How to make a rental ledger – Precision and accountability reign paramount in convoluted property management. No document embodies these traits more fittingly than a rental ledger, a testament to the financial exchanges between a landlord and tenant. This comprehensive guide will walk you through creating and maintaining an effective rental ledger.

Rental ledgers are an integral part of effective property management, crucial for maintaining transparent, precise, and up-to-date records of all financial transactions between a landlord and tenant.

The Australian Government’s Money smart guide explains that rental ledgers are documents every landlord should diligently maintain. They assist in keeping track of rental payments and serve as evidence of the rental history, which can be invaluable when negotiating lease renewals or examining the potential for rental increases.

How to Make a Rental Ledger?

Maintaining a rental ledger can seem challenging, particularly for first-time landlords. However, it can become a manageable, routine task with the right approach and understanding. This article will guide you through creating and maintaining a rental ledger, providing insights on its importance, format selection, entries, and common challenges you may encounter.

Understanding the Importance of a Rental Ledger

The significance of a rental ledger can be encapsulated in its role as a single, authoritative record of all financial exchanges between a tenant and a landlord. This comprehensive document is a testament to a tenant’s payment behavior, showcasing an unambiguous, chronological narrative of their financial commitments and adherence to the stipulated rent schedule.

A rental ledger is an indispensable tool for landlords. It helps maintain transparency and organization, as each transaction made throughout the lease is meticulously recorded and readily available for review. It clarifies the landlord-tenant relationship, mitigating the risk of misunderstandings and disputes related to rent payments, deposit refunds, and additional charges.

Furthermore, a well-maintained rental ledger can be a potent instrument during non-payment or delayed payments. It is a reliable record of precedent payments, bolstering the landlord’s claim in any rental disputes. The ledger can provide tangible proof of payment irregularities or rent arrears, if any, thus reinforcing the landlord’s legal stand.

From the tenant’s perspective, the rental ledger acts as a financial mirror, reflecting their rental payment habits. For tenants, it is a tool to track their rent payment history, observe due dates, and plan their finances accordingly. It can also be useful when tenants seek future accommodation, as it outlines their consistency and reliability in meeting rent obligations.

In the broader financial context, the rental ledger aids in accurate tax computation, providing an unambiguous record of rental income over a fiscal year. It can streamline the filing process of tax returns, helping landlords adhere to regulatory compliance easily and precisely.

A rental ledger, while simple in structure, plays a significant role in efficient property management. It fortifies the financial dynamics of the landlord-tenant relationship, aids in legal and tax-related matters, and promotes financial discipline and transparency.

Choosing the Right Format for Your Rental Ledger

The format of your rental ledger should reflect your unique needs as a landlord and provide a clear, organized overview of the financial transactions tied to your property. The choice of format can substantially impact the ledger’s ease of use, clarity, and overall effectiveness. Here are a few factors to consider when deciding on the format that best suits your needs.

- Physical vs. Digital:The traditional approach involves maintaining a physical ledger, using paper and pen to record transactions. This method can provide a tangible record of transactions, but it can also be prone to loss, damage, or mistakes. On the other hand, a digital ledger (such as an Excel spreadsheet or a specialized software solution) offers benefits like automated calculations, easy backups, and improved accessibility. Digital ledgers also align well with modern tech-oriented practices, making them popular.

- Software Solutions:Numerous property management software solutions available in the market provide integrated ledger functionality. These applications track rental payments and automate various other property management tasks, saving landlords considerable time and effort. If you are managing multiple properties or find the task of ledger maintenance daunting, this could be a viable option.

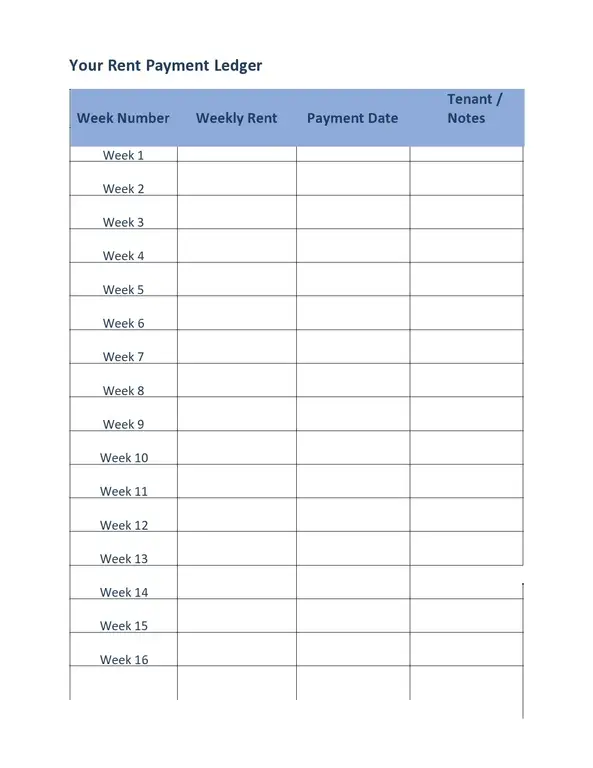

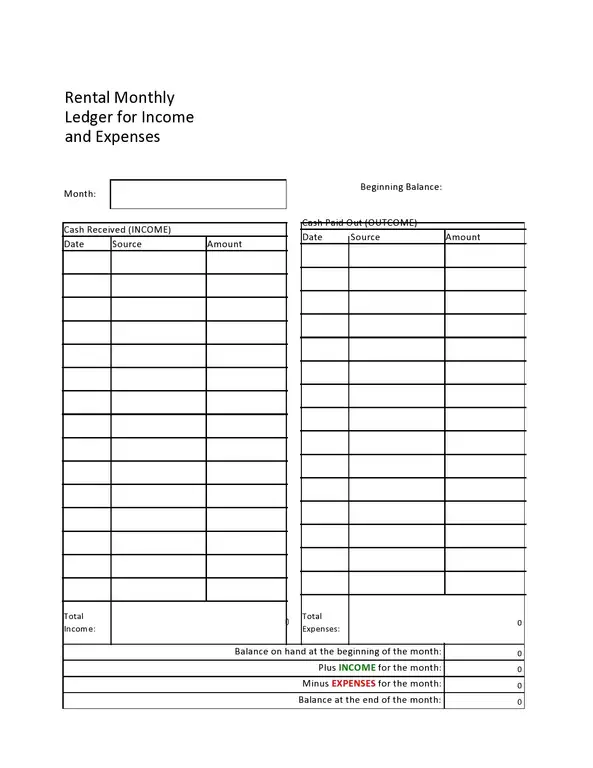

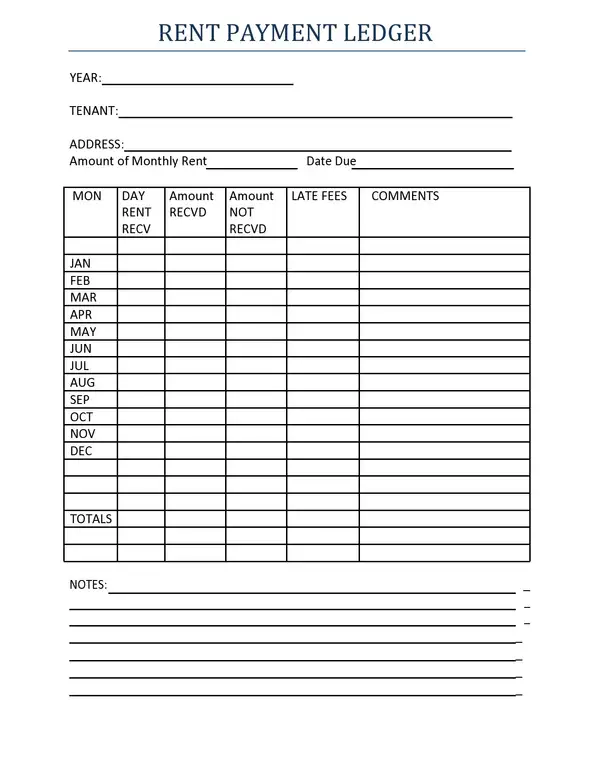

- Template Selection:Templates can be invaluable if you go digital or stick with a traditional physical ledger. Templates offer a pre-structured format for your records, making entering and reading data more streamlined. Choose a template with fields for all necessary data, such as payment date, amount, tenant name, property details, and any pertinent notes.

- Customization:No two rental situations are identical, and your ledger should reflect the unique aspects of your property and tenancy agreement. When choosing a format, consider its potential for customization. Can you add or remove fields as needed? Can you incorporate reminders or alerts for key dates? A flexible format that adapts to your needs can be a significant asset.

- Clarity and Accessibility:Your rental ledger should be easy for you and your tenant to read and understand. Consider the ledger’s layout and design when making your choice. An effective ledger presents data clearly and coherently, allowing anyone reviewing it to comprehend the state of financial affairs quickly.

- Scalability:If you plan to expand your rental property portfolio in the future, your ledger format should be able to grow with you. Ensure the chosen format comfortably accommodates multiple properties without becoming cumbersome or confusing.

The “right” format for your rental ledger will depend on your personal preferences, the nature of your rental property, and your comfort level with various tools and platforms. Choose a format that makes ledger management a simpler, more efficient task.

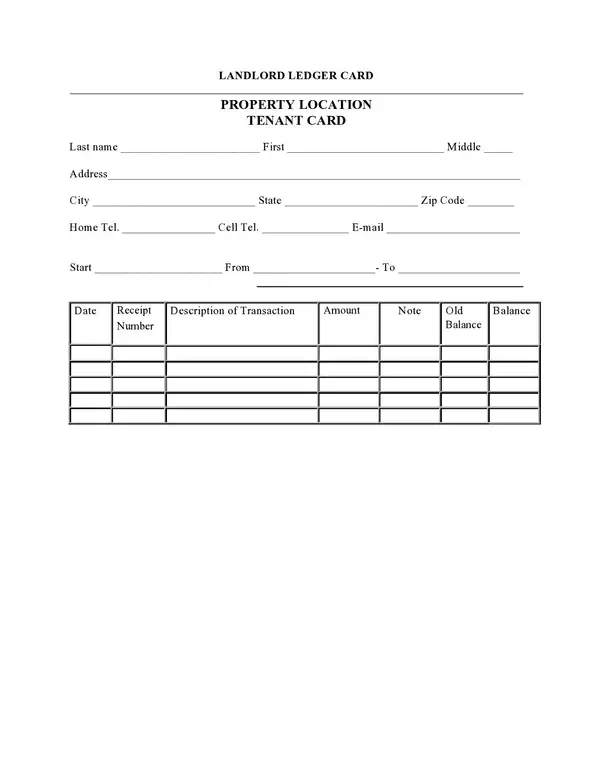

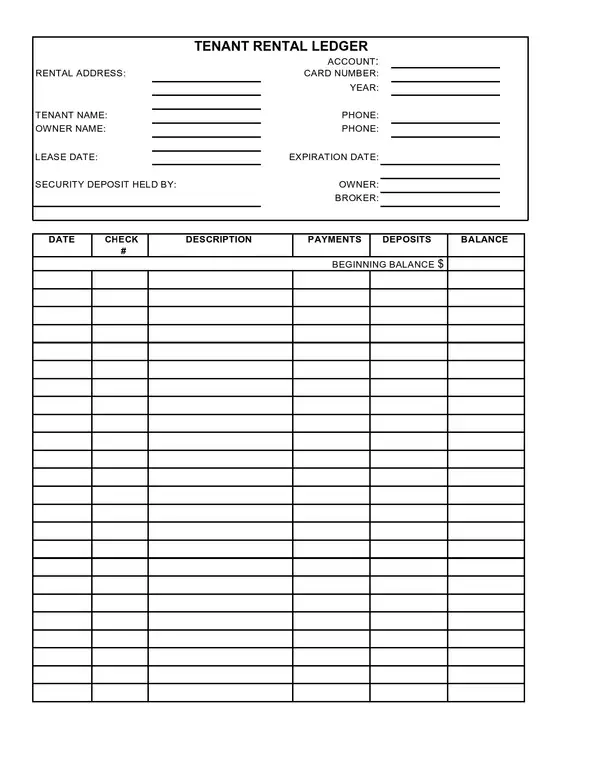

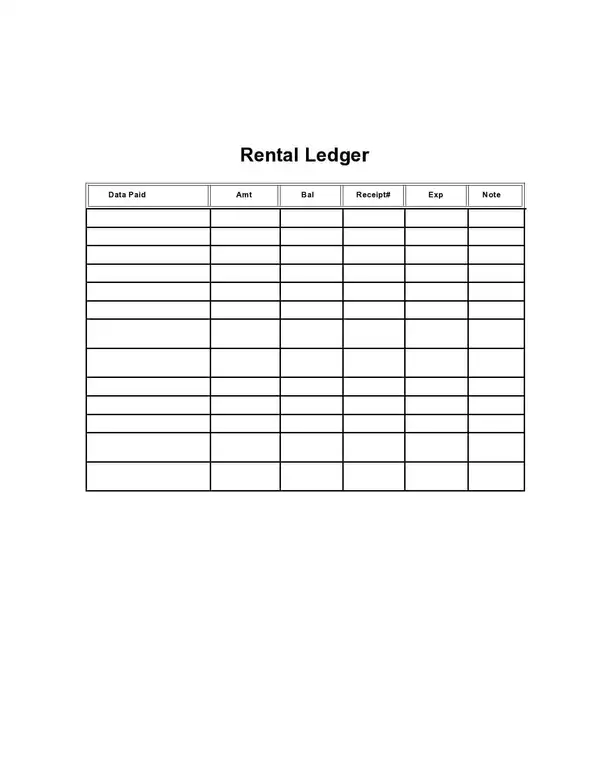

Create Columns for Key Information

- Date of Payment

The cornerstone of every ledger, the date of each transaction, forms the timeline for your financial history.

- Description of Transaction

Capturing the nature of each transaction aids in accurately categorizing funds and assists in reconciliations and audits.

- Amount Paid

The quintessence of every financial transaction – the amount exchanged, must be meticulously recorded.

- Amount Due

If the tenant owes any balance after payment, it should be outlined here to encourage prompt clearance.

- Balance

A running balance gives a quick overview of the current financial standing between landlord and tenant.

Start with the Opening Balance

Kick start your ledger with the opening balance, commonly the initial rent due at the inception of the lease.

Recording Each Transaction in Detail

Every payment, whether rent, security deposit, or maintenance fee, should be diligently recorded to ensure the ledger’s integrity.

Regular Updates to Your Ledger

Frequent updates keep your ledger current and accurate, reducing the chances of discrepancies and fostering trust with your tenants.

Accuracy Check: Cross-verification with Bank Deposits

Cross-checking ledger entries with bank deposits and cash receipts affirms your records’ validity and helps prevent fraud.

Closing Balance: An Overview

This figure, the outcome of all transactions, provides an immediate snapshot of the tenant’s account at any given time.

Provide Tenant Access

Providing tenants access to their ledger instills confidence, empowers them to track their payments, and reduces the possibility of disputes.

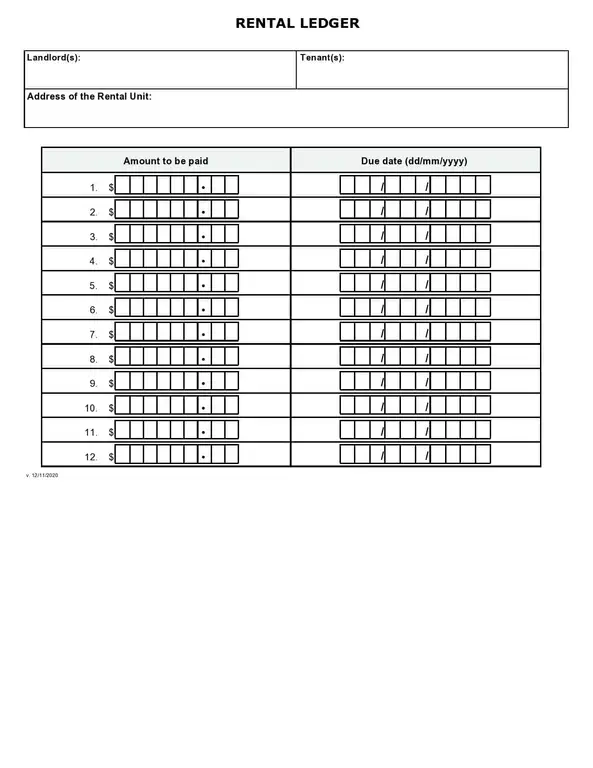

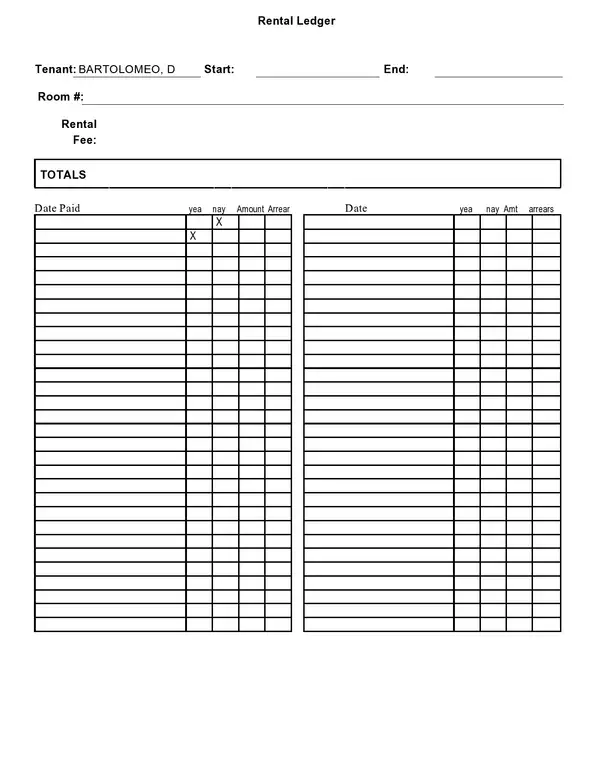

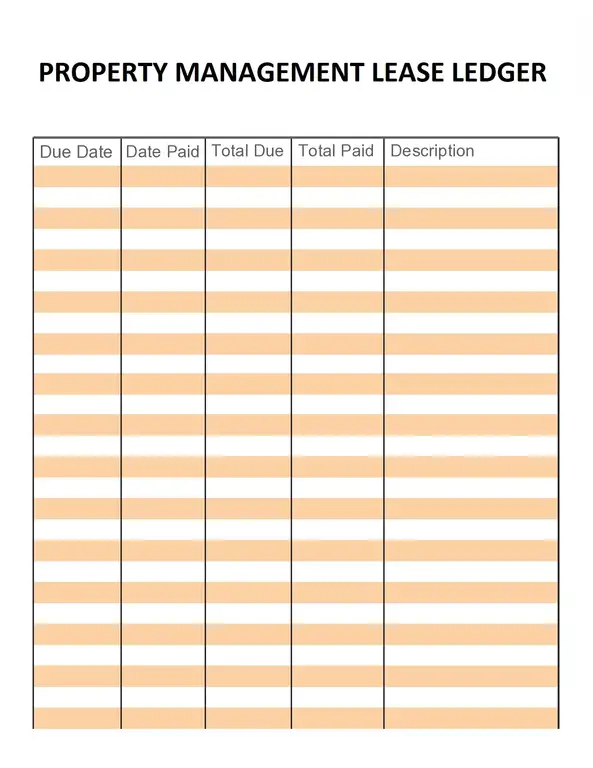

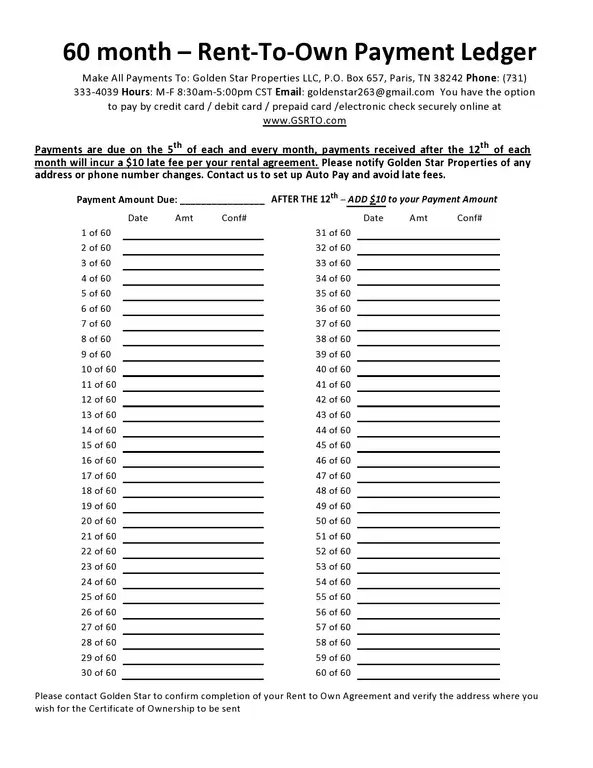

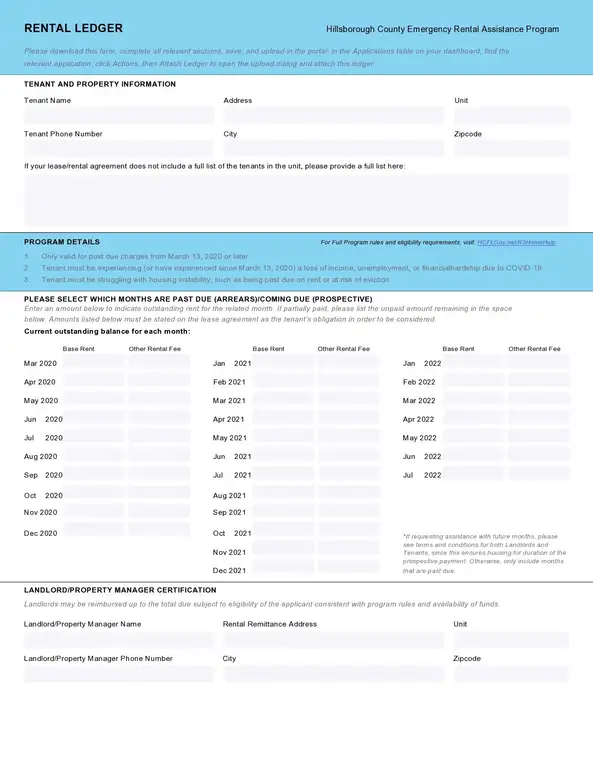

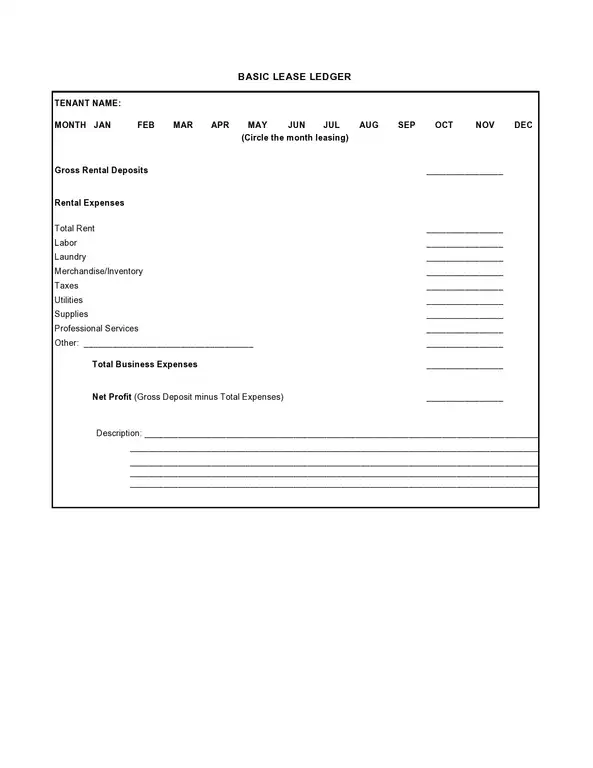

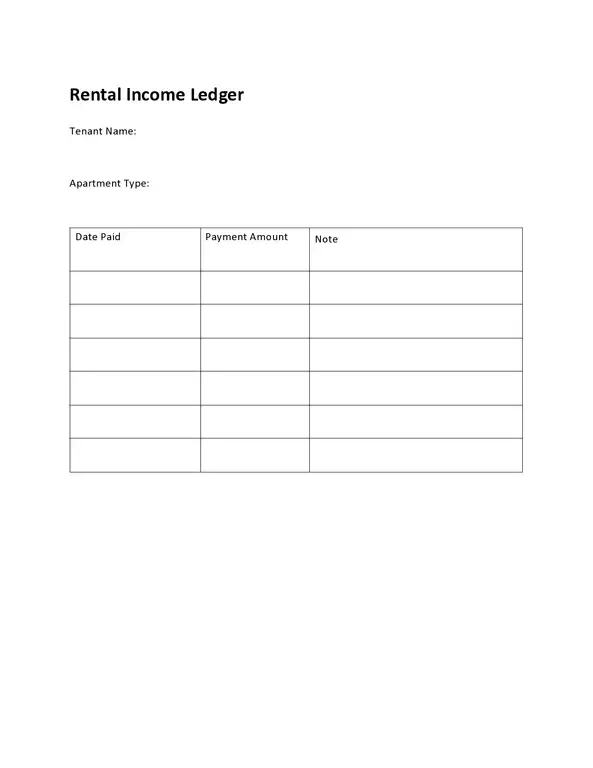

Rental Ledger Template

It is a structured format that helps you record and track the transactions associated with your rental property. While templates can vary, they commonly contain the following fields:

- Property Details include the address and other pertinent details, like the unit number.

- Tenant Information: The name and contact information.

- Date: The date of every transaction is recorded for chronological tracking.

- Rent Due: This field reflects the rent payment due per rental period.

- Payment Received: Here, you record the exact received.

- Payment Method: This reflects the tenant’s chosen payment, whether a cheque, bank transfer, cash, or other.

- Outstanding Balance: If there are any arrears, they are noted here. The outstanding balance should ideally be zero, indicating that the tenant has fully paid their rent.

- Notes: This section is for other statements or details about a transaction, such as a tenant paying for a repair or withholding a portion of the rent due to an issue with the property.

Utilizing the Template Efficiently

Using a rental ledger template effectively requires consistency and precision. Follow these best practices to ensure accuracy:

- Keep It Current: Update the ledger as soon as a transaction happens. Refrain from letting receipts pile up, increasing the chance of errors.

- Be Precise: Double-check every entry for accuracy. Remember that a small error can snowball into bigger problems down the line.

- Consistency is Key: Use the same format for dates and monetary values. Consistency will make it easier to read the ledger and find specific entries.

- Backup Your Records: Always keep a backup of your ledger, whether a physical copy or a digital backup. It is crucial for record-keeping and a safety net in case the original is lost or damaged.

- Confidentiality: Be mindful of the information in the ledger. It includes sensitive data, so ensure it has stored securely and only accessed by authorized individuals.

Common Challenges in Rental Ledger Management

Effectively managing a rental ledger can be a multifaceted endeavor, sometimes presenting challenges that require astute attention and smart problem-solving strategies. Here are a few common issues that may arise in rental ledger management and practical solutions to overcome them.

- Inconsistencies in record-keeping:A consistent or complete ledger can result in accurate tracking of rental payments, leading to potential disputes and confusion. Mitigate this by establishing a standardized process of documenting every transaction, including the date, amount, and relevant notes. Adherence to this procedure can ensure consistency and comprehensiveness in your ledger.

- Misinterpretation of entries:Only some know financial jargon or bookkeeping practices. Confusion or misinterpretation of ledger entries can lead to unnecessary misunderstandings. It can be avoided using clear and simple language for each entry and providing an accompanying note for non-standard transactions or charges.

- Time management:Regularly updating a rental ledger can be time-consuming, especially for landlords managing multiple properties. Incorporating digital tools like property management software or apps can automate this task, saving you valuable time without compromising accuracy.

- Missing entries:Overlooking a payment or charge can lead to an inaccurate depiction of the financial relationship. Consider setting up reminders for due dates or significant dates tied to your rental property to prevent this. Technology can automate these reminders, ensuring every transaction is noticed.

- Data Security:As a rental ledger contains sensitive financial information, security is paramount. Protecting the ledger from unauthorized access or potential data loss is essential. It can be achieved by utilizing secure cloud-based systems for digital ledgers or maintaining physical ledgers in a secure location.

- Legal Compliance:Keeping track of legal obligations related to rental income and expenses can be challenging. Ensure your ledger aligns with relevant local and national laws to facilitate regulatory compliance and accurate tax filings.

- Dispute Resolution:Should a dispute arise, a well-documented rental ledger can be instrumental in resolving the issue. However, interpretation of the ledger may become a challenge. Having a neutral third party, like a property management company, can be helpful in such cases, providing an unbiased interpretation of the records.

Navigating these challenges in rental ledger management can be facilitated by a blend of diligent practices, effective utilization of technology, and an understanding of legal requirements. These efforts culminate in a robust rental ledger, a significant asset in successful rental property management.

Legal Implications of a Rental Ledger

The rental ledger is not just a financial tool but has significant legal implications. Accurate and comprehensive record-keeping can protect both landlords and tenants in the event of a legal dispute. It provides objective evidence of the history of payments and charges, preventing he-said-she-said situations and ensuring a fair resolution.

A rental ledger is a crucial evidence in court proceedings related to eviction or other rental disputes. In many jurisdictions, the landlord must demonstrate a tenant’s chronic or egregious failure to pay rent to proceed with eviction legally. The rental ledger serves as this necessary documentation, providing a chronological record of payment history that can prove a pattern of delinquency.

The rental ledger can also serve to protect tenants from wrongful eviction. For example, if a landlord alleges non-payment of rent, the tenant can use their copy of the ledger to prove their punctual and full payment of rent.

Some legal jurisdictions require landlords to provide tenants with a statement of their account or rental ledger periodically or upon request. Non-compliance with these regulations could result in legal penalties, making maintaining an accurate and up-to-date rental ledger a best practice and a legal necessity.

The rental ledger is essential in maintaining legal transparency in the landlord-tenant relationship. Meticulously documenting all financial transactions provides a solid legal footing for both parties, ensuring disputes can be resolved fairly and equitably.

Legal Implications of a Rental Ledger in Australia

A rental ledger is crucial in the Australian rental property landscape, governed by laws and regulations specific to each state or territory. Landlords, property managers, and tenants alike should be aware of these legal implications:

- Record-Keeping Requirements: According to the Residential Tenancies Act of various states in Australia, landlords or property managers are required to keep detailed records of rental payments. It is where a rental ledger is handy, serving as a formal record of all rent-related transactions. Maintaining and updating this ledger consistently is crucial to comply with these legal requirements.

- Privacy Laws: Rental ledgers contain sensitive information about tenants, including their names and potentially their contact details. The Australian Privacy Act requires landlords and property managers to secure this information and restrict its disclosure. Any misuse of this information could lead to severe legal penalties.

- Dispute Resolution: A rental ledger serves as legal proof of transactions in disputes between landlords and tenants about unpaid rent or other charges. The ledger can be presented in the state’s tenancy tribunal or other dispute resolution bodies to support the landlord’s claim.

- Bond Refunds: The bond or security deposit is a significant part of rental agreements in Australia. When the tenancy ends, the rental ledger can provide evidence of rent payments and other charges, which could influence the bond refunded to the tenant.

- Rent Increases: In Australia, rent increases are governed by specific regulations. For instance, rent can only be increased once every 12 months in Victoria, and tenants must be given at least 60 days’ notice. A rental ledger can provide proof of these increases, ensuring they align with legal requirements.

- Tax Compliance: The Australian Taxation Office (ATO) requires landlords to report rental income and eligible expenses for tax purposes. A rental ledger can support this process by providing a detailed record of rental income received and property-related expenses.

- Notice Periods and Evictions: The ledger also records any fees associated with notice periods or evictions. Under Australian law, landlords must adhere to prescribed notice periods before evicting a tenant. A rental ledger can prove that all such legal procedures were followed.

Rent Ledger and Tax Implications

One key aspect of a rental ledger often overlooked is its value in tax preparation and documentation. Landlords and tenants can leverage the data in a rental ledger to optimize their tax filing process and potentially realize significant tax benefits.

For landlords, the rental ledger serves as a record of rental income, which is crucial for income tax reporting. By meticulously documenting every rent payment received, landlords can ensure they accurately report their income to tax authorities, thus avoiding potential penalties for under-reporting.

Additionally, the ledger’s record of property-related expenses can help landlords claim applicable deductions. It can include repairs, maintenance, property insurance, mortgage interest, and depreciation costs, significantly reducing a landlord’s taxable income.

In the event of an audit by the IRS or other tax authorities, having a well-maintained rental ledger can be invaluable. It provides a clear, chronological record of income and expenses related to the rental property, demonstrating the landlord’s diligent financial management and reducing the likelihood of discrepancies.

For tenants, while rent payments are generally not tax-deductible, certain jurisdictions or situations may allow for exceptions. For example, if a portion of the property is used exclusively for business purposes, that portion of the rent may be deductible as a business expense. In such cases, a rental ledger can be proof of rent payments and help tenants claim any applicable deductions.

A rental ledger is not just a tool for tracking rent payments and property expenses; it can also play a pivotal role in tax planning and compliance. Both landlords and tenants can benefit from using a rental ledger to track finances related to the rental property and optimize their tax situations.

Who Can Use a Rent Payment Ledger?

While traditionally used by landlords and property managers, rent payment ledgers have a broader spectrum of applicability. Here is a look at who can benefit from using a rent payment ledger and how:

- Landlords: The primary users of rent payment ledgers, landlords can track income from each rental property, monitor timely payments, and handle disputes efficiently with accurate records. It also simplifies the tax filing process, as they have all the necessary income data.

- Property Managers: A rental ledger is an indispensable tool for those managing multiple properties on behalf of landlords. It enables them to maintain transparency with property owners, provide professional service to tenants, and efficiently manage their administrative duties.

- Tenants: Tenants can also maintain their rental ledgers. It helps them keep track of their rent payment schedules, monitors any additional charges, and provides them with proof of payment in case of disputes. A well-maintained ledger can also prove beneficial when moving, as it is a testament to their reliability as a tenant.

- Real Estate Agencies: Agencies can use rental ledgers to provide value-added services to their clients, such as handling rental collection and dispute resolution. It also aids in providing detailed financial reports and analyses.

- Accountants and Tax Professionals: A detailed rental ledger can make an accountant’s job easier when calculating income and expenses for rental properties. It also assists in accurately calculating tax liabilities and deductions.

- Legal Professionals: A comprehensive rental ledger can be important evidence in legal disputes between landlords and tenants. Legal professionals can use it to establish facts about the rent payment history.

- Software Developers: Developers designing property management software can incorporate rental ledger functionality into their products. This addition can significantly enhance their product’s appeal to landlords, property managers, and real estate agencies.

A rent payment ledger is for more than just landlords or property managers. Its benefits extend to various individuals and professionals in the real estate and rental industry. By maintaining an accurate and up-to-date rent payment ledger, each party can ensure the rental process’s transparency, accuracy, and efficiency.

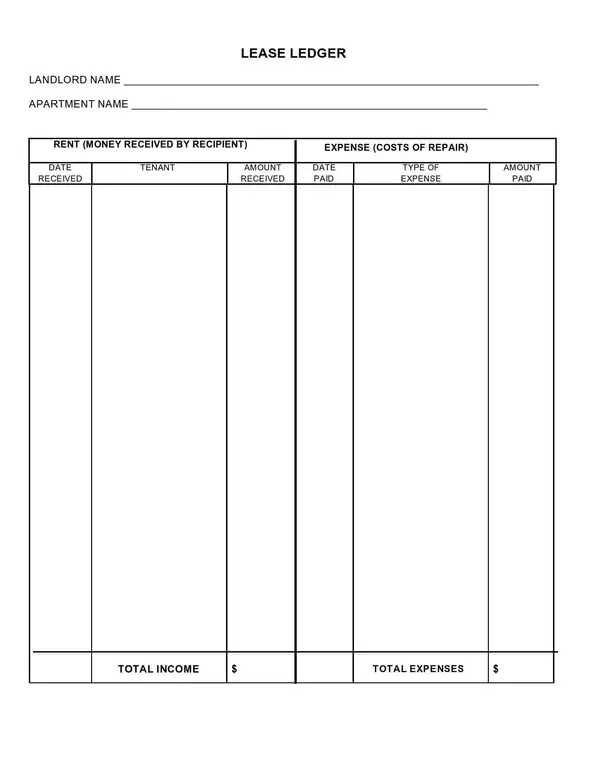

How a Lease Ledger Benefits Property

A lease ledger can significantly benefit property management in several ways. Here is an in-depth look at how a well-maintained lease ledger can improve your property management efforts:

- Organized Record Keeping: One of the key benefits of maintaining a lease ledger is organized record keeping. It helps property owners and managers track rental payments, late fees, security deposits, maintenance costs, and other property-related transactions. With everything documented meticulously, there is a decreased chance of financial discrepancies and misunderstandings.

- Effective Tenant Communication: When tenants understand a detailed record of their financial transactions, they are likely to be more responsible with their rental payments. A lease ledger can help improve the landlord-tenant relationship by establishing clear lines of communication about payment expectations and timelines.

- Efficient Financial Management: Accurate and timely financial data is essential for effective property management. A lease ledger helps track income and expenses related to each property, aiding in financial planning and budgeting. It also supports better cash flow management by providing insights into incoming rental income and outgoing expenses.

- Legal Protection: A lease ledger serves as a legal document that records all financial transactions between the landlord and tenant. The ledger can provide necessary evidence in disputes, protecting the property owner’s interests.

- Tax Preparation: Maintaining a lease ledger simplifies the tax preparation process. The ledger contains detailed records of rental income and expenses incurred for property maintenance, which is critical for calculating tax liabilities.

- Enhanced Property Value: Regular updates in the lease ledger regarding maintenance and upgrades can indirectly enhance the property’s value. Prospective tenants or buyers can review these updates to assess the property’s condition and upkeep, influencing their decision positively.

- Attracting Investors: For property owners looking to attract investment, a well-maintained lease ledger can demonstrate their professional approach toward property management. The ledger showcases the property’s financial performance, offering investors insights into potential returns.

A lease ledger is more than just a tool for tracking rent payments. It is a comprehensive financial management tool that can enhance property value, improve tenant relationships, aid in legal protection, and even attract potential investors. A lease ledger, therefore, becomes a cornerstone for efficient property management.

Maintaining a Ledger for Multiple Properties

Managing multiple ledgers can be a Herculean task. Leveraging technology can help streamline this process and enhance efficiency.

Handling Ledger for Vacant Rental Properties

Even when a property is vacant, documenting maintenance costs and other expenses in a ledger can provide valuable financial insights.

Dealing with Erroneous Entries

Errors are inevitable, but rectifying them is crucial to maintain the accuracy and reliability of your ledger.

Archiving Old Rental Ledgers

Storing old ledgers ensures you have access to historical data for audits, dispute resolution, or simply for reference.

How Rental Ledgers Help in Financial Planning

Rental Ledger Template PDF

It offers a clear and organized overview of revenue and costs associated with a property, thereby enabling more practical and strategic financial decision-making.

- For landlords, it delivers an essential record of rental income. It allows them to track the regularity and punctuality of rent payments, providing a reliable forecast of future income. This predictable cash flow can significantly aid in budgeting for property maintenance, mortgage payments, insurance costs, and taxes.

- The ledger’s documentation of expenses incurred, such as repairs, renovations, or other property-related costs, provides a comprehensive view of the financial demands of property management. By understanding and anticipating these costs, landlords can more effectively plan their finances, set aside the necessary funds, and ensure their rental business remains profitable.

- It presents a useful budgeting and financial control tool for the tenant. The ledger visually represents a significant monthly expense by recording the dates and amounts. It can help tenants plan their finances, ensuring sufficient funds for rent and other living expenses.

Digitization: The Future of Rental Ledgers

In today’s digital era, transitioning from physical to digital mediums is inevitable and beneficial in many ways. The domain of property management, and specifically, rental ledgers, is no exception to this shift.

Digital rental ledgers bring about a higher degree of efficiency and precision in handling transactions. With automated entry systems, the chances of manual errors decrease dramatically. This level of precision is particularly crucial in legal scenarios where the accuracy of rent payment records can have significant implications.

Digital ledgers offer the convenience of anytime-anywhere access. Whether you are a landlord who owns properties across different locations, or a tenant who frequently travels, having a digital record means you can access your rental ledger from any device. This universal accessibility becomes even more important when instant access to payment histories might be required.

An added advantage is that digital ledgers can be integrated with various financial software systems. This integration allows for a seamless data flow, making it more manageable to handle financials, process payments, generate invoices, or prepare year-end tax reports. Furthermore, real-time updates can be made to the ledger, allowing both parties to view the current status without delays and fostering transparency in the landlord-tenant relationship.

A significant aspect where digital rental ledgers outperform their physical counterparts is their contribution to the environment. We can reduce reliance on paper by opting for digital records, playing our part in environmental conservation.

In terms of security, while it is true that digital data can be susceptible to cyber threats, reputable digital ledger providers employ robust security measures to protect user data. These can include data encryption, secure user authentication, regular backups, and compliance with data protection regulations. Therefore, if managed responsibly, it can be as secure, if not more, than physical records.

The digitization of rental ledgers presents numerous advantages in efficiency, convenience, integration, environmental impact, and, potentially, security. While the shift may require some initial effort in learning and adaptation, the long-term benefits make it a worthy investment for a smoother, more efficient rental management process.

Conclusion

How to make a rental ledger – Creating and maintaining a rental ledger may appear daunting initially, but it can become an effortless part of property management with the right tools and practices. As a testament to the fiscal history between landlord and tenant, a well-kept rental ledger is an invaluable asset in effective property management.

The rental ledger benefits landlords by delivering a transparent overview of their rental revenue and costs but also assists tenants in tracking their payment history and maintaining financial discipline.

When selecting the format for your rental ledger, consider physical vs. digital options, software solutions, template selection, customization capabilities, clarity, accessibility, and scalability. Choose a format that suits your specific needs and simplifies the management of your ledger.

Remember to include important columns such as the date, description of transactions, the amount paid, due, and balance. Starting with an opening balance, recording each transaction in detail, regularly correcting the ledger, cross-verifying with bank deposits, and providing tenant access are important for keeping a real and up-to-date rental ledger.

Managing it can present challenges, such as inconsistencies in record-keeping, misinterpretation of entries, and time management. These can be overcome through standardized processes, clear communication, and leveraging digital tools and technologies. You can ensure a smooth and compliant rental process by addressing common challenges and understanding the legal implications of a rental ledger.

Furthermore, a rental ledger has significant tax implications for landlords and tenants. It can facilitate accurate income reporting, expense deductions, and audit readiness, contributing to optimal tax planning and compliance.

It is a versatile tool that benefits landlords, property managers, tenants, real estate agencies, accountants, tax professionals, legal professionals, and software developers. Its applications extend beyond rent payment tracking and assist in practical contact, financial planning, legal protection, and attracting investors.

By embracing it and leveraging the available templates and technological solutions, you can streamline property management, enhance financial planning, and foster a transparent and harmonious landlord-tenant relationship. Start creating your rental ledger today and experience its benefits to your rental property endeavors.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.