Examples of last will and testament forms: Making a last will and testament would be useful as you can control all assets you own after you die. Generally, you can arrange things through the testament, including appointing beneficiaries, stipulating guardians for the children, and defining who will execute the will.

Some parties should have been involved in your last will and testament so it will be legal and enforceable.

Key Parties Involved in a Last Will and Testament

Creating a will isn’t just about listing assets and beneficiaries. It’s about understanding the legal framework that governs this essential document.

Ensuring its legality and enforceability involves various key parties, each crucial in giving your will the weight it deserves. There are some key parties involved:

Beneficiary

The beneficiary is a person or some people who will receive something from your assets after your death. There’s no limit on how many persons you want to appoint as a beneficiary in your last will and testament. You are allowed to appoint beneficiaries not only to people who are blood-related but you can also appoint certain organizations.

If you want to give your wealth to more than one person, outline the last will and testament as clearly as possible. You must ensure that you count and write all your assets precisely. Afterward, you should also mention what to do with the wealth.

You may want to divide the wealth equally to each beneficiary, or you are willing to share it as you want it to each person. It is crucial to keep your last will and testament clear and try to be fair, as one of the beneficiaries might protest to the executor for feeling treated unfairly.

Alternate Beneficiary

An alternate beneficiary is needed if something happens to the main beneficiaries and is no longer alive. You should consider alternate beneficiaries in your last will and testament, especially if the main ones are the same age as you. Although they only accept something if the main beneficiary is available, they will be treated properly when the main beneficiary is present.

Witness

You must present at least two people when writing a last will and testament. It is fundamental and necessary to make the form legal and ironclad. The two people should be able to witness and attest if needed, that you are in sound mind and not under pressure or stress when you sign the will.

Executor

An executor is the party you give authority to execute the whole testament sample. The executor should be someone you trust who will ensure that your will is executed as it is. Choosing a family member gives too many risks, possibly creating disputes among other beneficiaries. Most people give authority to their lawyer as executor of their last will.

How to Make Your Last Will and Testament

Creating a last will is a smart move. It helps you make choices about your things after you’re gone. Let’s learn how to make one:

- Start with a Declaration

Start by saying who you are. Make sure people know you’re choosing this without anyone making you do it.

Like this: “I, [Your Name], living at [Your Address], am making this will because I want to, and I’m thinking clearly.”

- Choose a Helper (Executor).

Pick someone you trust to do what your will says. This person makes sure everything goes to the right places.

Like this: “I want [Friend’s Name] from [Friend’s Address] to help do what my will says.”

- Pick Who Gets Your Things (Beneficiaries).

Name the people or groups you want to give your things to.

Like this: “I want to give my [Item, like “watch”] to [Person’s Name], who is my [how they’re related to you, like “cousin”].”

- Say Who Gets What?

List all your big things, like your house or special jewelry. Say who should get each one.

Like this: “My house at [House Address] should go to [Person’s Name].”

- Who Looks After Young Kids?

If you have kids that are still young, choose someone to take care of them.

Like this: “If I’m not here, I want [Person’s Name] to look after my kids.”

- Have a Backup Plan.

Sometimes, the first person you pick might be somewhere else. So, choose another person just in case.

Like this: “If [First Person’s Name] isn’t here, then [Second Person’s Name] should get my [Item].”

- A ‘Just in Case’ Rule:

If you need to mention something, say where it should go.

Like this: “Anything else I have when I’m gone should go to [Person’s Name].”

- Sign It:

You and two friends (who need to get something from the will) should sign the will. It’s like saying, “We saw this!”

Like this: “I, [Your Name], and my two friends signed this on [Date].”

- Keep It Safe:

Put your will somewhere safe, like a strong box. Tell the helper you picked where it is.

- Look at It. Sometimes

Things change. You could move or have a new baby. When big things change, look at your will and change it if needed.

Note: Making a will is a big deal. Talking to a helper (like a lawyer) is a good idea to ensure it’s right.

Why Make a Last Will and Testament?

Making a will is a tough task. But it’s a smart move that helps people and families. April M. Townsend Esq., an expert on this topic, says making a will is like making a plan for the future. Here are some reasons why:

You Decide Who Gets What

Without a will, rules decide who gets your things. You pick who gets what with a will, like toys, money, or even your favorite books.

Kids Are Taken Care Of

If you have kids, a will says who looks after them. It means your kids are with people you trust.

No Fights in the Family

Sometimes, families argue about stuff when someone passes away. A clear will stops these fights because everyone knows what you want.

Faster Process

With a will, sharing your stuff is quicker and easier. No long waits!

Special Gifts

You can leave special things to special people, like giving your baseball card collection to your best friend.

Pick Someone You Trust

A will lets you pick someone you trust to ensure everything goes as planned.

Feel Good

Making a will feels good. You know everything is sorted out.

Save Money

Goodwill can help your family save money on taxes.

Your Business is Safe

If you have a business, a will says what should happen to it.

Show You Care

A will is like a final hug. It shows you cared about what happens next.

But making a will is a way to ensure things go how you want after you’re gone. It’s a plan that helps everyone you care about.

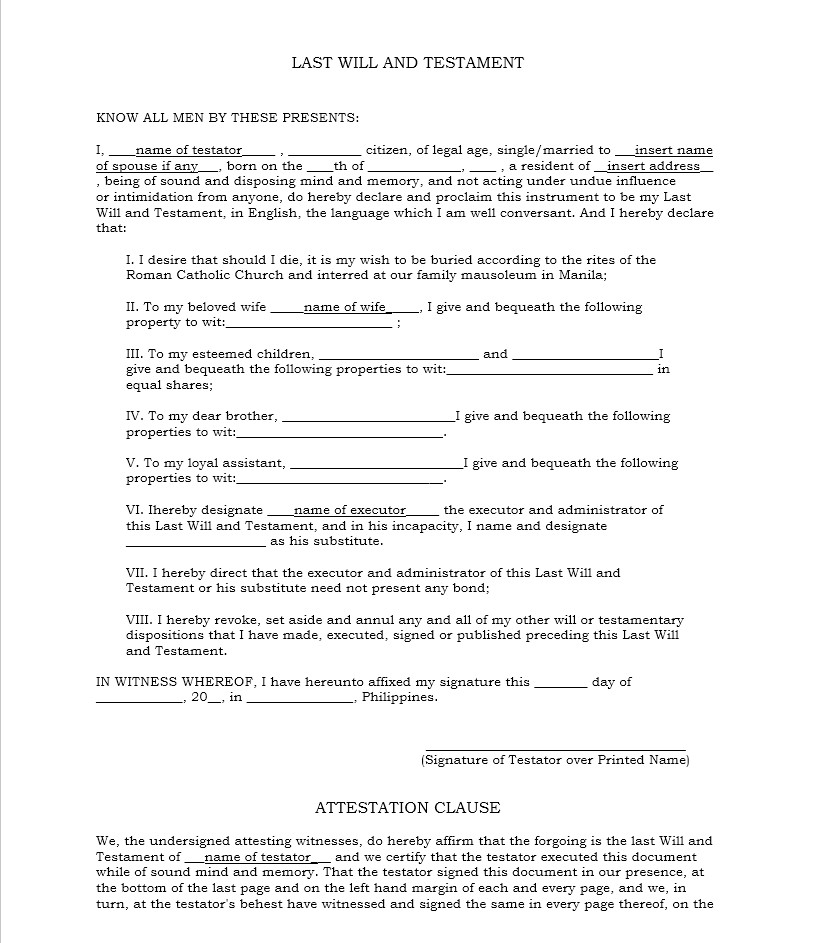

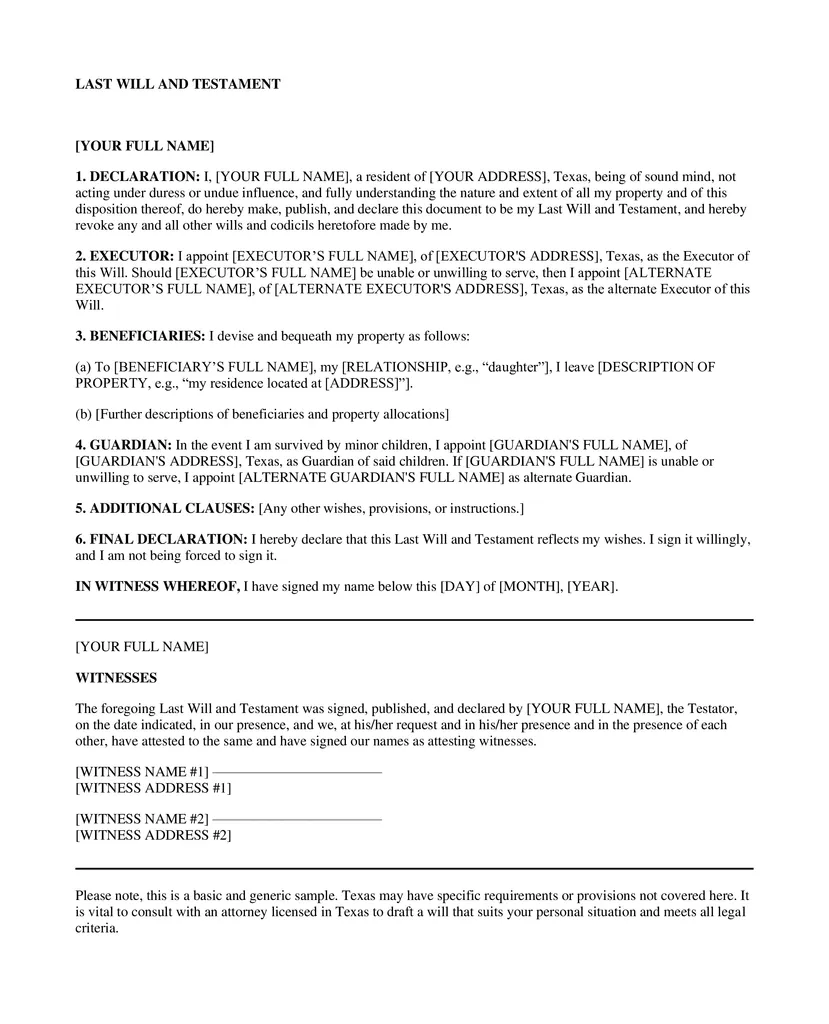

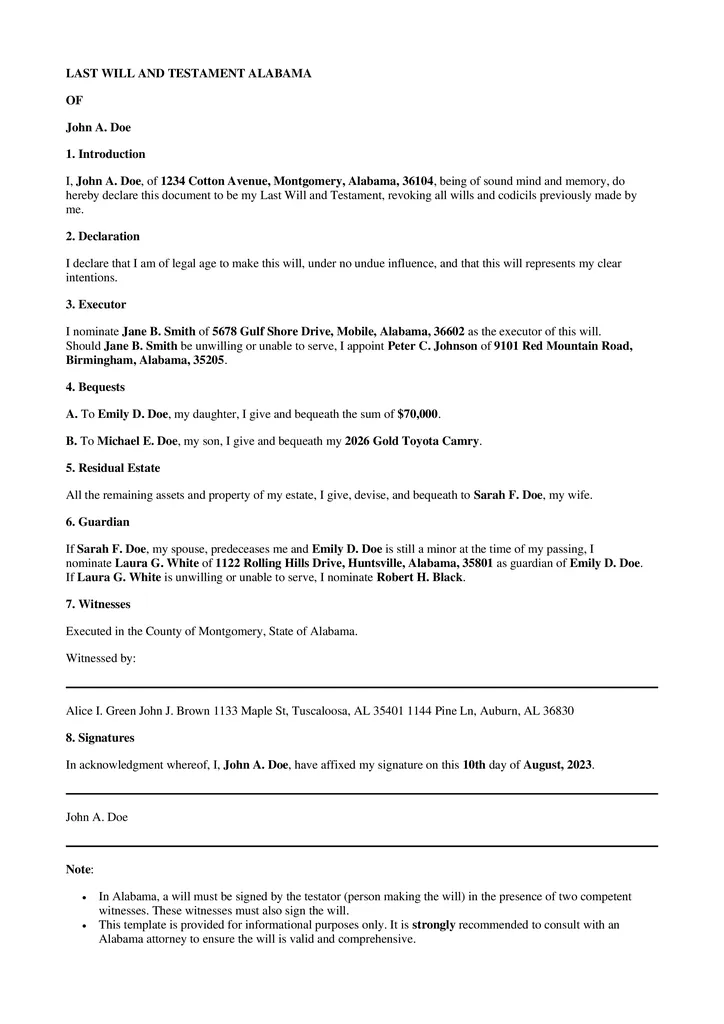

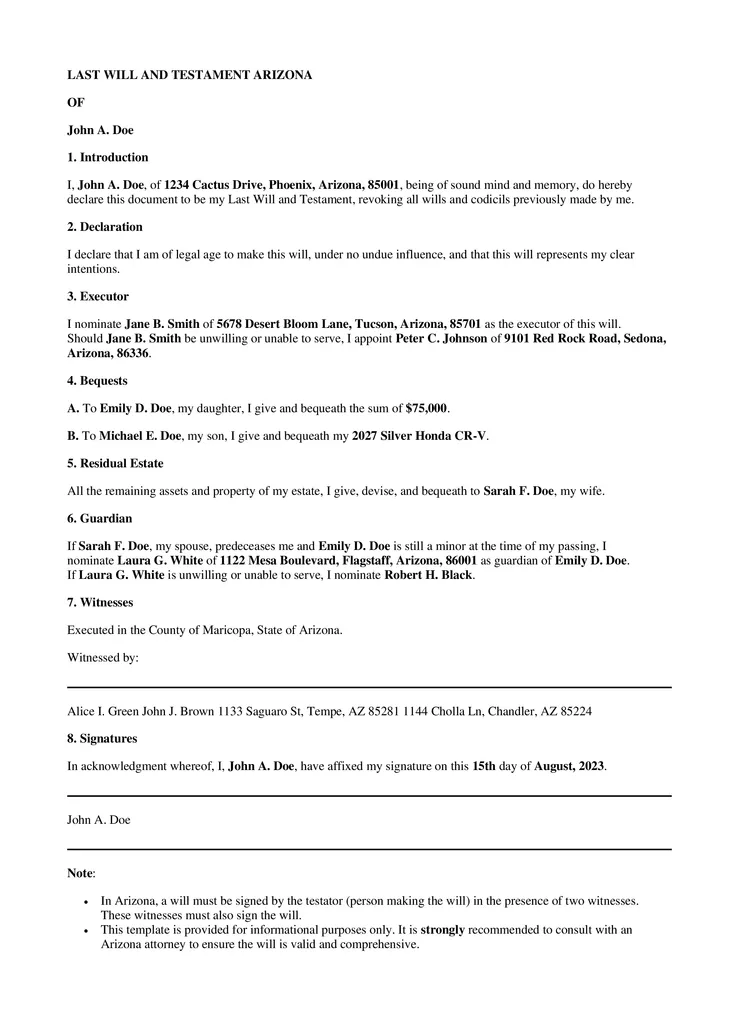

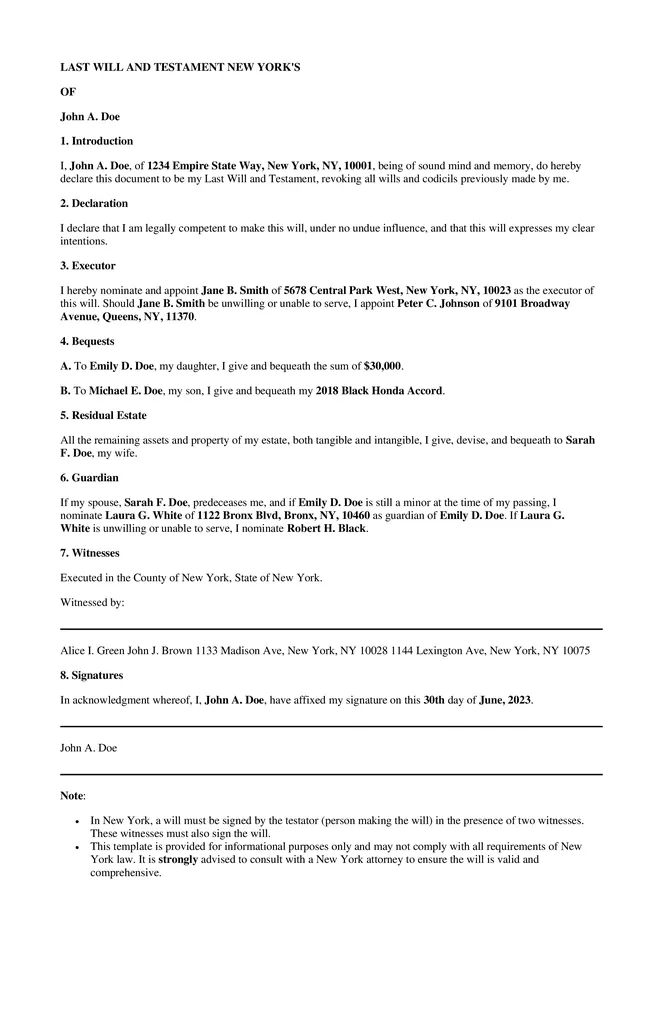

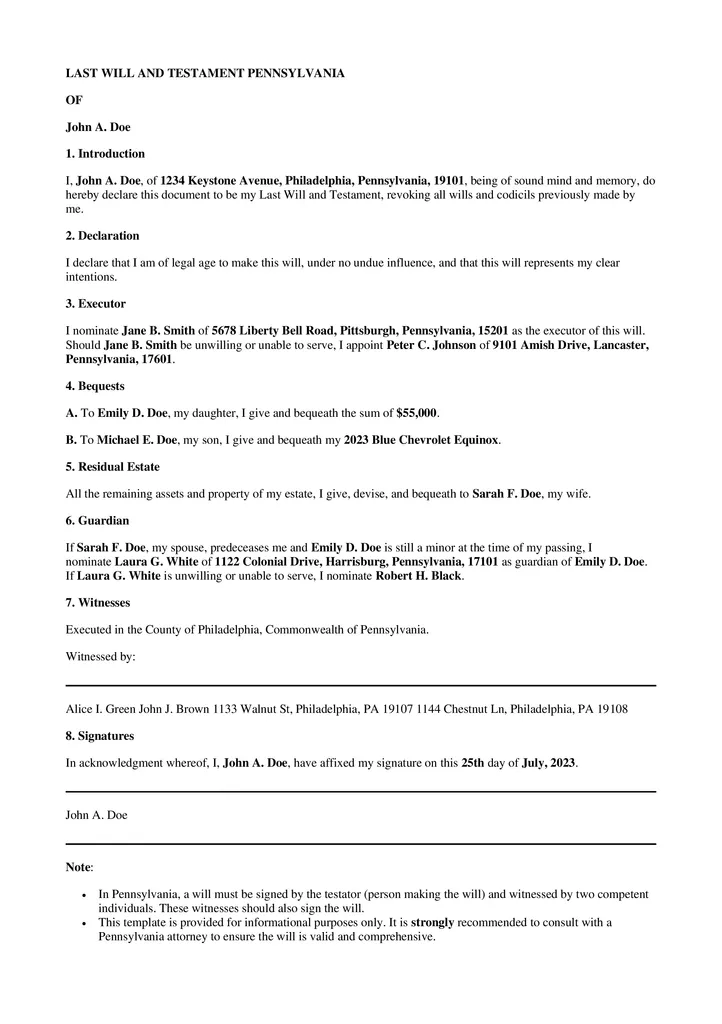

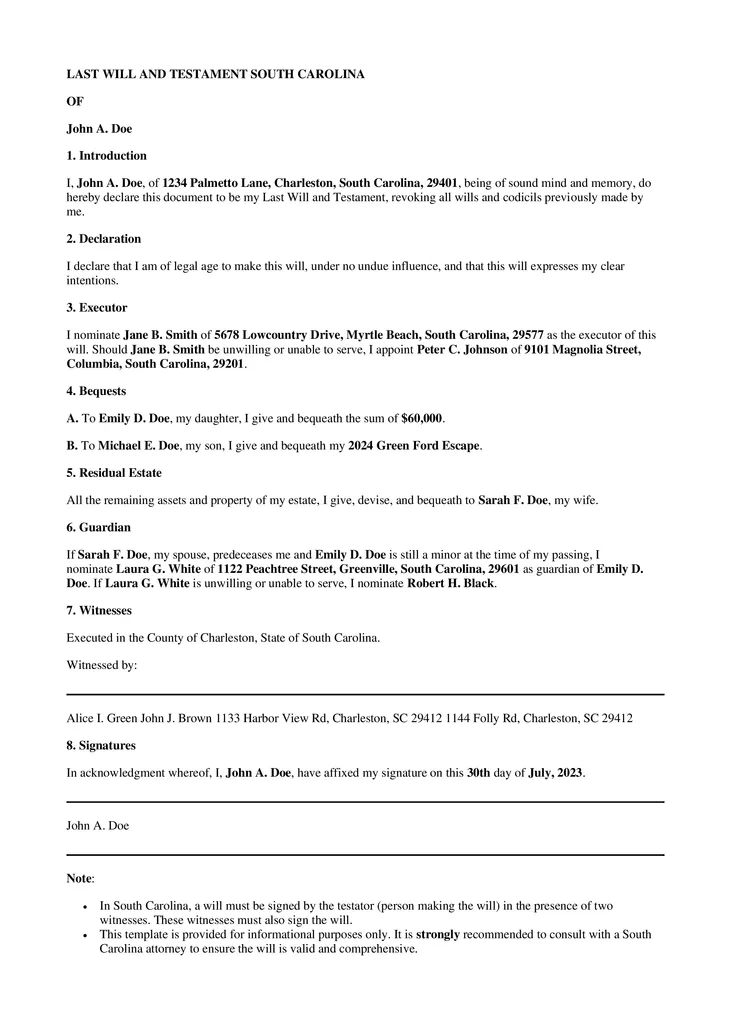

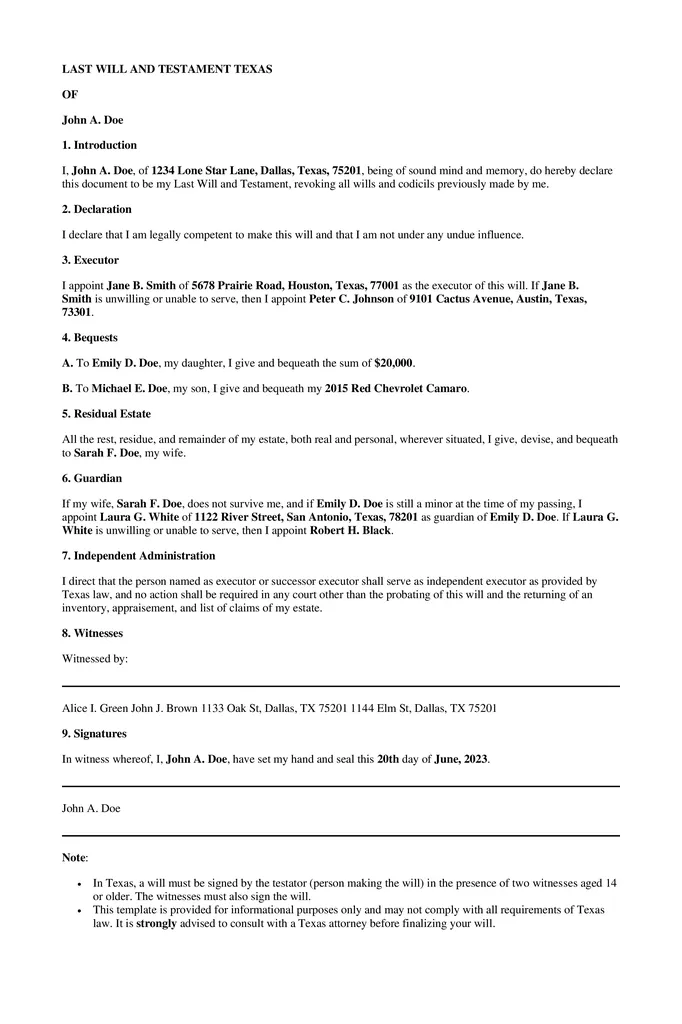

Examples of last will and testament forms and templates by State

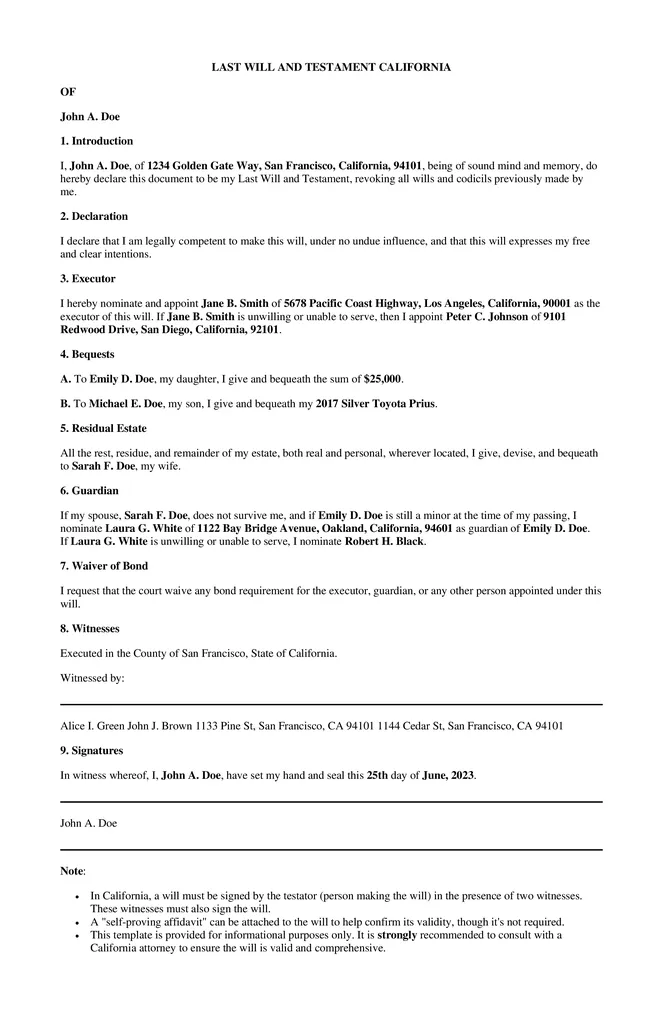

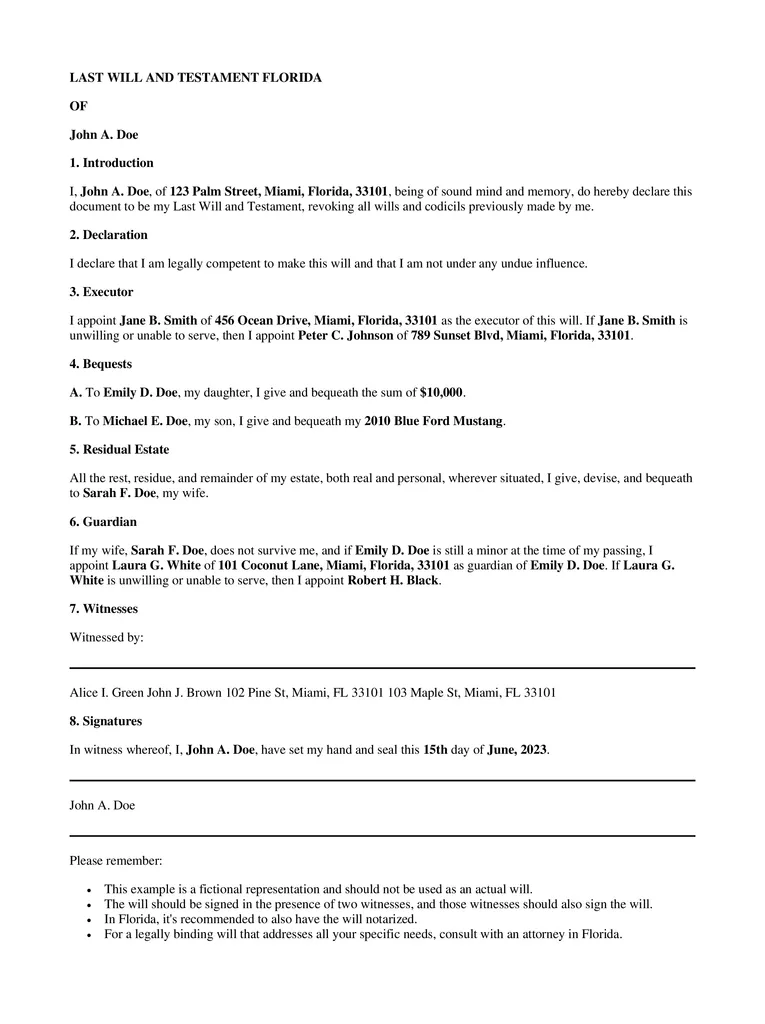

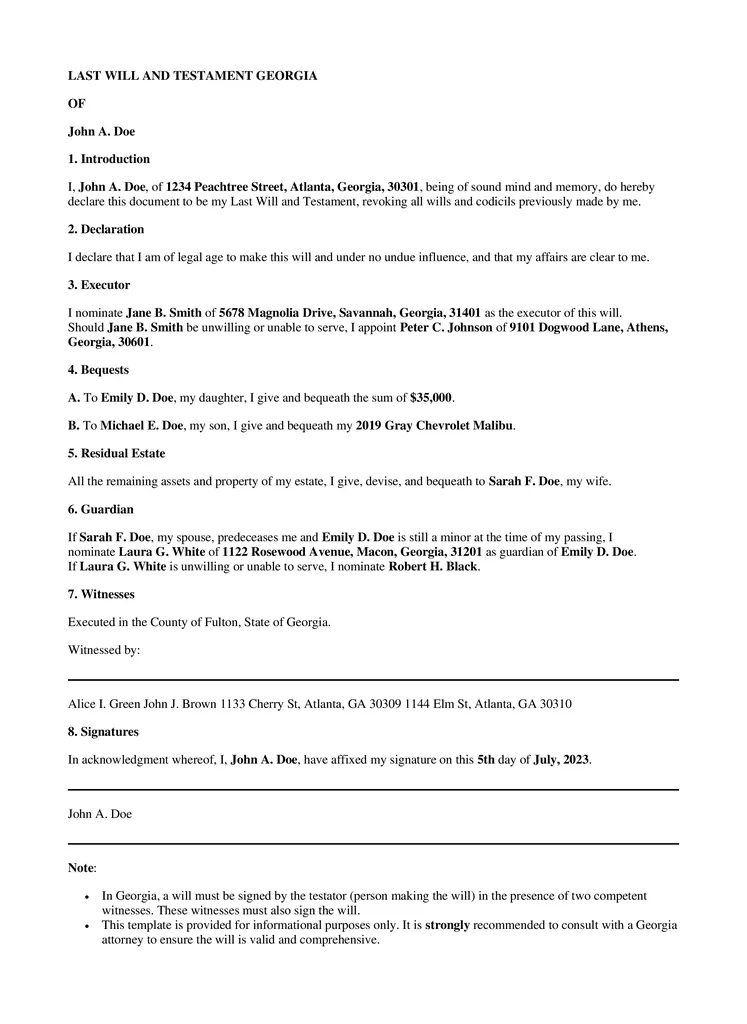

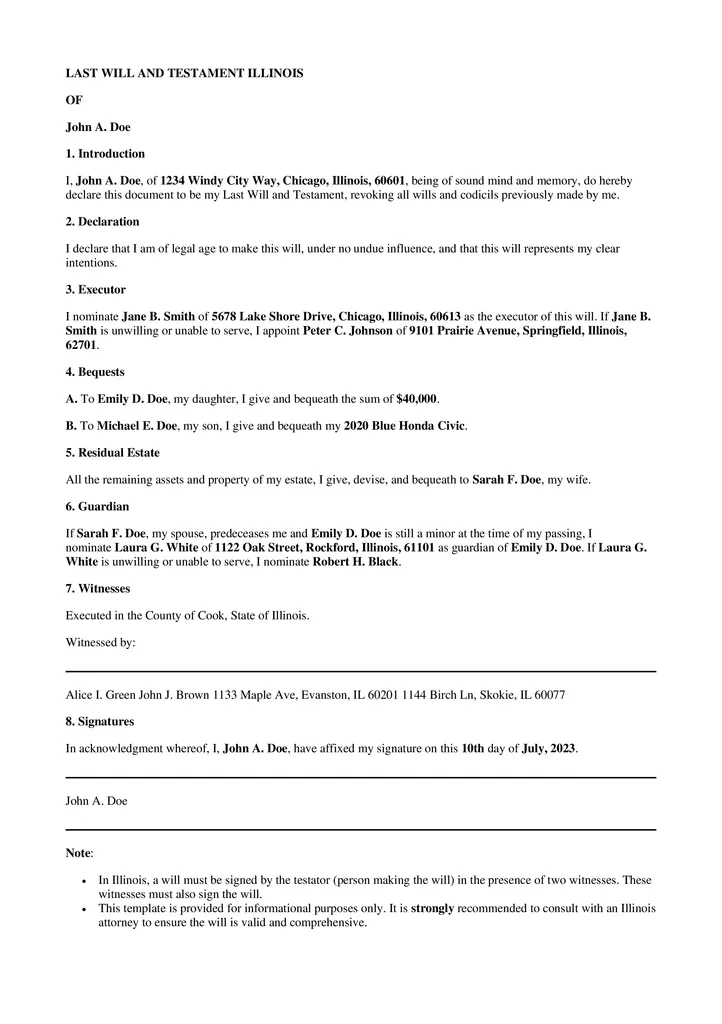

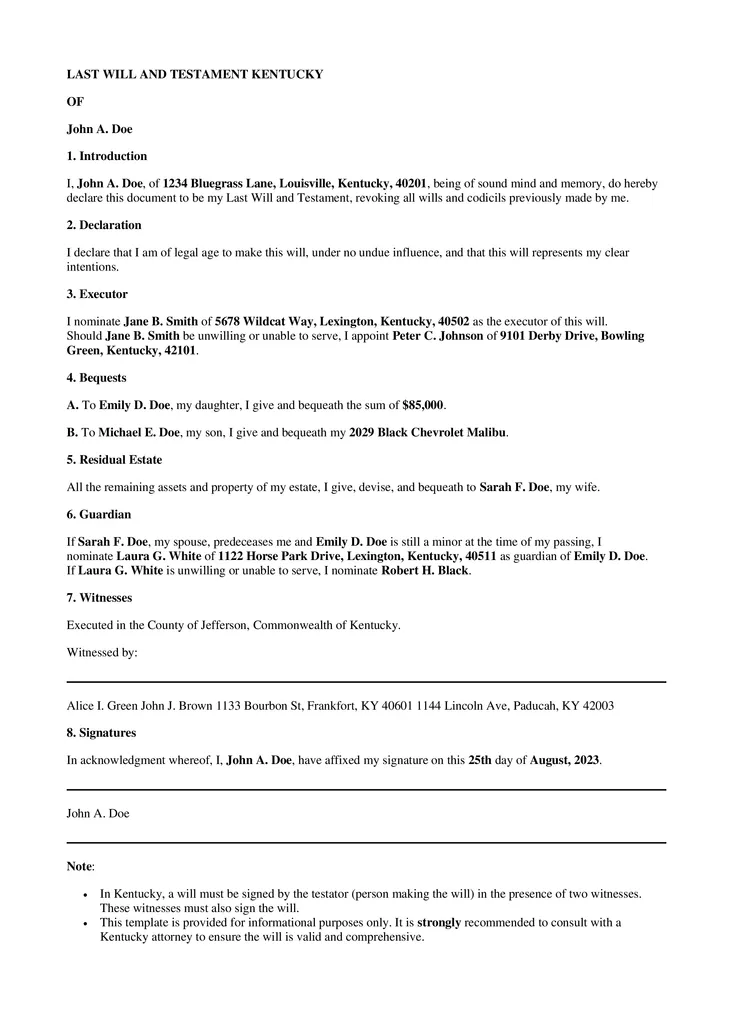

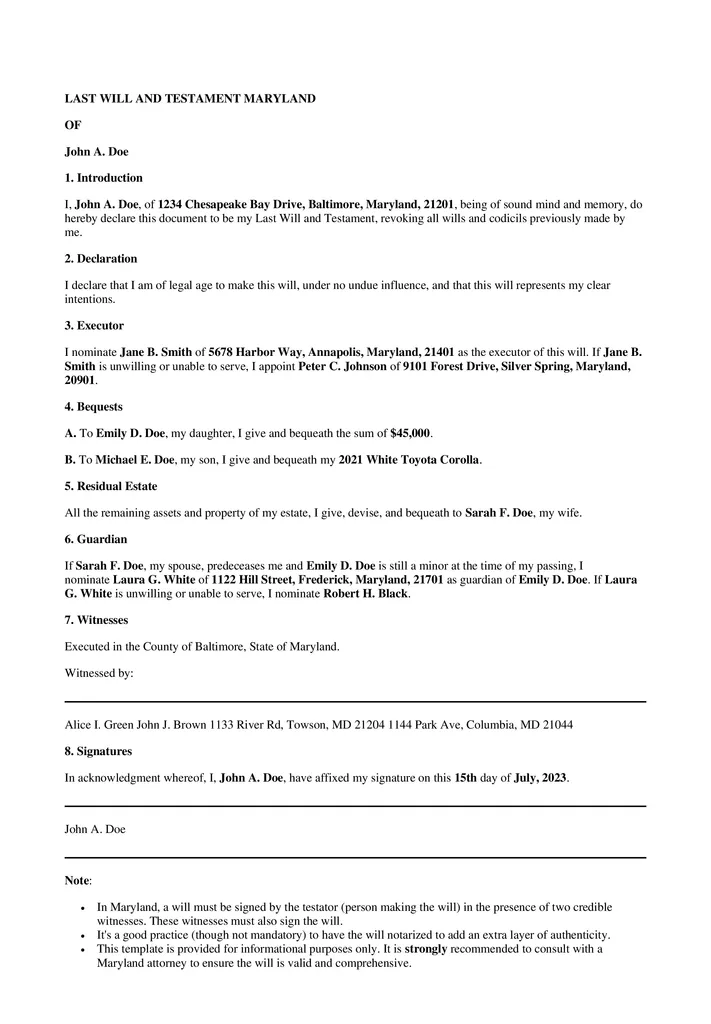

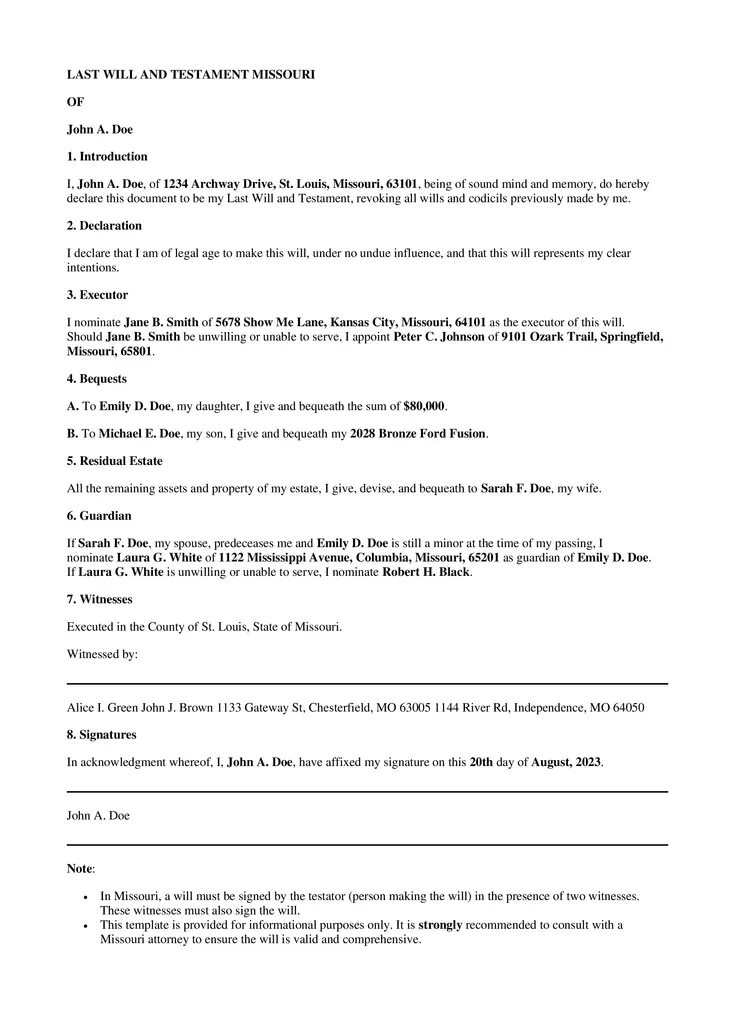

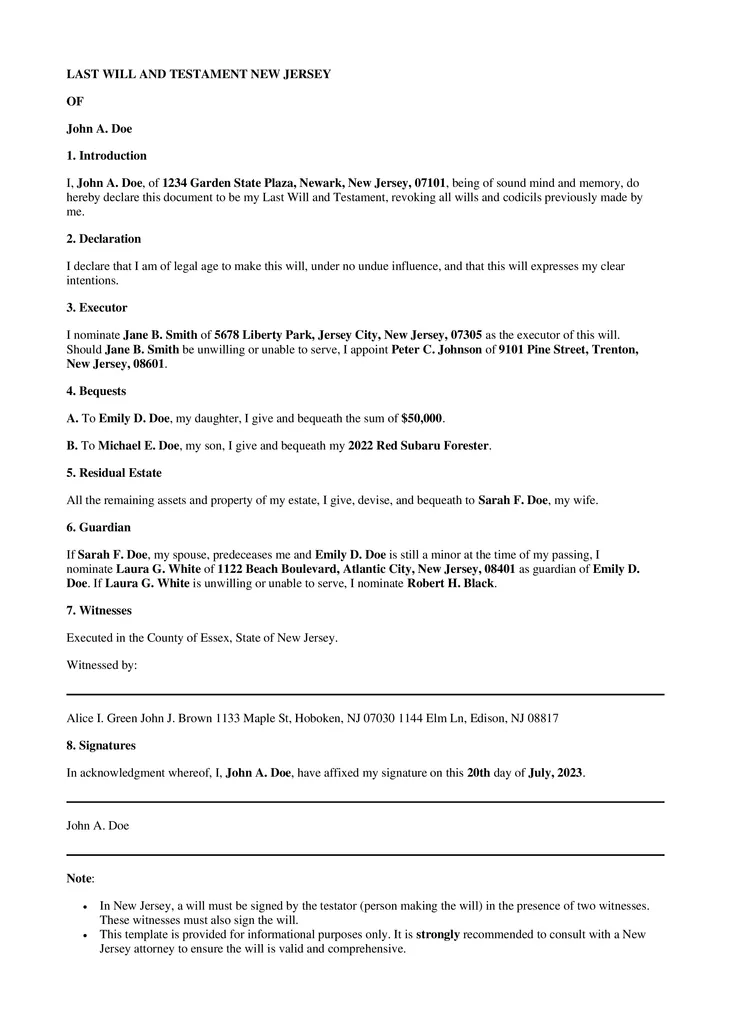

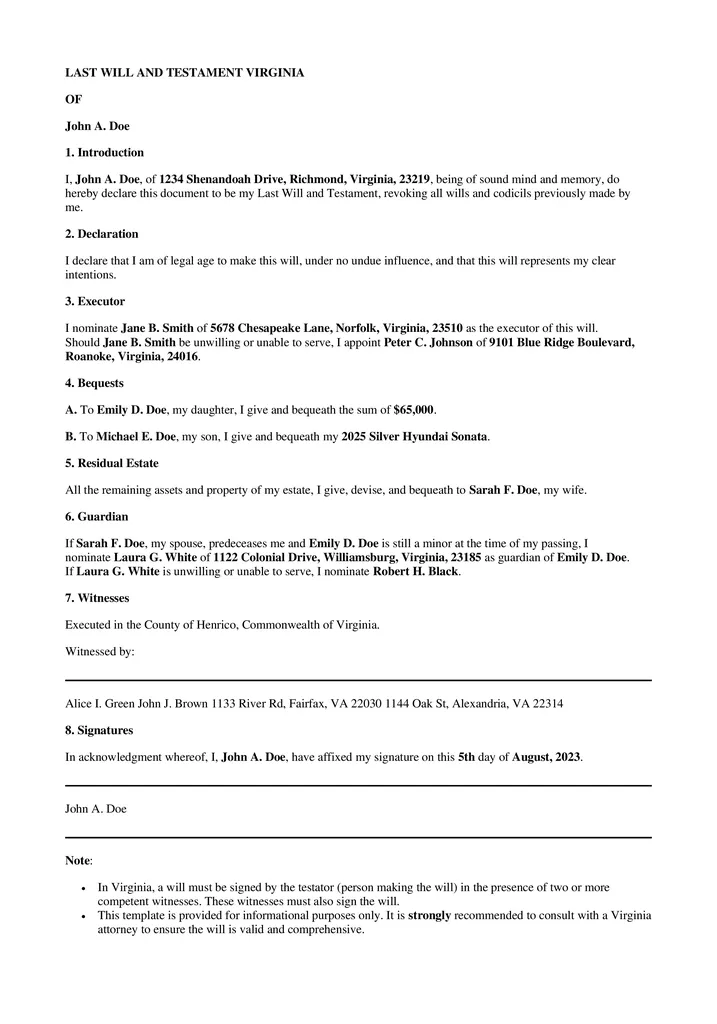

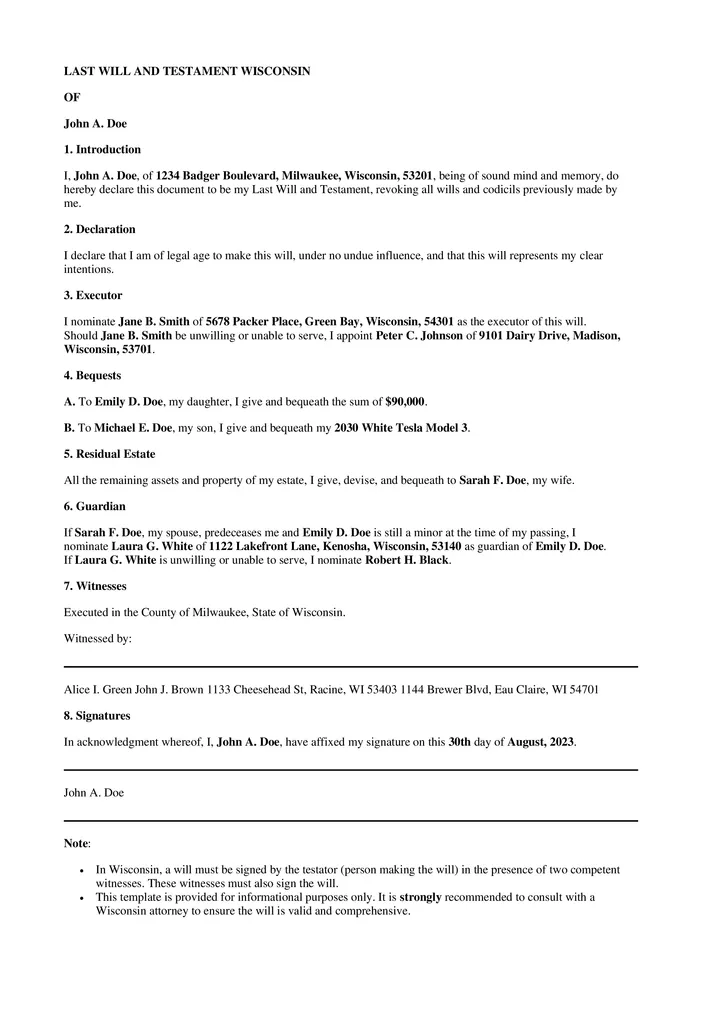

Every state in the U.S. has rules about making a Last Will and Testament. It means a will that works in one state might not work in another. Below are some popular state-specific templates:

- Texas: The Lone Star state has its guidelines for how wills should be written and signed.

- Florida: With many retirees, Florida’s will template addresses its unique population.

- California: Being a big state, California has laws that might differ from other states.

- New York: The Empire State has strict laws, especially for big cities like NYC.

- Georgia: The Peach State’s template includes its rules and guidelines.

- Illinois: Known for its windy city, Chicago, Illinois, also has its will guidelines.

- Maryland: The Old Line State template is molded to fit its state laws.

- New Jersey: The Garden State’s will template follows its state guidelines.

- Pennsylvania: The Keystone State’s rich history also comes with its specific will laws.

- South Carolina: This Southern state has its charm and rules for wills.

- Virginia: One of the original 13 colonies, Virginia has old traditions and a unique will format.

- Alabama: Heart of Dixie, Alabama’s will template is tuned to its state laws.

- Arizona: The Grand Canyon state template factors in its unique southwestern guidelines.

- Missouri: The Show-Me State’s will template is clear and concise, like its motto.

- Kentucky: Known for its derby, Kentucky also races ahead with its will guidelines.

- Wisconsin: The Badger State’s will template is straightforward, protecting residents’ assets.

Each state has a template that ensures residents’ wishes are respected after they pass. If you’re thinking of making a Last Will and Testament, it’s a good idea to check with local rules or chat with an expert. They can make sure everything is clear and legal.

Common Mistakes in the Last Will and Testament

Writing a last will and testament is key in planning for the future. However, people often make mistakes that can cause problems later on. Here’s a list of common errors to avoid:

- Not Reviewing the Will: Life changes, like getting married, having kids, or buying a new house. Always update your will when big things happen in your life.

- Forgetting Witnesses: Many places require two people to watch you sign your will. They can’t be people who get stuff from your will. They need to sign it, too.

- Not Being Clear: Knowing who gets what is important. If not, people might fight or need clarification later on.

- Skipping Details: If you want someone specific to get something, like a piece of jewelry or a painting, say it clearly in your will.

- Not Picking a Backup: Sometimes, the person you pick to get something might be away. It’s good to choose a second person.

- Not Naming a Guardian: If you have kids who are still young, you need to say who will take care of them if you’re not around.

- Picking the Wrong Helper (Executor): The person who ensures your will is followed is important. You should pick someone you trust.

- Waiting Too Long: Don’t wait too long to make a will. It’s good to have one, even if you’re young or think you have few things.

- DIY Errors: Some people need a lawyer to write a will. It can be okay, but they need to learn important rules and details sometimes.

- Not Storing It Safely: Put it somewhere safe once you make your will. And make sure the right people know where it is.

- Forgetting Digital Assets: Today, many people have things online, like photos, emails, or social media accounts. Remember to say what should happen to these.

Conclusion

A last will and testament is like a guidebook. When someone passes away, it helps family and friends know what to do next.

This paper tells everyone who gets what and who will look after young kids. It’s a way to show you care, even if you’re not around.

Making or updating a will is a big job. It’s always a good idea to get help from experts so everything is done right. This way, everyone can feel better and more sure during a tough time.

FAQs

What is a Last Will and Testament?

It is a legal document where people write down who gets their stuff, like money or property, after they pass away. It can also say who will care for their children.

Why is it important to have one?

Having a will means your wishes are clear. With one, there might be fights or clarity about who gets what. Plus, the law might decide instead of you.

Do I need a lawyer to make a will?

Only sometimes. Some people use templates or online tools. But, if your wishes are tricky or you have lots of stuff, a lawyer can be helpful.

How old do I have to be to make a will?

In most places, you must be an adult, usually 18 or older. But some places might let younger people make a will if they are married or in the military.

Can I change my will after I make it?

Yes! If life changes, like having a baby or getting married, you can make a new will. Just be sure the new one is the only one that counts.

What happens if I die without a will?

If there’s no will, the law decides who gets your stuff. It is called “dying intestate.” It might not match what you wanted.

What’s the difference between a will and a living will?

A will talk about what happens after you pass away. A living will talks about what you want if you’re very sick and can’t speak for yourself, like if you want life support.

What is an executor?

An executor is someone you pick to make sure your will is followed. They handle things like paying debts and giving out what you left to others.

Do I need witnesses for my will?

Most of the time, yes. Witnesses make sure you signed the will and weren’t forced to.

Can a will be challenged in court?

Yes, sometimes. If someone thinks the will needs to be corrected or made fairly, It might ask a court to look at it.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.