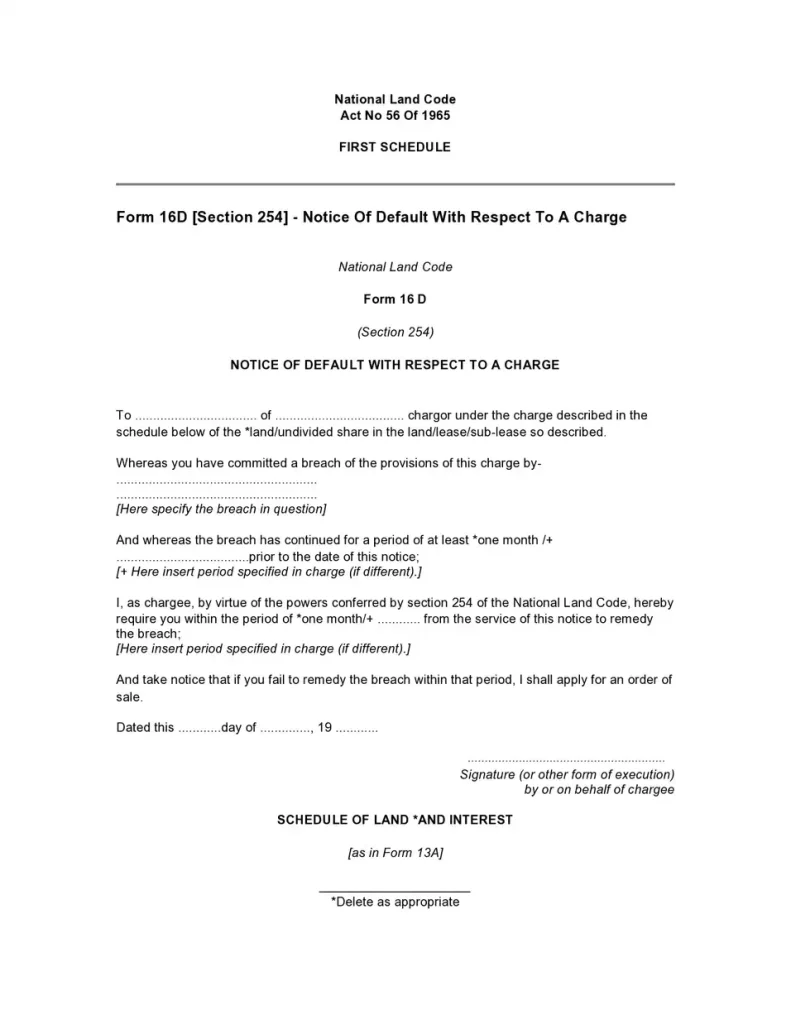

A notice of default letter is an important document that homeowners might receive if they fall behind on their mortgage payments. Understanding this letter is crucial to avoid further financial issues and legal troubles.

What is a Notice of Default Letter?

A mortgage lender sends a notice of default letter when a borrower misses several mortgage payments. This letter serves as an official warning that the loan is in default and that legal action may follow if the debt is not resolved.

Why Do Lenders Send This Letter?

Lenders send a notice of default letter to let you know you are behind on your mortgage payments. Here are the main reasons why they sent this letter:

- To Inform You

The lender wants to inform you that you have missed several payments. They need to make sure you know about the problem so you can take steps to fix it. - Legal Requirement

The law often requires lenders to send a notice of default letter. Lenders must follow certain legal steps before they can start the foreclosure process, and this letter is one of those steps. - To Give You a Chance to Catch Up

The letter gives you a chance to catch up on your missed payments. It’s a warning that you need to act quickly to avoid more serious problems like foreclosure. - Protecting Their Investment

Lenders have a lot of money invested in your home loan. If you don’t make your payments, they lose money. The notice of default is a way for them to protect their investment by encouraging you to pay what you owe. - Starting the Foreclosure Process

If you don’t respond to the notice of default, the lender can start the foreclosure process. This means they can take back your home and sell it to get their money back. The letter is the first official step in this process. - To Keep Records

Sending a notice of default letter helps the lender keep accurate records. It shows that they followed all the legal steps required before starting foreclosure. This can be important if there are any disputes later on. - Encouraging Communication

The letter encourages you to contact your lender. By talking to them, you might be able to work out a plan to catch up on your payments. Communication can often help solve the problem and avoid foreclosure. - Meeting Regulatory Requirements

State and federal laws regulate lenders. These laws often require lenders to send a notice of default as part of the process. This helps ensure that borrowers are treated fairly and have a chance to fix their situation.

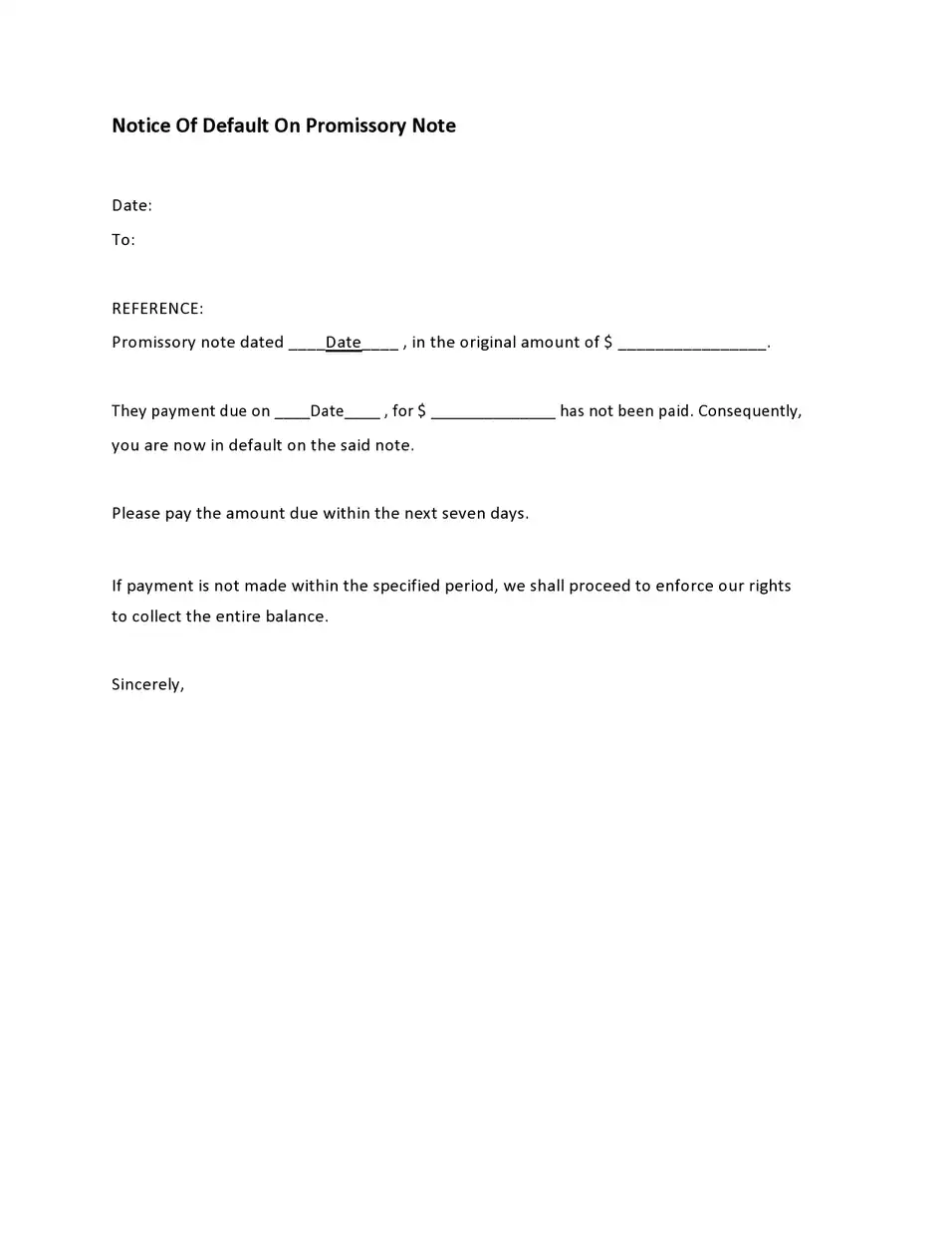

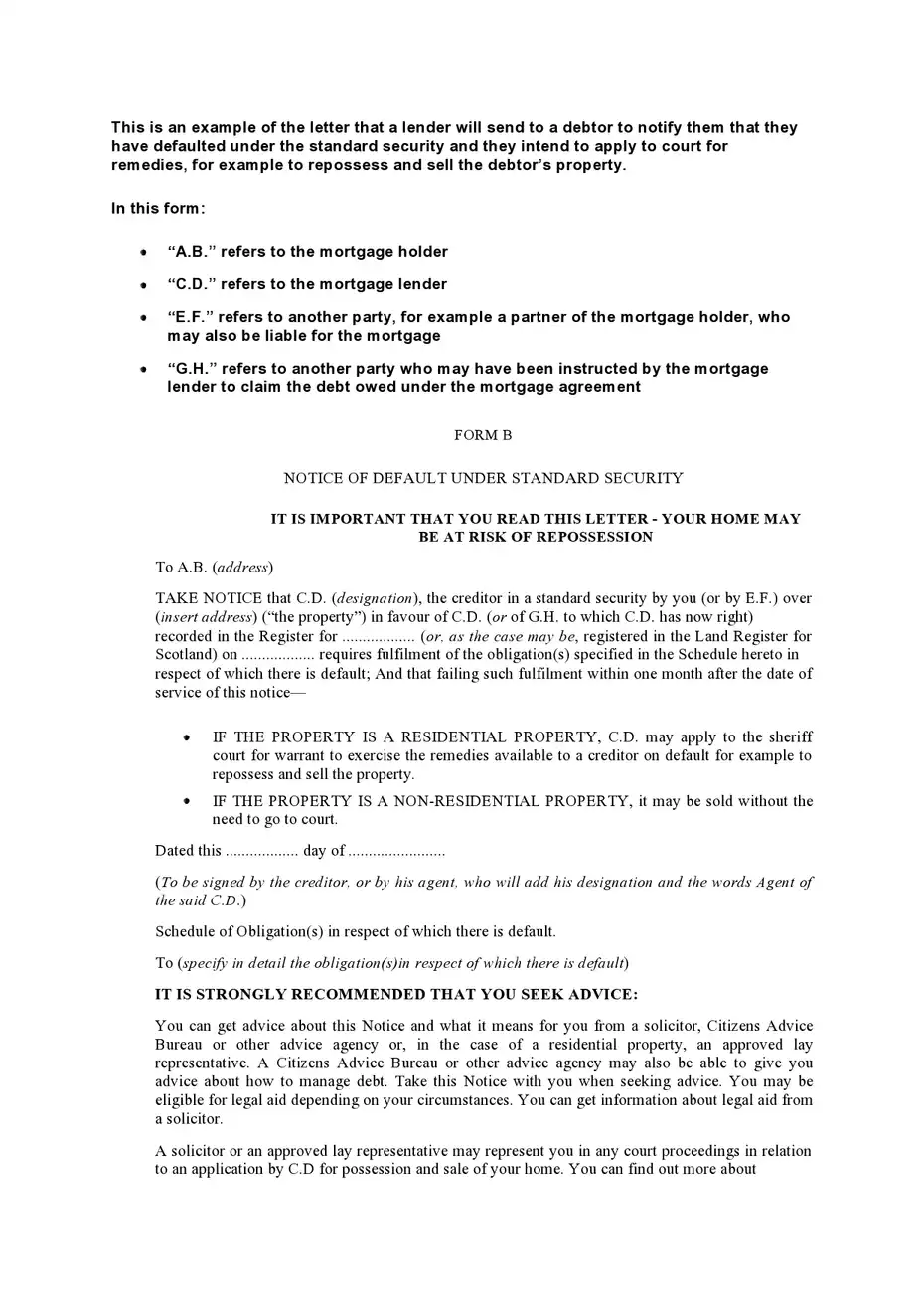

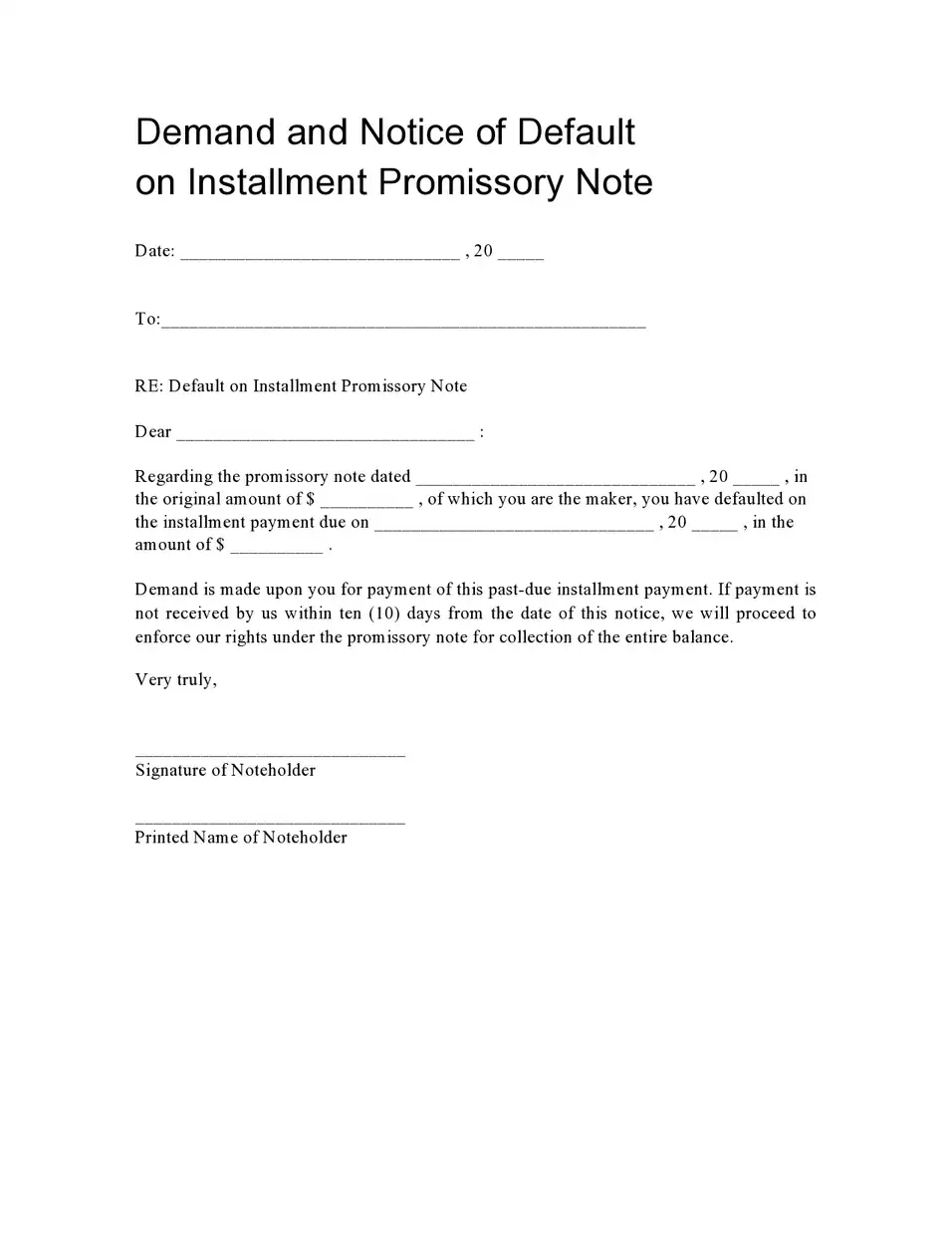

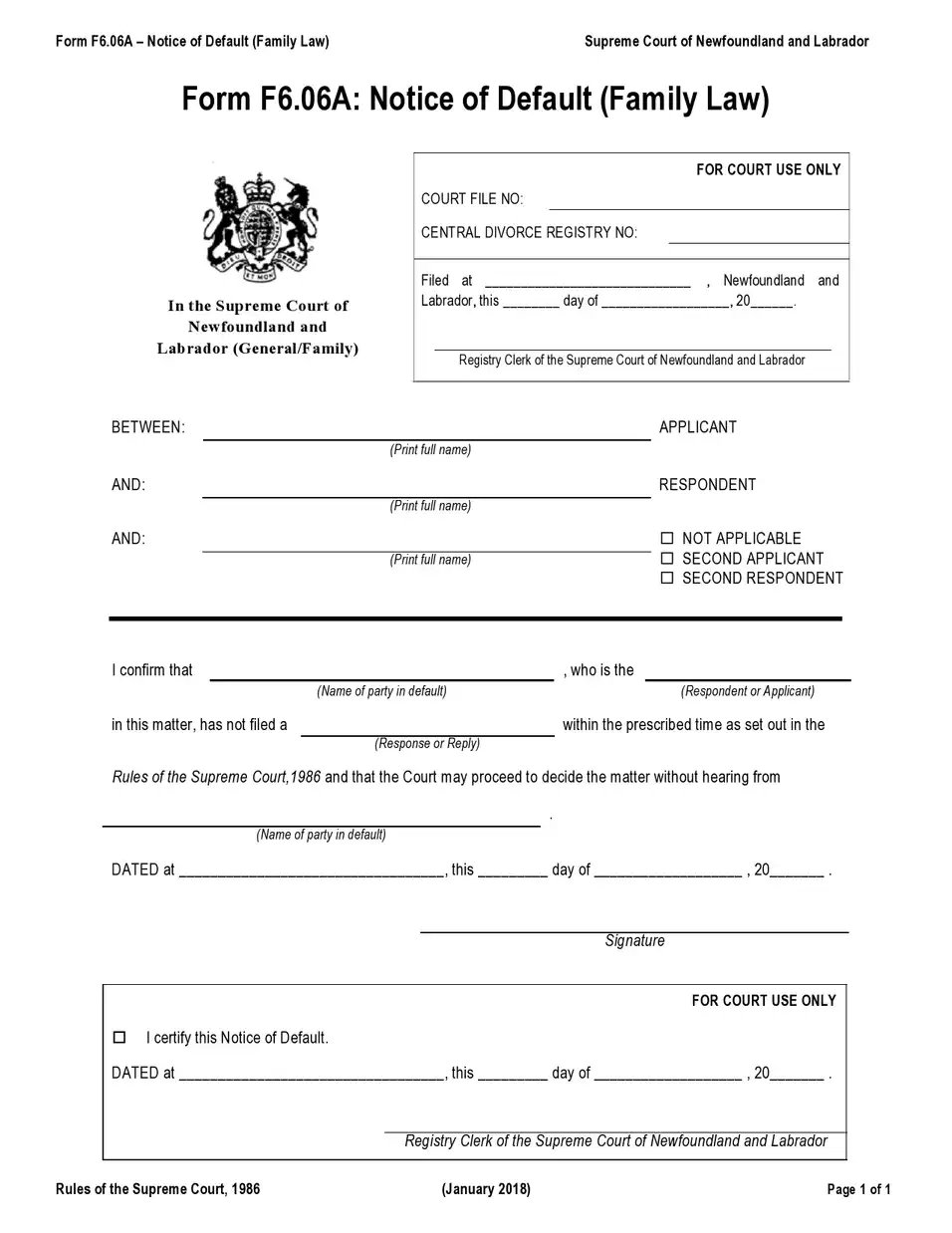

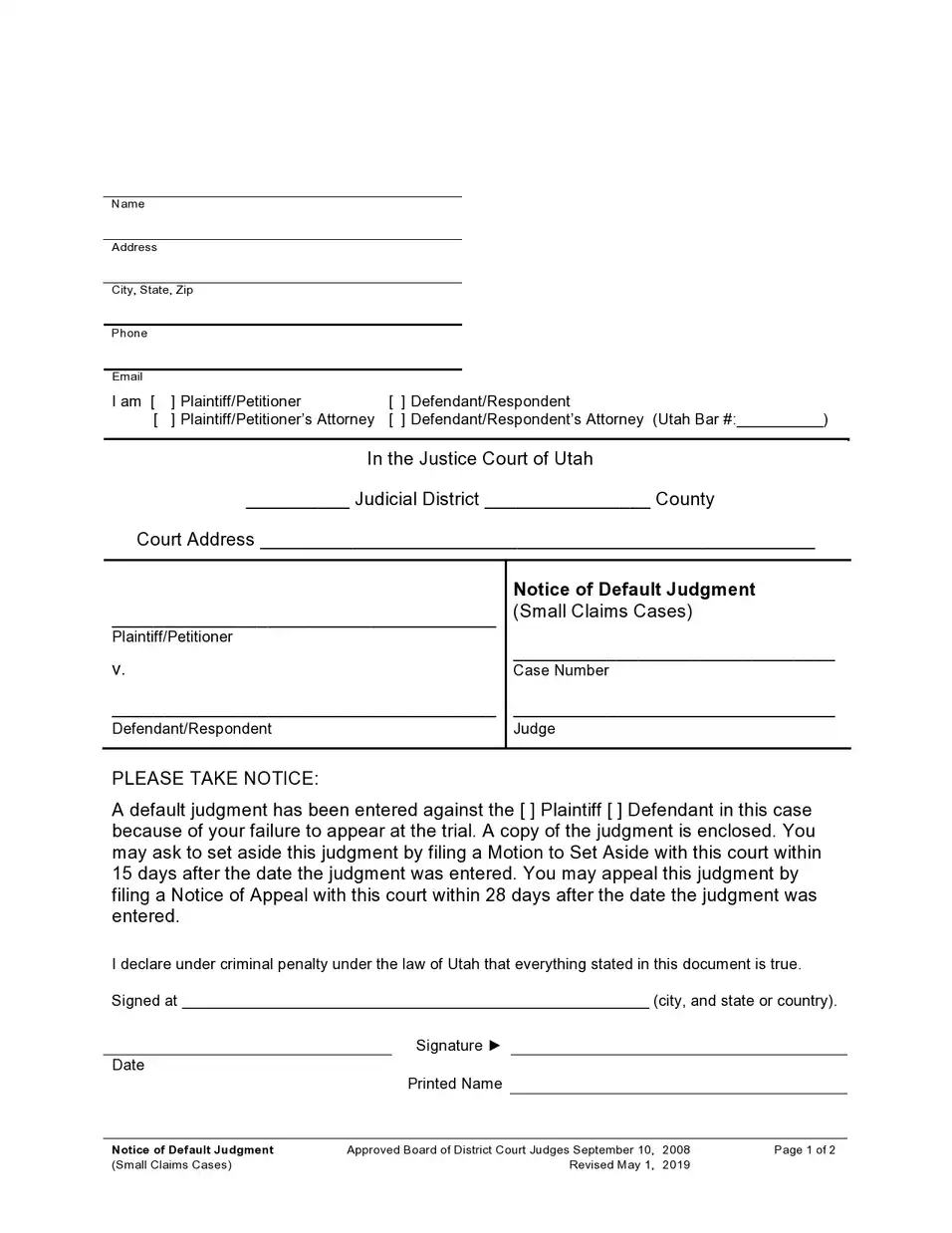

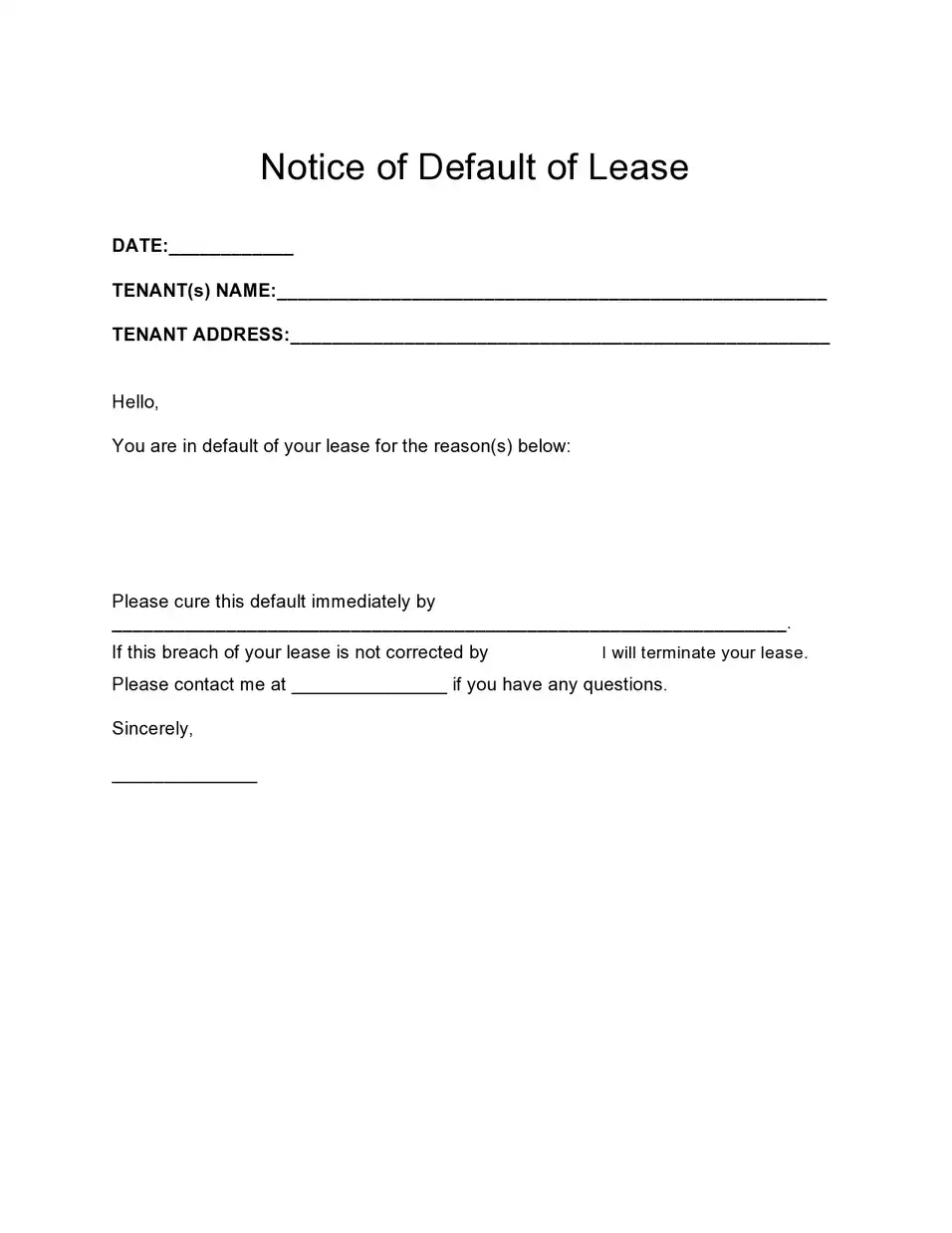

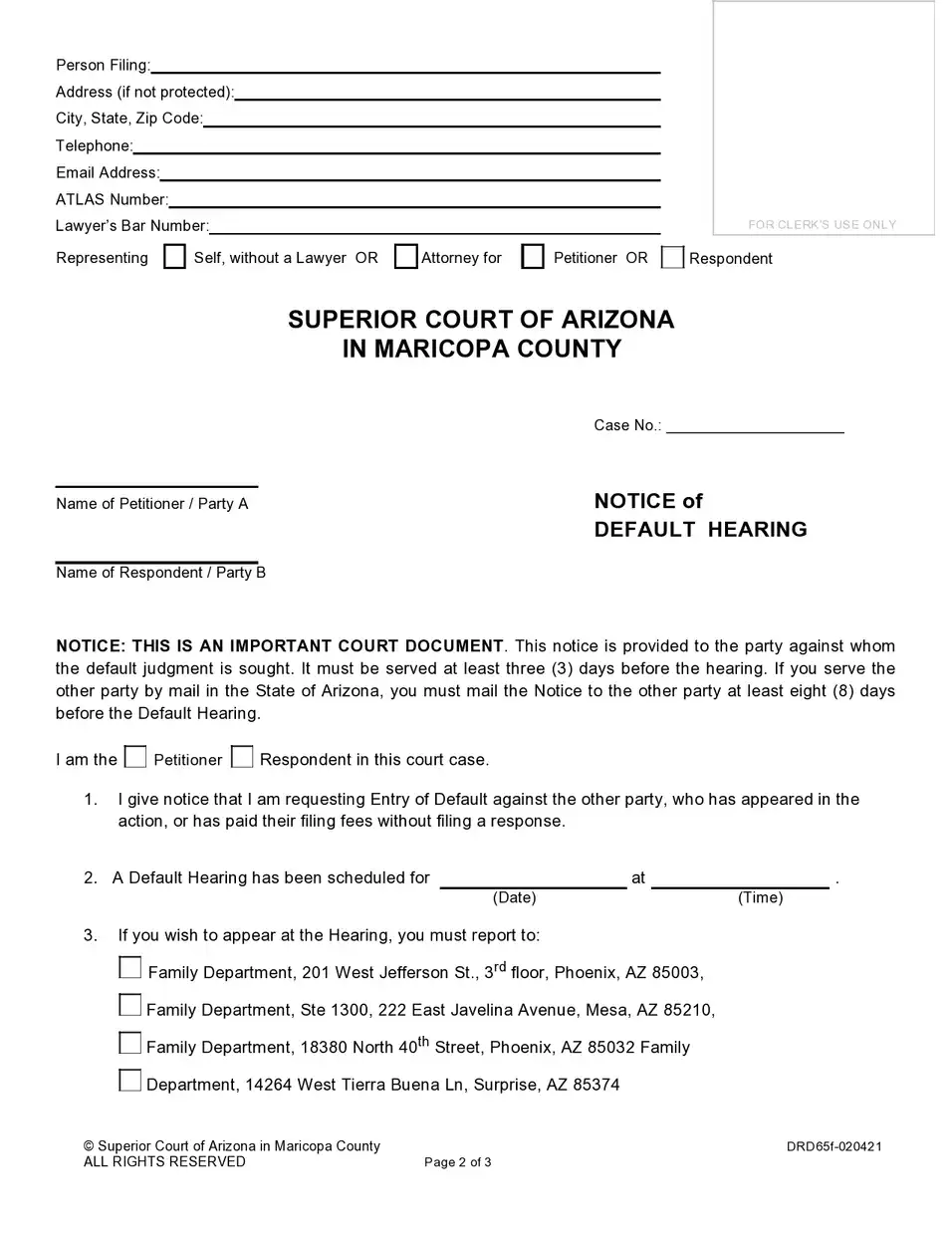

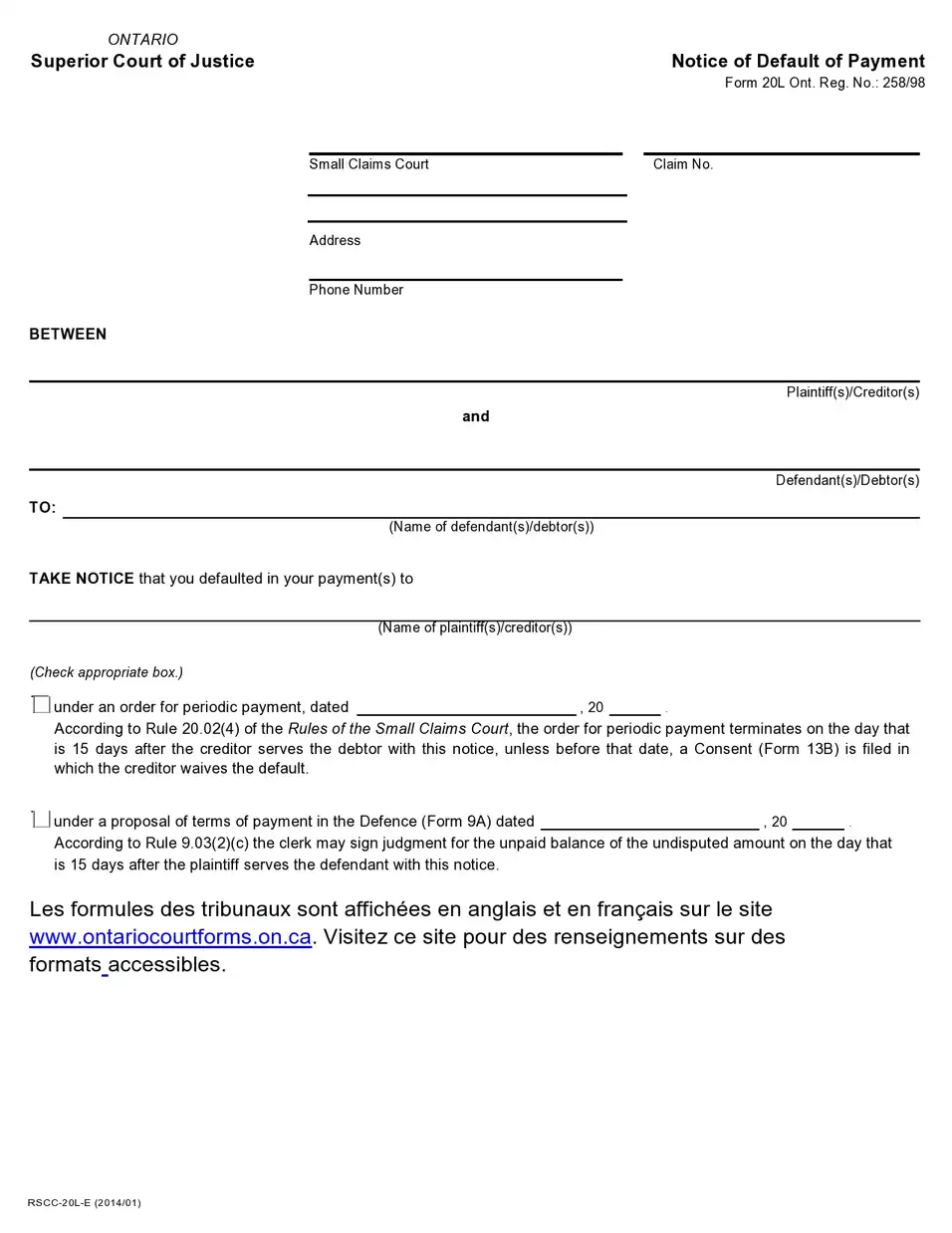

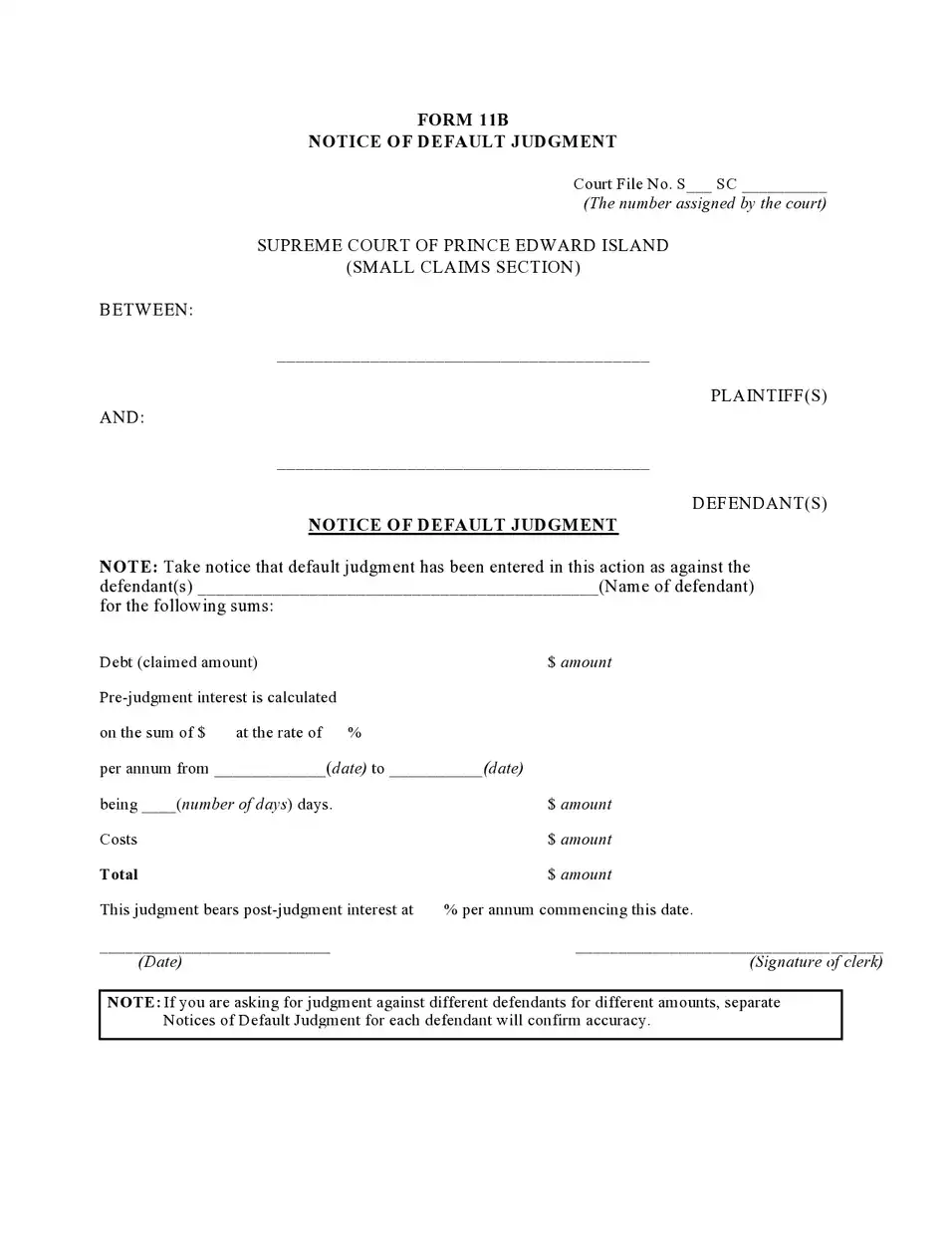

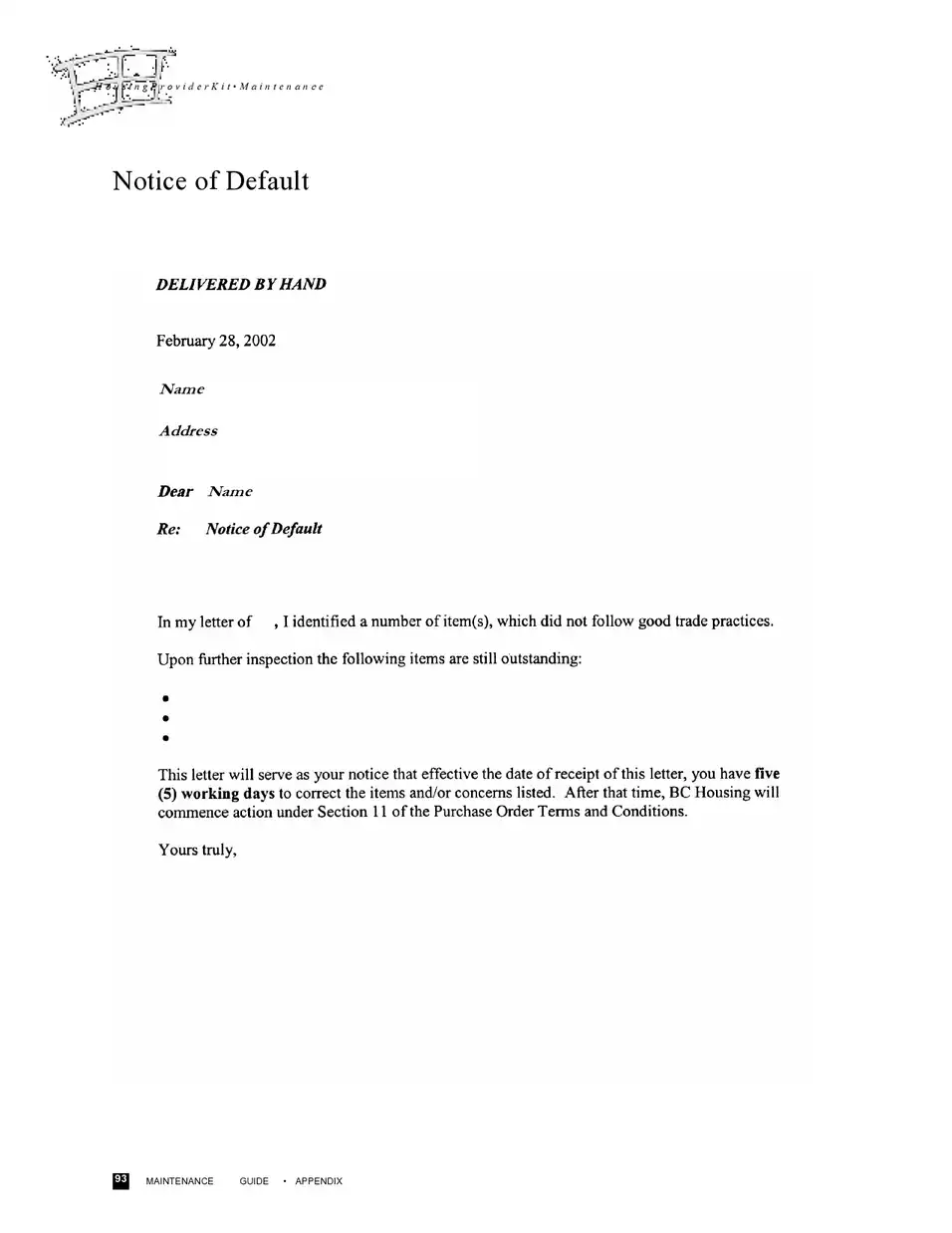

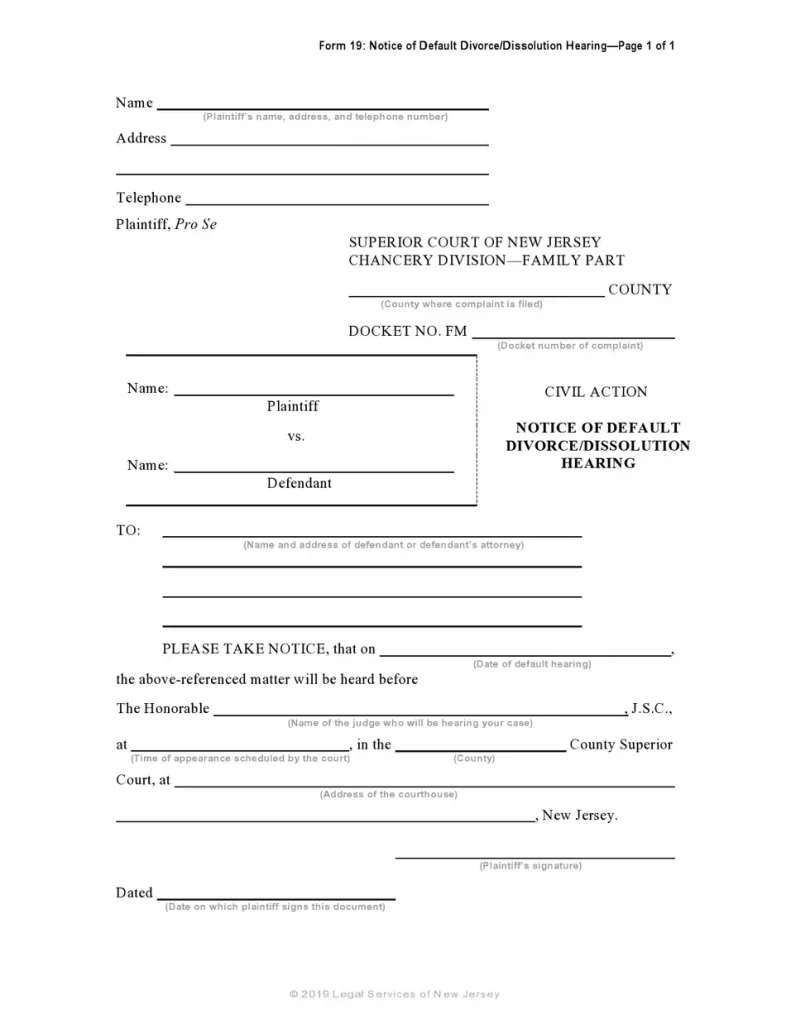

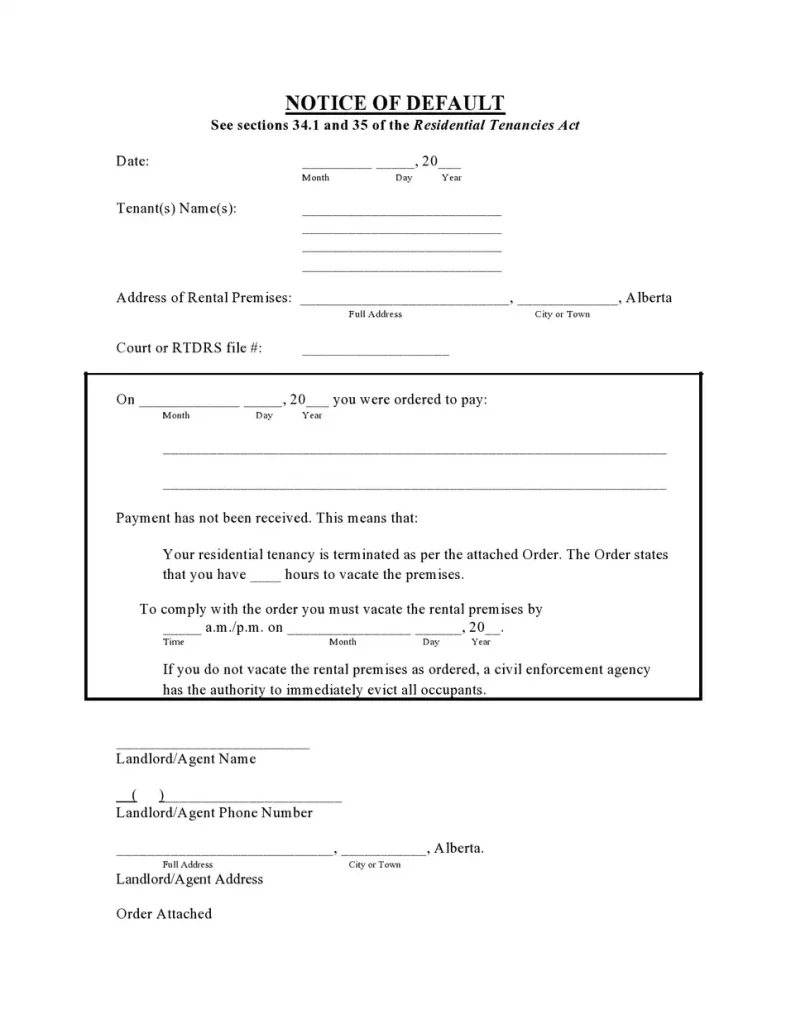

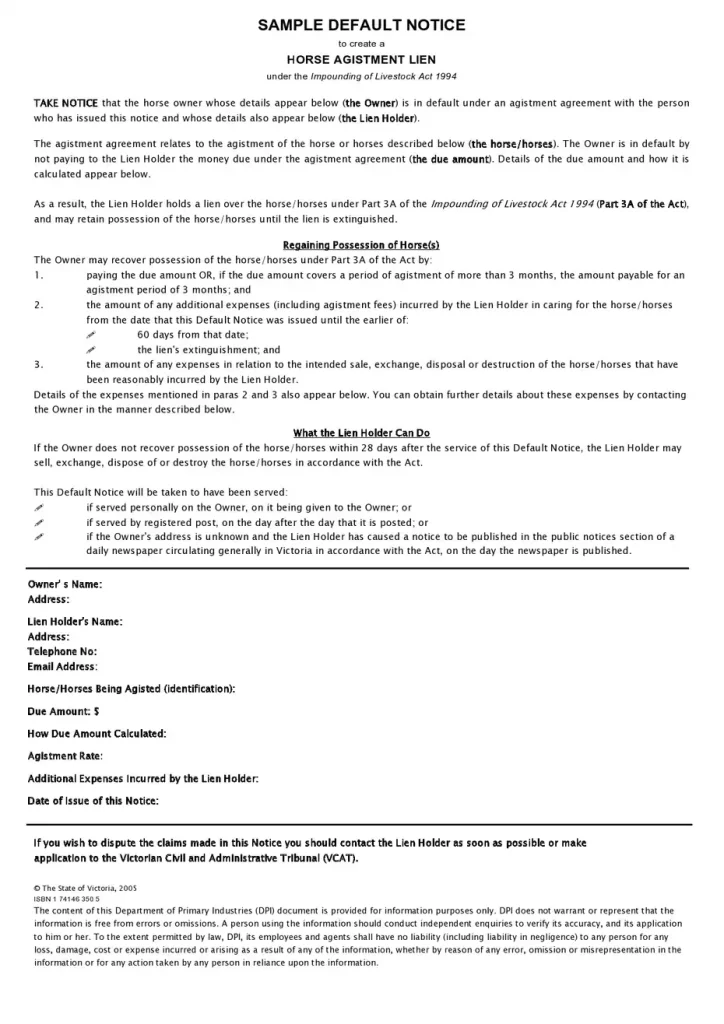

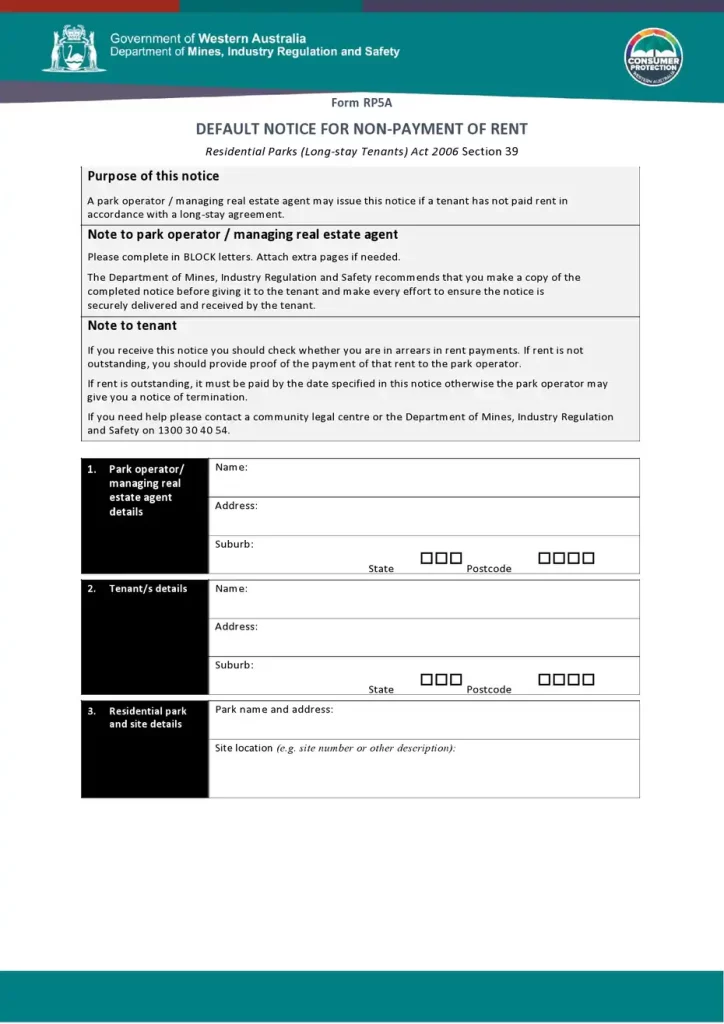

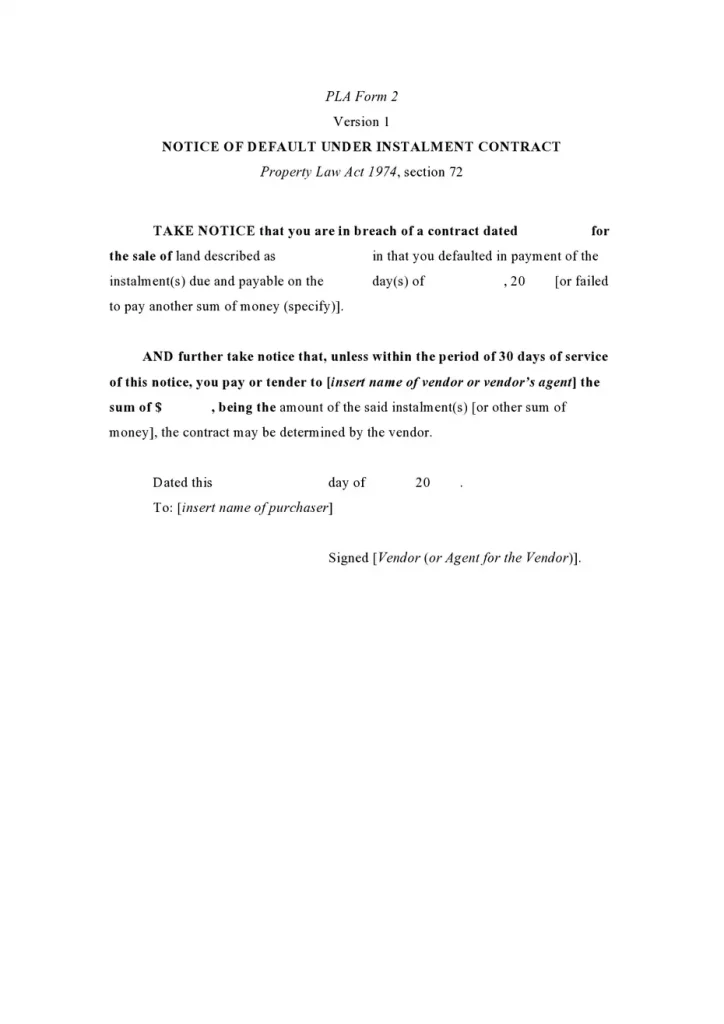

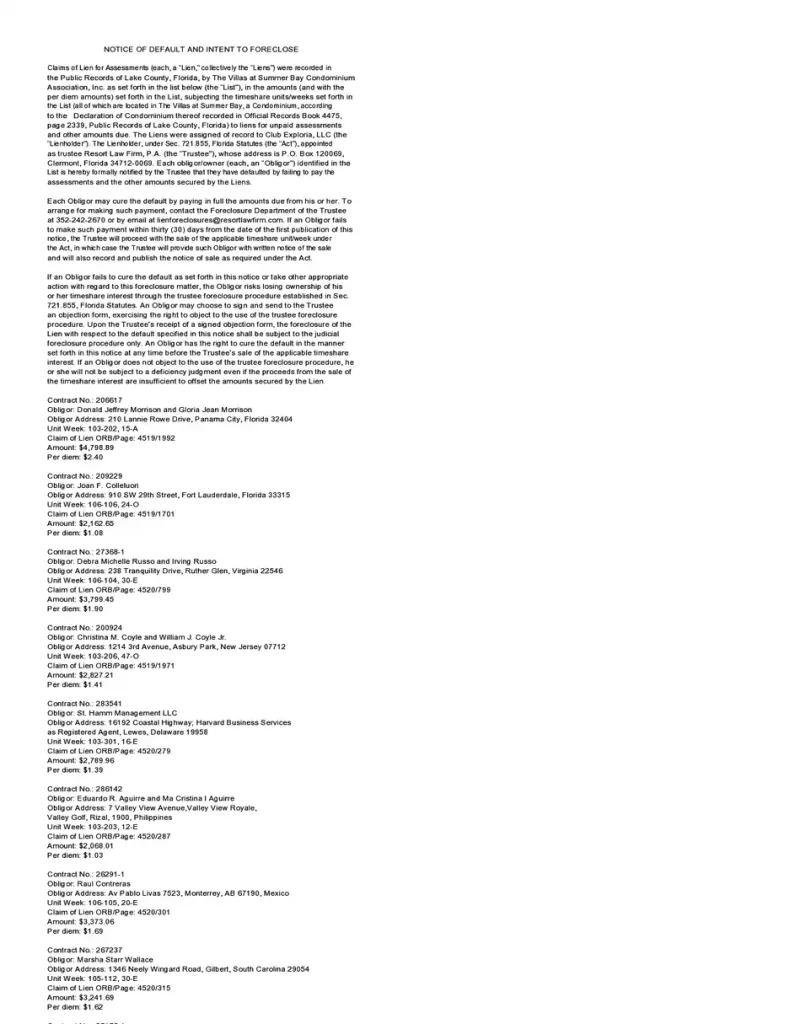

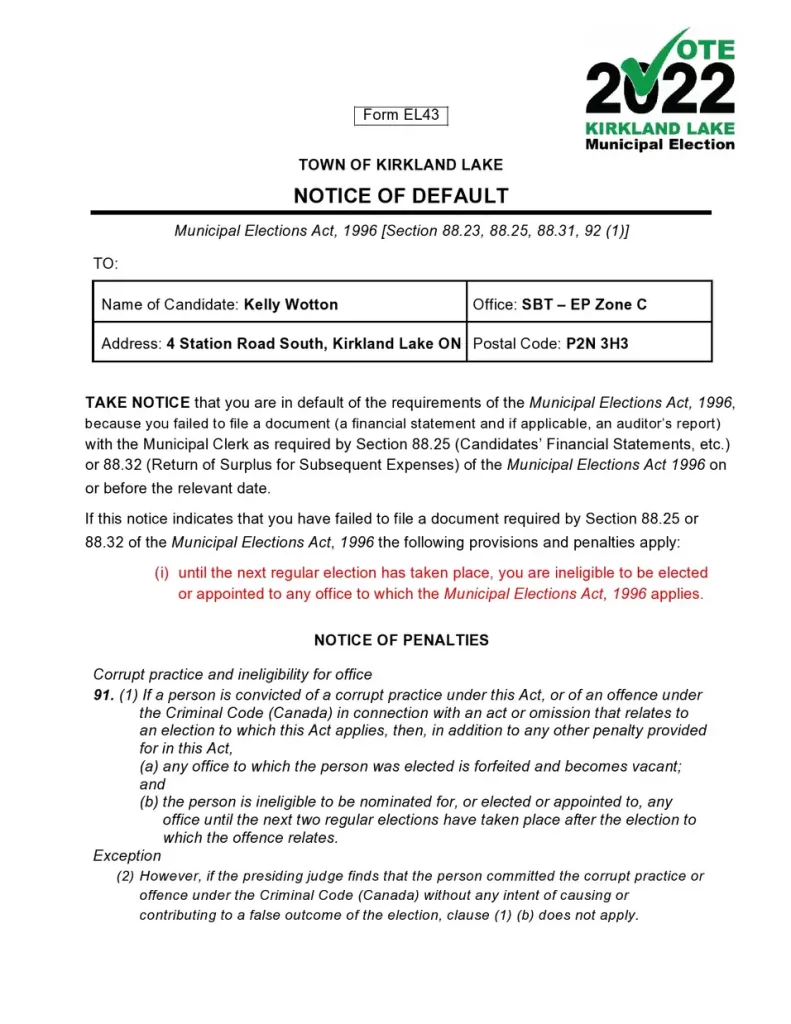

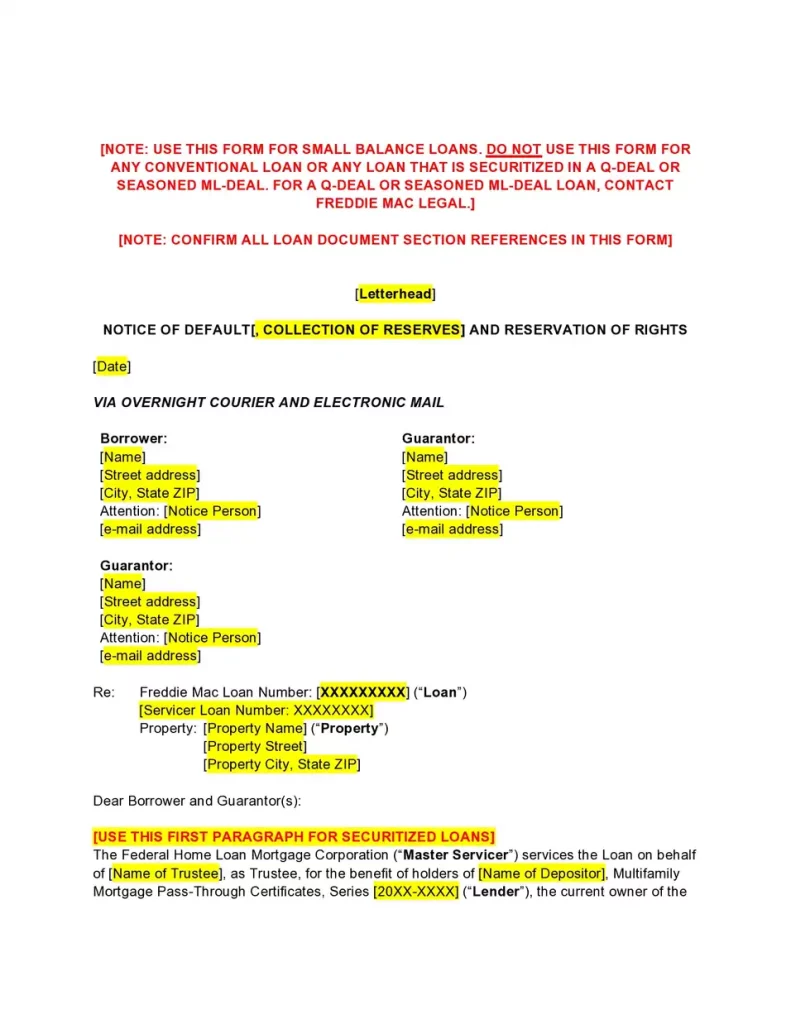

Notice of Default Letter Template

When is a Notice of Default Letter Issued?

A notice of default letter is issued when a homeowner falls behind on their mortgage payments. This usually happens after missing three or more payments in a row.

The exact number of missed payments can vary depending on the lender and the terms of the mortgage, but 90 days of non-payment is a common threshold.

Steps Before Issuing the Letter

Before sending a notice of default, lenders usually follow these steps:

- Reminder Notices: The lender sends reminder notices after the first missed payment.

- Late Fees: Late fees are added to the missed payments, and the borrower is informed.

- Collection Calls: The lender may call the borrower to discuss the missed payments.

- Final Warning: A final warning letter is sent before the notice of default.

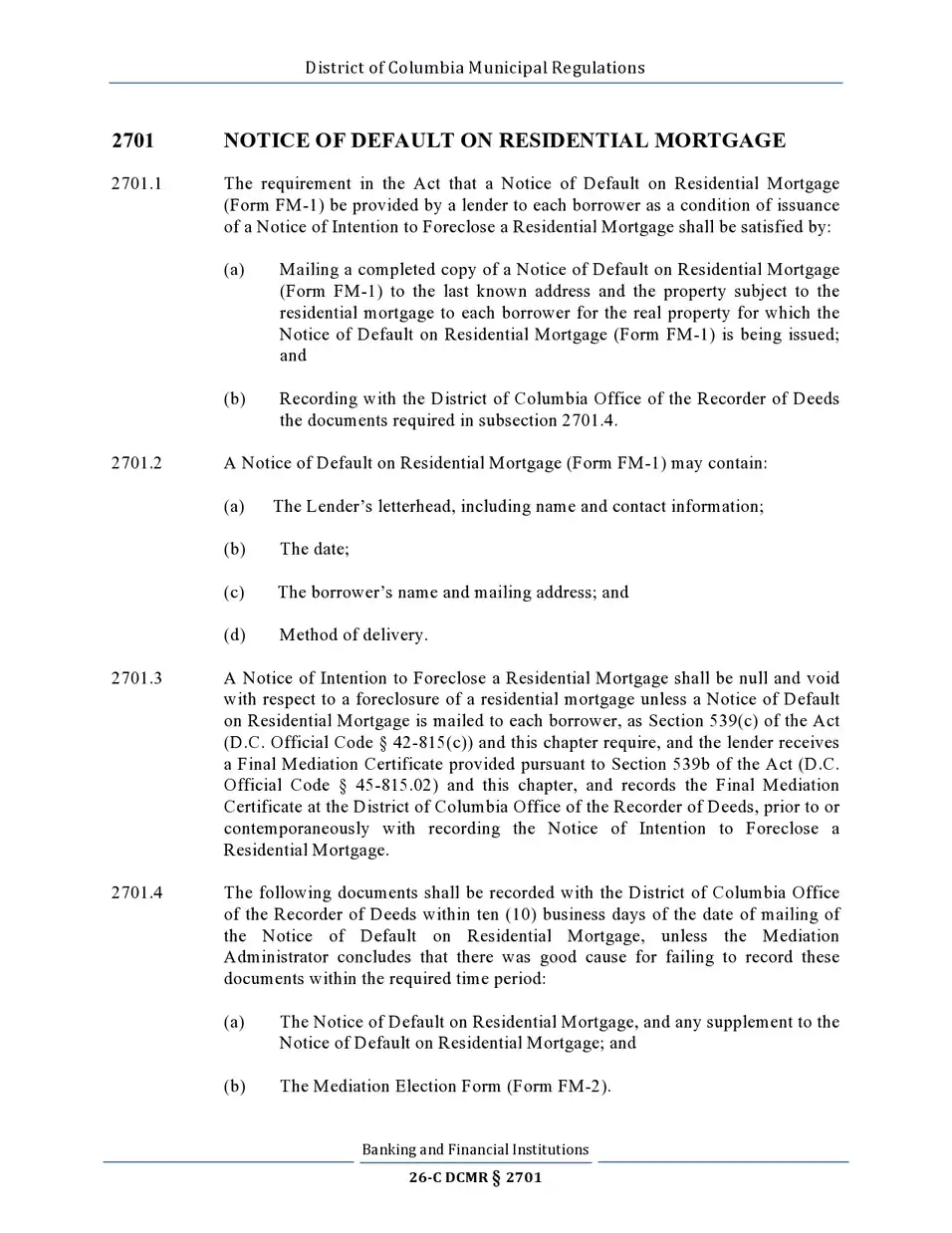

Legal Requirements

In many places, there are legal requirements that lenders must follow before they can issue a notice of default. These laws are meant to protect homeowners’ rights and give them a fair chance to catch up on their payments. The requirements can include:

- Notification Period: Lenders must wait a specific number of days after the missed payments before issuing the notice.

- Written Communication: The lender must send written notices and warnings.

- Opportunity to Cure: Homeowners are given a chance to pay the overdue amount and avoid default.

Example Timeline

Here is an example timeline showing when a notice of default letter might be issued:

- Day 1: First payment is missed.

- Day 15: First reminder notice is sent.

- Day 30: The second payment is missed; late fees are added.

- Day 45: A second reminder notice is sent.

- Day 60: Third payment is missed; more late fees are added.

- Day 75: Final warning letter is sent.

- Day 90: Notice of default letter is issued.

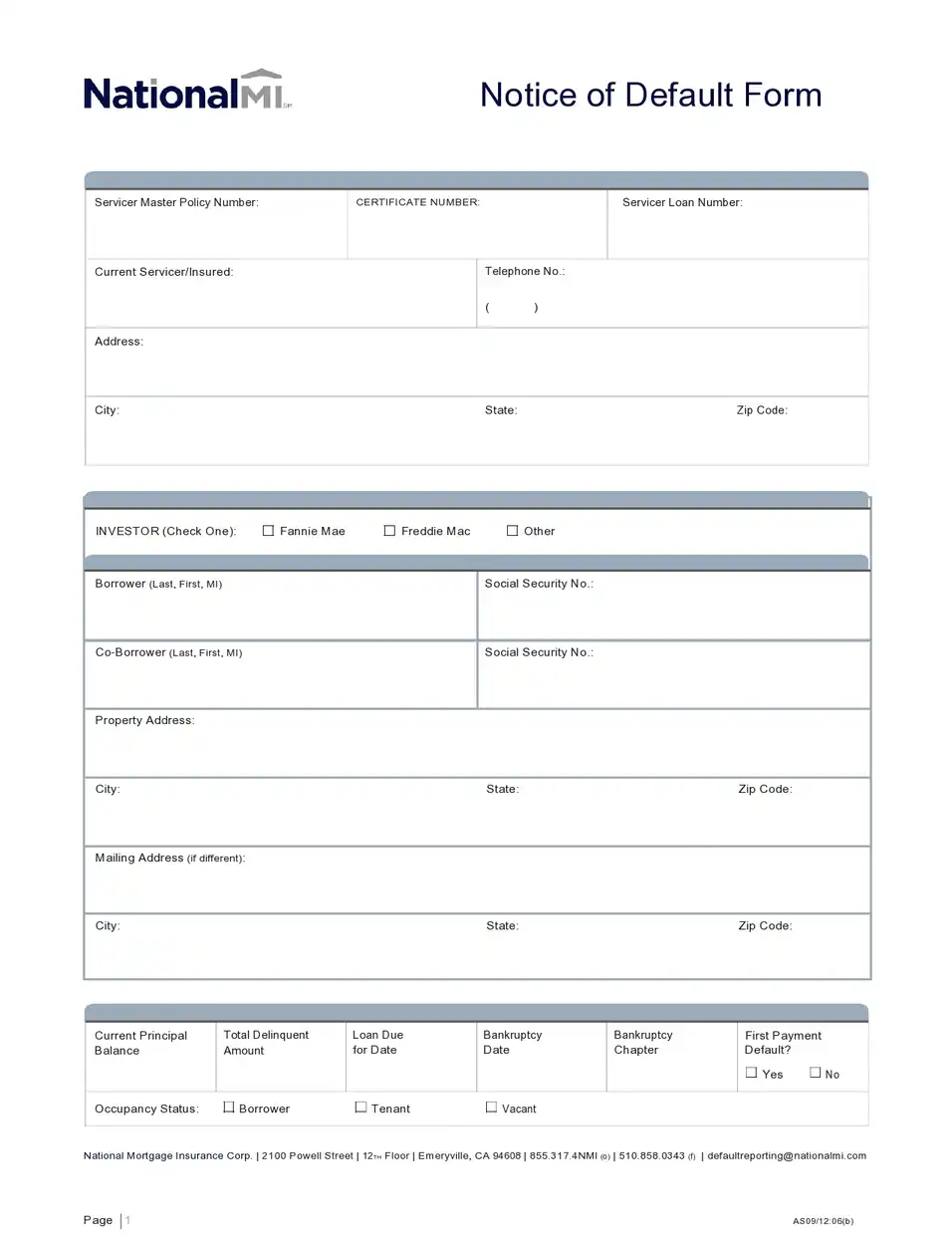

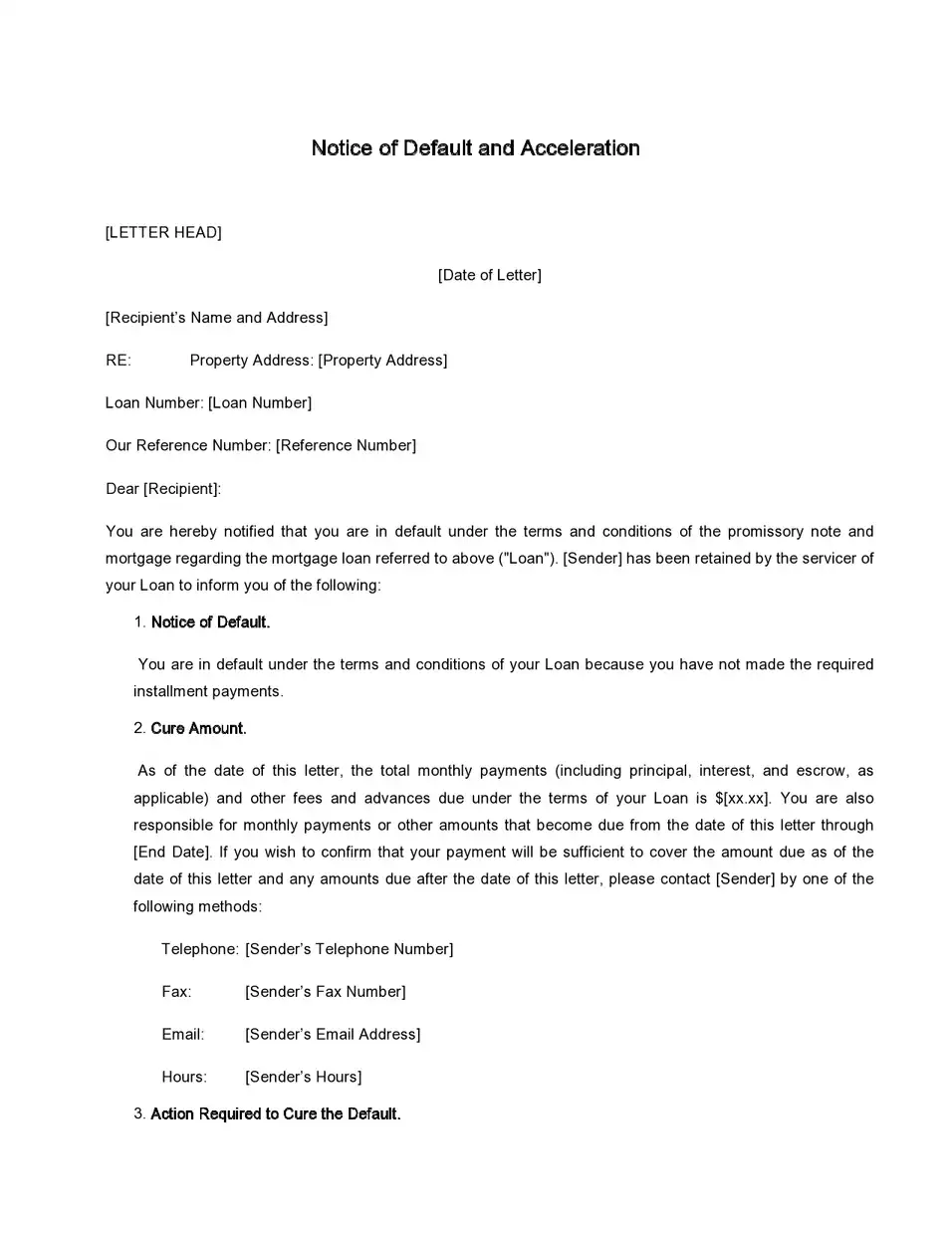

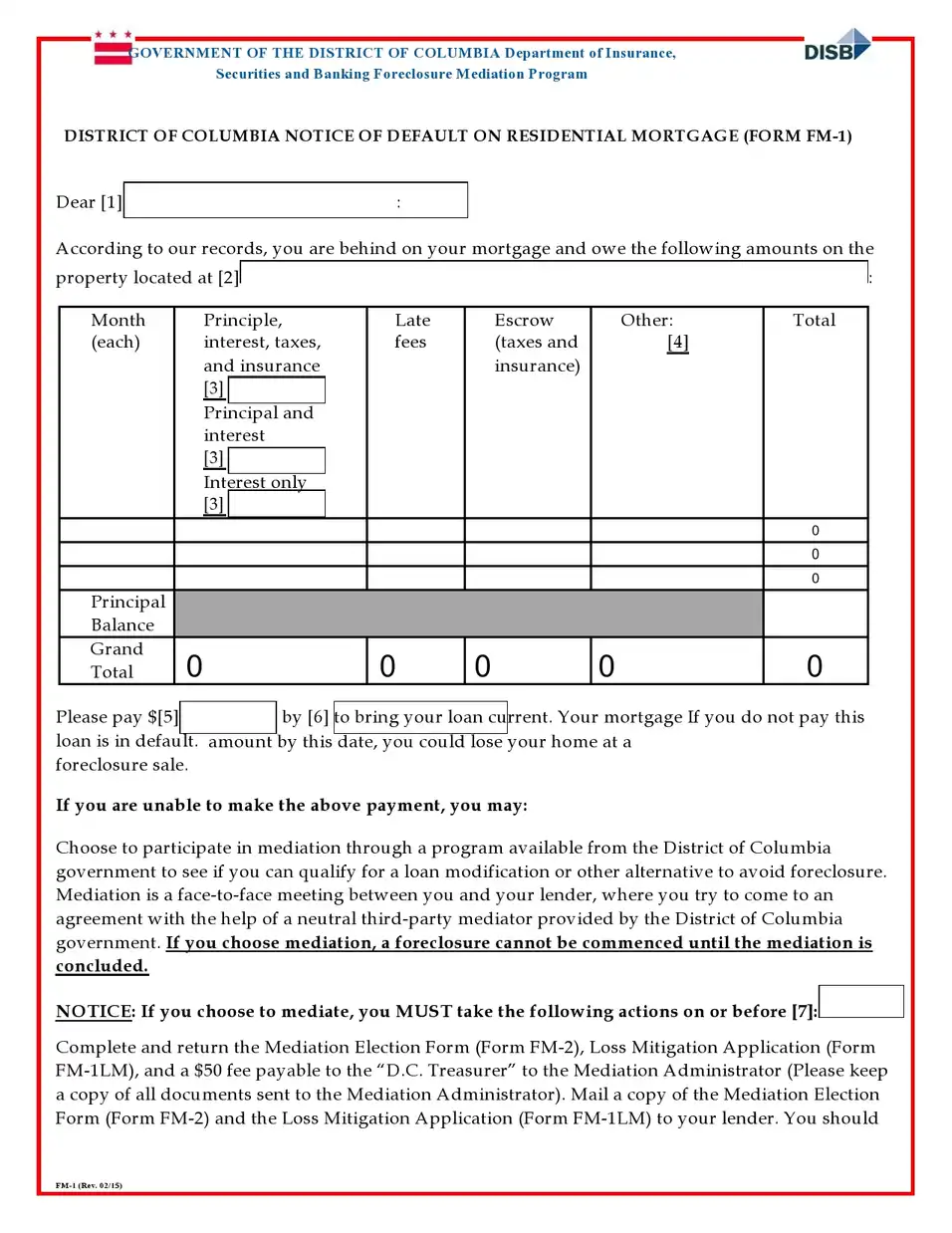

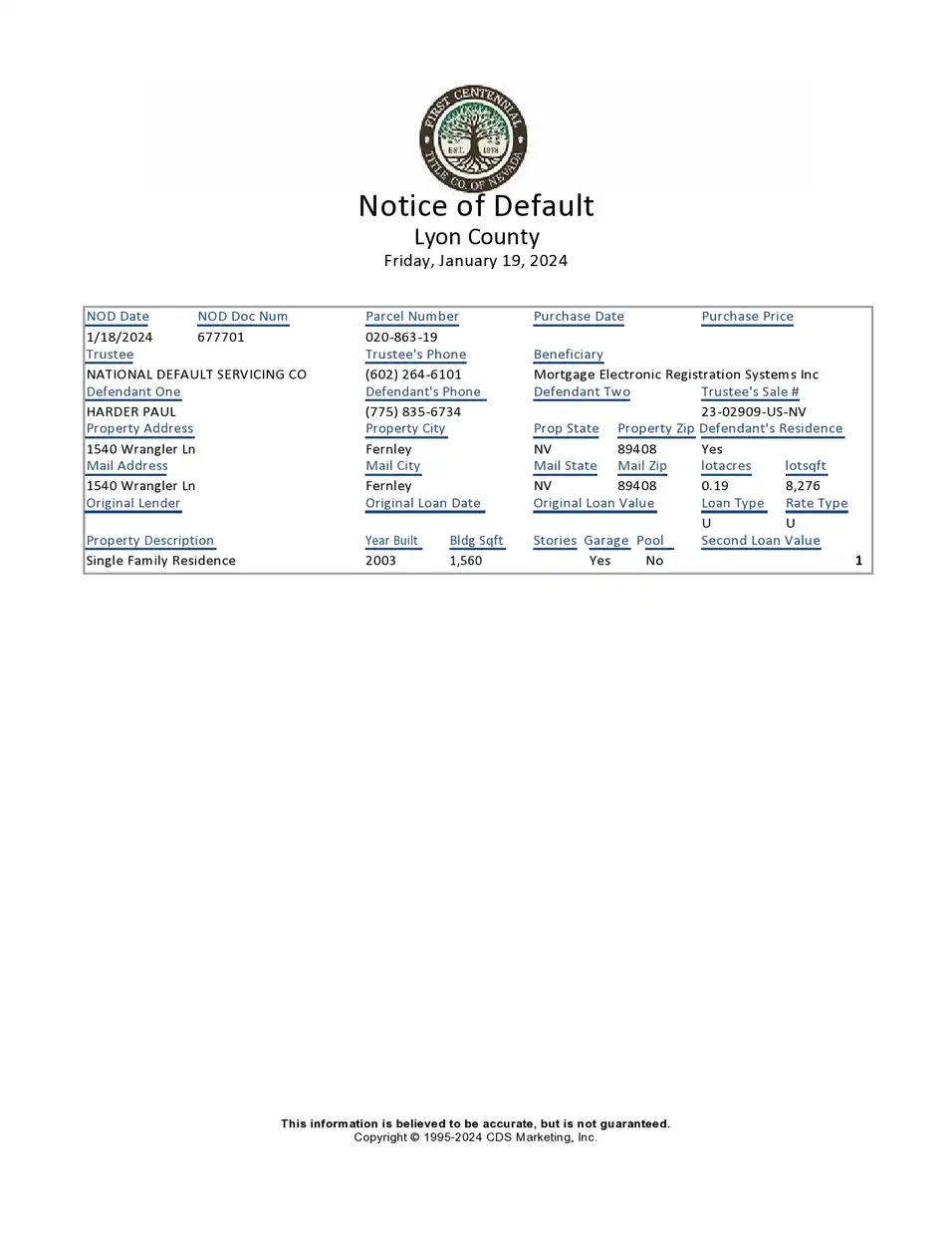

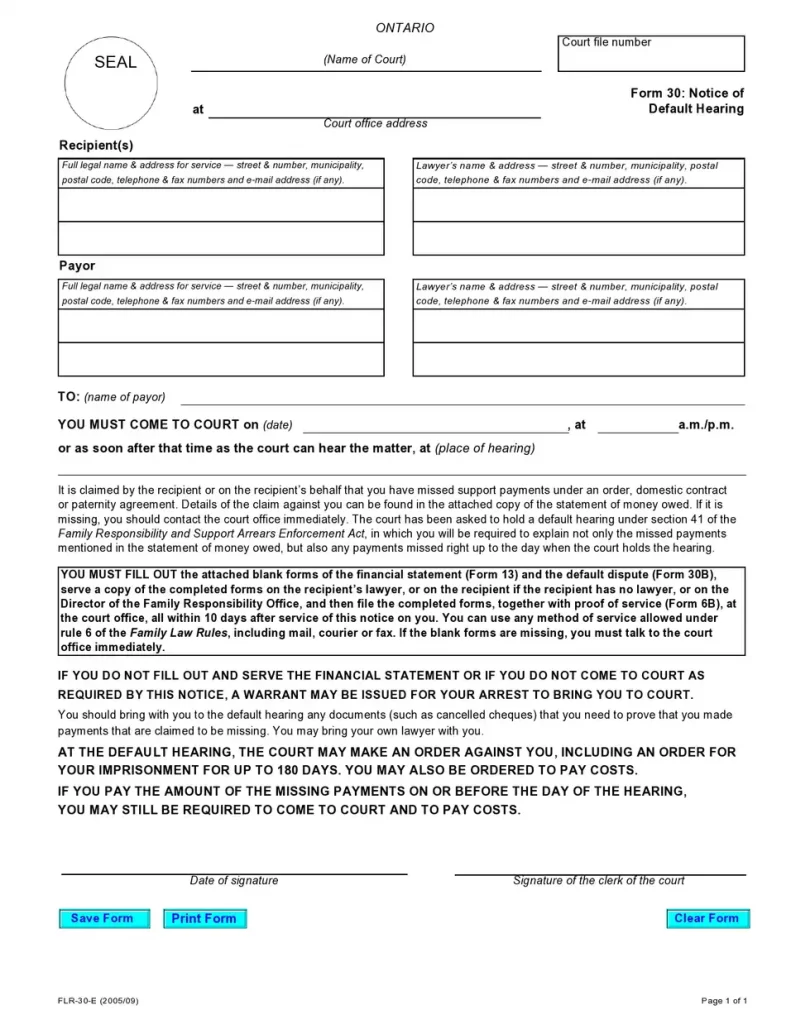

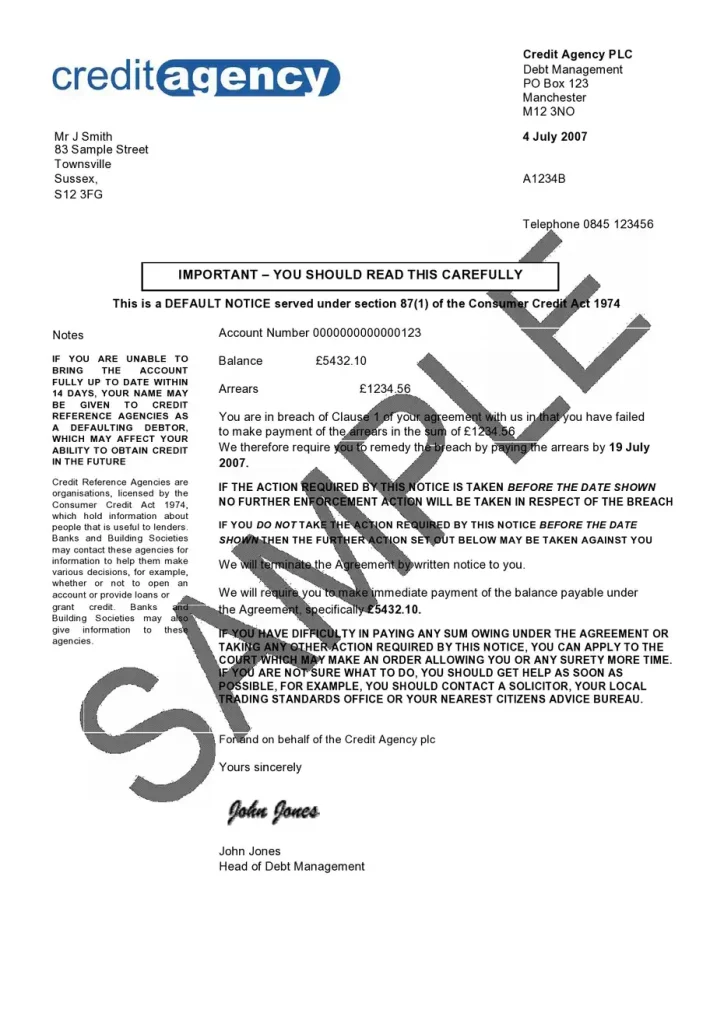

Information Included in a Notice of Default Letter

A notice of default letter contains important details about your missed mortgage payments. Understanding the information in this letter can help you take the right steps to fix the problem. Here’s what you can expect to find in a notice of default letter:

- Date of the Notice

The letter will include the date it was sent. This date is important because it marks the beginning of the timeline for taking action. You usually have a limited time to respond, so make note of this date. - Borrower’s Information

The letter will include your name and address. This helps ensure that the notice is sent to the correct person. - Loan Account Number

The letter will include your loan account number. This number is unique to your mortgage and helps the lender identify your account. Make sure this number matches your records. - Amount Past Due

The letter will state the total amount you owe, including missed payments, late fees, and any other charges. Knowing this amount is crucial for understanding how much you need to pay to bring your account current. - Payment Due Date

The letter will specify the date by which you need to pay the past due amount. This is your deadline for avoiding further action, such as foreclosure. - Breakdown of Missed Payments

You will see a detailed list of the payments you have missed. This breakdown can help you understand how the total past-due amount was calculated. - Late Fees and Penalties

The letter will include any late fees or penalties that have been added to your account. These fees are charges for missing payments and can add up quickly. - Actions Required

The letter will outline what you need to do to fix the problem. This might include paying the past due amount, contacting your lender, or exploring options like loan modification or repayment plans. - Consequences of Inaction

The letter will explain what will happen if you take action after the specified date. This usually includes the possibility of foreclosure, which means you could lose your home. - Contact Information for the Lender

The letter will provide contact information for your lender or loan servicer, including phone numbers, email addresses, and mailing addresses. It’s important to use this information to get in touch with your lender as soon as possible. - Legal Notices

The letter may include legal language to inform you of your rights and the lender’s rights. This section might be harder to understand, so you may want to ask for help if you have any questions. - Options for Assistance

Some notices of default will include information about assistance programs or counselling services that can help you manage your mortgage and avoid foreclosure. These resources can be very helpful if you need help to make payments.

What Should I Do if I Receive a Notice of Default Letter?

Getting a notice of default letter can be very stressful. But don’t worry; there are steps you can take to handle the situation. Here’s what you should do:

1. Read the Letter Carefully.

First, read the letter carefully and make sure you understand what it says. The letter will tell you how much you owe, why you owe it, and what will happen if you don’t pay. Look for deadlines and any instructions from your lender.

2. Don’t Ignore the Letter

Ignoring the letter will only make things worse. If you don’t take action, you could lose your home. It’s important to respond quickly.

3. Contact Your Lender Immediately

Call your lender as soon as possible. Let them know you received the letter and want to talk about your options. Being proactive shows your lender that you are serious about fixing the problem.

4. Explain Your Situation

When you talk to your lender, explain why you missed your payments. Maybe you lost your job, had unexpected medical bills, or faced other financial challenges. Being honest helps your lender better understand your situation.

5. Ask About Your Options

Ask your lender what options are available to you. Here are some possibilities:

- Loan Modification: Changing the terms of your loan to make payments more affordable.

- Repayment Plan: Paying back the missed payments over time along with your regular payments.

- Forbearance: Temporarily pausing or reducing your payments.

- Refinancing: Getting a new loan with better terms to pay off the old one.

6. Seek Professional Help

Consider getting help from a housing counsellor or a financial advisor. They can offer financial advice and help you understand your options. Some non-profit organisations provide free counselling services.

7. Create a Budget

Look at your finances and create a budget. See where you can cut costs to free up money for your mortgage payments. A budget can help you manage your money better and make sure you don’t miss future payments.

8. Stay Organize

Keep all the documents and letters from your lender in one place. Write down the dates and details of any phone calls or meetings with your lender. Staying organised will help you keep track of everything.

9. Follow Through

Once you and your lender agree on a plan, follow through. Make your payments on time and stick to the plan. This will help you get back on track and avoid losing your home.

10. Don’t Lose Hope

It’s easy to feel overwhelmed but don’t lose hope. Many people face financial difficulties, and there are ways to overcome them. Stay positive and take it one step at a time.

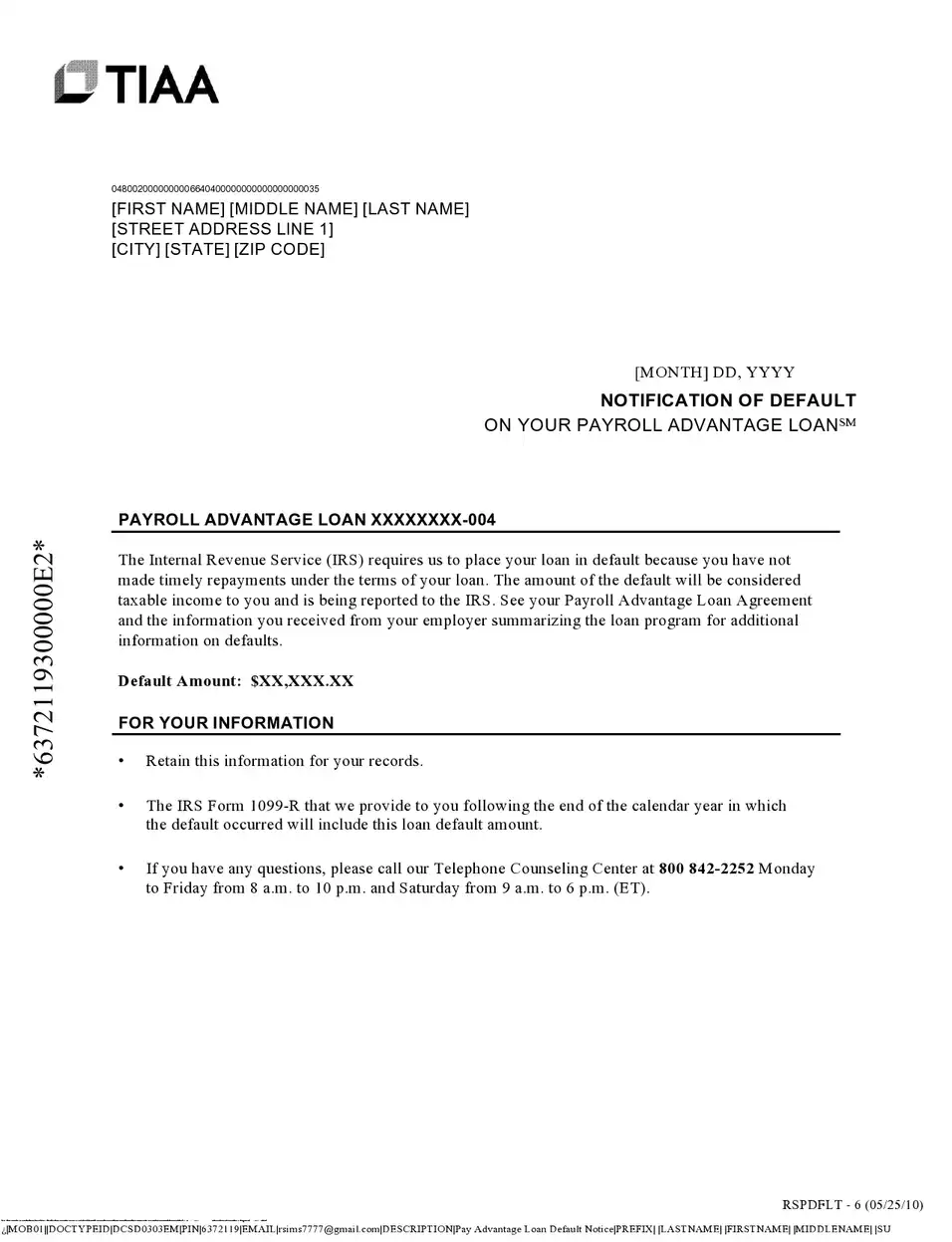

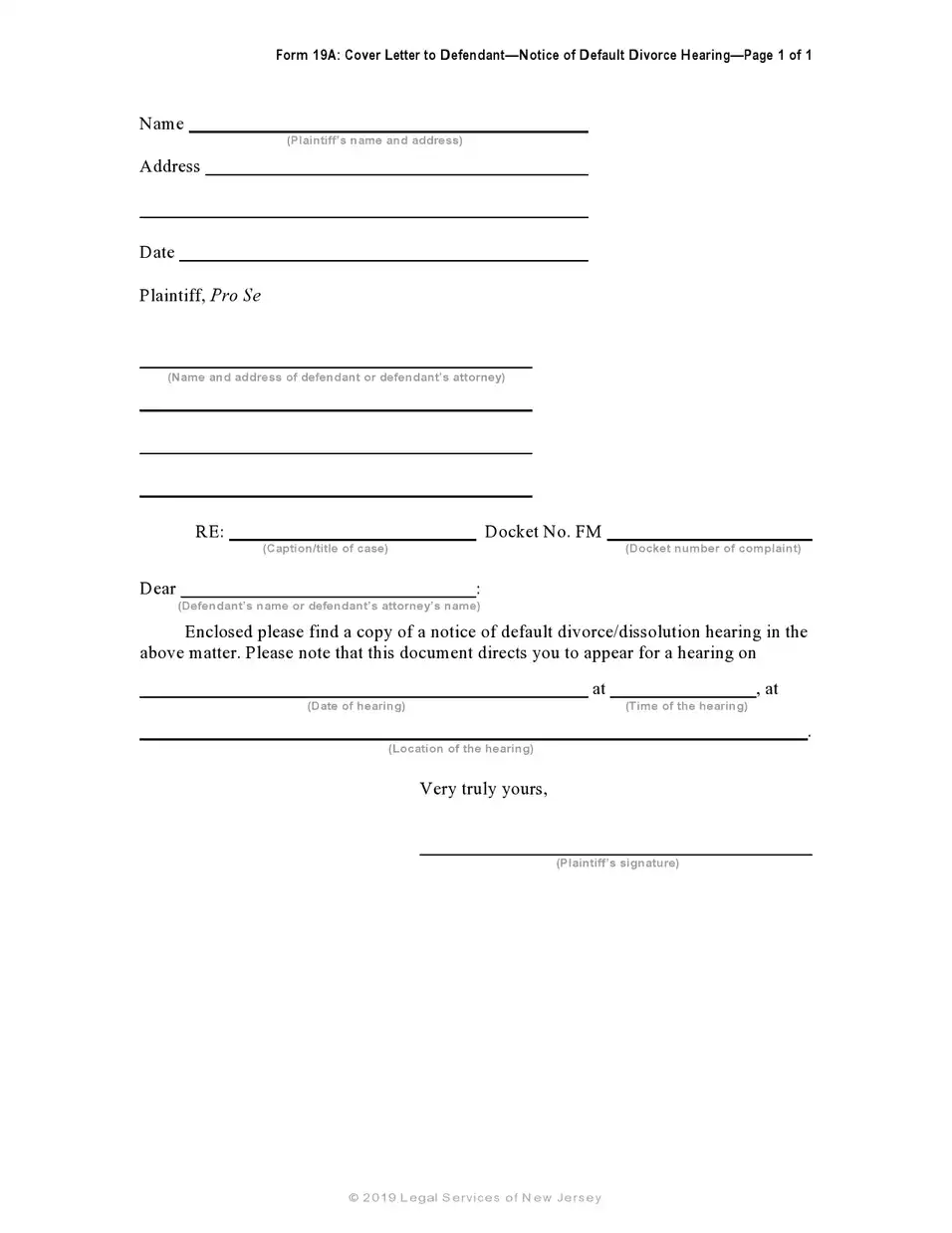

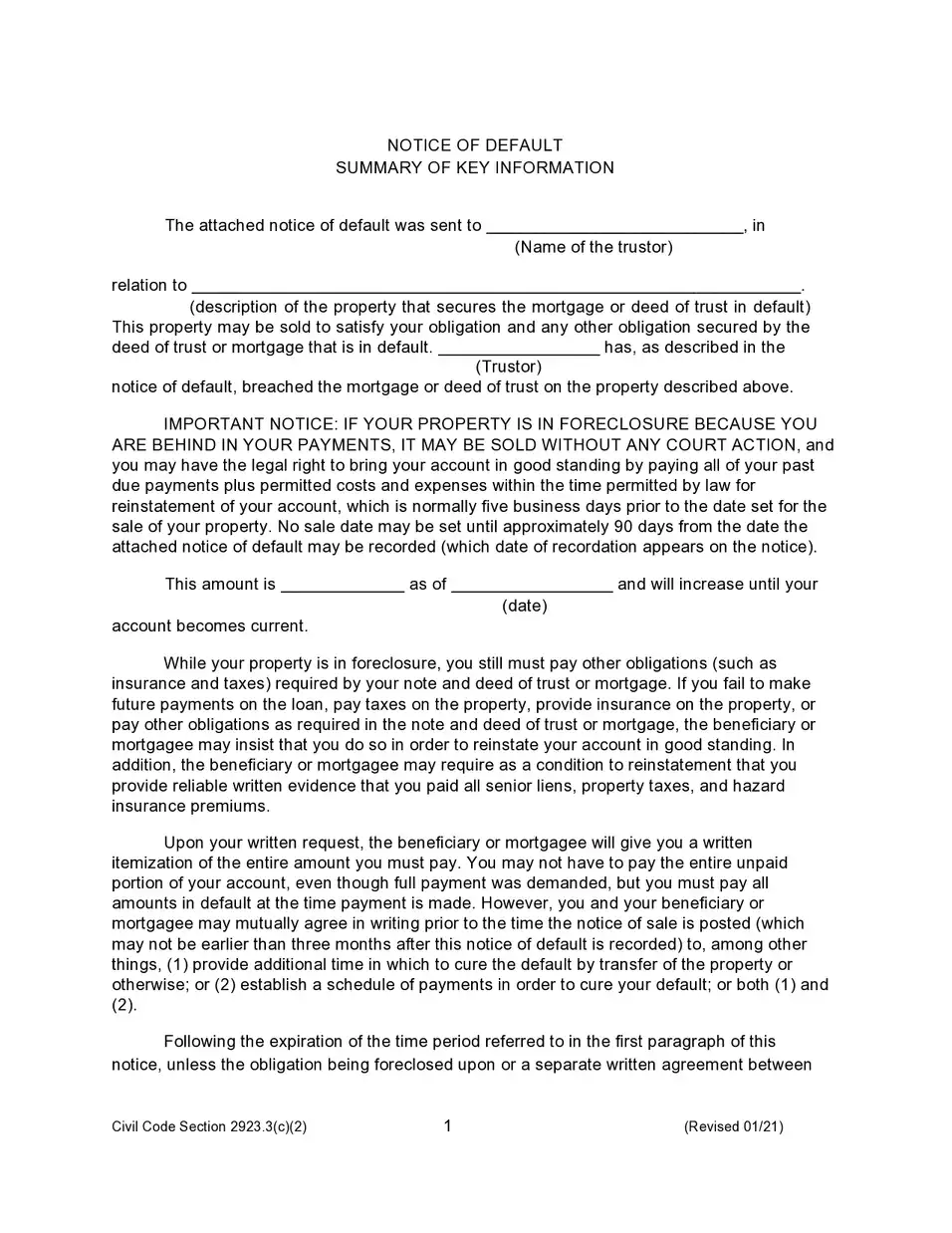

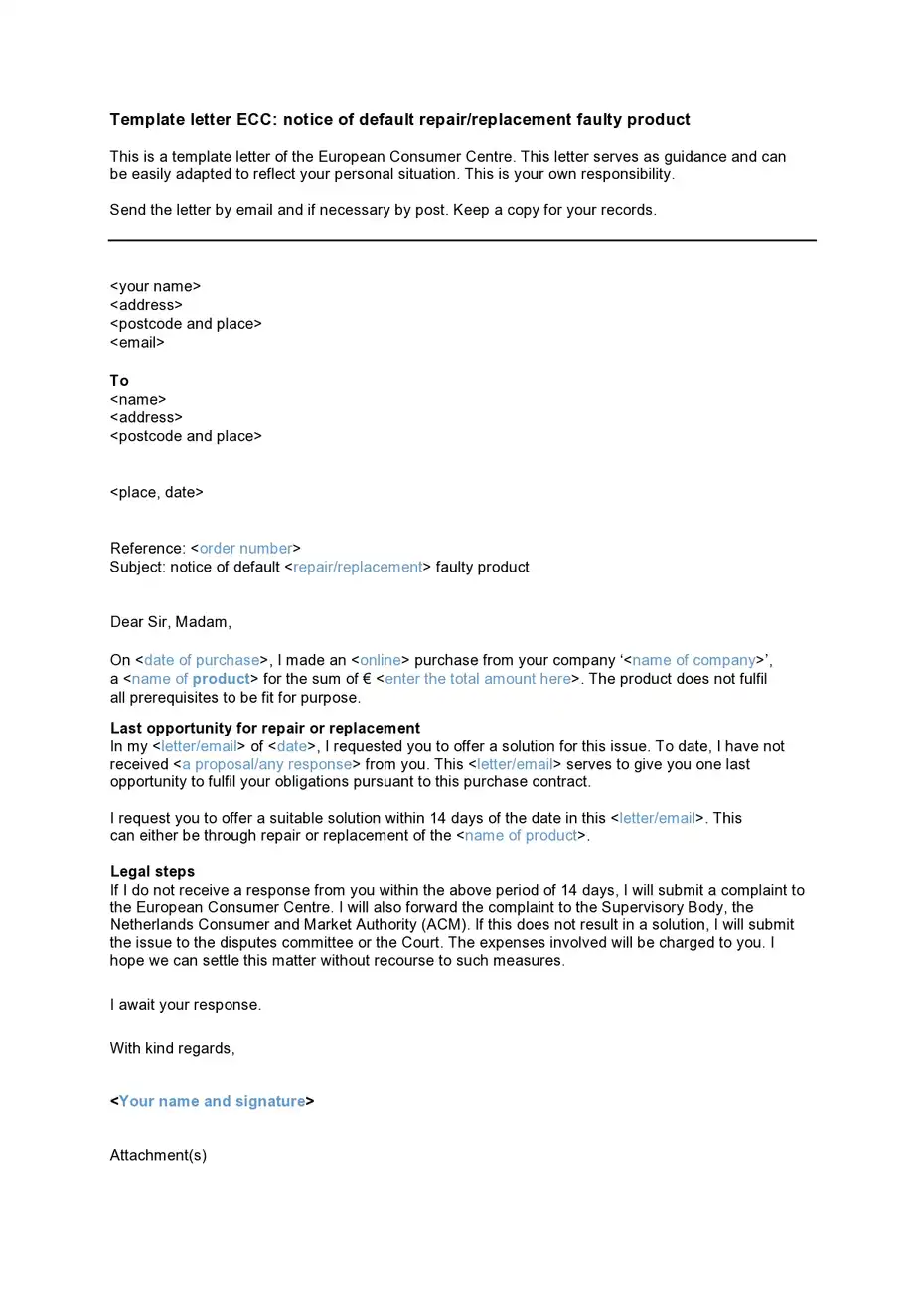

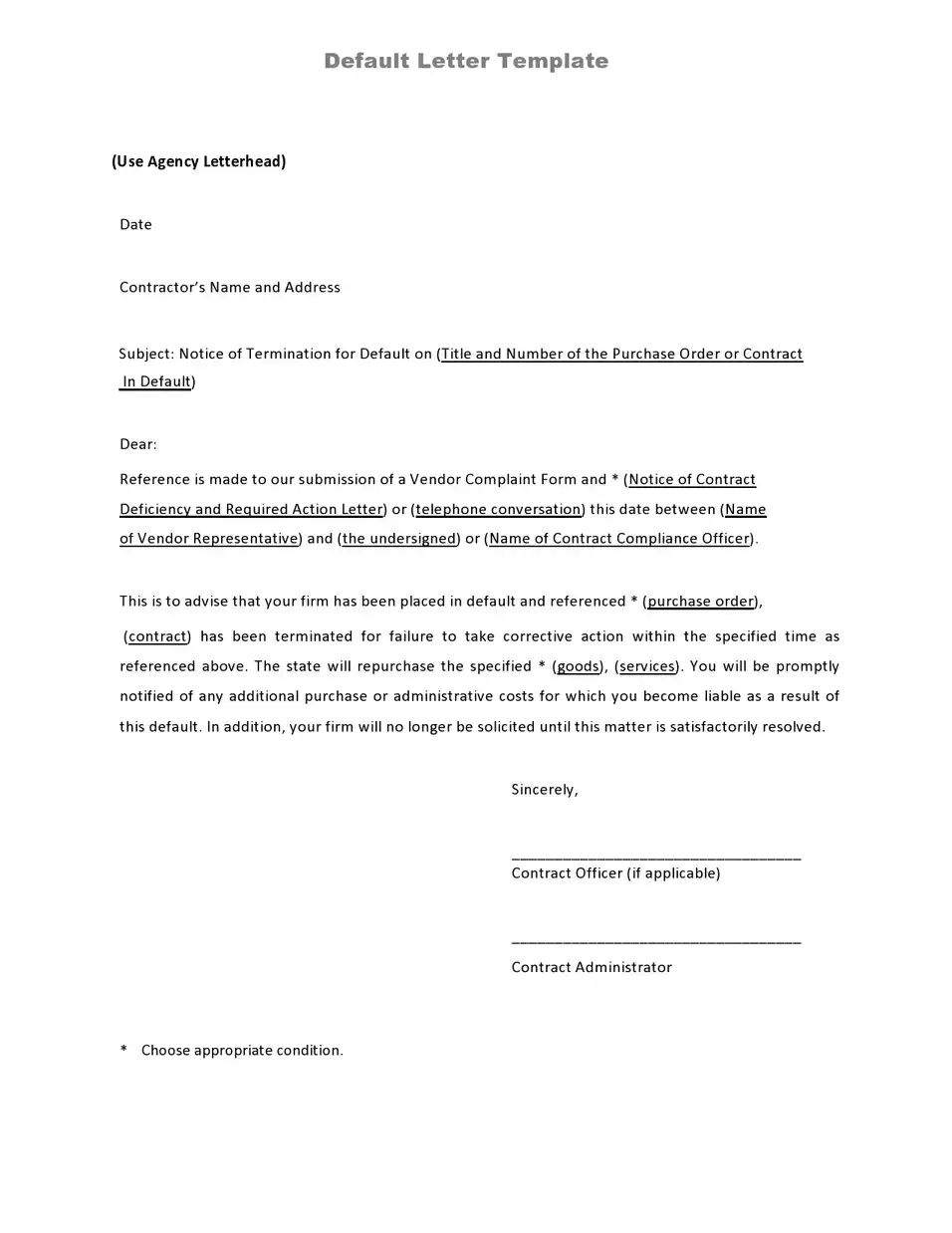

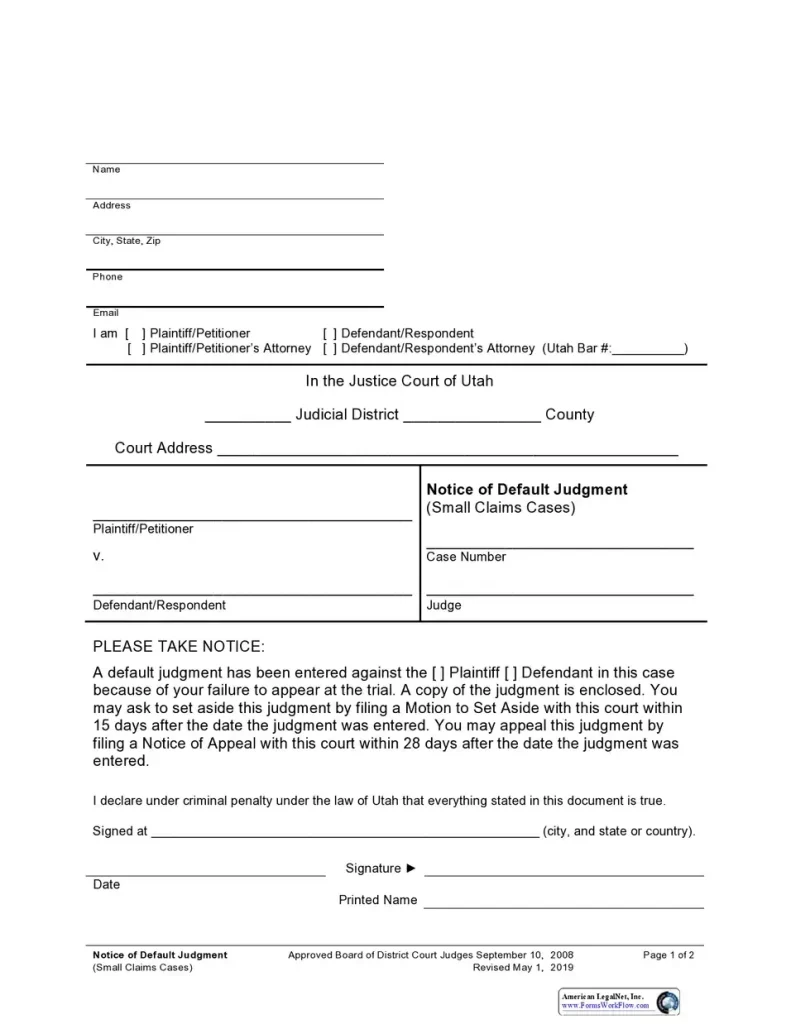

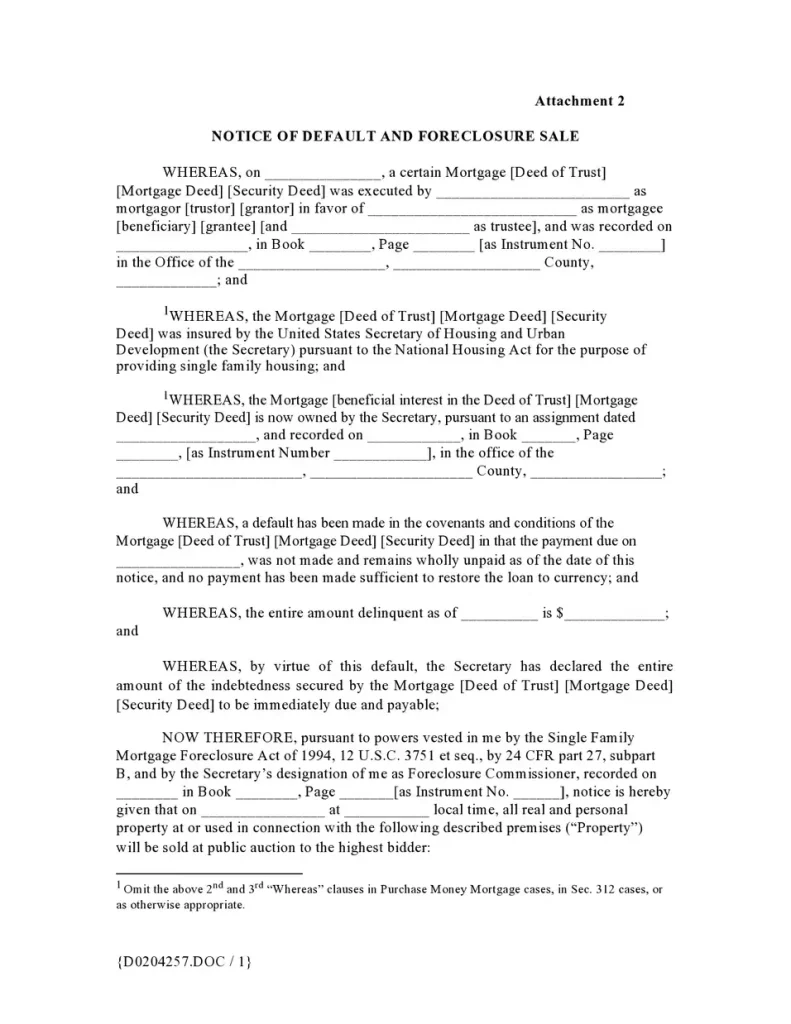

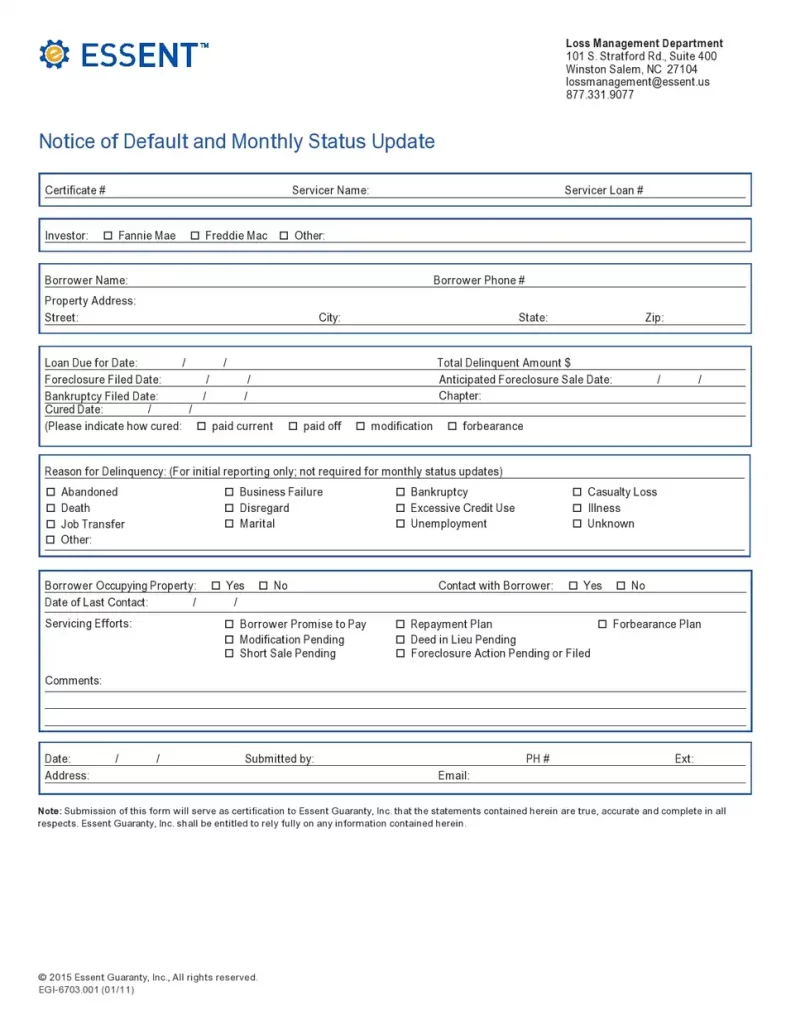

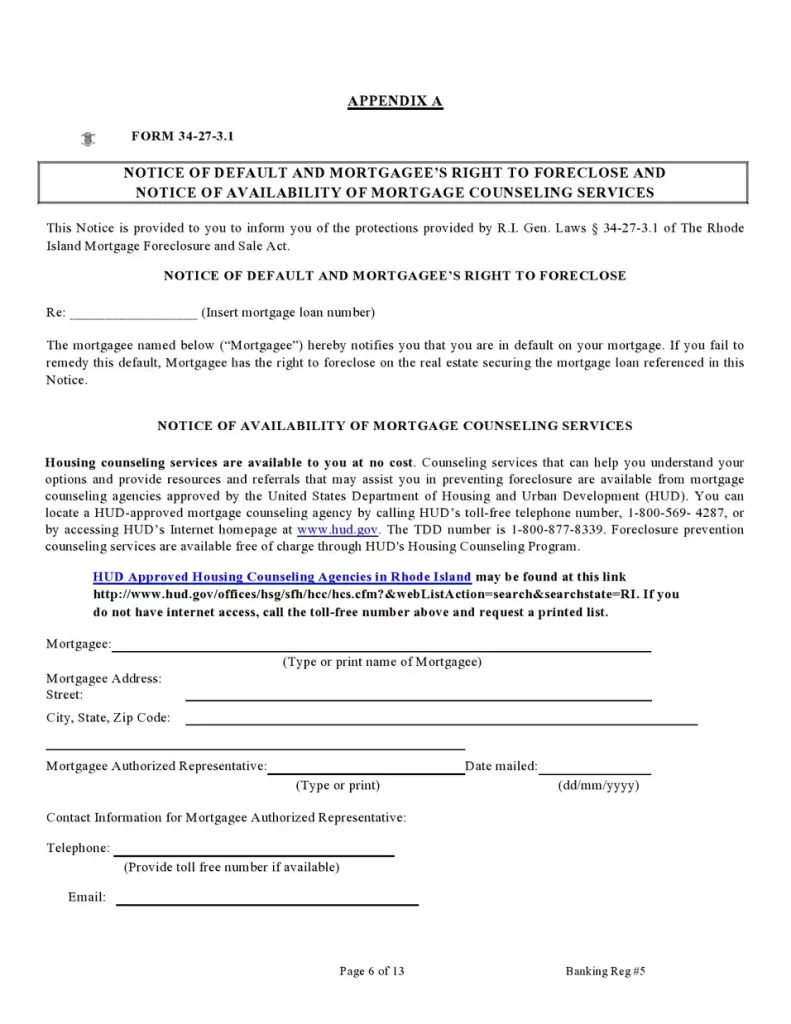

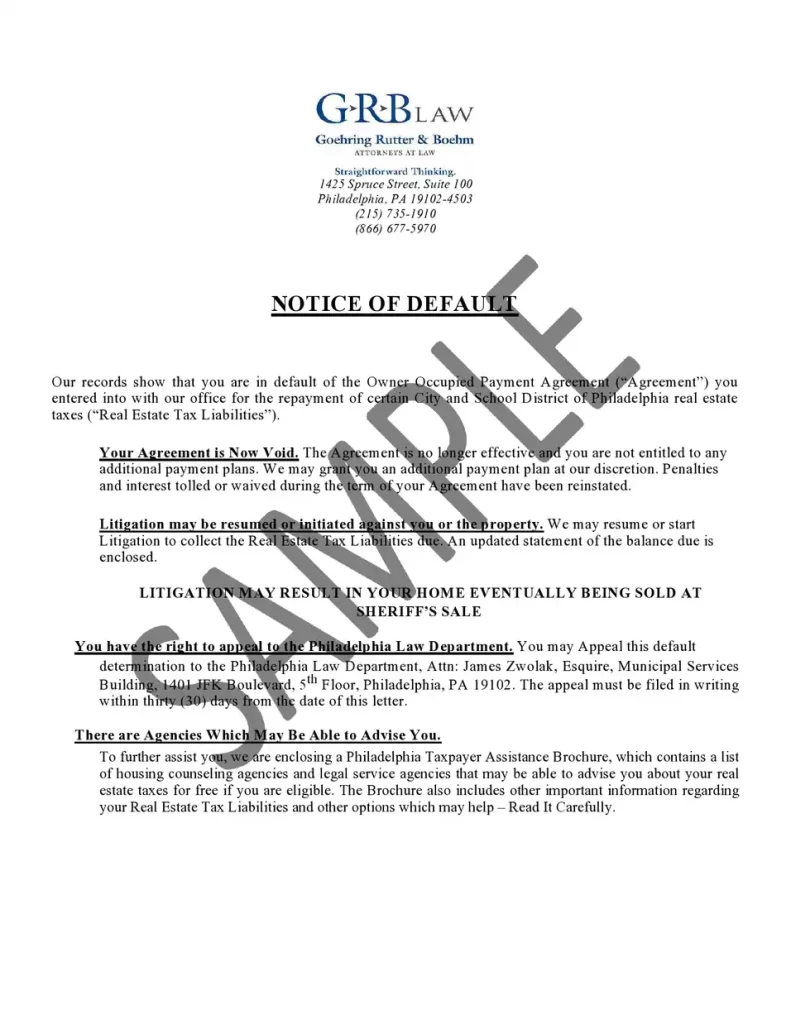

Notice of Default Letter Example

How Does a Notice of Default Affect Your Credit Score?

Receiving a notice of default can significantly impact your credit score. It indicates to credit bureaus that you are paying delinquency on your mortgage, which can lower your score and affect your ability to obtain new credit.

Response Time for a Notice of Default Letter

Typically, you have about 30 days to respond to a notice of default letter. Ignoring this deadline can lead to foreclosure and more severe financial consequences.

Negotiating the Terms of a Notice of Default

When you get a notice of default letter, it can be scary. But you can often negotiate the terms to find a default resolution. Here’s how you can do it:

- Contact Your Lender Right Away: The first step is to contact your lender as soon as you get the letter. Don’t wait. The sooner you talk to them, the better your chances of working out a plan.

- Explain Your Situation: Tell your lender why you missed your payments. Be honest about your financial situation. Maybe you lost your job, had medical bills, or faced other challenges. Lenders are more willing to help if they understand your situation.

- Ask for Options: Ask your lender about the options available to you. Here are some common ones:

- Loan Modification: This means changing the terms of your loan to make it more affordable. Your lender might lower your interest rate or extend the time you have to pay back the loan.

- Repayment Plan: You can agree to a plan that allows you to pay back the missed payments along with your regular payments over time.

- Forbearance: This is a temporary pause or reduction in your mortgage payments. It gives you time to get back on your feet financially.

- Refinancing: Refinancing means getting a new loan to pay off your old one. The new loan might have better terms that make it easier for you to make your payments.

- Show Your Commitment: Let your lender know that you are committed to paying back what you owe and taking steps to improve your financial situation. This could include looking for a new job, cutting back on expenses, or getting help from a financial advisor.

- Get Everything in Writing: If you and your lender agree on new terms, make sure to get everything in writing. This will protect you if there are any misunderstandings later on. Keep a copy of all documents and agreements.

- Follow Through: Once you have an agreement, make sure to follow through on your end of the deal. Make your payments on time and stick to the plan you agreed on. This will help you rebuild your credit and avoid future problems.

- Seek Professional Help: If you need help negotiating with your lender, consider getting help from a housing counsellor or an attorney. They can give you advice and help you understand your rights and options.

Consequences of Ignoring a Notice of Default Letter

Ignoring can lead to serious problems. Here’s what can happen if you don’t take action:

- Late Fees and Penalties: If you ignore them, late fees and penalties will keep adding up. These extra charges can make it easier to catch up on your payments. The longer you wait, the more you will owe.

- Credit Score Damage: A notice of default gets reported to credit bureaus. This can cause a big drop in your credit score. A lower credit score makes it harder to get loans, credit cards, or even rent an apartment in the future.

- Legal Action: If you don’t respond, your lender might start legal action against you. This can include filing a lawsuit to recover the money you owe. Legal action can be stressful and expensive.

- Foreclosure: One of the most serious consequences of ignoring it is foreclosure. This means your lender can take back your home.

- Eviction: After foreclosure, you may be evicted from your home. This means you will have to move out, and you might need a place to live.

- Deficiency Judgment: Sometimes, after foreclosure, the sale of your home might only cover part of the amount you owe on your mortgage. If this happens, your lender might get a deficiency judgment against you. This means you will still owe money even after losing your home.

- Difficulty in Future Borrowing: Having a notice of default and foreclosure on your record makes it much harder to get credit in the future. Lenders see you as a higher risk, so that they might deny your applications for loans or credit cards.

- Stress and Emotional Impact: Ignoring can cause a lot of stress and emotional strain. Worrying about losing your home and dealing with financial troubles can affect your mental and physical health.

- Loss of Equity: If you have built up equity in your home, ignoring it can result in losing that equity. Equity is the difference between what your home is worth and what you owe on it. Losing your home means losing this valuable asset.

- Limited Housing Options After foreclosure and eviction, finding a new place to live can be tough. Many landlords check credit reports, and a foreclosure can make them less likely to rent to you.

Who Sends a Notice of Default Letter?

The mortgage lender or the loan servicer sends a notice of default letter. These are the companies that handle your mortgage payments. Let’s break this down to understand it better.

Mortgage Lender

A mortgage lender is the company that gives you the loan to buy your house. They provided the money you needed to purchase your home, and in return, you agreed to pay them back with interest over a set period. If you miss your payments, the mortgage lender will be the one to send you a notice of default letter.

Loan Servicer

Sometimes, the company that services your loan is different from your lender. A loan servicer manages your loan account.

They handle the day-to-day tasks like collecting your payments, keeping track of your balance, and sending you statements. If you need to catch up on your payments, the loan servicer will usually send a notice of default letter.

Both the lender and the loan servicer have a big interest in making sure you keep up with your mortgage payments. When you miss payments, it affects their financial interests.

Notice of Default Letter Sample

Here is the notice of default letter sample:

References:

- Federal Trade Commission (FTC): FTC Mortgage Payments and Foreclosure

- S. Department of Housing and Urban Development (HUD): HUD Foreclosure Avoidance Counseling

- Legal Information Institute (LII) at Cornell Law School: LII Foreclosure Overview

Conclusion

A notice of default letter sample is a serious warning that requires immediate attention. Always contact your lender, explore your options, and seek professional help if needed to manage your debt effectively.

Daniel Wilson Is a Seasoned communications professional and letter-writing expert. With over a decade of experience in corporate and non-profit sectors, Has developed a deep understanding of the power of effective communication.

Specializes in creating versatile letter templates that can be tailored to any situation. In this blog, Daniel shares a passion for the art of letter writing, offering practical tips, customizable templates, and inspiring ideas to help you communicate with clarity, confidence, and impact.