A hardship letter is a document which explained your specific situation, this letter generally shows that you are unable to pay off your debt. In order to ask special considerations, then someone who is in a hard condition with their financial situations using this letter which also is known as the financial hardship letter. It usually used by people who are unable to pay off their mortgage or credit card payments and this is a great way to get the leniency from lenders. hardship letter sample is very important to avoid the foreclosure-related to your assets.

How to write a convincing hardship letter

Here are some advice on how to write a convincing hardship letter:

- Keep it Brief: While providing enough detail to describe your problem is necessary, keep your letter brief. Aim for a single page. Your lender is likely busy and may need more time to read a lengthy letter.

- Explain Your Situation Clearly: Be precise and detailed about your economic problem. Describe what caused it, whether it’s a career loss, medical invoices, or another unexpected expense. The more clearly you can describe your problem, the easier it will be for your lender to understand and empathize with your events.

- Create a Detailed Request: Be detailed about your submission. State your request for a loan change, a quick payment reduction, or a service form.

- Demonstrate Your Willingness to Team: Establish your lender, and you will cooperate and do your part. If you request a temporary payment reduction, explain how you plan to catch up once your financial problem enhances.

- Be Honest and Sincere: Don’t exaggerate or make false claims about your problem. Be open and truthful about your events and your intentions.

- Proofread: Before sending your letter, proofread it for any mistakes. A well-written letter that compliments mistakes will be more convincing and professional.

Following these tips, you can write a hardship letter that clearly and effectively communicates your problem and ask your lender.

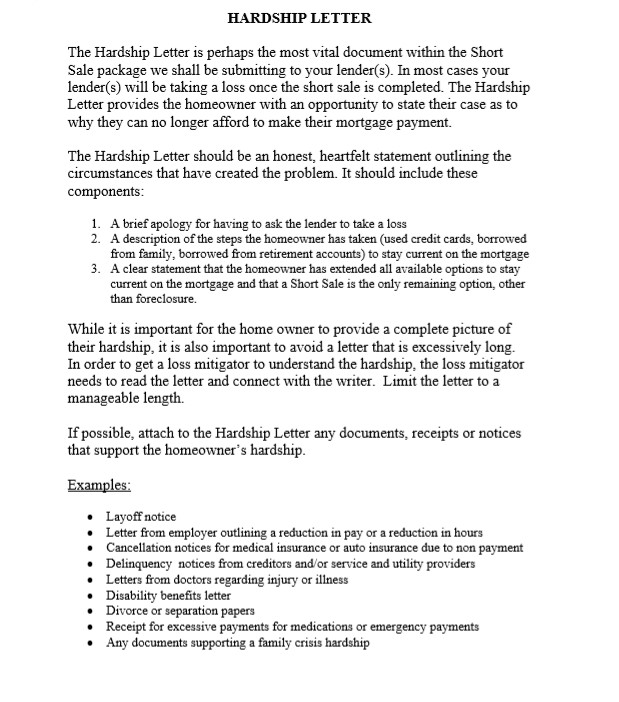

Components of a Hardship Letter

Here are the key components that should be contained:

- Description of Financial Situation: Begin your letter by clearly explaining your current financial situation. It should contain the reasons for your economic problem, such as career loss, medical costs, or a significant life event. Be honest and straightforward, providing as much detail as necessary to help the lender understand your circumstances.

- Specific Request: After describing your problem, state your specific request. It could be a demand for a loan change, a temporary reduction or suspension of payments, or even debt forgiveness. Be clear and specific about what you are asking for.

- Evidence Supporting Your Claim: Provide evidence to support your claims of financial hardship. It could include documents like pay stubs, bank statements, medical invoices, or a job termination notice. Providing proof adds credibility to your claims and helps the lender understand the severity of your situation.

- Plan for Repayment: If you ask for a temporary reduction or suspension, outline your plan for catching up on payments once your economic problem enhances. It shows the lender that you are dedicated to fulfilling your financial obligations.

- Restatement of Request: Conclude your letter by restating your request. It reinforces your message and leaves the lender with a clear understanding of your request.

- Contact Information: Don’t forget to contain your reference data so the lender can easily reach you if they have questions or need further information.

- Polite and Professional Tone: Maintaining a polite and experienced tone Remember, you are asking for assistance, so being respectful is important.

By including these key components in your hardship letter, you can effectively communicate your problem to your lender and improve your possibilities of receiving the assistance you need.

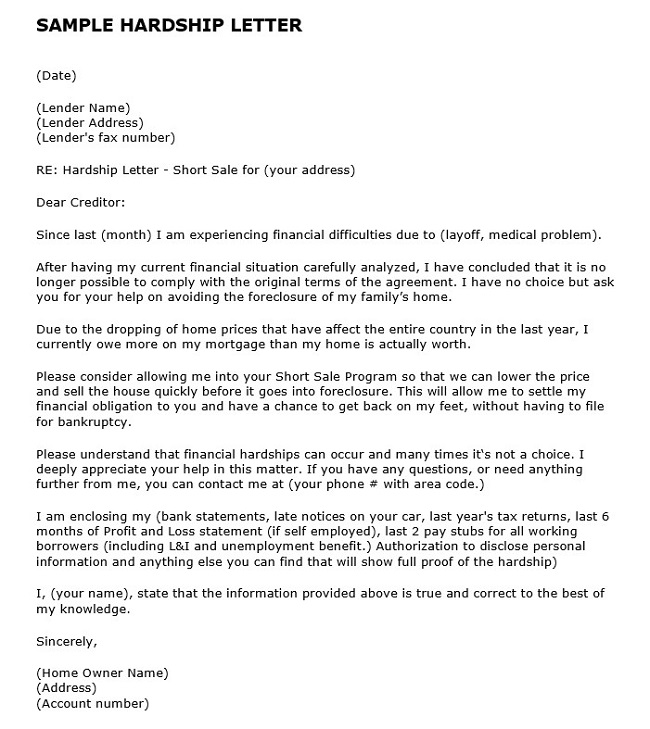

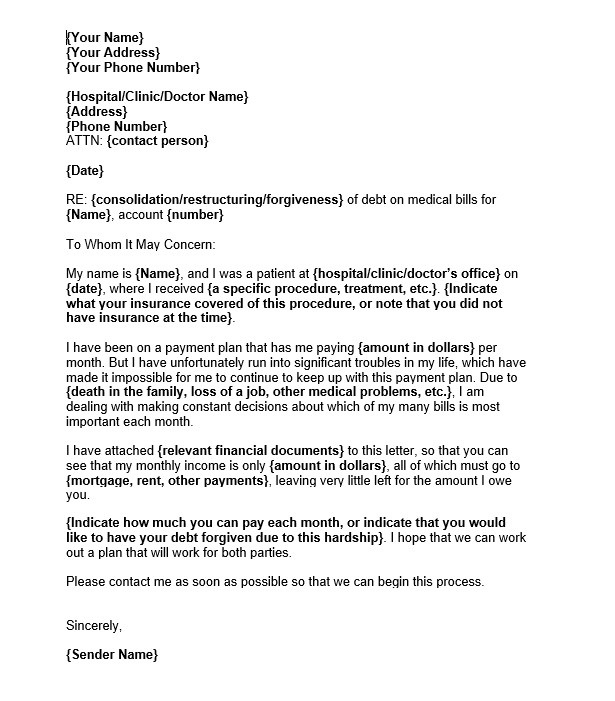

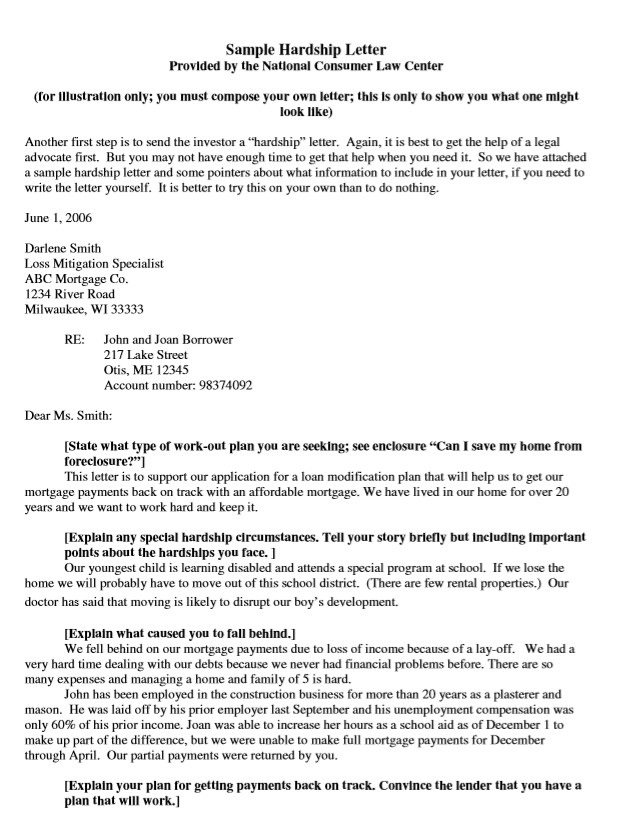

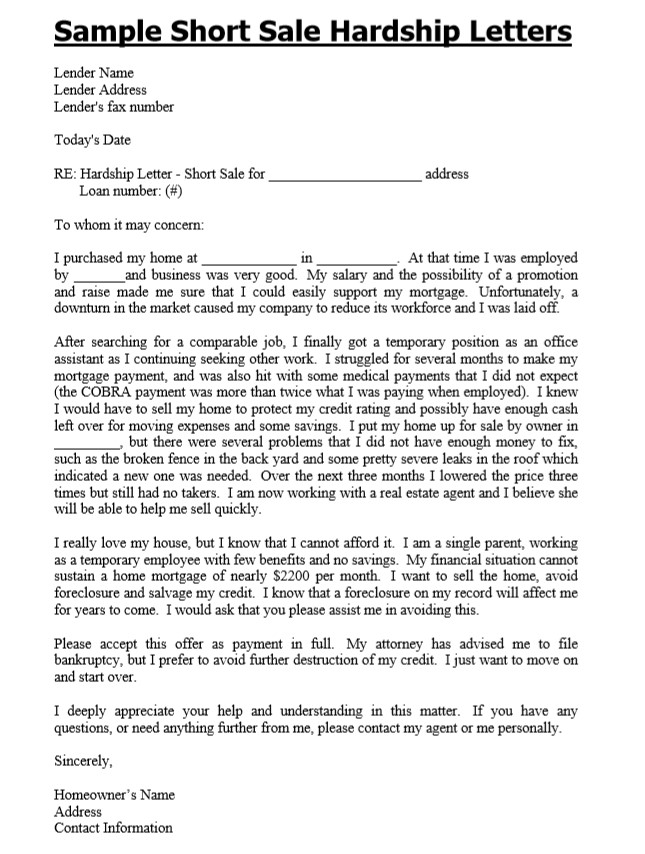

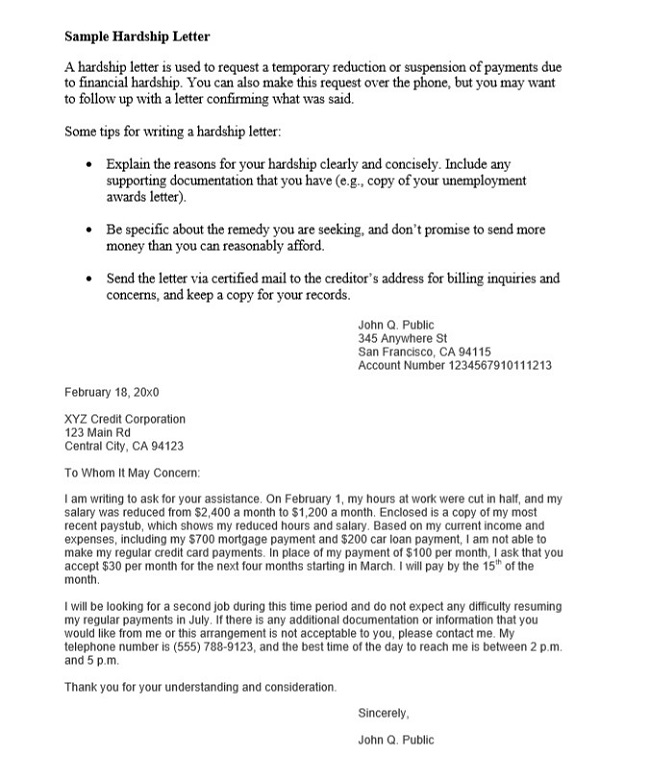

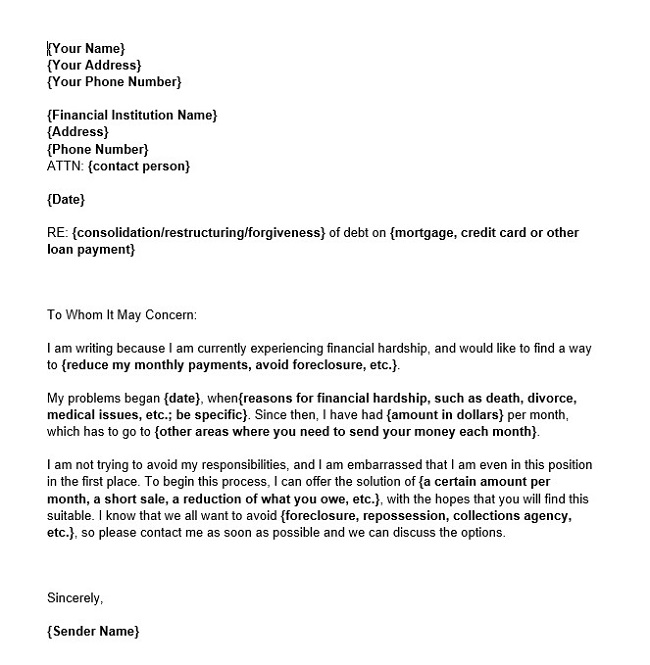

Free Hardship Letter Template

Hardship letter templates include all the necessary elements, such as the introduction, description of the economic problem, detailed request, and closing. These templates can be customized to fit your exact problem and conditions.

Here are some benefits of using It:

- Simplifies the Process: Templates provide a clear format for your letter, creating the writing process simpler and less daunting. You require to fill in your exact details.

- Ensures All Necessary Information is Included: Templates provide you contain all the necessary details. It can be particularly useful if you require clarification on what to contain.

- Saves Time: You can focus on filling in your exact points rather than worrying about the format of the letter.

- Provides a Professional Appearance: It appears in your letter, which can create a positive impression on your lender.

These templates can be found on financial advice websites, legal aid websites, and template repositories. Remember, while templates can provide a good starting point, it’s important to accurately personalize your letter to reflect your situation and needs.

Hardship letter templates can help address financial difficulties. They simplify writing, providing you contain and present all the required information professionally.

Avoiding Common Mistakes in Hardship Letters

When writing a hardship letter, avoiding common mistakes that could undermine its effectiveness is crucial. Here are some common pitfalls and how to avoid them:

- Being Too Vague: One common mistake is needing to be more detailed about your economic problem and the help you seek. Be detailed about the occasions directed to your economic problem, and clearly state what assistance you require.

- Not Providing Enough Detail: While your letter should be concise, it’s important to provide enough detail to give your lender a clear understanding of your situation. Include specific information about your revenue, costs, and events like job loss or medical issues.

- Not Clearly Stating the Request: Your letter should clearly state your request. Whether you’re seeking a loan modification, a temporary payment reduction, or some other assistance, make sure your request is clear and specific.

- Neglecting to Display Your Effort: Your lender wants to see that you’re trying to improve your economic status. Be sure to mention any steps you’ve brought to reduce costs, improve income, or otherwise address your economic problems.

- Failing to Proofread: A letter full of mistakes can undermine your credibility. Be sure to proofread before sending it to confirm it’s free of spelling, grammar, and punctuation errors.

The Impact of a Well-Written Hardship Letter

Here’s how a well-crafted hardship letter can make a difference:

- Securing Leniency from Lenders: A compelling hardship letter can persuade lenders to provide some form of leniency. It could be a loan modification, a temporary payment reduction, or even a temporary payment pause. The key is to provide an honest account of your financial hardship and how it has affected your ability to meet your financial obligations.

- Avoiding Serious Consequences: In severe cases, a well-written hardship letter can help you avoid serious consequences like foreclosure or legal action. By explaining your situation and demonstrating your willingness to find a solution, you can show your lender that you are committed to resolving the issue.

- Building a Case for Negotiation: A hardship letter can also serve as a basis for negotiation with your lender. You can engage your lender in discussing possible solutions by outlining your financial difficulties and proposing a realistic repayment plan.

- Demonstrating Responsibility: Finally, a well-crafted hardship letter shows your lender that you are taking responsibility for your situation. It shows that you are proactive, committed to finding a solution, and willing to work with your lender to resolve your financial difficulties.

A hardship letter can be a powerful tool in navigating financial hardship. It allows you to effectively communicate your situation to your lender, negotiate possible solutions, and ultimately work toward financial stability.

When to Use a Hardship Letter

It is a valuable tool that can be utilized in various financial problems.

It functions as formal, written communication to a lender, explaining the financial difficulties an individual is facing and requesting assistance or leniency.

Here are some scenarios where it can be particularly useful:

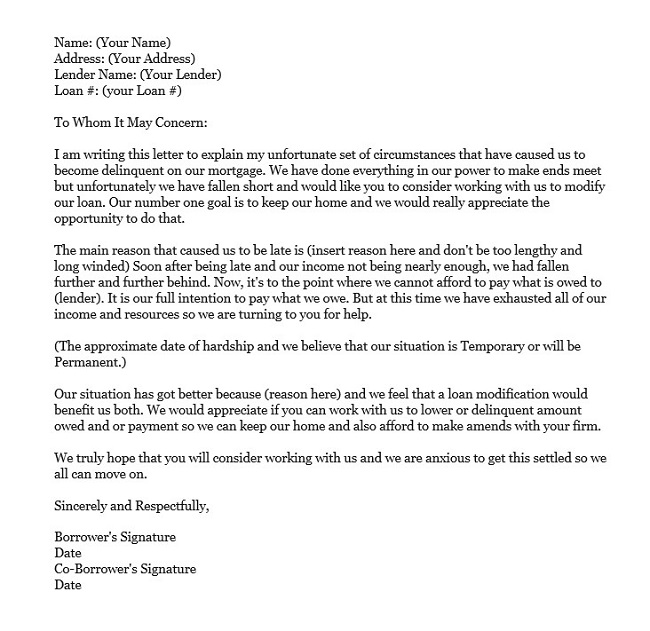

Inability to Make Mortgage Payments: If an individual cannot meet their mortgage payments due to monetary, It can be used to ask for a loan change or reduction or suspension of payments. It should describe the reasons for the monetary hardship and provide proof to back these claims.

Difficulty in Meeting Credit Card Payments: It can quickly become overwhelming, especially when faced with high-interest rates and late fees. It can be used to negotiate lower interest rates, waive late fees, or establish a manageable repayment plan.

Seeking Leniency from Lenders: In situations where an individual cannot meet their financial obligations due to unforeseen events such as career loss, medical crises, or a death in the family, It can be used to ask for leniency from lenders. It could include extending the loan term, reducing the interest rate, or forgiving some debt.

Avoiding Foreclosure: If an individual faces the threat of foreclosure, It can be a crucial part of a loan change application or a short sale request. The letter should detail the reasons for the monetary problem and demonstrate the individual’s willingness and plan to get back on track with their payments.

It provides a platform for people to share their economic situation with their lenders personally and directly, potentially showing more favorable terms and financial relief. Understanding when to use a hardship letter is key to effectively managing financial hardships.

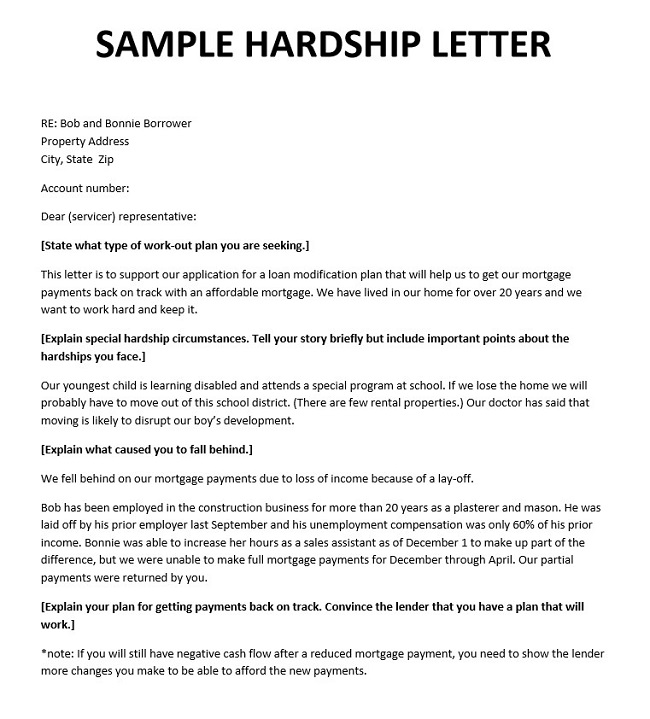

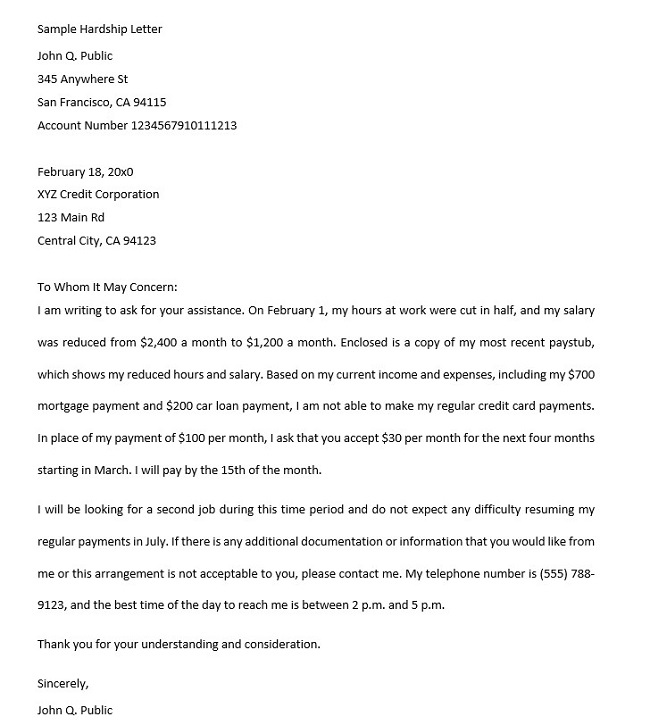

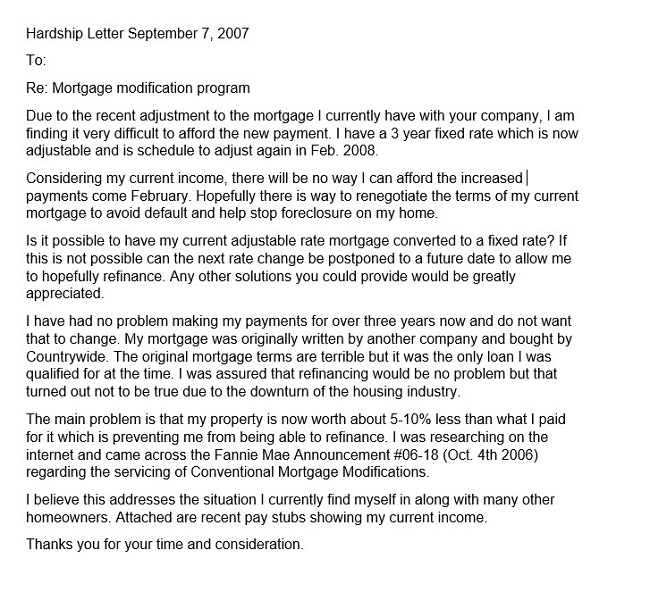

Hardship Letter Samples

Hardship letters are a critical tool for individuals facing financial difficulties. They allow you to communicate your situation to your lender and request assistance. To help you understand how to write an effective hardship letter, let’s look at some samples and discuss what makes them effective.

Sample 1: Mortgage Modification Request

Dear [Lender’s Name],

I am writing to explain the financial difficulties I am currently facing and to request a modification to my mortgage terms.

Due to [explain the reason for your hardship, e.g., loss of job, medical emergency], I have been unable to meet my monthly mortgage payments. I have exhausted my savings and cannot secure additional income now.

I am committed to keeping my home and believe modifying my mortgage terms would allow me to meet my payment obligations. I am requesting [state your specific request, e.g., a reduction in the interest rate or an extension of the loan term].

Thank you for considering my request. I hope we can find a solution that will allow me to meet my financial obligations and maintain my home.

Sincerely, [Your Name]

This sample is effective because it clearly states the reason for the hardship, makes a specific request, and expresses a commitment to meeting financial obligations.

Sample 2: Credit Card Debt Hardship Letter

Dear [Credit Card Company’s Name],

I am writing to inform you of my current financial hardship and request assistance managing my credit card debt.

Due to [explain the reason for your hardship], I have been unable to meet my monthly credit card payments. This situation is temporary, and I am actively seeking solutions to improve my financial standing.

I am requesting [state your specific request, e.g., a temporary reduction in the monthly payment, waiving late fees]. I believe this will allow me to manage my debt more effectively and avoid further financial distress.

Thank you for your understanding and assistance during this challenging time.

Sincerely, [Your Name]

This sample is effective because it explains the hardship, requests specific assistance, and assures the lender that the situation is temporary.

FAQs

Do hardship letters work?

Yes, It can be very effective if they are well-written and sincere. They provide a platform for you to describe your economic problem to your lender and request assistance. However, the effectiveness relies on the specifics of your problem and your lender’s policies.

What should I include in a hardship letter?

A hardship letter should clearly define your economic crisis, the reasons for your financial difficulties, a specific request for assistance, and any appropriate supporting documentation. It’s also important to communicate your readiness to cooperate with the lender and your dedication to fixing the problem.

How can I ensure my hardship letter is taken seriously by my lender?

To ensure it is taken seriously, provide it is well-written, clear, and concise. Be open regarding your problem and provide as much detail as possible. Also, have any supporting documentation that can validate your claims?

Can a hardship letter help me avoid foreclosure?

It can assist you in bypassing foreclosure. Explaining your problem and demonstrating your willingness to find a key can persuade your lender to assist, such as a loan modification or a temporary payment pause.

How long should a hardship letter be?

It should be brief and to the point. Typically, it should be one page long at maximum. The purpose is to express your concern and request without overwhelming the reader with unnecessary details.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.