Are you looking to enhance your credit score? Our pay-for-delete letter template can simplify the process. With our customizable and step-by-step instructions, you’ll be on your way to a brighter monetary future in no time. Let’s explore a letter, who to send it to, what to include, and some helpful pro tips.

What Is a Pay-for-Delete Letter?

This letter is a formal proposal to a creditor. In recovery for this action, you commit to spending some of the outstanding debt.

The letter can be addressed to the initial creditor or the creditor handling the debt. The ultimate objective is to enhance your credit score by clearing negative marks.

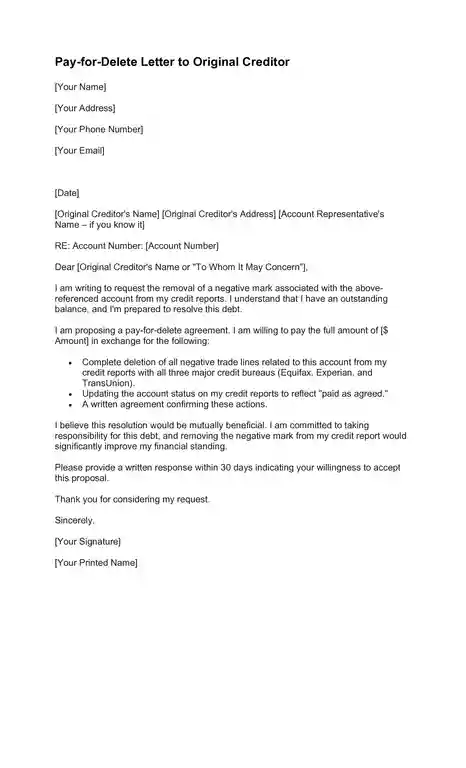

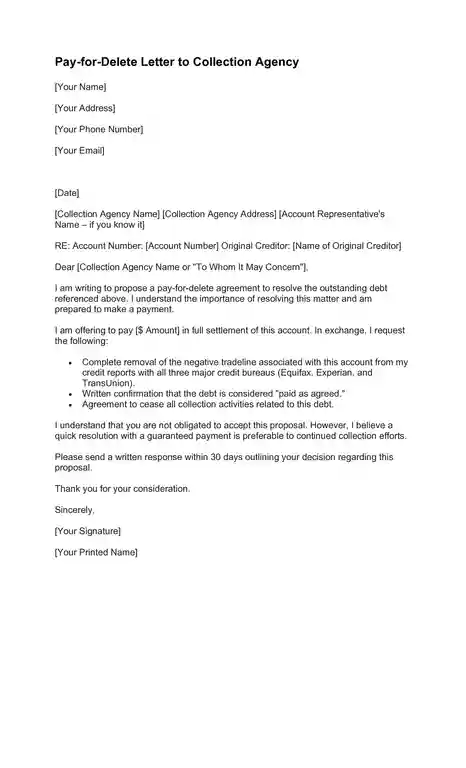

What information should include in a pay for delete letter?

Must-Have Info:

Your Info

Name, address, phone, email.

Their Info

Company name, address, and if you know it, the person handling your case.

Account Details

Account number, who you originally owed the money to (if different from who you’re contacting now), and how much is owed.

Your Offer:

- Say clearly you want a “pay-for-delete” deal.

- State how much you’ll pay (all at once is best).

- Be firm: payment is ONLY if they remove the bad mark from your credit report.

Get It In Writing

Ask for a written agreement spelling out the deal before you pay.

Set a Deadline

Give them a reasonable amount of time to reply.

Example of How to Word It:

“I’m offering to pay [amount] to fully settle this account. In exchange, you must agree in writing to remove the negative item from my credit reports with all three credit bureaus (Equifax, Experian, Trans Union).”

Why This Matters:

- No Confusion: Makes sure you and the collector agree on the deal.

- Starting Point: Your first offer is where the negotiation begins.

- Protection: A written agreement means they can’t take your money and not fix your credit.

Extra Tips:

- Keep It Short: These letters should be to the point.

- Be Professional: Firm but polite gets better results than angry.

- Check Your Work: Typos make you look bad.

Important: It’s smart to have a credit counselor or lawyer look over the agreement before you pay anything. They can make sure it’s fair to you.

When to Consider Pay-for-Delete

- You NEED to Fix a Collection: Collections tank your credit score. If you have one, it’s a big problem.

- You CAN Actually Pay: No point in trying pay-for-delete if you’re broke. You have to be able to make them an offer.

- You’re Ready to Haggle: Collectors sometimes take less than the full amount. You gotta be willing to negotiate.

When Pay-for-Delete MIGHT Not Be the Best Option?

- The Debt Is Legit: If you really owed the money and the info on your report is correct, it’s harder to get it removed.

- It’s Almost Gone Anyway: Bad marks disappear from your credit report after a while (usually 7 years). If it’s old, waiting might be smarter.

- You Need Help Super Fast: Pay-for-delete takes time and might not even work. If you need your score higher NOW, focus on other things.

Is Pay-for-Delete Even Legal?

The short answer is yes, but there’s more to it:

It’s Just an Offer: No law says collectors HAVE to agree. Think of it like haggling over a price, not a guaranteed fix.

Accuracy is Key: Credit reports should be truthful. If the debt was real, fixing your report by paying it off gets ethically tricky:

- Is it Fair?: Some people feel wrong “buying” their way out of a debt they really owed.

- It Might Come Back: The original lender could sell the debt, and the new collector could put it back on your report.

Laws to Know

- Fair Credit Reporting Act (FCRA): This is about making sure credit reports are accurate.

- Fair Debt Collection Practices Act (FDCPA): This has rules about how collectors can treat you, but doesn’t mention pay-for-delete specifically.

Why Some People Worry

Consumer groups are concerned that pay-for-delete could lead to collectors caring more about getting paid than accurate records.

How to Stay Safe

- Written Agreement A Must: Get it in writing that they’ll mark the debt “paid” AND remove the bad mark from your report.

- Don’t Pay Yet: Only pay AFTER the credit bureaus confirm the change.

- Watch for Cheaters: Sneaky collectors might try to change the date on the debt to make it look newer. Check for this!

Extra Notes:

- State Laws Matter: Some states have extra rules about debt collection.

- Ask a Pro: If you’re unsure about anything, talk to a credit counselor or lawyer for advice.

Will They Agree to Pay-for-Delete?

Sadly, there’s no guarantee. It depends on a few things:

- Their Rules: Some companies NEVER do pay-for-delete. Others are more flexible.

- How Old’s the Debt: They’re more likely to bargain on really old debts they think they won’t collect anyway.

- How Much You Owe: It’s easier to get them to remove a small debt than a huge one.

- Your Overall Credit: If your credit is mostly good, they might not care about one bad mark. But if it’s already messy, they’re less likely to help.

- Who You’re Dealing With: Some collectors are nicer than others!

Tips for Getting a “Yes”

- Offer a Lump Sum: Having all the cash ready is tempting to them.

- Start Low: Offer less at first. You can always go higher during negotiation.

- Get It in Writing: Never pay without a signed agreement saying they’ll fix your credit.

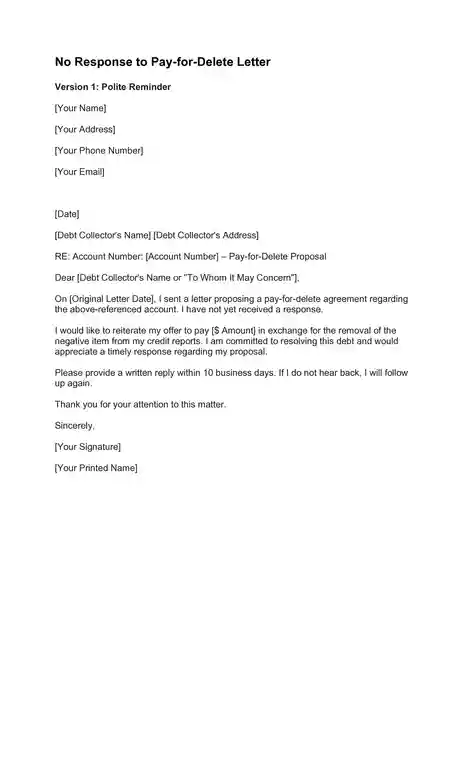

- Don’t Give Up Easily: If they don’t respond, politely follow up. Showing you’re serious helps.

If They Say “No”

- You Still Have Options: Try to at least get them to say the debt is “paid” on your report. That’s not as good, but better than nothing.

- Check If It’s Accurate: Are the details about the debt on your credit report even correct? If not, dispute it!

- Focus Long-Term: Build good credit with on-time payments. That matters more over time.

Important Stuff to Remember

- It Might Not Work: Be prepared they might say no, no matter what.

- It Could Come Back: Even if you get it removed, they could sell the debt to another collector who puts it back on your report. Boo!

Other Ways to Get Help

- Goodwill Letter: If you have good credit overall but made one late payment, try writing a polite letter asking them to forgive it.

- Get a Pro: Credit repair companies or lawyers might be better at negotiating than you.

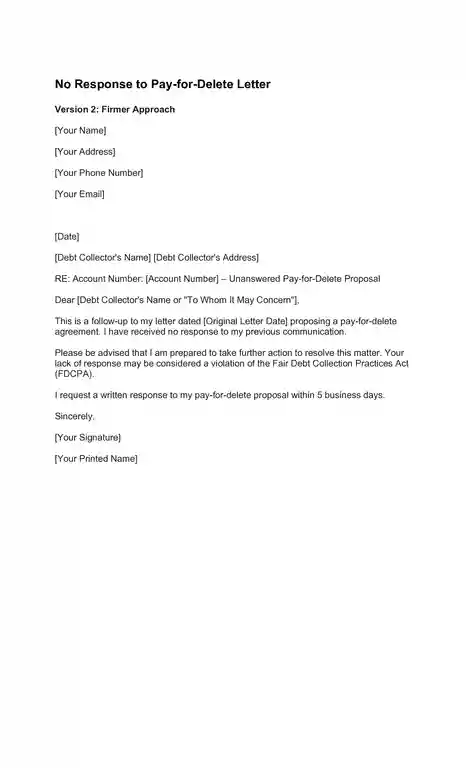

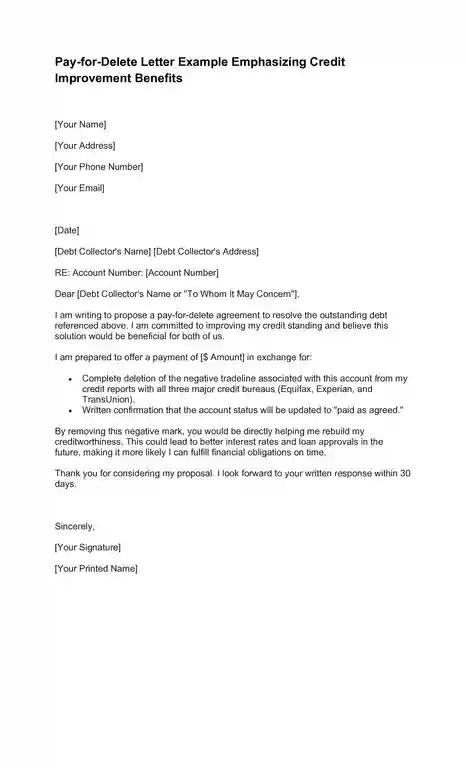

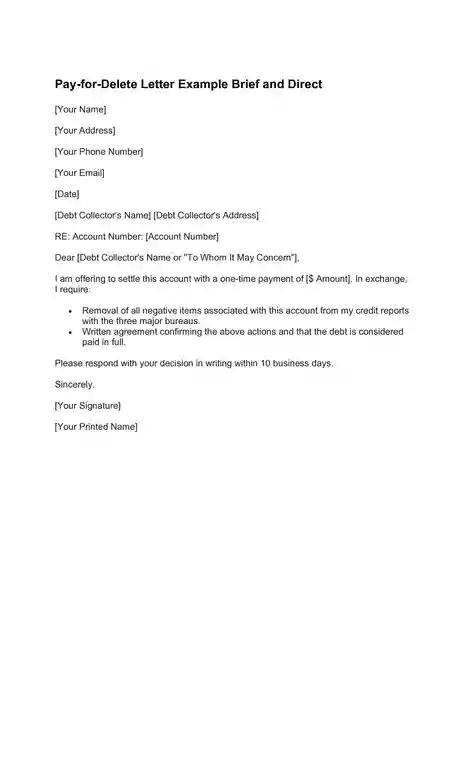

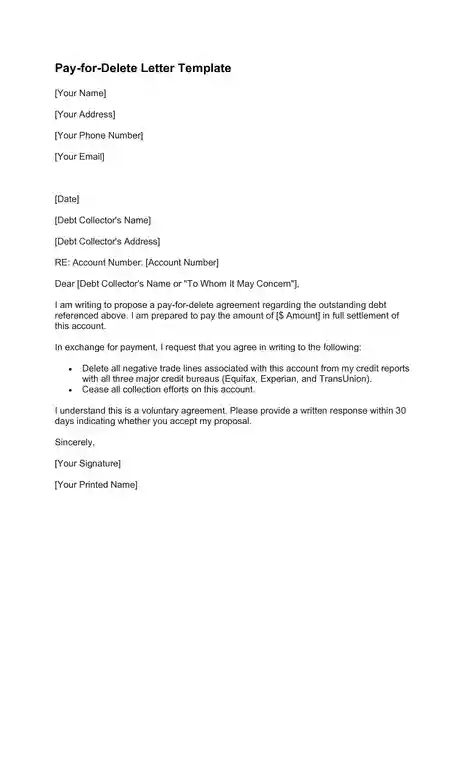

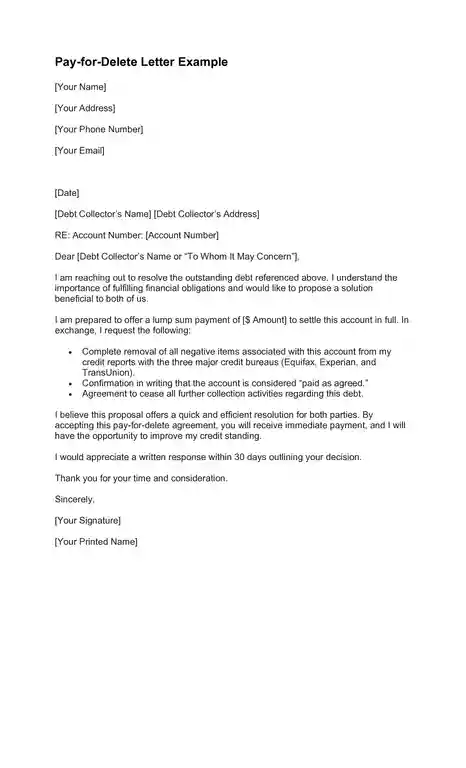

Free Pay-for-Delete Letter Template

How to Get the Best Results from a Pay-for-Delete Letter

Get That Agreement in Writing

Never pay a dime until you have a signed agreement saying they’ll remove the bad mark from your credit report.

Negotiate Like a Pro

Start by offering less than the full amount. They might take it, especially if the debt is old.

Pay AFTER You Check

Don’t hand over money until you’ve seen proof that the negative item is gone from your credit report.

Important Things to Know

- It’s Not a Sure Thing: Collectors don’t HAVE to accept your offer. Be prepared for that.

- Get Help If You Need It: Unsure about negotiating? Credit repair companies or lawyers who deal with debt can be useful.

Other Options If Pay-for-Delete Fails

- Fight Back Against Mistakes: Are there errors in how the debt is listed on your report? If so, dispute it!

- Ask for Forgiveness: If you have good credit but slipped up once, try writing a goodwill letter to the creditor asking them to remove the late payment mark.

- Focus on the Big Picture: The best way to improve your credit is simple: pay bills on time and don’t max out your cards.

How Will Pay-for-Delete Help (or Not) My Credit Score?

The Good Stuff It CAN Do:

- Ditch a Big Problem: Collections are a major drag on your score. Getting rid of one can boost it a lot.

- Less Debt is Good: Paying off the debt lowers how much you owe overall. That’s important to credit scores.

- Shows You’re Trying: A recent payment on your report looks responsible, which can help a little.

Things That Get Tricky:

- They Might Say “No”: If they won’t agree to the deal, your score stays the same.

- Scores Are Complicated: Old scoring systems hate collections. New ones care less. So the improvement depends.

- It’s Not a Magic Eraser: If the rest of your credit is a mess, fixing one thing has less impact.

How MUCH Will My Score Go Up?

Sadly, nobody can say for sure. It depends on:

- How Bad Was It: Big, recent collections hurt more, so fixing those helps the most.

- The Rest of Your Report: If you’re doing well otherwise, the boost will be bigger.

- What Score They Use: Lenders use different scoring systems, so it’s unpredictable.

Important to Remember: Even if it works, the original debt didn’t disappear. This mainly gets rid of the part that’s actively hurting your score.

Pay-for-Delete is Just One Tool

Focus on these other things too, they matter a LOT:

- Never Be Late: Paying on time is the single most important thing for your score.

- Use Credit Wisely: Keep card balances low, don’t open too many accounts at once.

- Be Patient: Bad marks fade over time. Building good habits makes your score climb.

Should I Do a Pay-for-Delete Letter Myself or Hire Someone?

It depends. Here’s how to decide:

When to Try It Yourself:

- Good at Negotiating: If you write well and feel confident haggling, you might save money doing it yourself.

- Simple Situation: A small debt without complications might be easy to handle.

- Tight Budget: Pro help costs money. If you can’t afford it, DIY might be your only option.

When Pro Help Might Be Better:

- Messy Situation: Big debts, disputes, or lots of bad marks on your credit report get tricky. Experts know how to handle this.

- Unsure or Scared: If it seems overwhelming, a pro can guide you and make sure you’re treated fairly.

- No Time: Pros can save you time and hassle.

- Need Peace of Mind: Knowing someone with experience is on your side can bring comfort.

Types of Help:

- Credit Repair Companies: They deal with debt collectors a lot. But be careful – some are shady. Research them well!

- Lawyers: Can give advice on your rights and even fight for you if the collector breaks the law.

Things to Think About

- Cost vs. Reward: Is the pro’s fee worth the potential credit score boost?

- No Guarantees: Even pros can’t force collectors to agree. Keep expectations realistic.

- Middle Ground: You could write the letter yourself, then just pay a credit counselor or lawyer to look it over before you send it.

Important If You Do It Yourself:

- Learn the Rules: Know the laws that protect you from unfair debt collectors.

- Get It In Writing: Never pay without a written agreement saying they’ll remove the bad mark!

How Long Will It Take to See Results After Sending a Pay-for-Delete Letter?

The time it takes varies. Here’s why:

- How Fast They Respond: Some collectors act quickly on offers, others take weeks or even longer.

- Negotiating: If they don’t like your first offer, going back and forth takes extra time.

- Credit Report Updates: Even if they agree to remove the bad mark, it takes time for them to tell the credit bureaus (like Equifax) and for those changes to show up. This can take about a month.

What Could Happen:

- Best Case: They say “yes” right away, and your credit report is fixed within a month.

- Worst Case: They say “no,” or things get slow and messy. It might take many months or not work at all.

While You Wait:

- Be Patient: Fixes don’t happen overnight. Be ready for it to take a while.

- Track Your Progress: Once you have an agreement, check with them to make sure they sent the removal request.

- Check Your Credit Report: Keep an eye out to see if the bad mark disappears.

How to Make it Faster:

- Reply Quickly: Answer their questions or offers fast.

- Don’t Give Up: If they don’t reply, politely follow up.

- Know Your Rights: Learn the laws about debt collection so you know if they’re doing something wrong.

Important Note: Even if it works, your credit score won’t jump up magically. Good credit takes time to build.

What to Do if Your Pay-for-Delete Request is Denied

It’s frustrating when a collector or creditor says “no” to your pay-for-delete offer. Remember, they don’t have to agree. But don’t give up yet! Here’s what you can try:

Try a Lower Offer: If you owe a lot, propose paying a smaller amount. They might accept less money rather than nothing.

Ask for “Paid as Agreed”: They’ll update your credit report to show the debt as paid. It’s better than removal, but it’s better than a collection.

Other Options:

- Check for Errors: If there are mistakes on your credit report about the debt, dispute them.

- Goodwill Letter: If you generally have good credit but made one late payment, try composing a polite letter requesting the initial creditor to forgive it.

- Be Patient: Bad marks fade over time. Keep making on-time payments to build good credit.

How to Negotiate Better

- Know Your Rights: Learn the laws about debt collection so you know if they’re acting unfairly.

- Save Everything: Keep copies of letters and emails if you need proof.

- Get Help: If the debt is big or things get messy, consider hiring a credit repair company or lawyer. They might be better at negotiating.

Important Reminders:

- No Guarantees: Sometimes, they still need to budge. Be prepared for that.

- The Debt Could Come Back: Even if you get it removed, they might sell it to a new collector who puts it back on your report.

- Focus on the Long Run: Fixing one bad mark helps, but the best way to improve your credit is by always paying on time and using credit wisely.

Conclusion

A pay-for-delete letter template is a tool that can help you clean up your credit. It’s not magic, but if you write a good letter and pick the right situation, it can give your credit score the boost it needs!

“Ready to tackle those collection accounts? Here’s how to start fixing your credit today: Dispute any errors on your credit report. Consider a goodwill letter if the debt was a one-time slip-up. * If ready, draft a pay-for-delete offer and start negotiating!”

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.