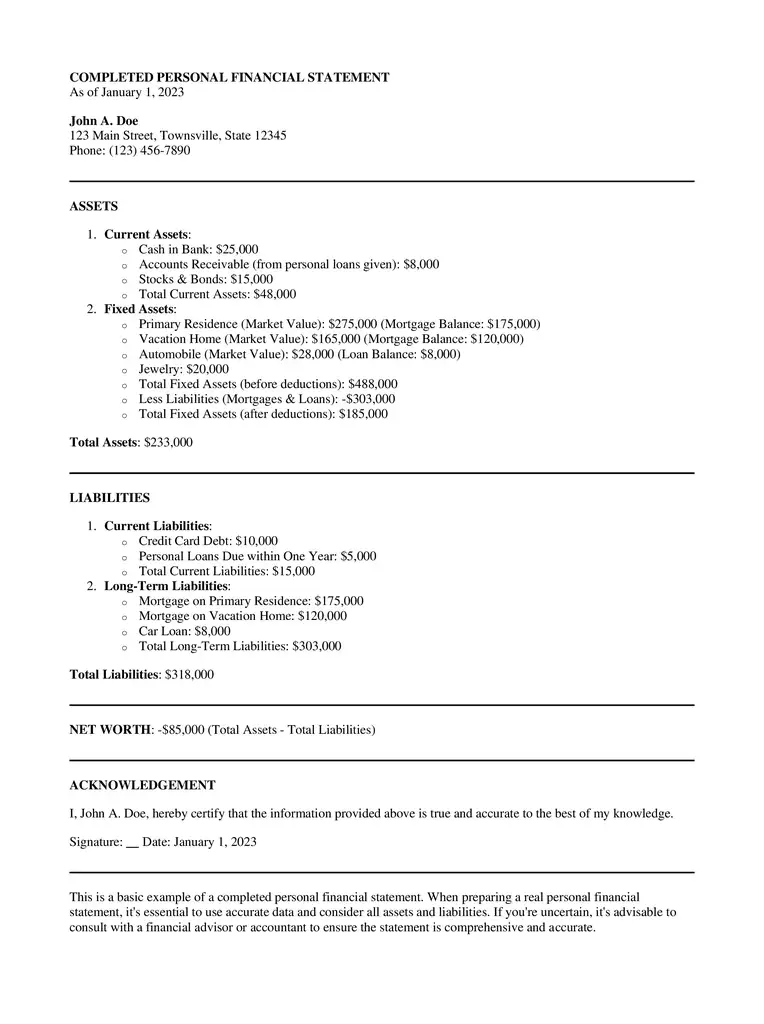

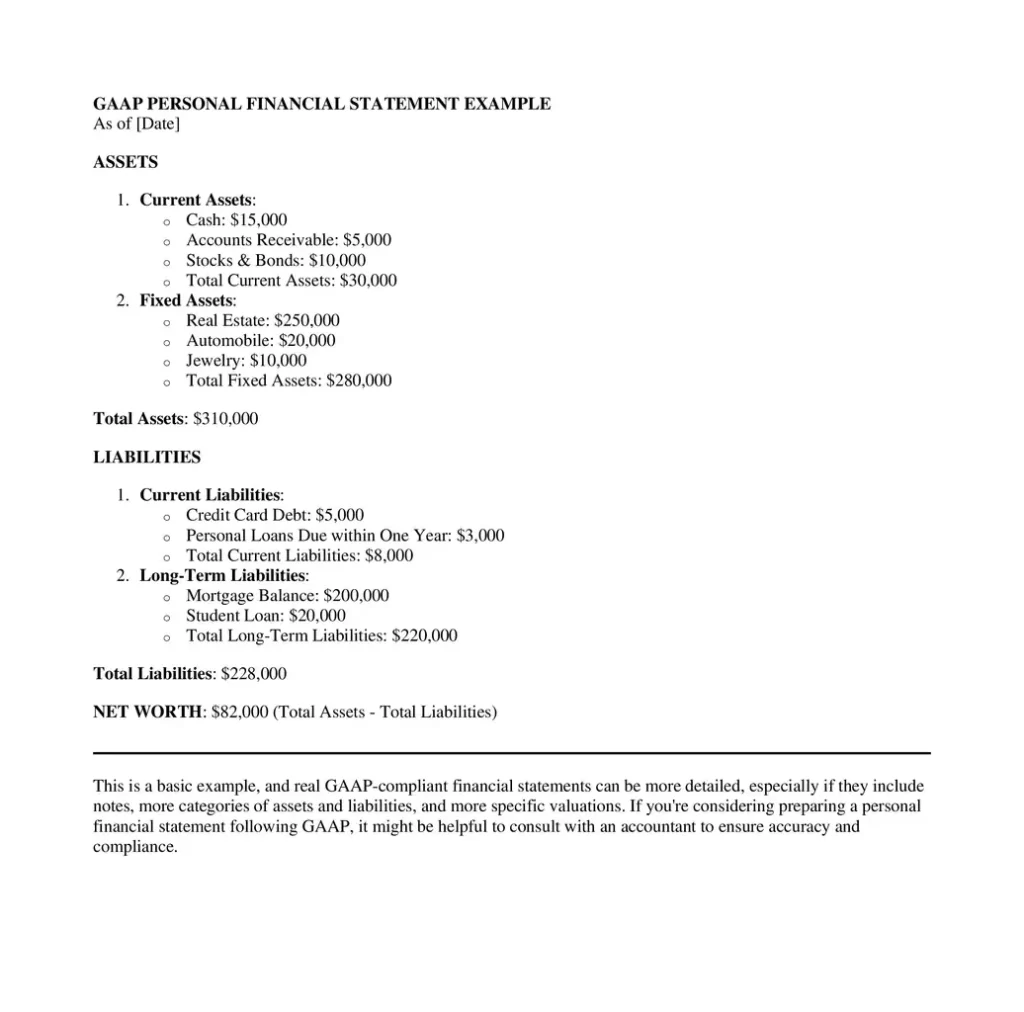

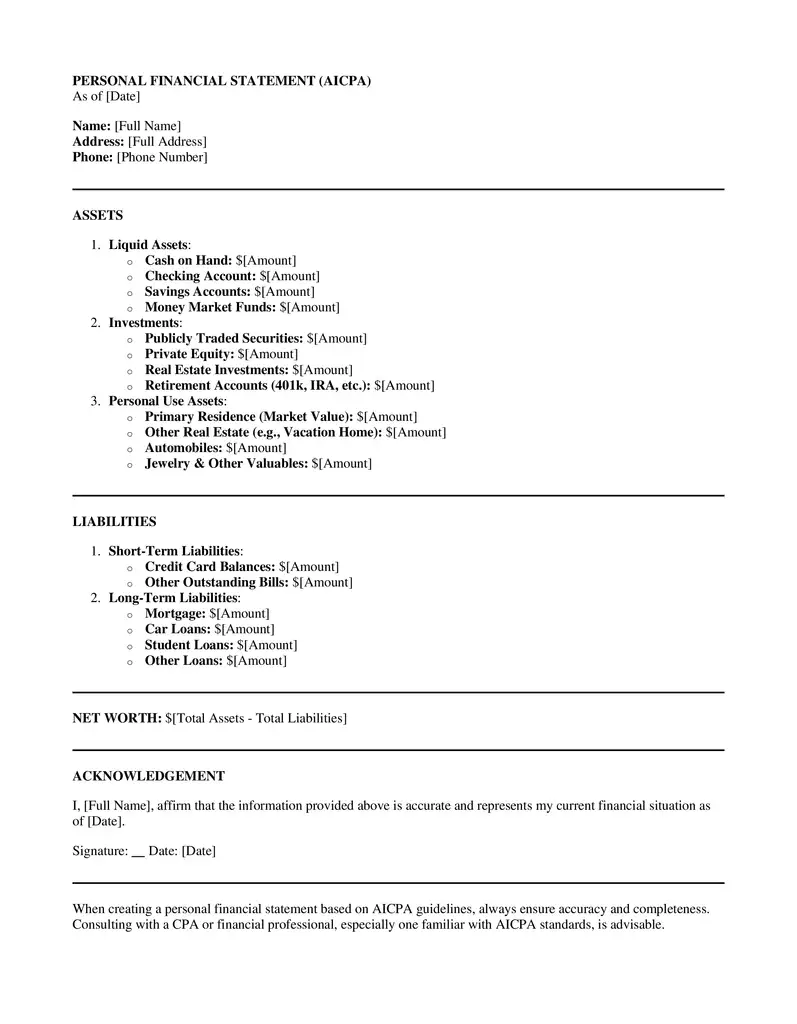

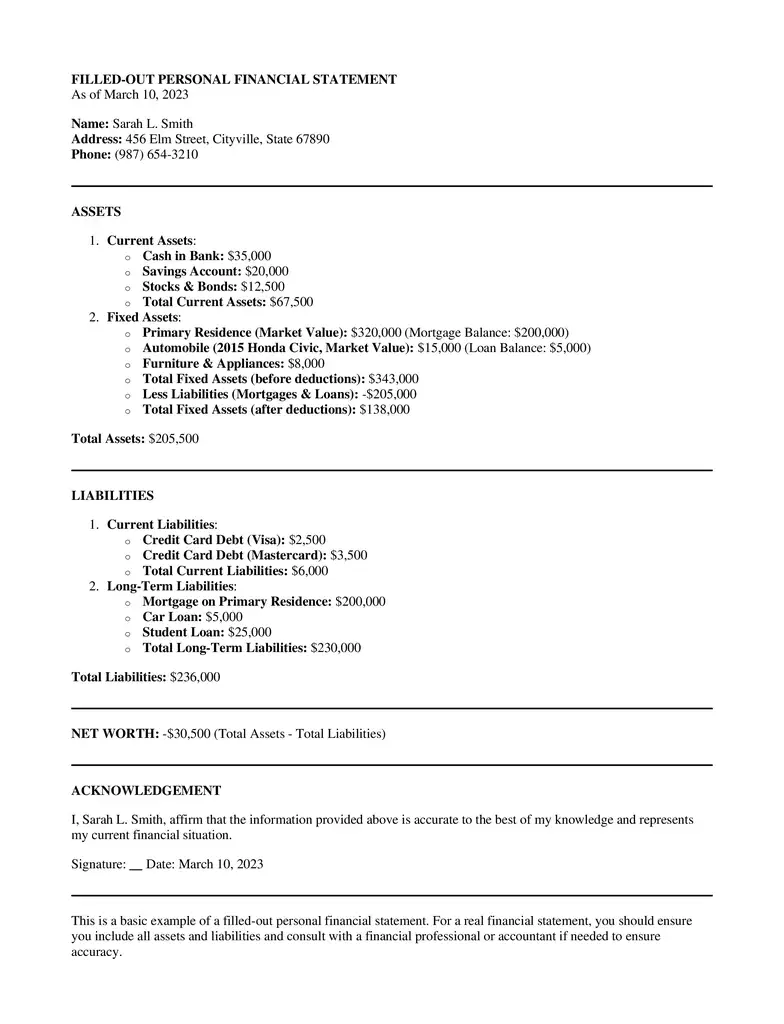

Free Personal Financial Statement Examples & Templates

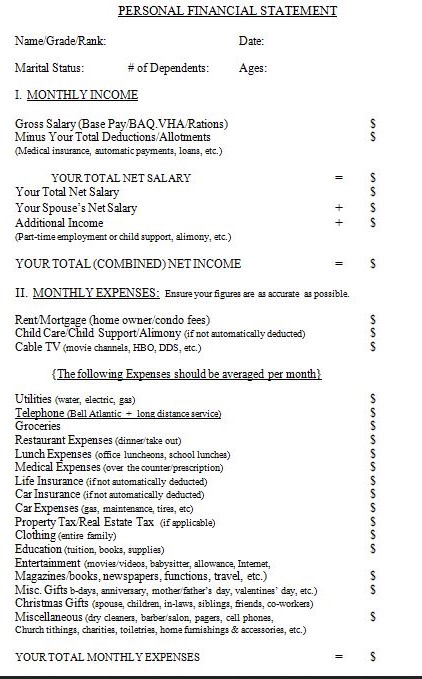

Personal Financial Statement Templates

How to Make Your Financial Statement

- Start with Personal Information:

- Full Name: Write your complete name.

- Address: Mention where you currently live.

- Contact Details: Include your phone number and email address.

- List Your Assets (What You Own):

- Cash and Bank Accounts: Write down all the money you have in hand and your bank accounts.

- Investments: Note any stocks, bonds, or other investments you own.

- Real Estate: Add the value of homes or lands you own.

- Vehicles: List cars, bikes, or other vehicles you have.

- Personal Property: Includes jewelry, electronics, and other valuable things.

- Retirement Funds: Note down money in retirement accounts, like a 401(k).

- Write Down Your Liabilities (What You Owe):

- Mortgages: If you have a home loan, write the amount you still owe.

- Loans: List car loans, student loans, or any other loans you have.

- Credit Card Balances: Write the total money you owe on credit cards.

- Other Debts: Add any other money you might owe.

- Note Your Income (Money You Get):

- Salary: How much do you earn from your job?

- Other Income: Add money from side jobs, gifts, or other places.

- Track Your Expenses (Money You Spend):

- Housing: How much do you pay for rent or mortgage each month?

- Utilities: Add costs for things like electricity and water.

- Transportation: Write down money for gas, bus tickets, etc.

- Food: Include costs for groceries and eating out.

- Other Expenses: Note other things you spend money on regularly.

- Calculate Your Net Worth:

- Total Assets: Add up the value of everything you own.

- Total Liabilities: Add all your debts.

- Net Worth: Subtract liabilities from assets to find your net worth.

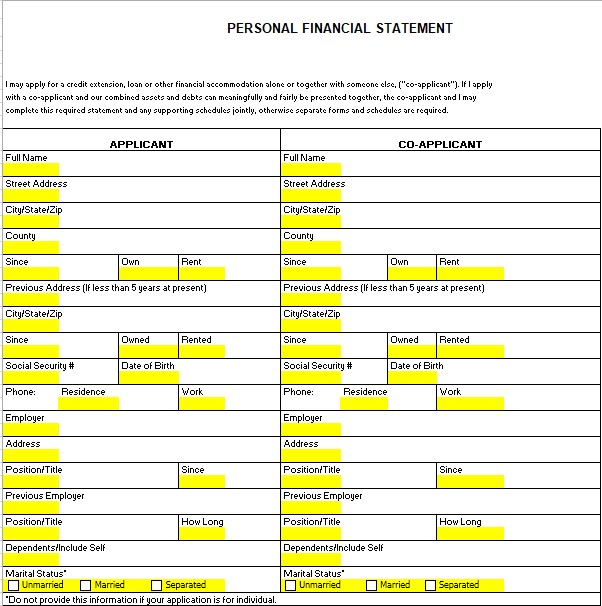

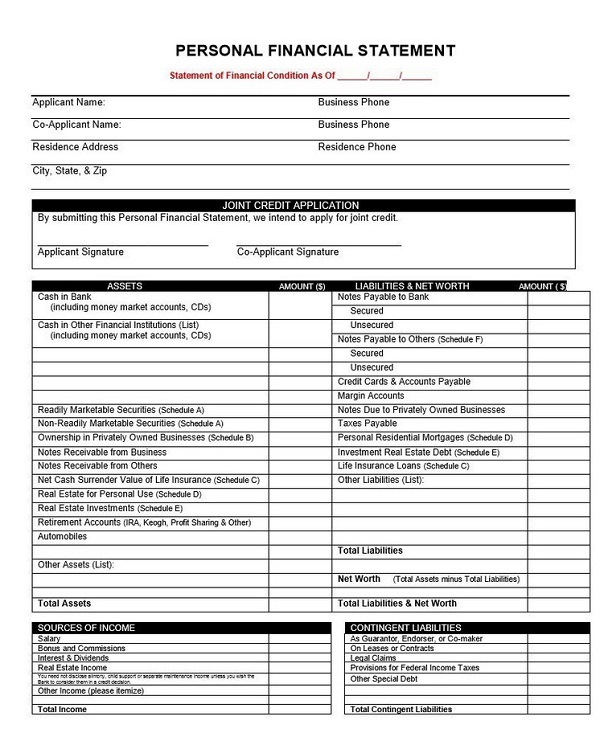

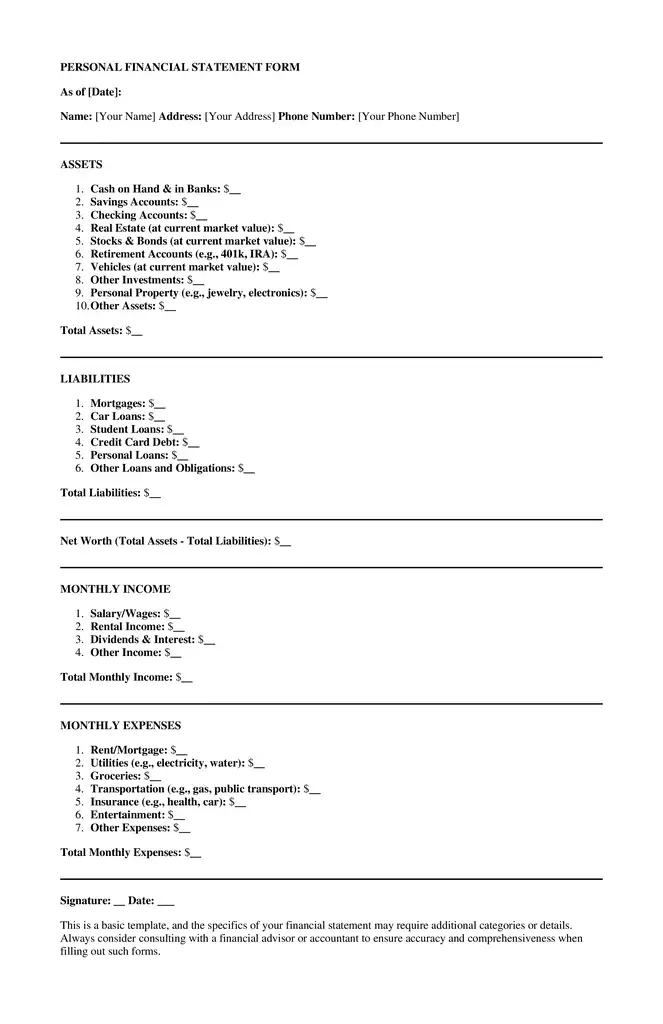

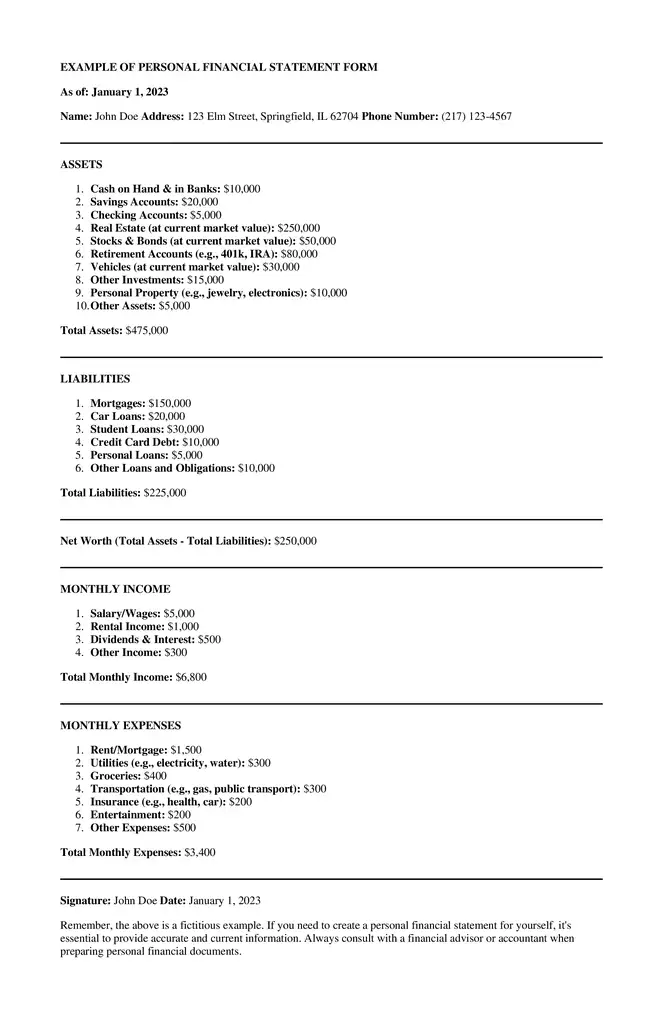

Personal Financial Statement Form

It’s like a money report card. It shows what you have (like money or things) and what you owe (like loans). You get a number when you take away what you owe from what you have. This number tells you how you’re doing with your money.

How to Fill It Out:

1. Get All Your Money Papers Ready

2. Write Your Name and Address

3. Write Down What You Have (Assets)

4. Write Down What You Owe (Liabilities)

5. Find Out Your Money Score (Net Worth)

6. How Much You Earn and Spend

7. Check Everything: Look at everything you wrote. Make sure it’s right.

8. Sign Your Name and Date: Put your name at the bottom. Also, write the date.

9. Keep It Updated: Look at your money report card once a year. Or when big money, things change.

Remember: If you’re giving this paper to someone (like a bank for a loan), make sure it looks how they want.

Mistakes to Avoid When Drafting a Personal Financial Statement

Not Being Specific

Generalizing Numbers:

When you write down numbers about your money, it’s easy to guess or round up. But guessing can make our money map clearer. It’s always best to use exact numbers so we know the real story of our finances.

Forgetting Small Expenses

Little Things Add Up:

Sometimes, you must remember to add small costs, like our daily coffee or snacks. But even small things can add up over time. By writing down everything, big and small, we get a clearer picture of where our money goes.

Not Updating Regularly

Change is Constant:

Our money habits can change often. You could pay off a loan or get a gift. If you update our statement, it will be accurate. It’s good to check and update your financial statements habitually.

Mixing Up Assets and Liabilities

Knowing the Difference:

Assets are things we own that have value, like a car or house. Liabilities like loans or credit card debt. It’s important to list them in the right sections so we understand our true financial health.

Not Seeking Expert Advice

Two Heads are Better than One:

Even if we’re good with money, it can help to talk to an expert. They can give us advice and point out things we might have missed. By getting a second opinion, we make sure our financial statement is the best it can be.

Conclusion

We all need to know about our money. A money paper helps with that. It’s like a treasure map but for money!

If you need money paper, make one. If you have one, check it. It helps you be ready for cool things in the future.

Seeing the use of the personal financial statement examples, you now need to make your financial statement.

What Can You Do Now?

Want a money map? You can find easy ones online. Once you make one, tell us! Did you save for a toy? Did you pay off something? Your story can help others.

This guide is here to help you with your money. Knowing about your money is good. Start today and be ready for fun things later!

Frequently Asked Questions (FAQs)

What is a personal financial statement?

A personal financial statement is like a map of your money. It shows what you own, what you owe, the money you get, and what you spend. It helps you see your money.

Why do I need a personal financial statement?

It helps you know your money better. With it, you can make smarter choices about saving, spending, or even asking for a loan.

Is it the same as a bank statement?

No, they’re different. A bank statement only shows the money going in and out of your bank account. A personal financial statement shows all your money stuff in one place.

How often should I update my statement?

It’s good to update it whenever there’s a big change, like buying a house or paying off a big debt. But checking it at least once a year is a smart idea.

What if my expenses are more than my income?

It means you’re spending more money than you’re getting. You should think about ways to save more or earn extra money.

Can I make my financial statement?

Yes, you can! There are templates online to help, or you can even draw one yourself on paper.

Is my financial statement private?

Yes, it’s your private information. Share it if needed, like with a bank if you want a loan.

What’s “net worth”?

It’s a number that shows how much money you have. You get it by taking what you own and subtracting what you owe.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.