Payment agreement template word: A payment agreement is like saying, “I promise,” when someone gives or gets money. It tells how and when to give the money back.

Now, saying this promise is easy with a thing called a payment agreement template word. Both the person giving and getting money write their names and other things on it.

For the one giving money, this paper is like a helper. It’s a list showing how the money will come back. No worries, no forgetting. Everything is there to see.

For the one getting money, this paper is like a map. It shows how and when to give the money back.

The payment agreement template word makes giving and getting money simple and clear. So, if you are giving or getting money, this paper is like a helpful friend. Let’s learn more about it!

Importance of Payment Agreement

A Payment Agreement is like a handshake in writing when money is lent or borrowed. It’s a clear way to say, “Yes, I agree to pay back the money.” Here’s why having a clear Payment Agreement is so important:

Saying Yes to the Loan

- Proof of Agreement: The Payment Agreement is a paper that shows both the person lending and the person borrowing money said yes to the loan.

- Clear Understanding: It helps both people understand how the money will be paid back.

Keeping Promises:

- Promise to Pay: The person borrowing money promises to pay it back in a certain way and by a certain time.

- Promise to Lend: The person lending money promises to lend it, knowing when and how they will get the money back.

Avoiding Forgetfulness

- Reminder: The Payment Agreement is a reminder of what was agreed. It helps if someone needs to remember what they promised.

- Check on Progress: Both people can look at the Payment Agreement to see if the payments are being made as promised.

Staying Fair and Friendly

- Fairness: The Payment Agreement helps keep things fair because everyone knows the rules.

- Good Relations: It can help keep a good relationship between the person lending and the person borrowing money.

Protection for Both

- Safety for the Lender: The person lending money has a paper that says they should get the money back.

- Safety for the Borrower: The person borrowing money has a paper that says how they agreed to pay the money back.

Ready for Surprises

- Plan for Problems: The Payment Agreement can have plans for what to do if there is a problem, like if payments are late.

- Changing Plans: If something changes, the Payment Agreement can be changed and agreed to again.

When to Create a Payment Agreement

A Payment Agreement is the backbone of any lending or borrowing activity. Let’s look at when you need to make one and how to start making it when lending money.

Scenarios Necessitating a Payment Agreement:

Personal Loans

If you borrow money from friends or family, it’s good to have a payment agreement. It helps everyone remember what was agreed upon.

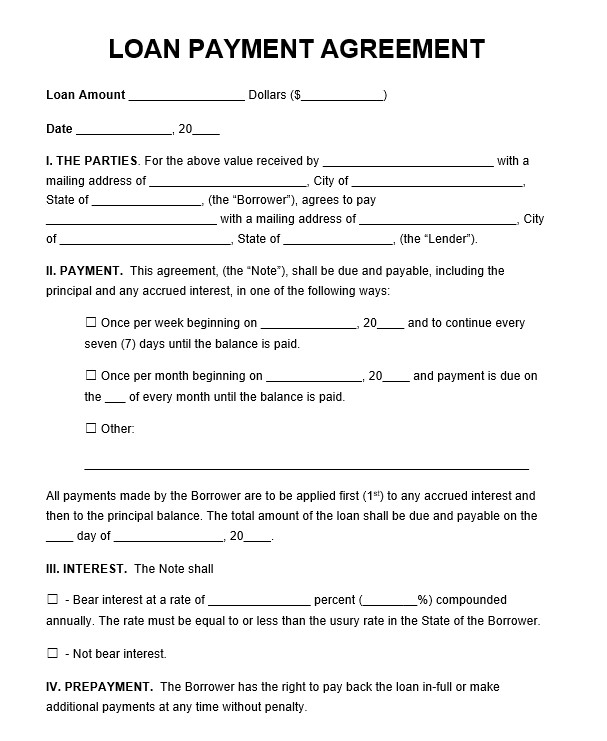

Business Loans

When a business gets money from a bank or someone else, a payment agreement is needed to write down how the business will pay the money back.

Purchase of Goods on Credit

If you buy something now and promise to pay later, a payment agreement can be written down when and how you will pay.

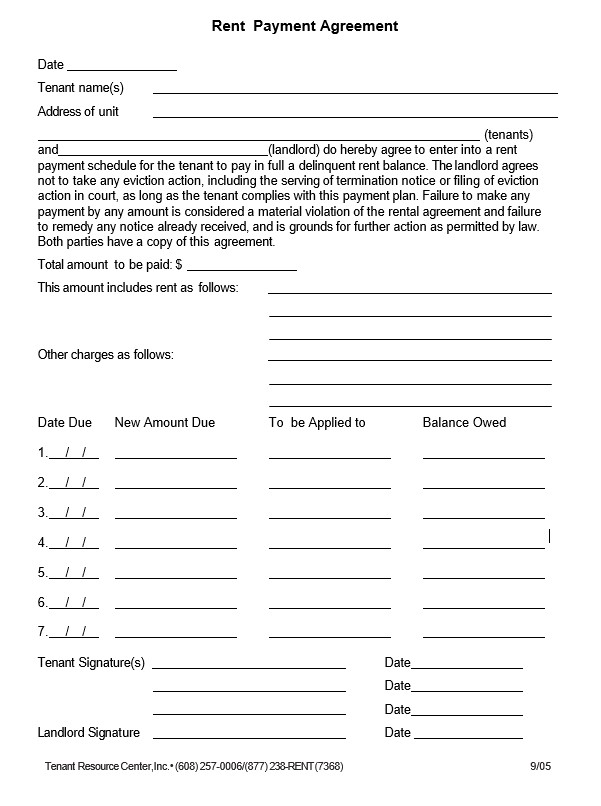

Rental Agreements

Renting a place to live or for your business also needs a payment agreement. It says when the rent should be paid.

Service Payment Plans

If you get a service and agree to pay over time, a payment agreement can help keep track of what you need to pay.

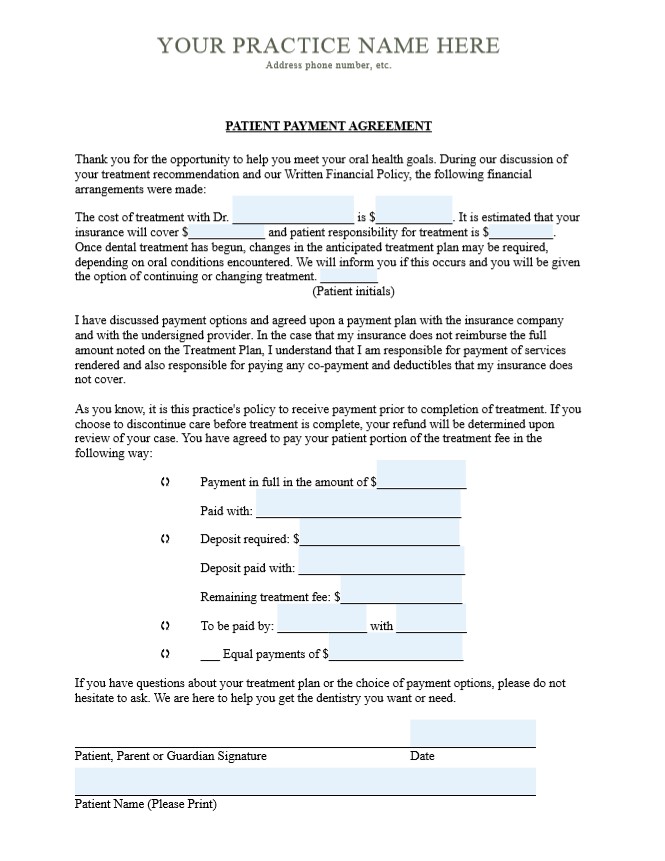

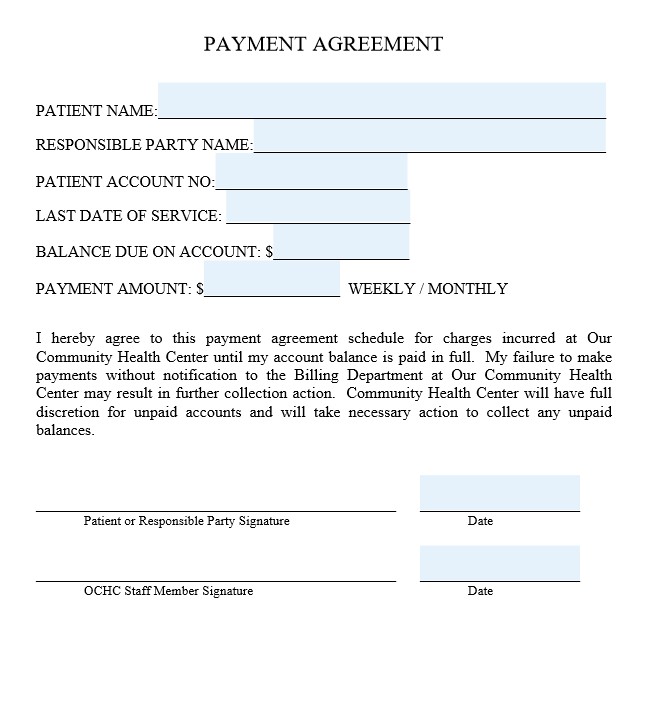

Medical Payment Plans

If medical services are provided with a plan to pay over time, a payment agreement should be drafted.

Initial Steps in Creating a Payment Agreement

Understand the Necessity

Understand that a payment agreement helps avoid problems.

Gather Necessary Information

Write down all the important details like how much money it will be paid back and any extra money for interest.

Choose a Template

Use a simple template, like one from Word, to help you make your payment agreement.

Customize the Template

Put all the details you collected into the template to make your agreement.

Review and Revise

Look through the agreement to ensure accuracy, clarity, and completeness. Make revisions if necessary to ensure all terms and conditions are well defined.

Get it Signed

Have both the lender and borrower sign the agreement to make it official. It’s a good practice to have witnesses or notarize the agreement for added legal standing.

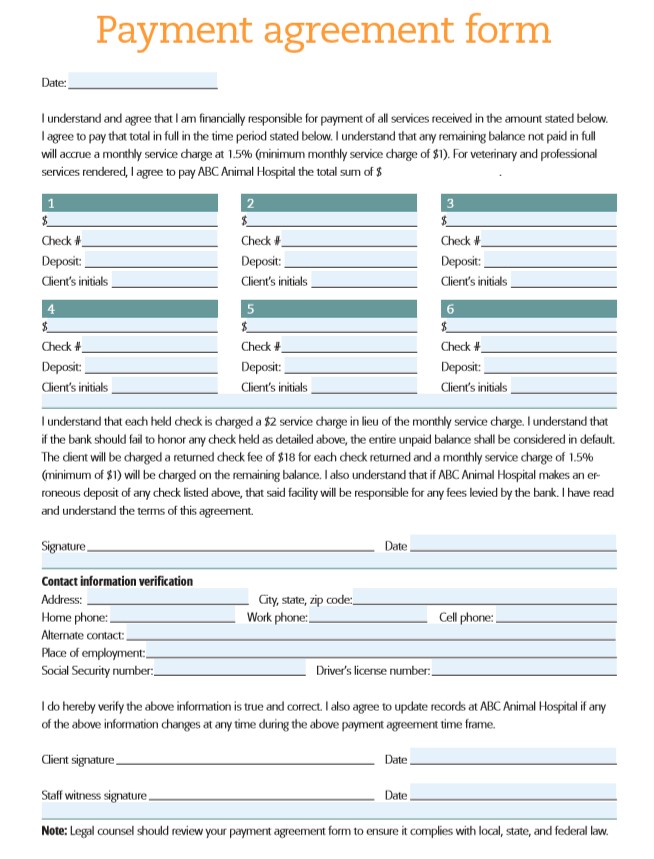

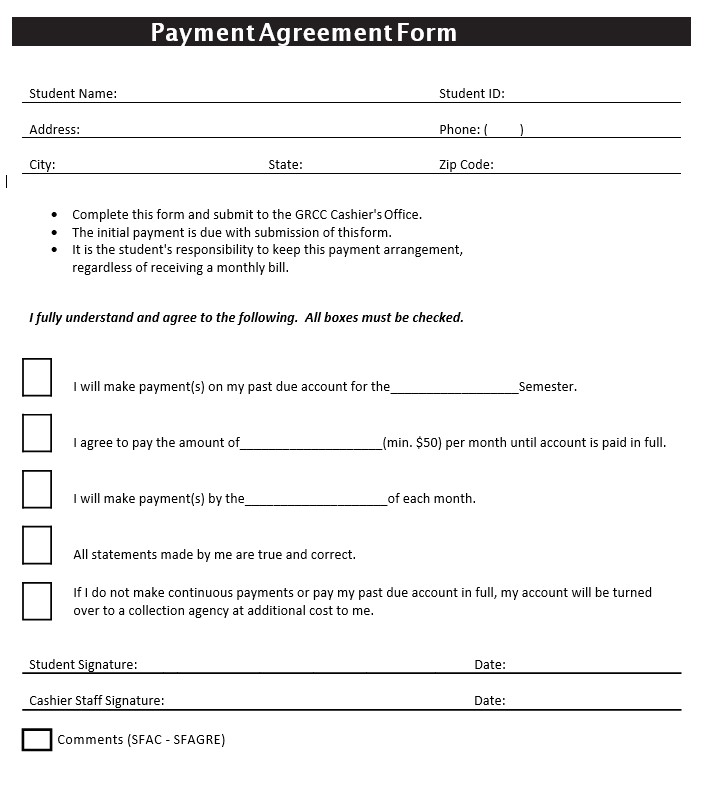

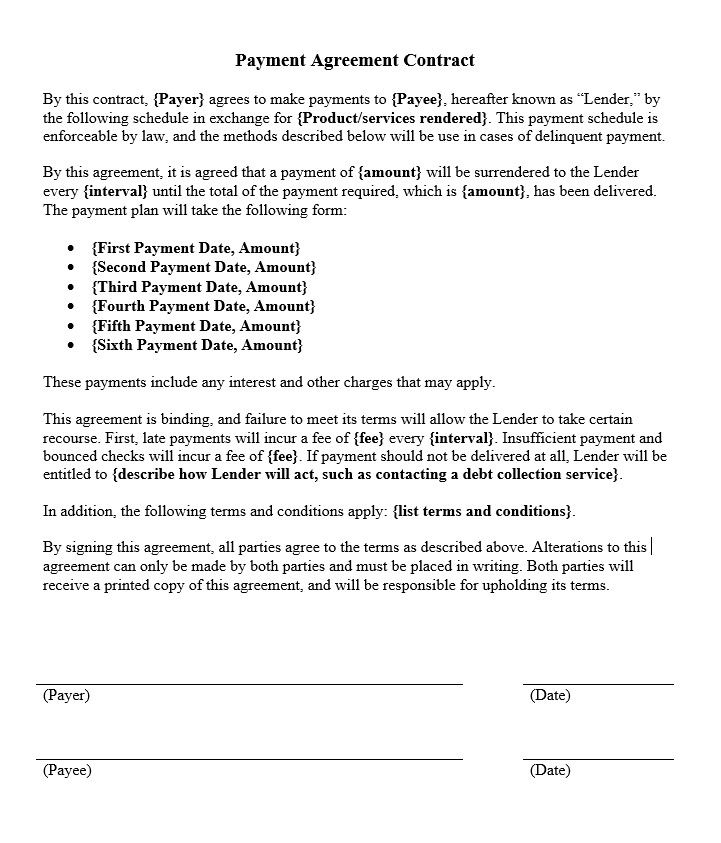

Components of a Payment Agreement Template

A Payment Agreement Template is a helpful tool when lending or borrowing money. It’s like a map that shows everyone the way from borrowing to paying back. Here are the main parts of a payment agreement template:

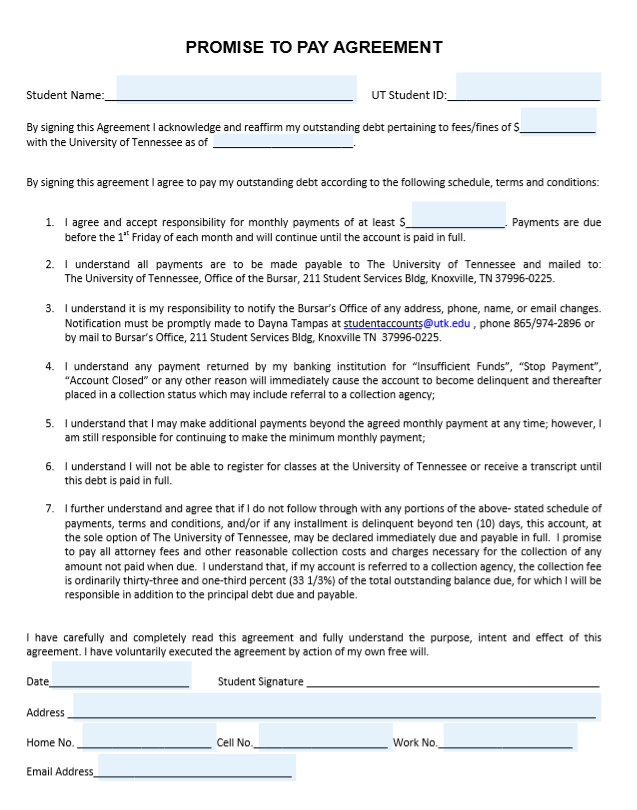

Describing Who is Who

- Lender: This is the person or group who is lending or giving money to someone else. Their name, address, and contact details are written down.

- Borrower: This is the person or group who is borrowing or taking money from someone else. Like the lender, their name, address, and contact details are written down too.

Saying Yes to the Loan Amount

- Acknowledgment of Loan Amount: This is where the borrower says, “Yes, I borrowed this money.” The exact amount of money borrowed is written down so everyone agrees.

Writing Down the Loan Details

- Loan Amount: This is the total amount of money borrowed. It’s written down clearly so everyone knows.

- Payment Periods: This part tells how often the borrower will pay back some money – like every week or every month – and for how long.

- Interest Rates: If extra money called interest is being paid back with the loan, the rate of interest is written here. This part can say how the interest is figured out, too.

Features of an Effective Payment Agreement Template

A good Payment Agreement Template is like a clear roadmap for paying back a loan. It tells everyone what to do and expect. Here are some things that make a Payment Agreement Template really useful:

Clear Terms and Conditions

A good template makes all the rules of the loan easy to understand.

Full Details about the Loan

A useful template gives all the information about the loan. It tells how much money is being borrowed, how it should be paid back, and what happens if it’s paid back late.

Following the Law

Sometimes, the laws of the state or the country have rules about lending and borrowing money. A good template will have a place to write these rules so that everyone is following the law.

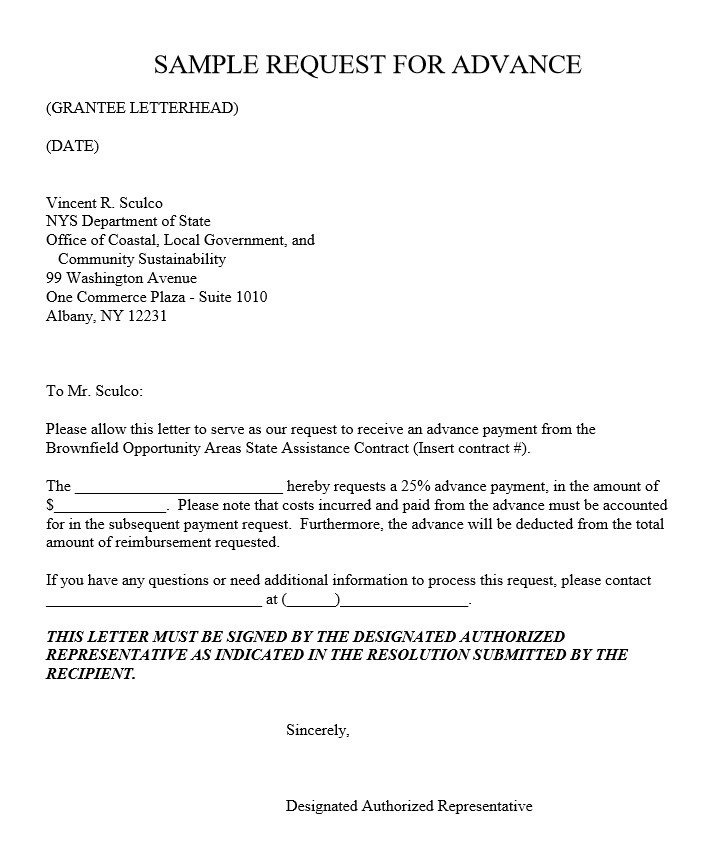

Steps to Create a Payment Agreement Using Word Template

Creating a Payment Agreement using a Word template is easy and straightforward. It’s like coloring within the lines to make a clear picture of how the loan will be paid back. Here’s how you can do it:

Finding a Template

- Search Online: You can find many Payment Agreement templates online. Some are free, and others might cost a little money.

- Use Word: Microsoft Word also has templates. You can open Word, go to the “File” menu, select “New,” and then type “Payment Agreement” in the search box to find templates.

How to customize

- Open the Template: Open the template in Word to start making your Payment Agreement.

- Fill in the Blanks: The template will have places for you to type in information about the lender, the borrower, the loan amount, and how it will be paid back.

- Change What You Need To: Every loan is different. If there is something in the template that doesn’t fit your loan, you can change it. You can also add anything that is missing.

Checking the Details

- Check the Information: Look at every piece of information you typed to make sure it’s correct. It’s like checking your work in school to make sure you didn’t make a mistake.

- Check the Spelling: Use Word’s spellcheck to find and fix any spelling mistakes.

- Read it Out Loud: Reading the agreement out loud can help you make sure it makes sense and is easy to understand.

Saving and Sharing

- Save Your Work: Save the Payment Agreement on your computer. It’s good to save it more than once while you’re working.

- Print or Email: You can print the agreement and give it to the other person, or you can email it to them. If you email it, saving it as a PDF is a good idea so it stays the way you want it.

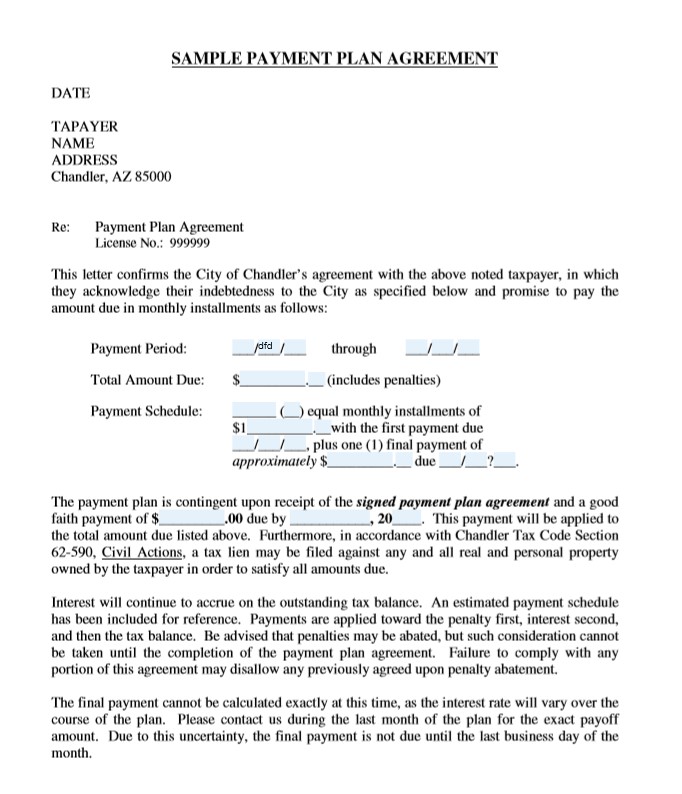

Including Interest Rates in Your Payment Agreement

Interest rates are extra money paid for borrowing money. They can change how much is paid back in total. Here’s how to include and figure out interest rates in a Payment Agreement:

Talking About Interest Rates

- Mention Interest: In the Payment Agreement, clearly say if interest will be paid.

- Rate of Interest: Write down the rate of interest. It is often a percentage, like 5% or 10%.

- How Often Interest is Added: Say how often the interest is added to what is owed, like every month or every year.

Putting Interest Rates in the Agreement

- Interest Section: Make a section in the Payment Agreement just for interest.

- Examples: Give an example to show how the interest works.

Figuring Out the Interest

- Simple Interest: This is interest on just the amount borrowed. The formula is (Amount Borrowed x Rate of Interest x Number of Years) / 100.

- Compound Interest: This is interest on the amount borrowed and the interest already added. The formula is amount Borrowed x (1 + Rate of Interest) number of Times Interest is Added – Amount Borrowed.

- Using Tools: Some online tools and calculators can help figure out the interest.

Showing the Total Amount to be Paid

- Total With Interest: Write down the total amount to be paid back with the interest.

- Payment Schedule: Make a schedule that shows each payment, how much goes to the interest, and how much goes to pay back the loan.

Benefits of Organized Documentation

Having organized documentation is like having a clean desk. You can find what you need fast. When you lend or borrow money, a well-made Payment Agreement is a part of keeping things organized. Here’s how it helps:

Avoiding Confusion

- Clear Information: All the details about the loan are in one paper. It’s easy for everyone to understand.

- Easy to Find: If a question comes up, you can find the answer quickly in the Payment Agreement.

Stopping Disputes Before They Start

- Agreed Terms: A Payment Agreement has all the terms of the loan that both the lender and the borrower have agreed to. It can stop arguments before they start.

- Written Proof: If there is a dispute, the Payment Agreement is written proof of what was agreed.

Making a Well-Structured Payment Agreement

- Use a Template: A template can help make sure the Payment Agreement is well-organized and easy to read.

- Include All Details: Make sure to include all important details, like the amount of the loan, the interest rate, and when payments should be made.

- Review and Check: Look over the Payment Agreement to make sure it’s clear and doesn’t have any mistakes.

Keeping Everything in One Place

- One Document: A well-structured Payment Agreement keeps all the information about the loan in one document.

- Easy to Reference: It’s easy to look back at the Payment Agreement if you need to check something.

Professional Approach

- Shows Professionalism: Having a well-made Payment Agreement shows that you are serious about the loan.

- Builds Trust: It can help build trust between the lender and the borrower because everything is clear from the start.

Payment agreement template word

Making a Payment Plan Legally Binding

Making a payment plan legally binding is like making a strong handshake on paper. It’s making sure both people keep their promises about the money. Here’s how to do it:

Get It in Writing

Write down all the details in a document. Who is lending, who is borrowing, how much money, and when it should be paid back?

Check the Legal Stuff

Check all the important details, like names and addresses, are correct in the document.

Sign on the Dotted Line

Both the person lending and the person borrowing sign the document. It’s like saying, “We agree to this.”

Notarize If Necessary

Sometimes, getting a notary to sign it, too, helps. A notary is a person who checks the signatures are real.

Follow the Law

Make sure the plan follows the money lending and borrowing laws where you live.

Keep Copies

Both people should keep a copy of the signed document. It’s like having a picture of the promise made.

Clear Instructions

The document should say how and when payments should be made. It helps keep the promise.

Talk about What Ifs

The document should say what happens if a payment is late. It helps avoid surprises and problems later.

Conclusion

Using a Payment Agreement template in Word is very easy and smart when you need to lend or borrow money.

Now it’s your turn! It’s a simple helper that can make things clear and smooth. So, go ahead, use a Payment Agreement template in Word, and make your lending or borrowing easy and clear!

FAQs

What is a Payment Agreement Template?

A Payment Agreement Template is a form that helps write down the details when someone lends or borrows money. It’s like a map of how the money should be paid back.

Why should I use a Payment Agreement Template?

Using a template makes lending or borrowing money clear and easy. It helps avoid confusion and keeps a record of what was agreed.

Where can I find a Payment Agreement Template?

You can find templates online or in programs like Microsoft Word. Just search for “Payment Agreement Template,” and you’ll find many options.

Can I change the template to fit my needs?

Yes! Templates are made to be changed. You can add, change, or remove anything to fit your lending or borrowing situation.

How do I fill out a Payment Agreement Template?

Just follow the sections in the template. Usually, you’ll fill in names, the amount of money, how it will be paid back, and other important details.

What if the loan details change after the agreement is made?

You can make a new Payment Agreement or change the old one, but both the lender and borrower must agree to the new details in writing.

Can a Payment Agreement Template be used for any amount of money?

Yes! Whether it’s a small amount or a big amount, a Payment Agreement Template can be used to write down the details clearly.

What should I do after filling out the template?

After filling out the template, both the lender and borrower should read it, agree to it, and sign it. Keep copies for both parties as a record of the agreement.

Do I need a lawyer to use a Payment Agreement Template?

You don’t need a lawyer, but it can be a good idea if a lot of money is involved or if the loan terms are complex.

Is a Payment Agreement legally binding?

Yes, a signed Payment Agreement can be used as a legal document if there are problems later on.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.