When deciding to conduct a partnership or cooperation with other parties, the partnership agreement must be provided. What is it actually? It is a kind of letter that loads all items important to conduct a good partnership. Commonly, it is a professional partnership dealing with business, companies, and institutions. To add professionalism, there are also terms and conditions along the disclaimer added. It is suggested that the agreement letter must have a legal force. Therefore, if one of the parties violates the contracts, they can get the necessary punishment.

This article delves into the importance of a partnership agreement, how to write one, the legal aspects to consider, the essential components to include, and common mistakes to avoid. Read on to comprehensively guide partnership agreements and their role in successful business partnerships.

Why is a partnership agreement important?

The significance t in business collaborations cannot be overstated. Here’s why it’s a vital document:

- Clarifying Roles and Duties: It defines each member’s functions and duties. This clarity helps prevent misconceptions and conflicts by ensuring all members comprehend their responsibilities.

- Profit and Loss Allocation: Most crucial aspect is determining the allocation of profits and losses among members. It is typically proportionate to each member’s assistance to the company, whether in capital, investments, or effort.

- Dispute Resolution Mechanisms: Disagreements are a common occurrence in any company collaboration. It can establish guidelines for determining conflicts, such as mediation or arbitration, facilitating quick and amicable resolutions.

- Business Continuity Provisions: It can outline the activity course if a member exits the company, becomes incapacitated, or passes away, ensuring the business’s continuity in these scenarios.

- Protection for Minority Partners: For collaborations where one or more members hold a smaller stake, It can protect their rights and interests.

- Overriding Default State Laws: State laws will govern the partnership without a contract. These rules may not always align with the partners’ or the business’s best interests. The contract allows partners to establish rules, offering greater flexibility and control.

It is a fundamental instrument for any company collaboration. It sets clear expectations, mitigates disputes, and ensures smooth business operations.

It’s always advisable to seek legal counsel when preparing a partnership agreement to ensure all partners’ interests are sufficiently protected and the agreement adheres to all relevant laws and regulations.

How do you write a partnership agreement?

It is a crucial step in establishing a business partnership. Here’s a step-by-step guide on how to create one:

- Identify the Parties Involved: Identify all parties interested in the contract. Contain their full names and addresses.

- Define the Purpose of the Partnership: Clearly state the goal of the collaboration. It could be a general statement about the type of company the association will engage in.

- Specify the Duration of the Partnership: Indicate the duration of the partnership. It could be a specific period or until a certain event occurs, such as the completion of a project.

- Outline Roles and Responsibilities: Describe each member’s roles and duties. It has its duties, decision-making powers, and obligations to the association.

- Detail Capital Contributions: Specify the fund’s contributions each member will complete. It could include money, property, or services. Also, detail how future capital contributions will be made.

- Describe Profit and Loss Distribution: It will be distributed among the partners. It is typically based on each partner’s capital contribution.

- Set Dispute Resolution Procedures: Establish guidelines for fixing disputes among members. It could involve mediation or arbitration.

- Provide for Changes in the Partnership: Contain requirements for adding or removing members and what happens if a partner dies or becomes incapacitated.

- Include a Dissolution Plan: Detail the methods for dissolving the partnership. It includes how assets will be allocated and obligations paid off.

- Sign and Date the Agreement: All members should sign and date the contract. It’s also a good idea to have the contract notarized.

It is a lawful record, and it’s always a good idea to consult a legal professional when drafting one. It can help ensure that the agreement is legally sound and that all partners’ interests are protected.

Legal Aspects of a Partnership Agreement

Legal Considerations are instrumental in averting disputes and facilitating the smooth functioning of the partnership. Here are some pivotal legal considerations:

Legally Enforceable: It is a contractual agreement between partners. Once signed, it becomes legally enforceable, obligating each partner to adhere to the responsibilities stipulated in the agreement. Non-compliance could result in legal repercussions.

Involvement of Legal Counsel: Although it’s feasible to draft It without legal aid, involving a lawyer is generally advisable. A lawyer can ensure that the agreement is legally robust and comprehensive and safeguards the interests of all partners. They can also help decipher legal terminology and ensure all partners fully comprehend the agreement’s terms.

Validity: it must satisfy certain legal criteria. For instance, it must be explicit and specific, and all partners must sign it. The deal might be clear and clear if it is vague or ambiguous.

Dispute Resolution: It usually incorporates provisions for resolving partner disagreements. It could involve mediation, arbitration, or litigation. These provisions help avert expensive and protracted legal disputes.

Modifications and Revisions: Amendments or revisions to the partnership agreement may be required over time. Any alterations to the contract should be documented in writing and signed by all partners to be legally enforceable.

Termination and Dissolution: The partnership agreement should stipulate provisions for terminating the partnership and dissolving the business. It includes the distribution of assets, payment of debts, and the disposition of each partner’s share of the business.

The legal considerations are vital in ensuring the partnership’s smooth operation and the protection of all partners. It’s always prudent to seek legal advice when drafting, reviewing, or amending a partnership agreement.

Essential Parts of a Partnership Agreement

Here are some of the fundamental parts that should be incorporated into a partnership agreement:

Identification of the Partners: It should unambiguously state the names of all the members involved in the relationship. It establishes who is legally obligated to adhere to the agreement’s terms.

The partnership’s objective: It should distinctly define the partnership’s objective. It includes the business’s nature, the partnership’s goals, and the activities it will undertake.

Capital Contributions: It should specify the capital contributions of each partner. It has the value of money, property, or services each member will contribute to the partnership and the timeline for these contributions.

Profit and Loss Allocation: It should delineate how profits and losses will be distributed among the partners. It could be an equal distribution based on each partner’s capital contribution or the amount of effort they invest in the business.

Management and Decision-Making: It should outline how the partnership will be handled and how findings will be made. It includes who has decision-making authority within the partnership and how disagreements will be resolved.

Resolution of Disputes: It should incorporate a clause outlining the procedures for resolving partner disputes. It could involve mediation, arbitration, or litigation.

Termination and Dissolution: It should detail the circumstances under which the partnership can be terminated and the procedures for dissolving it. It includes the distribution of assets, payment of debts, and the disposition of each partner’s share of the business.

Amendments: It should stipulate how it can be amended. Typically, amendments require the written consent of all partners.

By incorporating these essential elements, a partnership agreement can provide a clear structure for the partnership, prevent misunderstandings, and safeguard the interests of all partners.

Tips for Preparing a Partnership Agreement

Here are some tips for preparing an effective partnership agreement:

- Be Clear and Specific: Be as specific as possible about all parts of the partnership, including the functions and duties of each partner, the company of profits and losses, and the methods for fixing disputes. Avoid vague language that could guide misunderstandings.

- Address All Potential Issues: Think about all the potential issues that could arise in the partnership and address them in the agreement. It includes what happens if a partner wants to leave the partnership, if a partner passes away, or if the partnership is not profitable.

- Seek Legal Advice: A lawyer can assist in guaranteeing that the contract is legally sound, includes all required components, and protects all members’ interests.

- Review Regularly: Business needs and relationships can change over time, so it’s a good idea to review regularly and make updates as necessary. It can assist in providing that the agreement continues to reflect the current state of the partnership.

- Get It in Writing: Always put the partnership agreement in writing. A documented contract is lawfully enforceable and delivers a clear description of the terms of the association.

- Mutual Agreement: Make sure all members consent to the terms of the collaboration contract. Each member should be able to check the agreement, suggest changes, and seek independent legal advice if desired.

Following these tips, you can prepare a partnership agreement that provides a strong basis for your business collaboration and benefits to ensure a smooth and prosperous partnership.

Mistakes and How to avoid

Awareness of these pitfalls can help you avoid them and create a more effective agreement. Here are some common mistakes and how to avoid them:

- Not Having a Partnership Agreement: Even if you’re going into business with a close friend or family member, it’s crucial to have a written agreement outlining the partnership’s terms. It can help prevent misunderstandings and disputes down the line.

- Being Vague or Incomplete: A partnership agreement should be clear and comprehensive. Avoid vague language and address all potential issues that could arise during the partnership. It includes how profits and losses will be divided, the roles and responsibilities of each partner, and what happens if a partner wants to leave the partnership.

- Not Seeking Legal Advice: While it’s possible to draft a partnership agreement on your own, seeking legal advice is advisable. A lawyer can help ensure that the agreement is legally sound and protects all partners’ interests.

- Not Planning for the Unexpected: Planning for unexpected events in a partnership agreement is important. It includes what happens if a partner passes away, if a partner wants to leave the partnership, or if the partnership is not profitable. Planning these scenarios can help prevent disputes and ensure a smooth transition.

- Not Reviewing the Agreement Regularly: A partnership agreement should be a living document reviewed and updated regularly. As the business evolves, the agreement should be adjusted to reflect changes in the partnership.

By avoiding these common mistakes, you can create a partnership agreement that provides a strong foundation for your business partnership and helps ensure a smooth and successful partnership.

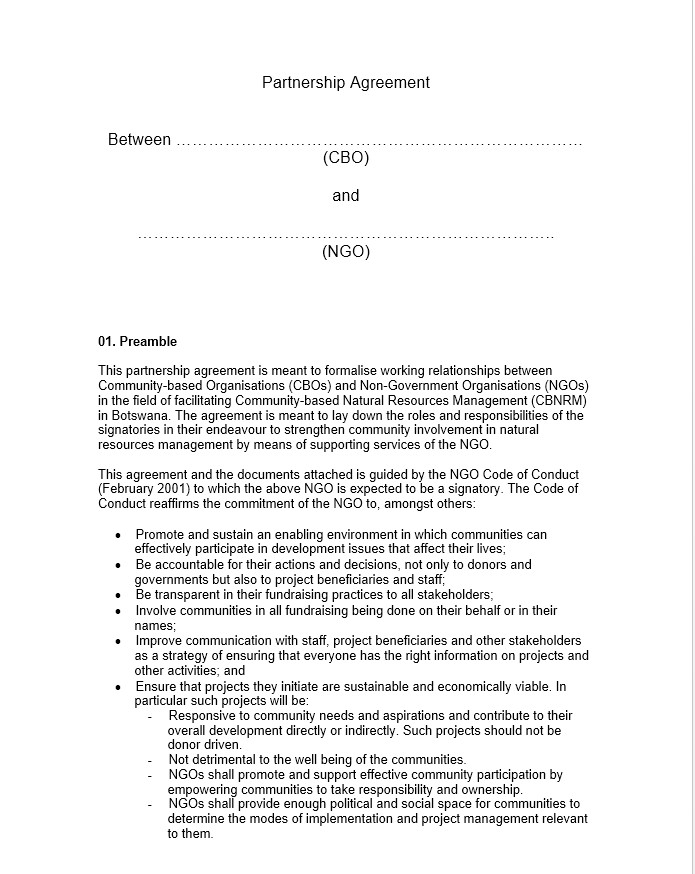

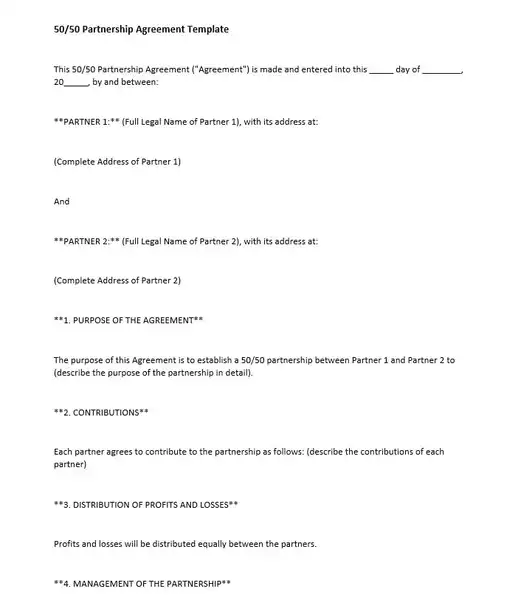

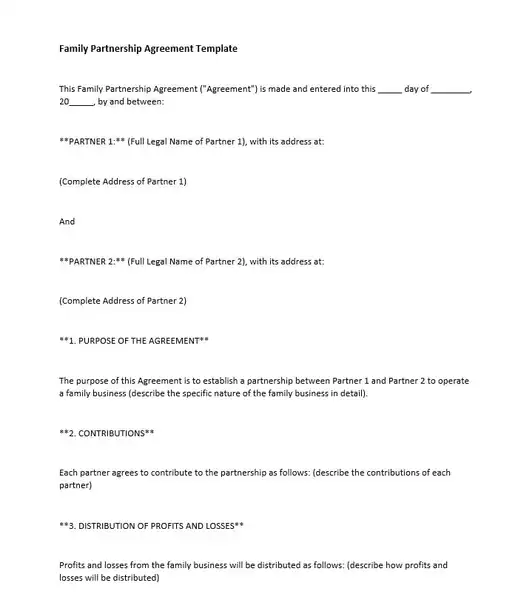

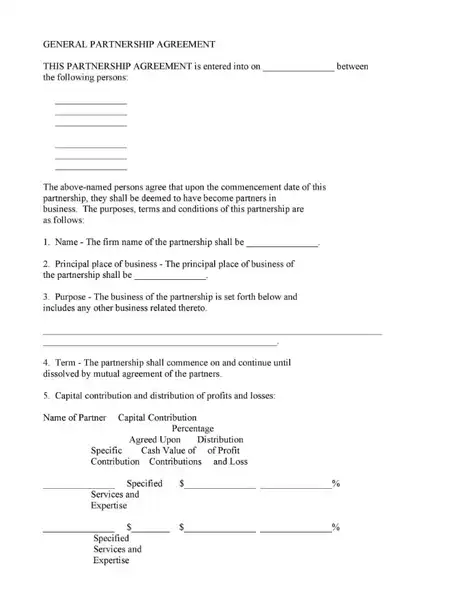

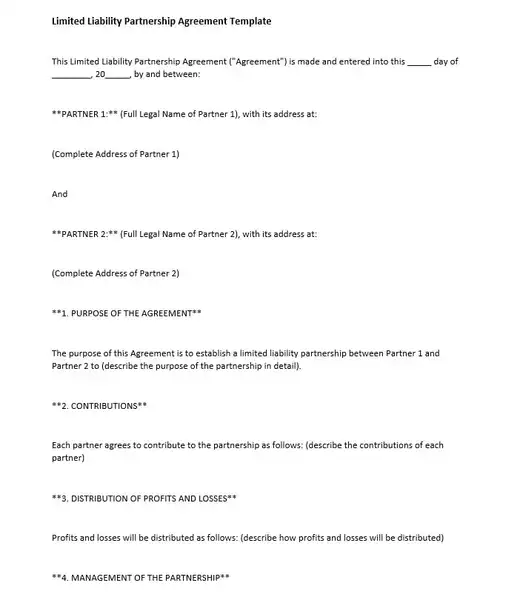

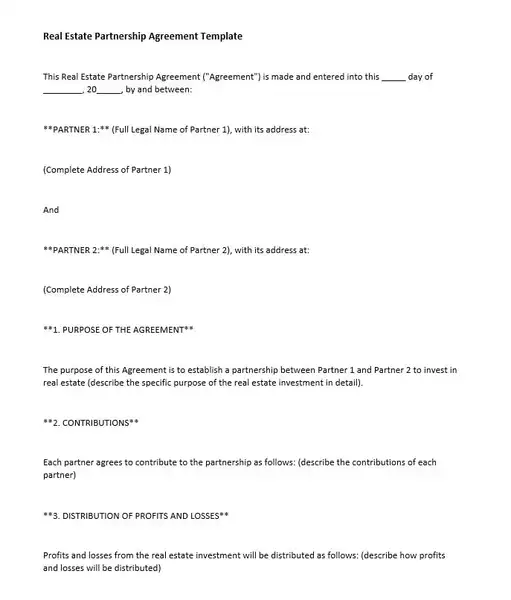

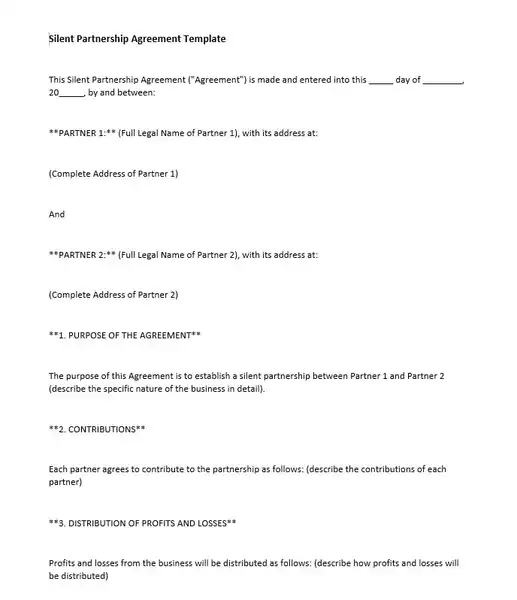

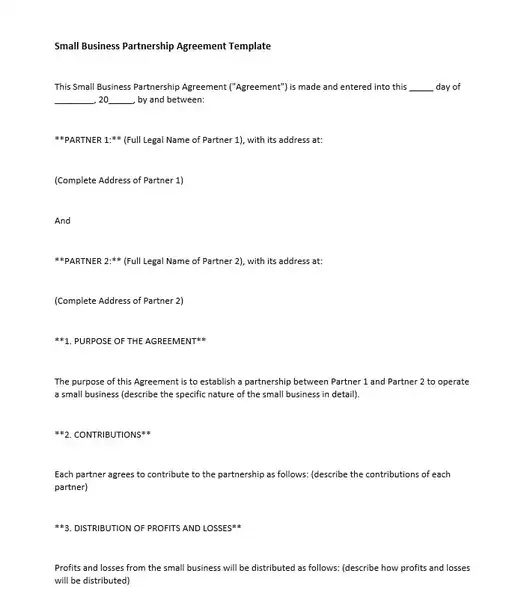

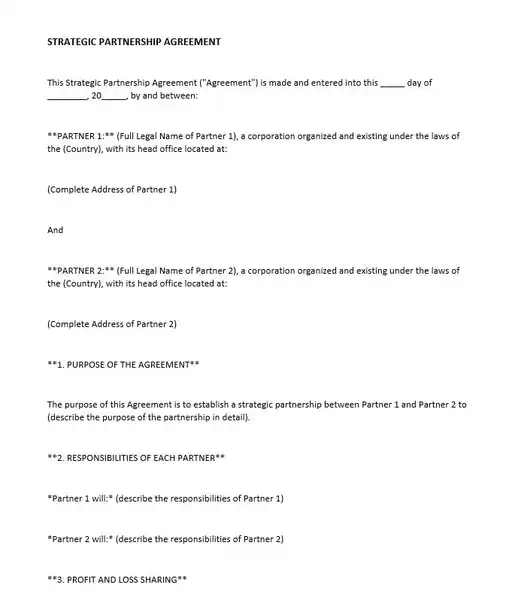

Partnership agreement template

To acknowledge the partnership agreement template more, you should learn about the act published in your country. It is to avoid any unnecessary thing happening in the future.

FAQs

What happens if partners operate without a partnership agreement?

It can lead to uncertainty and potential disputes. With a written agreement, partners are subject to default state laws, which may align with their intentions or best interests. It can also make it difficult to resolve disputes or handle changes in the partnership, such as the departure of a partner.

What is the process of dissolving a partnership as per the agreement?

The process for dissolving a partnership should be outlined in the partnership agreement. It typically involves settling the partnership’s debts, distributing the remaining assets among the partners, and filing the necessary paperwork with the state. The process can vary depending on the agreement’s terms and the state’s laws.

How can a partnership agreement help prevent disputes among partners?

It can help prevent disputes by clearly outlining each partner’s roles, responsibilities, and expectations. It can specify how decisions are made, how profits and losses are divided, and how disputes are to be resolved. By having these details agreed upon in advance, partners can avoid misunderstandings leading to disputes.

How can a partnership agreement be amended or revised?

It can be amended or revised with the consent of all partners. The process for making amendments should be outlined. Typically, amendments must be made in writing and signed by all partners to be legally binding.

How are profits and losses divided in a partnership agreement?

The division of profits and losses is typically outlined in the partnership agreement. It can be divided equally or based on each partner’s capital contribution or the work they put into the business. The agreement should specify how profits and losses are divided to avoid misunderstandings.

How does a partnership agreement protect the interests of minority partners?

It can protect the interests of minority partners by clearly outlining their rights and responsibilities. It can specify their share of profits and losses, their role in decision-making, and their rights in the event of a dispute. It can help ensure that their interests are respected and that they have a say in the partnership’s operation.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.