Are late payments hurting your credit score? Don’t worry, you can fix it. Late payments can happen to anyone, and they can mess up your credit score. But you can do something about it.

This guide will show you how to use a late payment removal letter template to fix mistakes and work with creditors. With our free template and helpful tips, you’ll soon have a clean credit report!

Understanding Late Payments on Your Credit Report

A late payment is simply a missed due date on a credit account. Seems minor, right? Not quite. The impact of late payments escalates quickly:

- 30 days late: Your first warning shot. It’s a blip on your credit report, but multiple 30-day lates can cause real damage.

- 60 days late: The situation intensifies. Your credit score nosedives, and debt collectors may start hounding you.

- 90+ days late: This is the danger zone. Your score plummets, and legal action could be a possibility.

Think of your credit score as your financial reputation. The Consumer Financial Protection Bureau (CFPB) states that payment history makes up a whopping 35% of your FICO score. Even a single late payment can slash a good score by 60-110 points.

As Beverly Harzog, a well-known credit expert, puts it, “Late payments are like a black mark on your credit report. While time can heal the wound, the initial impact can be quite severe.”

The Late Payment Ripple Effect

Late payments don’t just affect your credit score in a vacuum. They trigger a chain reaction that can create a financial avalanche:

- Lower Credit Score: This limits your access to credit and the best interest rates, costing you more in the long run.

- Higher Interest Rates: Lenders view you as a risky borrower and charge you more to compensate.

- Restricted Borrowing Power: Getting approved for loans, especially for big purchases like a house or car, becomes much harder.

- Increased Insurance Costs: Some insurers use credit information to set premiums, and late payments can mean you’ll pay more.

- Housing Challenges: Landlords often check credit reports, and late payments can make it difficult to secure a rental.

- Employment Setbacks: A surprising number of employers consider credit history in their hiring decisions.

Why You Need to Take Action, NOW

Addressing late payments isn’t just about vanity metrics; it’s about your financial well-being and future opportunities. By taking charge, you can:

- Repair Your Credit: A higher score unlocks better interest rates, loan terms, and more financial choices.

- Expand Your Borrowing Power: Get approved for the credit you need to achieve your goals.

- Save Money: Lower interest rates and fees mean more money in your pocket.

- Peace of Mind: Take back control of your finances and eliminate the stress that comes with bad credit.

Don’t let late payments hold you hostage. Empower yourself with the knowledge and tools to remove those blemishes from your credit report and safeguard your financial future. Let’s start the journey towards a brighter financial tomorrow!

Why Late Payments Are a Bummer for Your Credit

A good score makes you super popular, opening doors to lower interest rates, better credit card offers, and even dream apartments. But late payments? They’re like showing up late to the party – not a good look!

Here’s how late payments can mess with your credit:

- Payment History: This is the biggest part of your credit score, kind of like your reputation. Late payments are like gossip that makes you less trustworthy.

- Credit Utilization: Late payments can make lenders nervous, so they might raise your interest rates or lower your credit limits. That means paying more and having less to spend.

- New Credit: It’s harder to get approved for new credit cards or loans if you have a history of being late. It’s like not getting picked for the team because you missed too many practices.

When Can You Get Rid of Late Payments?

Even though late payments are a drag, there are times when you can get rid of them:

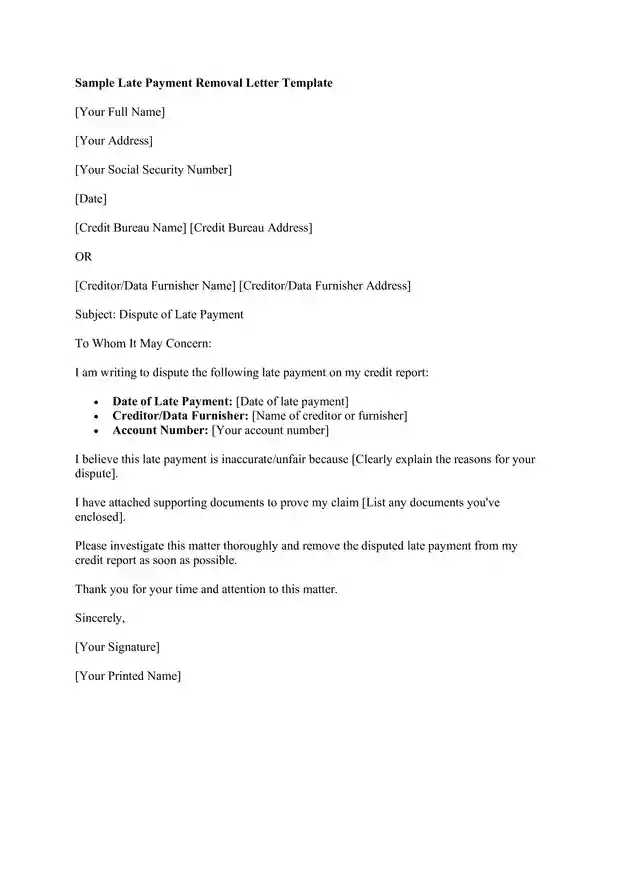

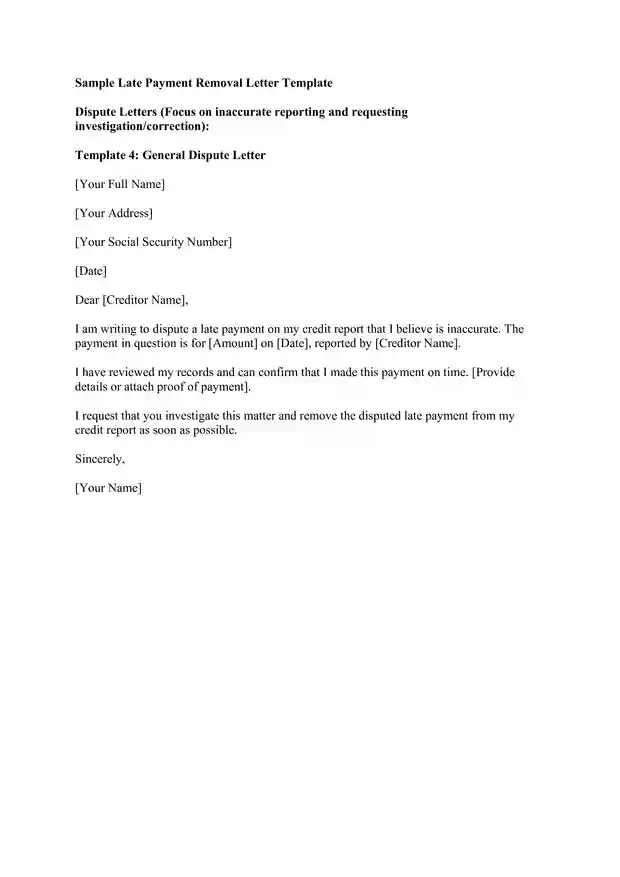

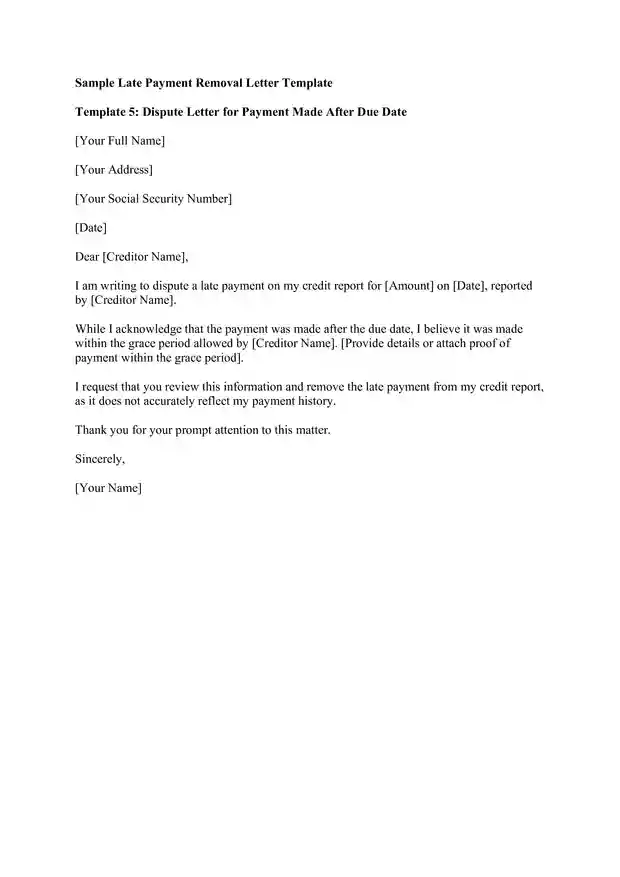

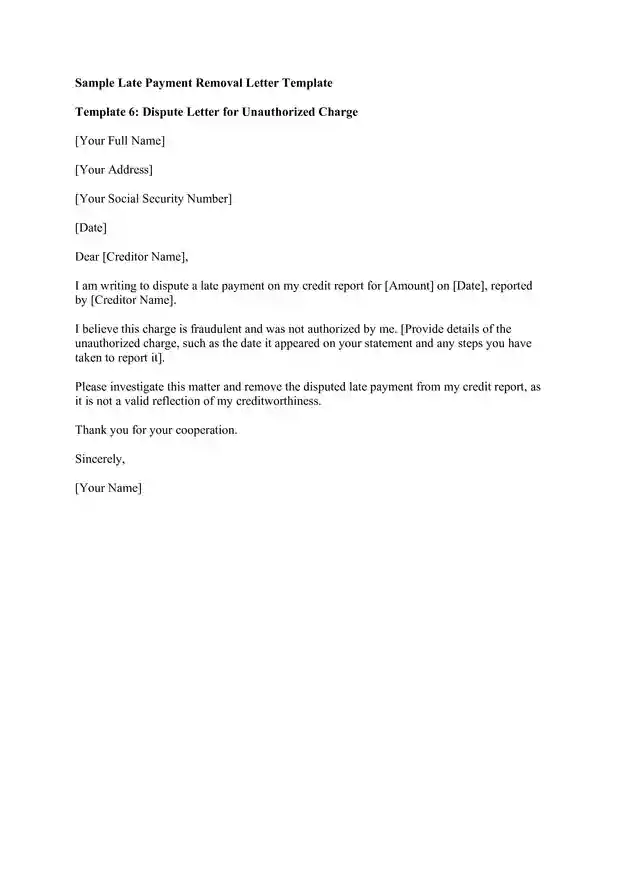

- Oops, They Messed Up! (Inaccurate Reporting): If the late payment is a mistake – maybe you paid on time, but they marked it late – you have the right to tell the credit reporting company and the lender to fix it.

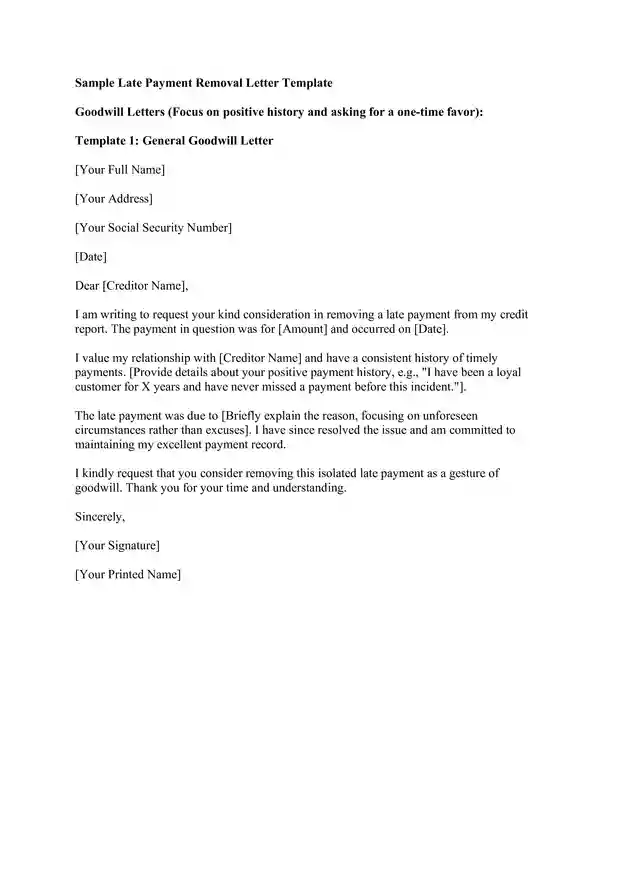

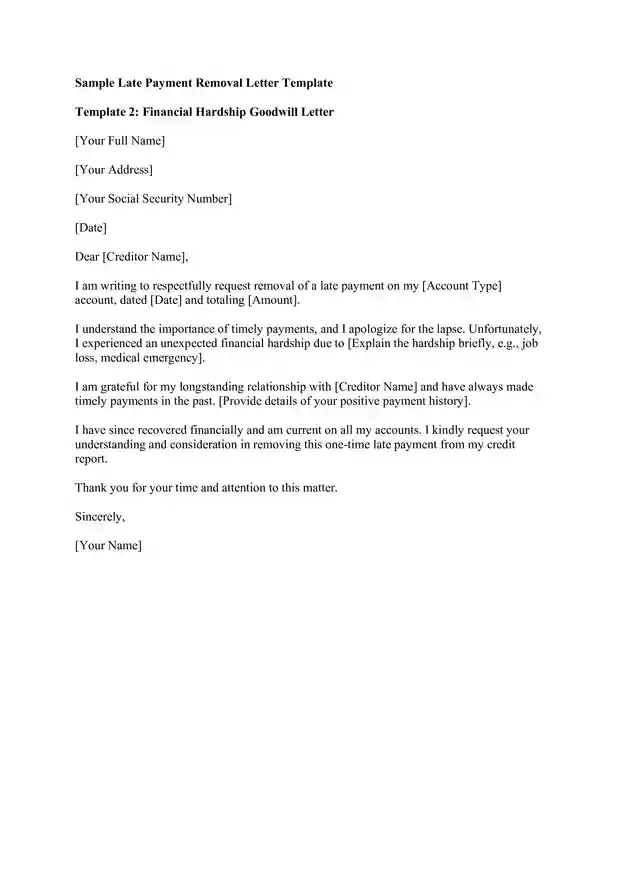

- Asking for a Favor (Goodwill Adjustment): If you’re usually a good customer and this was a one-time thing, you can nicely ask the lender to remove it.

- Making a Deal (Pay for Delete): Sometimes, if a debt collector is reporting the late payment, you can offer to pay them off if they agree to remove it.

- Time’s Up! (Expired Time Limit): Most bad stuff on your credit report only sticks around for seven years. So, if a late payment is older than that, it has to be removed!

How to Remove Late Payments

Steps to Remove Late Payments:

- Get Your Reports: Get free copies from Experian, Equifax, and TransUnion at AnnualCreditReport.com.

- Spot the Late Payment: Look for any late payments and write down the details.

- Double-Check: Make sure the late payment is yours and the information is correct.

- Dispute with Credit Bureaus and Creditors: Write a letter explaining the issue and ask them to fix it.

Talking to Your Creditors:

If the late payment was your fault, don’t worry, you still have options! Try talking to the creditor:

- Be Polite and Professional: Explain what happened.

- Explain Your Situation: Tell them why you missed the payment and what you’re doing to fix it.

- Offer a Solution: Offer to pay the missed payment or set up a payment plan.

- Be Persistent: Keep asking politely.

Bonus Tip:

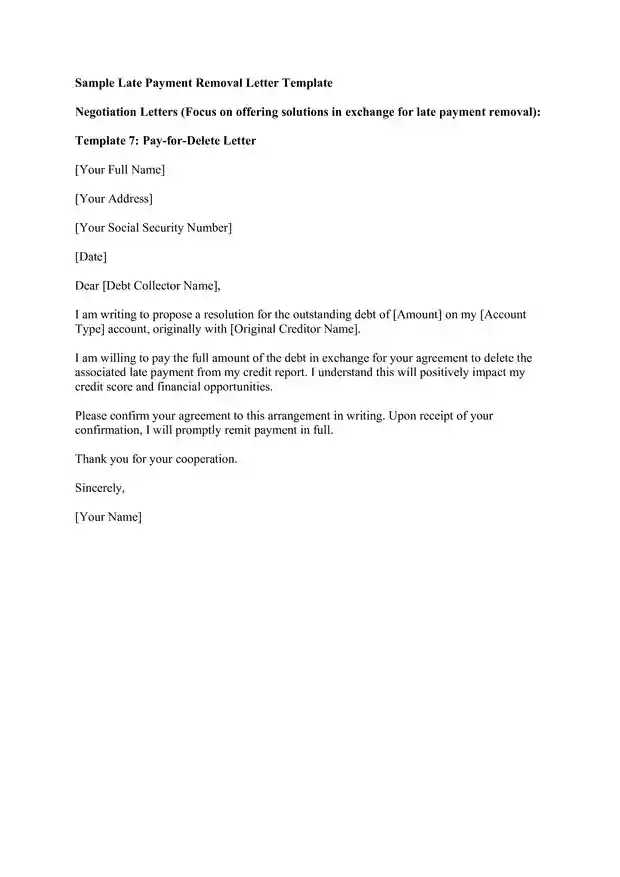

If your late payment is with a debt collector, try negotiating a “pay for delete” agreement. Offer to pay off the debt in return for the removal of the late payment.

Late Payment Removal Letter Template

Additional Strategies for Removing Late Payments

Tips for Maintaining a Good Credit Score:

- Pay Your Bills on Time: Set reminders to avoid missing payments.

- Check Your Credit Reports Regularly: Get free copies annually from Experian, Equifax, and TransUnion.

- Fix Mistakes Fast: Dispute any errors right away.

- Keep Your Credit Card Balance Low: Avoid maxing out your credit cards.

- Don’t Apply for Too Much Credit at Once: Too many applications can make you look risky to lenders.

There are other avenues to explore for removing late payments:

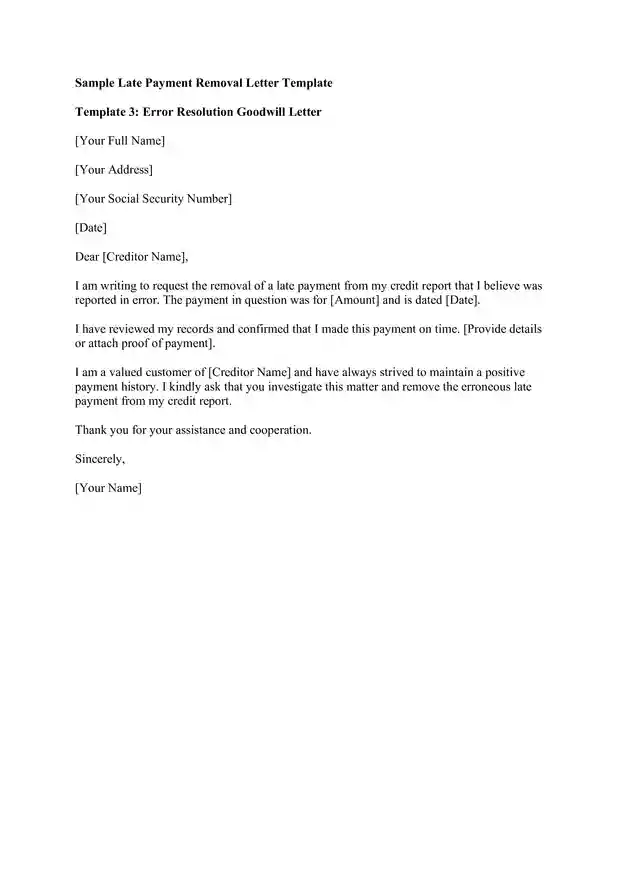

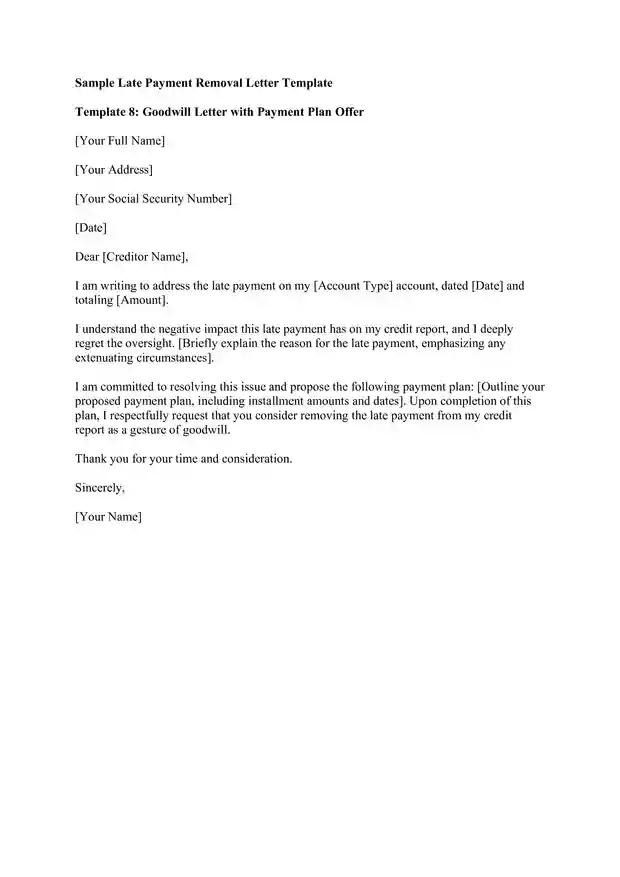

Goodwill Letters:

- How it works: Appeals to the creditor’s compassion, explaining your situation and requesting a one-time removal as a gesture of goodwill.

- Pros: Can be effective if you have a good payment history with the creditor and the late payment was an isolated incident.

- Cons: Not guaranteed to work, as it relies on the creditor’s discretion.

- When to use it: Best for isolated late payments with creditors you have a good relationship with.

Negotiating with Creditors:

- How it works: Directly contacting the creditor to discuss the late payment and negotiate a removal agreement. You might offer to pay off the debt or agree to a payment plan in exchange for removal.

- Pros: Can be effective if you can present a compelling case and offer a solution that benefits the creditor.

- Cons: Requires negotiation skills and may not always be successful.

- When to use it: If you have a strong reason for the late payment and are willing to work with the creditor to resolve the issue.

Credit Counseling Agencies:

- How it works: Nonprofit organizations that offer guidance on managing debt and improving credit. They may be able to negotiate with creditors on your behalf.

- Pros: Can provide professional assistance and leverage their relationships with creditors.

- Cons: May require a fee for services, and results are not guaranteed.

- When to use it: If you need help negotiating with multiple creditors or managing overwhelming debt.

Resources for Assistance:

- National Foundation for Credit Counseling (NFCC): Find reputable credit counseling agencies in your area.

- Consumer Financial Protection Bureau (CFPB): Learn about your rights as a consumer and file complaints against creditors.

Preventing Future Late Payments: A Proactive Approach

The best way to deal with late payments is to prevent them. Here’s how:

Master Your Finances:

- Create a Budget: Track your income and expenses.

- Set Financial Goals: Identify priorities and allocate funds.

- Build an Emergency Fund: Savings can cover unexpected expenses.

Utilize Tools and Technology:

- Set Up Automatic Payments: Ensure bills are paid on time.

- Use Calendar Reminders: Schedule reminders for due dates.

- Financial Apps: Use apps to track spending and send payment reminders.

Communicate with Creditors:

- Proactive Communication: Contact creditors if you anticipate a late payment.

- Negotiate Payment Plans: Work with creditors to create a payment plan.

By taking these steps, you can maintain a healthy credit history and avoid the stress of late payments.

FAQ

How long does it take to remove a late payment from my credit report?

It typically takes a few weeks to a few months, depending on the creditor’s policies.

What if the creditor refuses to remove the late payment?

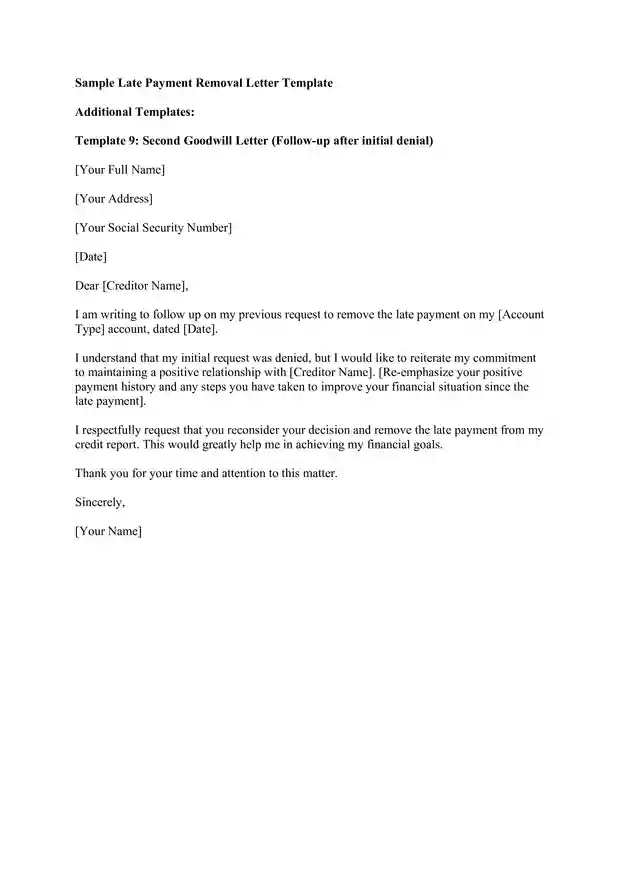

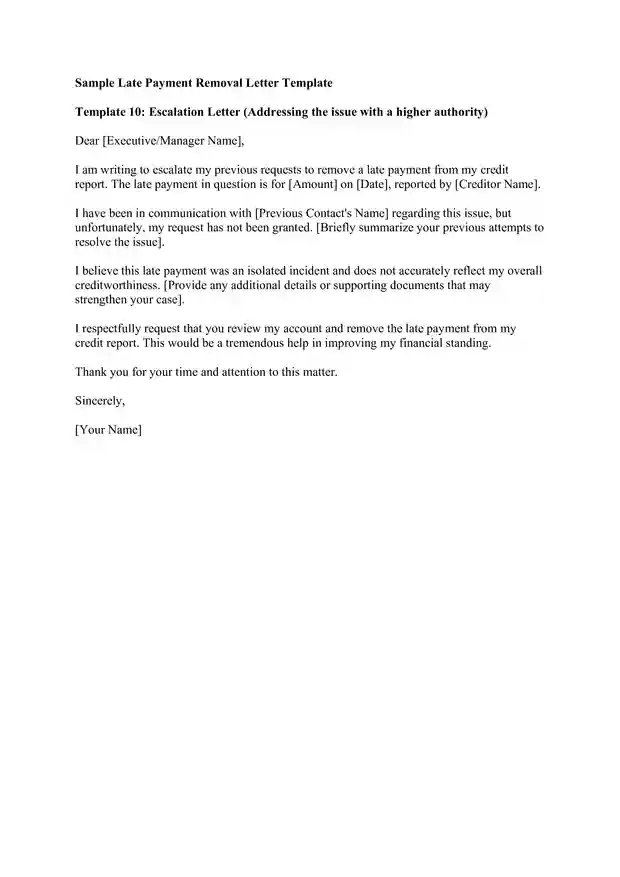

Try escalating the issue to a supervisor or file a dispute with the credit bureaus.

Can I remove multiple late payments at once?

Yes, you can request the removal of multiple late payments simultaneously.

Will removing a late payment significantly improve my credit score?

The impact depends on your overall credit history and the severity of the late payment.

Is there a cost associated with removing a late payment?

The process is typically free, but hiring a credit repair company may involve fees.

Can I use this letter template for any type of debt?

Yes, but you may need to tailor it for specific types of debt.

How often can I request a late payment removal?

There are no strict limitations, but focus on genuine instances.

Conclusion

You have the right to a fair and accurate credit report. Late payments don’t have to haunt your credit score forever. By disputing errors, negotiating with creditors, and practicing good financial habits, you can improve your credit and unlock a world of financial opportunities.

Daniel Wilson Is a Seasoned communications professional and letter-writing expert. With over a decade of experience in corporate and non-profit sectors, Has developed a deep understanding of the power of effective communication.

Specializes in creating versatile letter templates that can be tailored to any situation. In this blog, Daniel shares a passion for the art of letter writing, offering practical tips, customizable templates, and inspiring ideas to help you communicate with clarity, confidence, and impact.