The Importance of Mileage Log

For those who do not know, mileage log is a kind of form or template to claim deductions on your tax returns. In order to claim the deductions, you need to keep accurate records of your driving. Most of the people tend to record the time weekly or monthly. That kind of thing will not make the IRS happy and satisfied if there is an audit or your records.

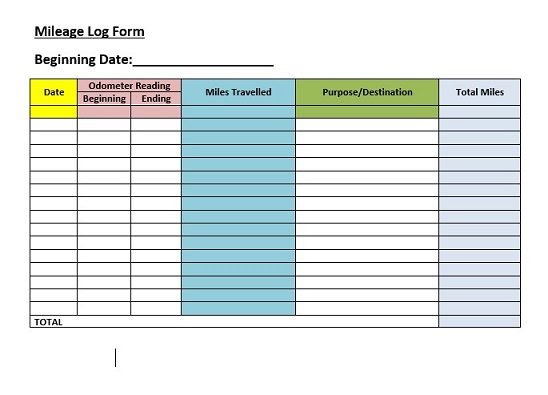

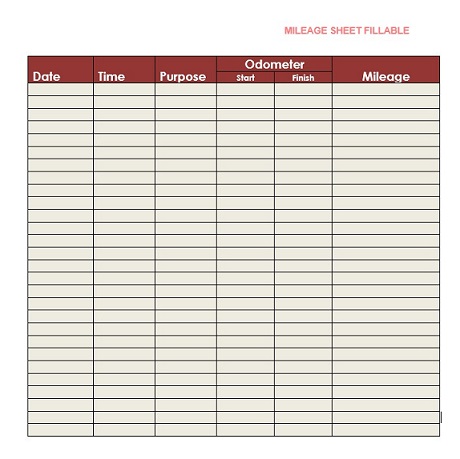

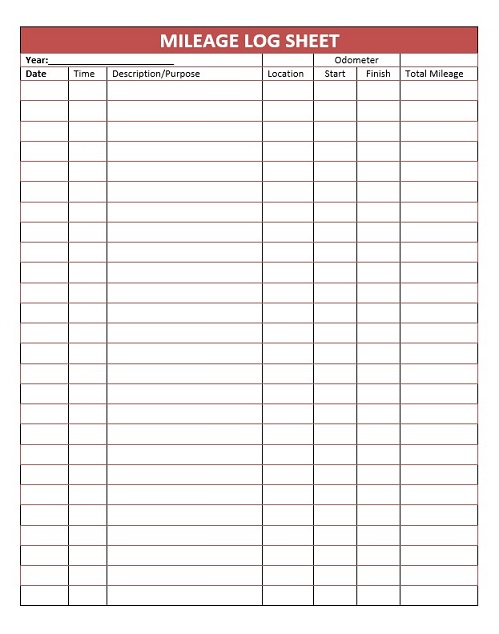

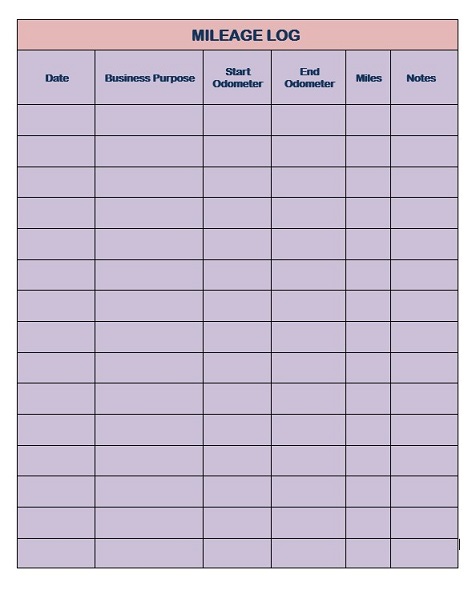

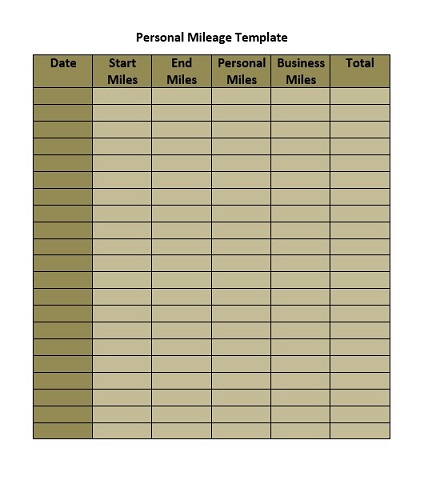

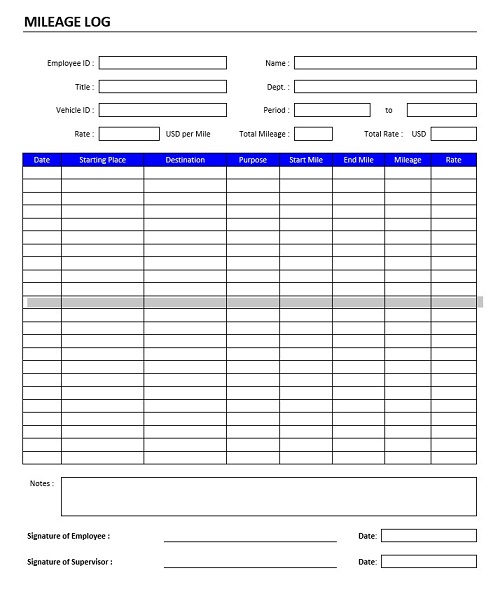

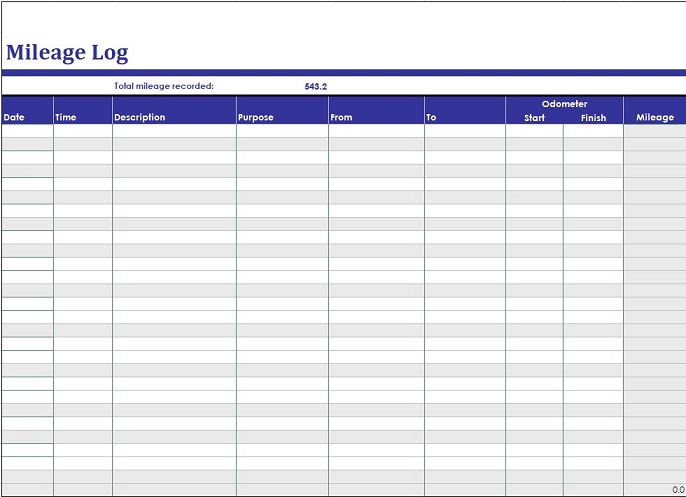

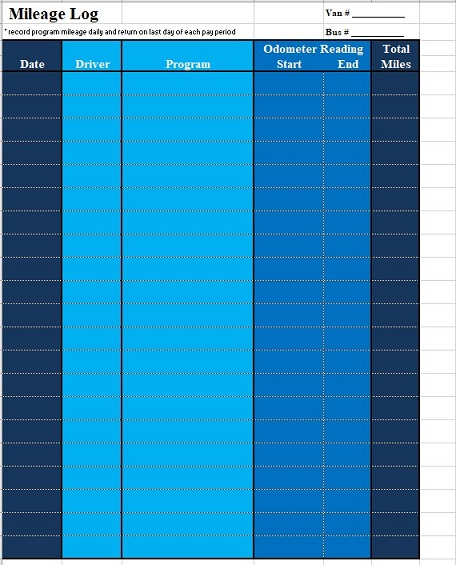

That is why the easiest way to keep accurate records is by using a mileage log template. The log will give you some spaces which will allow you to record your mileage for each trip you take. It has been known that the IRS disqualifies some deductions because there is no clear separation between driving for business and other trips.

The Content of the Mileage Log

There are quite many things which are needed to be included in the mileage. Those things are the date of the business trip, the starting point of the trip, the ending destination of the trip, the reason for the trip, the starting mileage on your vehicle, the ending mileage of the trip, and the tolls and other costs on the trip.

Do keep in mind that each of your trips must be recorded as well from the beginning to the ending mileage at the end of the day to make sure that the mileage log example is accurate. The IRS will also require you to keep these records on file for three years after you use them for the deduction claim.

Types of Business Driving

There are quite many types of business driving which qualify for you to claim deductions. In this case, you can use the mileage for these types of business driving.

- Driving between offices or work sites

- Errands and supply stops

- Business entertainment

- Airport travel

- Unrelated odd jobs

- Temporary job sites

- Seeking new employment

- Customer visits

Types of Mileage that Does Not Qualify

Here is the type of mileage which does not qualify

- Commuting

- Mistakes in the log

- Missing information

- Calculating deductions

Those are the short explanation of the log which you need to understand before you claim deductions on your tax returns. It does not matter what kind of deductions you are taking at the end of the year; you need to always keep precise records of your mileage.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.