Income Verification Letter Template Free – When you want to buy something big like a house, or you want to rent an apartment, or you need to ask the bank for some money (a loan), there’s a special letter you might need. This letter is called an Income Verification Letter.

What is this letter? It’s a note that tells people how much money you make. It helps them trust that you can pay for things. In this guide, you’ll learn what this letter is and why it’s important, see examples of what it looks like, find steps to write a great letter and discover who might need it.

If you are a boss (employer), someone who works (employee), or someone who needs to show how much money you make, this guide makes it easy! You’ll also learn about mistakes to watch out for, extra tips to make writing the letter easy, and answers to any questions you might have.

So if you ever need to show how much money you make, this guide is for you! It helps you understand income verification and makes everything clear and easy!

Why You Need Income Verification Letters

Why are these letters so important? Well, there are a few big reasons why you might need one:

Getting a Loan from the Bank

Imagine you like to buy something big like a house or a car, but you need more cash. You’ll need to borrow money from the bank. The bank wants to know if you can spend them back. It benefits to offer the bank that you create enough funds to do that.

Renting a Place to Live

If you like to rent a house, the owner wants to know if you can pay monthly rent. This letter tells them you have a steady job and money coming in.

Applying for Credit Cards

Sometimes, grown-ups use credit cards to pay for things and repay the credit card company later. The business needs to know that you can pay them back, and It can assist in proving that.

Government Help

If your family needs help from the government, like food assistance, they might ask for this letter. It helps them understand how much money your family makes so that they can give you the right amount of help.

Starting a New Job

Sometimes, when you start a new job, they like to understand how much money you made at your old job. This letter can help share that information.

Income Verification Letters are special. They’re like a trusty helper when you must prove how much money you make. Whether it’s for buying a house, renting an apartment, getting a credit card, or even starting a new job, this little letter plays a big part.

These letters help people trust you about money stuff. It’s like having a friend who says, “I know this person, and they’re telling the truth!”

How to write an income verification letter

Writing an Income Verification Letter might sound tricky, but don’t worry! It’s like writing a special note that tells how much money someone makes at their job. Here’s a step-by-step guide to help you:

Start with a Greeting

Begin with a nice hello. If you know the name of the person reading the letter, you can say, “Dear [Person’s Name].” If you don’t know the name, you can write, “To Whom It May Concern.”

Introduce Yourself

Tell the reader who you are and why you’re writing the letter. If you’re an employer, you might say, “I am writing to confirm the income of [Employee’s Name], who works at our company.”

Share the Money Details

Include how much money the person makes every year, month, or hour. Be clear and honest.

Talk about the Job

Write a little bit about the person’s job. You can mention their job title and what they do. For example, “They are a cashier at our store and have worked here for two years.”

Add Any Extra Money

You can mention that if the person makes extra money from other jobs or things they do.

Wrap It Up

Sum up everything in a nice ending. You might say, “I confirm that all this information is true. Don’t hesitate to contact me if you have any questions.”

Say Goodbye

Finish the letter with a friendly goodbye like “Sincerely” or “Thank you,” followed by your name.

Add Your Signature

Sign the letter with a pen above your printed name. It makes the letter look official!

Include Copies of Proof

Sometimes, you might need to add copies like pay stubs to show that the money details are correct. If you do this, add the word “Enclosures” at the end of the letter.

Writing an Income Verification Letter is like putting together a puzzle. Follow these steps, and you’ll have a nice letter with all the right details.

It’s an important letter that helps people trust how much money someone makes. So take your time, be clear, and you’ll do great!

Additional Tips for Writing an Income Verification Letter

You can make it even better with a little extra care! Here are some helpful hints:

Be Clear and Simple

- Use words that are easy to understand.

- Stick to the facts, and don’t add extra details that aren’t needed.

Be Polite

- Remember, this is a formal letter. Keep it nice and respectful.

Check Your Work

- Look over your letter for mistakes in spelling or information.

- Ask a friend or family member to read it and see if it makes sense.

Use a Professional Tone

- Even though we’re keeping things simple, it’s still a serious letter. Keep your writing formal and professional.

Make Copies

- Keep a copy of the letter for yourself.

- If you send copies of things like pay stubs, send copies, not the original items.

Provide Contact Information

- Include a way for the reader to contact you, like a phone number or email address.

Think About Privacy

- Be careful with personal information. Only share what’s needed.

Use a Proper Format

- Write the letter in a standard business letter format. If you need to learn how you can find examples online.

Consider the Purpose

- Consider why the reader needs this letter and ensure you include all the needed details.

Be Truthful

- Always tell the truth in the letter. Lying can cause big problems later on.

By following these tips, you’ll make your letter even stronger and more helpful. So take these tips to heart, and you’ll write a letter that does just that!

Common Mistakes in Writing

Here are some of the most common mistakes to avoid:

Providing Inaccurate Information

- mistakes: Providing false or incorrect information can lead to legal problems and loss of trust.

- How to avoid it: Double-check all figures and information before including them in the letter.

Complex Language

- Mistakes: Using words or phrases that are too difficult can confuse the reader.

- How to avoid it: Use clear and simple language that can be easily understood.

Lack of Proper Formatting

- Mistake: An improperly formatted letter must be more professional.

- How to avoid it: Follow a standard business letter format, including appropriate headings, salutations, and closing.

Missing Essential Details

- Mistake: Leaving out important information can make the letter complete and clear.

- How to avoid it: Include all necessary details, such as the income source, the verification period, and contact information.

Failure to Provide Supporting Documents

- mistake: Not including necessary documents can make the verification process harder.

- How to avoid it: Attach all required supporting documents, such as pay stubs or tax returns.

Being Too Informal

- mistake: An informal tone may seem unprofessional or disrespectful.

- How to avoid it: Maintain a formal and respectful tone throughout the letter.

Not Including a Signature

- Mistake: A missing signature can question the letter’s authenticity.

- How to avoid it: Always sign the letter electronically or manually.

Ignoring Privacy Concerns

- mistake: Sharing too much personal information can breach privacy.

- How to avoid it: Only include the essential personal details needed for the verification process.

Avoiding these common mistakes ensures the letter is accurate and professionally crafted to fulfill its intended function.

What key information must be included?

Here is the essential information that must be included:

- Sender’s Information: This section needs the name, address, and contact details of the employer or authoritative individual issuing the letter.

- Date: Mention the date when the letter is written.

- Recipient’s Information: Include the name and address of the specific individual or organization to whom the letter is addressed.

- Employee’s Details: Information such as full name, position, department, and possibly the employee’s identification number within the organization.

- Statement of Employment Verification: A precise declaration confirming the employee’s current employment status.

- Income Information: A detailed overview of the employee’s salary, encompassing base salary, bonuses, overtime, and other compensations. Mention the payment frequency if necessary (e.g., monthly, bi-weekly).

- Duration of Employment: Include the start date and, if relevant, the expected end date.

- Purpose of the Letter: Briefly explain why the letter is needed if known.

- Additional Income: If applicable, highlight additional income sources or financial benefits.

- Employer’s Signature: Ensure the employer or an authorized individual signs the letter. Include printed name, title, and contact information for verification.

- Enclosures (if any): List any supporting documents attached.

- Disclaimer (if necessary): A disclaimer might be needed to define the verification limitations or to highlight the confidentiality of the information provided.

- Contact Information for Verification: Include contact details of a person within the company who can verify the information to add authenticity to the letter.

What scenarios are required to present an income verification letter?

Here’s a look at some common scenarios:

- Applying for a Loan: Banks and other lenders may ask for this letter to see if a person can repay the money they want.

- Renting a Place to Live: Landlords might want to see this letter to make sure a person can pay the rent every month.

- Getting a Credit Card: Some credit card companies ask for this letter to decide how much they will let a person spend on a credit card.

- Applying for Government Help: Sometimes, people need help from the government, like food stamps. This letter can show how much a person makes, so the government knows how much help to give.

- Joining a School or College: Some schools ask for this letter when a family wants to get help paying for school.

- Buying a Car on Credit: Car dealers might want to see this letter if a person wants to pay for a car a little at a time.

- Getting Health Insurance: Some insurance companies want to see this letter to decide how much a person has to pay for health insurance.

- Adopting a Child: People who want to adopt a child might need this letter. It shows that they have enough money to care for a child.

- Setting Up a Payment Plan: If someone owes money and wants to pay it back a little later, they might need this letter.

- Getting a Mortgage: When buying a house, a person might need this letter to get a mortgage from the bank.

There are some times when a person might need an Income Verification Letter. It’s a paper that tells how much money a person makes, and many people want to see it for different reasons.

Who is Generally Responsible for Issuing an Income Verification Letter: The Employer or the Employee?

Do You Know Who Writes the Letter?

An Income Verification Letter is very important. But who writes it? Is it the Employer or the Employee? Let’s find out!

What the Employer Does

The boss is usually the one who writes this letter. They know how much money the worker makes so that they can write it down.

- Making Sure It’s Right: The boss must ensure everything in the letter is true.

- Keeping It Private: The boss must not tell anyone else what’s in the letter.

- Answering Questions: Banks or other places sometimes ask for this letter. The boss has to be ready to help quickly.

What the Employee Does

The worker has a part in this too. They don’t write the letter, but they help in other ways.

- Asking for the Letter: Usually, the worker is the one who asks the boss to write the letter.

- Giving the Right Details: The worker tells the boss what the letter is for and who should get it.

- Knowing What Is Shared: The worker should know what’s in the letter and make sure it’s okay with them.

Working Together

The boss and the worker must work together to ensure the letter does what it should. They both have jobs, and everything works fine if they do them right.

Knowing what both people have to do makes it easier to get the Income Verification Letter done right. It’s an important paper; the boss and the worker help make it happen without any trouble.

Income Verification Letter Template Free

Income verification letters are essential because they help people understand how much money you make. There are 20 different types, and they all serve special purposes. Let’s learn about them.

You should fill out this form with your name, address, and how much money you make. It’s very common and can be found in different ways.

Income Verification Letter Template Word

This special template is in Microsoft Word. It’s helpful because you can change it to make it perfect for your needs.

Income Verification Letter for Apartment

The owner might ask for this letter if you want to live in an apartment. It tells them you can pay the rent.

Income Verification Letter for Self-Employed

People who have their business use this letter. It shows how much money they make with bank papers or tax forms.

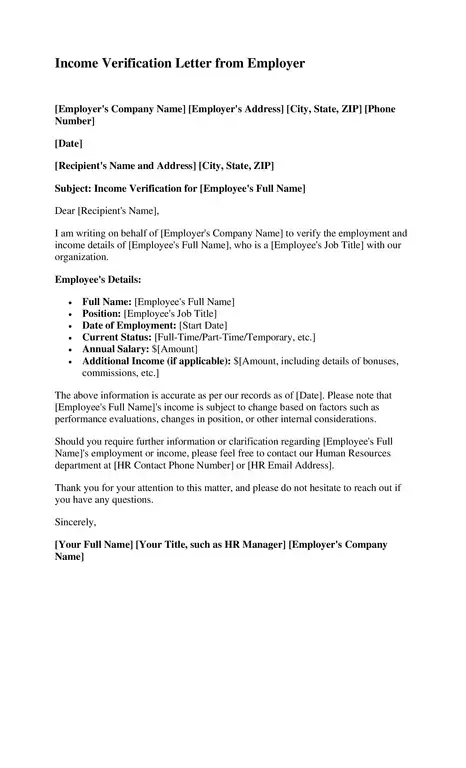

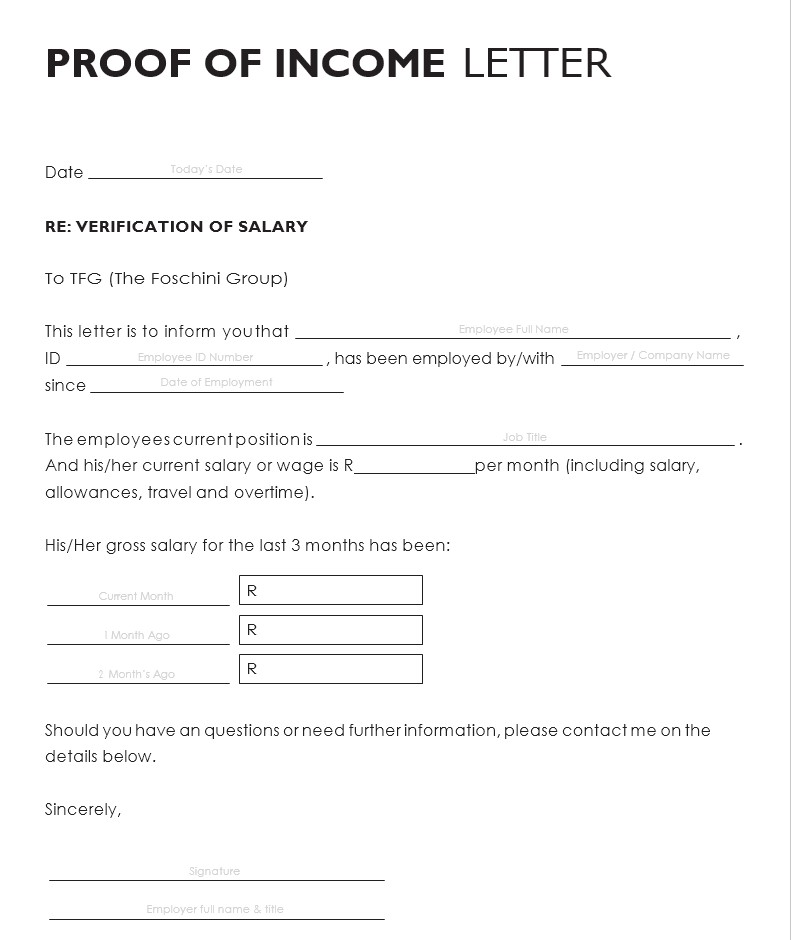

Income Verification Letter from Employer

This letter comes from your boss. It tells people how much money you make and is used when you want to borrow money.

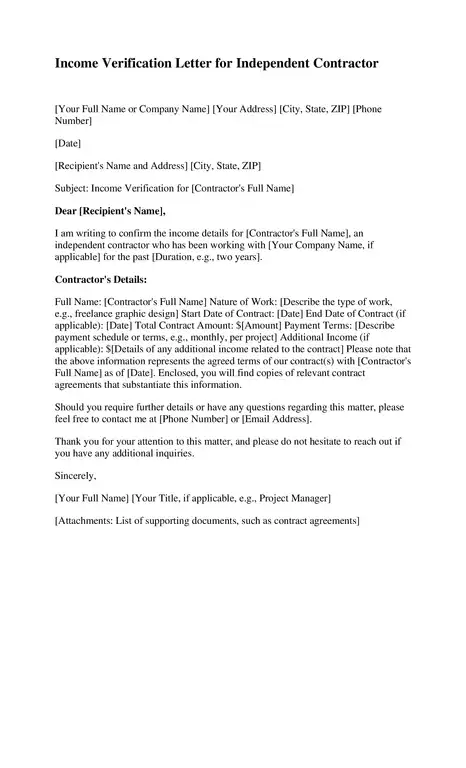

Income Verification Letter for Independent Contractor Template

People who work by themselves use this letter. It helps them show how much money they make.

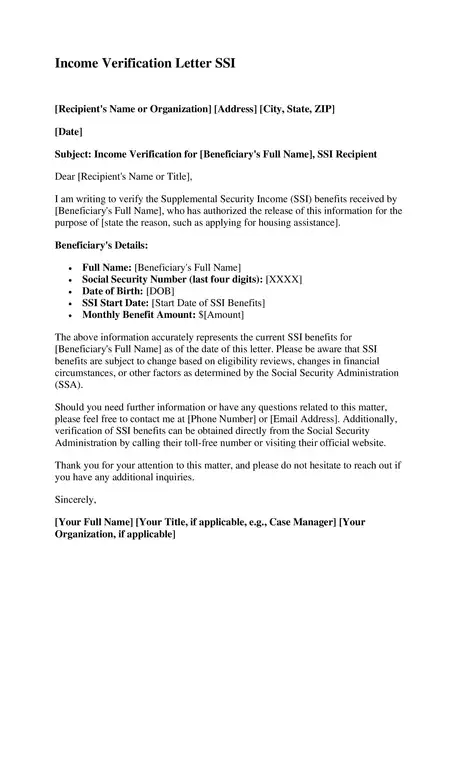

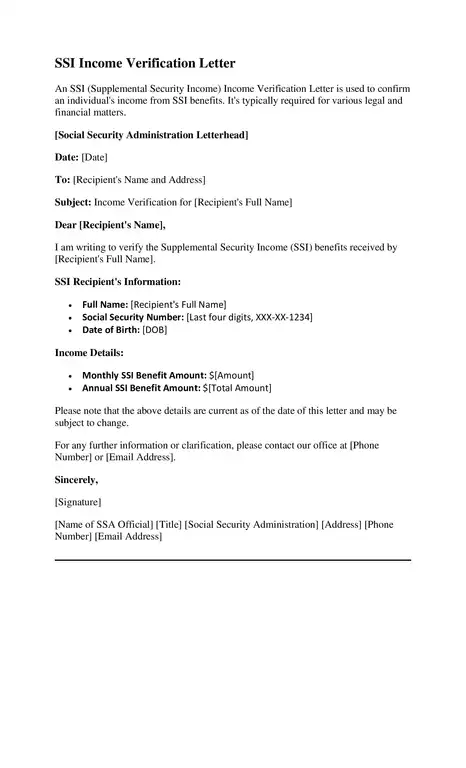

Income Verification Letter SSI

If you get special money called SSI, you might need this letter. It’s important for many different things.

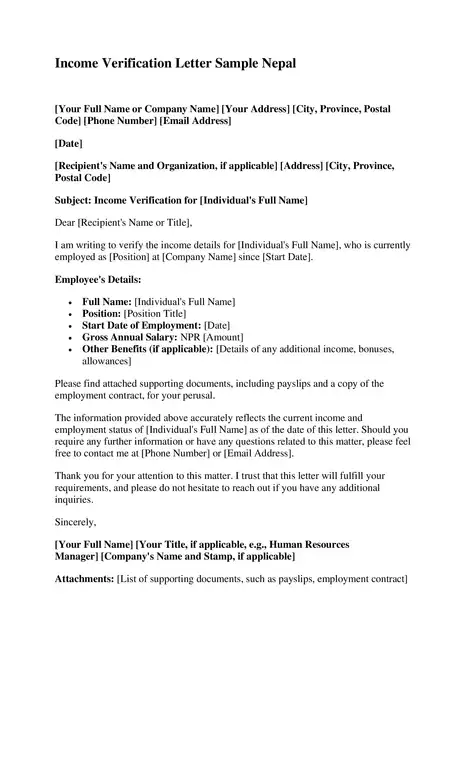

Income Verification Letter Sample Nepal

This letter is used in Nepal. It helps with things like getting a visa or a loan.

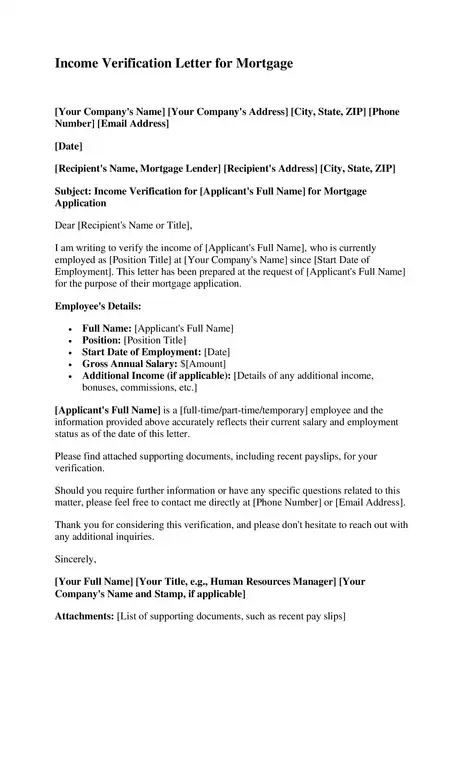

Income Verification Letter for Mortgage

The bank might ask for this letter if you want to buy a house. It shows them you can pay for the house.

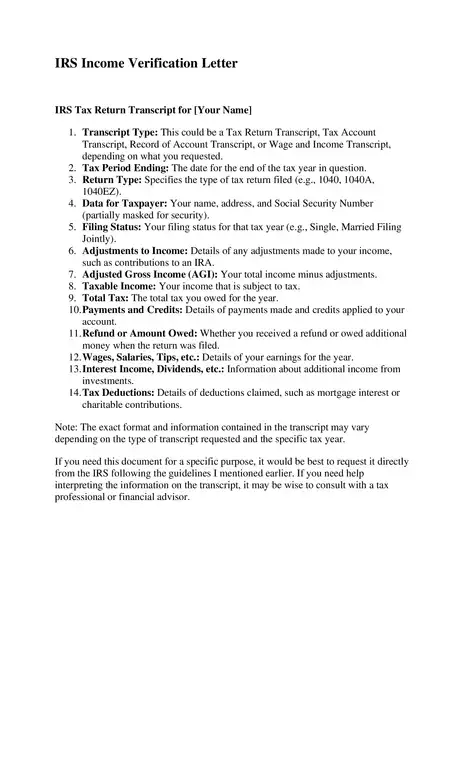

IRS Income Verification Letter

The tax people in America use this letter. It shows your money for taxes.

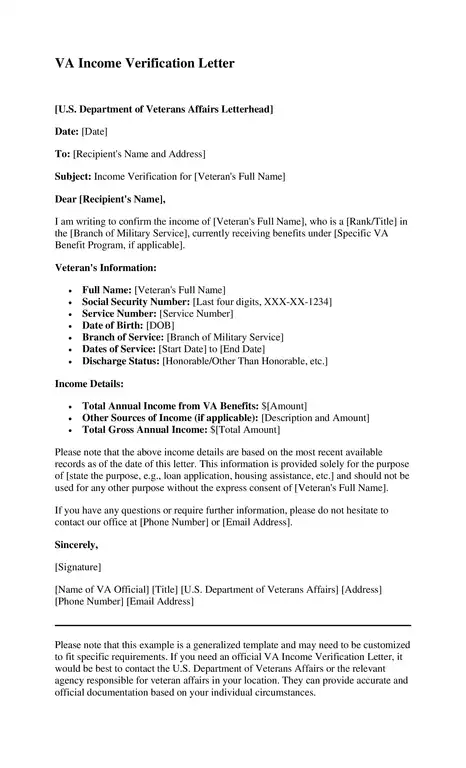

VA Income Verification Letter

If you were in the military, you might need this letter. It helps you get special things from the government.

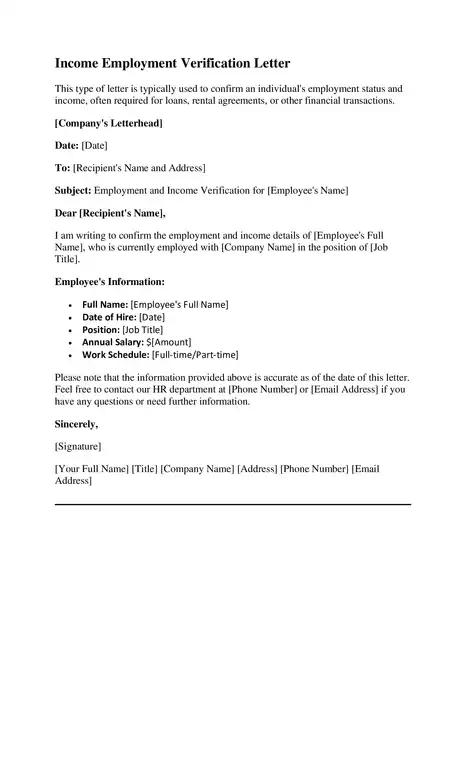

Employment Income Verification Letter

It is a normal letter that tells where you work and how much money you make.

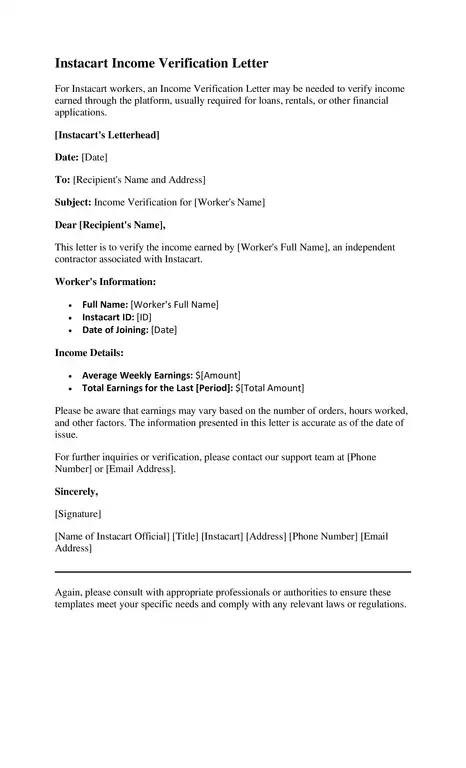

Instacart Income Verification Letter

People who work for Instacart might need this letter. It’s used when they want to borrow money or rent something.

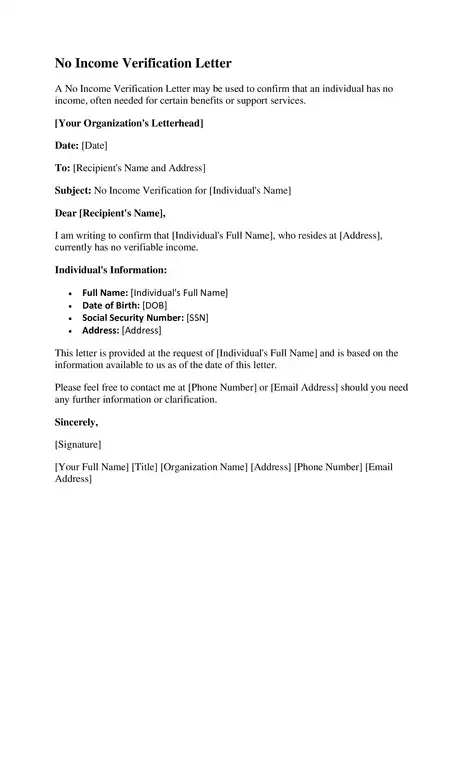

No Income Verification Letter

This letter tells people you don’t make any money. You might need it for special help.

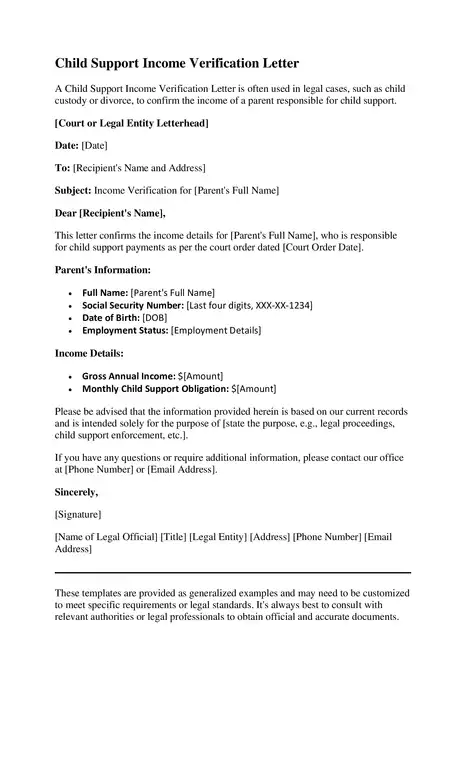

Child Support Income Verification Letter

This letter might be used in court for things like taking care of children after a divorce.

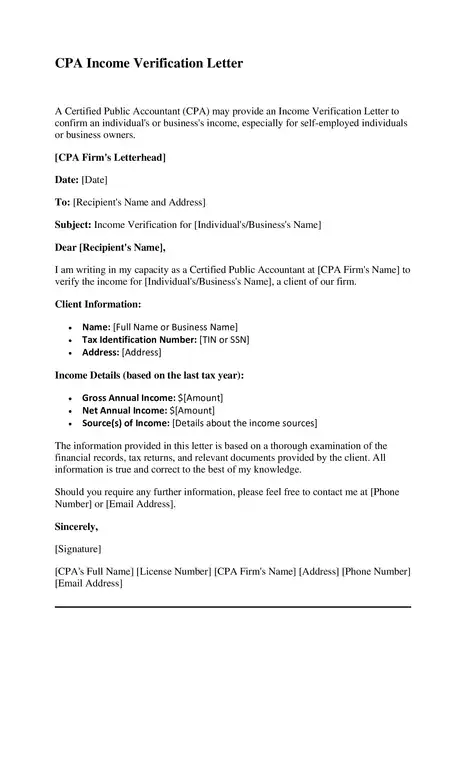

CPA Income Verification Letter

A special money person called a CPA can give you this letter. It helps with many different money things.

Income Employment Verification Letter

This letter tells people where you work and how much money you make.

Income Verification Letter from Accountant

An accountant might give you this letter. It helps with renting a home or borrowing money from a bank.

SSI Income Verification Letter

If you get SSI money, you might need this letter. It helps make sure you can get the money.

FAQS

Are there legal implications if incorrect or false information is provided in an Income Verification Letter?

Providing wrong or fake information in an Income Verification Letter is a serious issue.

It’s like telling a lie about how much money someone earns. If someone gets caught doing this, they might get into legal trouble. It’s always best to tell the truth, and ensure all the details are correct.

What supporting documents must be attached to be accepted by institutions like banks?

When you give an Income Verification Letter to a bank, you might also need to show some other papers.

These could include pay stubs, tax returns, or bank statements. These papers help the bank know that the information in the letter is true.

How can an individual request from their employer, and what details should they provide?

If you need an Income Verification Letter, you can ask your boss or the human resources department at work.

You should tell them why you need the letter and who it’s for (like a bank or a landlord). Give them enough time to write the letter, and it’s nice to say “please” and “thank you.”

Can it be sent electronically, and if so, what considerations must be considered for signatures and privacy?

Yes, an Income Verification Letter can be sent via email or electronic mail. But you must be very careful.

The letter has private information about how much money you make, so send it only to the right person. Some places might need a real signature, and others might be okay with a typed one. It’s good to ask what they need so you do everything right.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.