Expense Report Template Free Download – In business, financial management is a critical aspect that ensures the smooth operation of an organization. An expense report template is important among the various financial documents in a business setting. But what exactly is an expense report, and why is it so important?

An expense report template is a detailed form filled out by employees to account for their expenditures while performing their job functions. These expenditures could range from travel, meal, and lodging fees to any other costs incurred in the line of duty. The report is typically accompanied by receipts or other forms of proof for each expense, significantly if the amount exceeds a specific minimum requirement.

The purpose of an expense report is twofold. For the employee, it serves as a record of their work-related expenses, which they can submit for reimbursement. For the employer, it provides a clear and organized account of employee spending, which can be evaluated for validity and accuracy before reimbursement is made. Sometimes, an expense report can also be generated for an initial advance to an employee. Instead of reimbursement, the employer would deduct the expense from the employee’s advance.

Maintaining expense reports is crucial for both employees and employers. For employees, it ensures that they are fairly compensated for any out-of-pocket expenses incurred during their work. It also records their spending, which can be helpful for tax purposes or reimbursement disputes.

For employers, expense reports offer a way to track and manage business expenses. They provide valuable data that can be used for budgeting, financial planning, and auditing. They also serve as a form of accountability, ensuring employee spending aligns with company policies and guidelines.

In the next section, we will delve deeper into the contents of an expense report and the filling process. Understanding these details is crucial in utilizing expense reports effectively and maximizing their benefits in a business setting.

Understanding the Expense Report

While seemingly straightforward, several critical components contribute to its effectiveness as a financial document. Let’s delve into the contents and the filling process.

Contents of an Expense Report

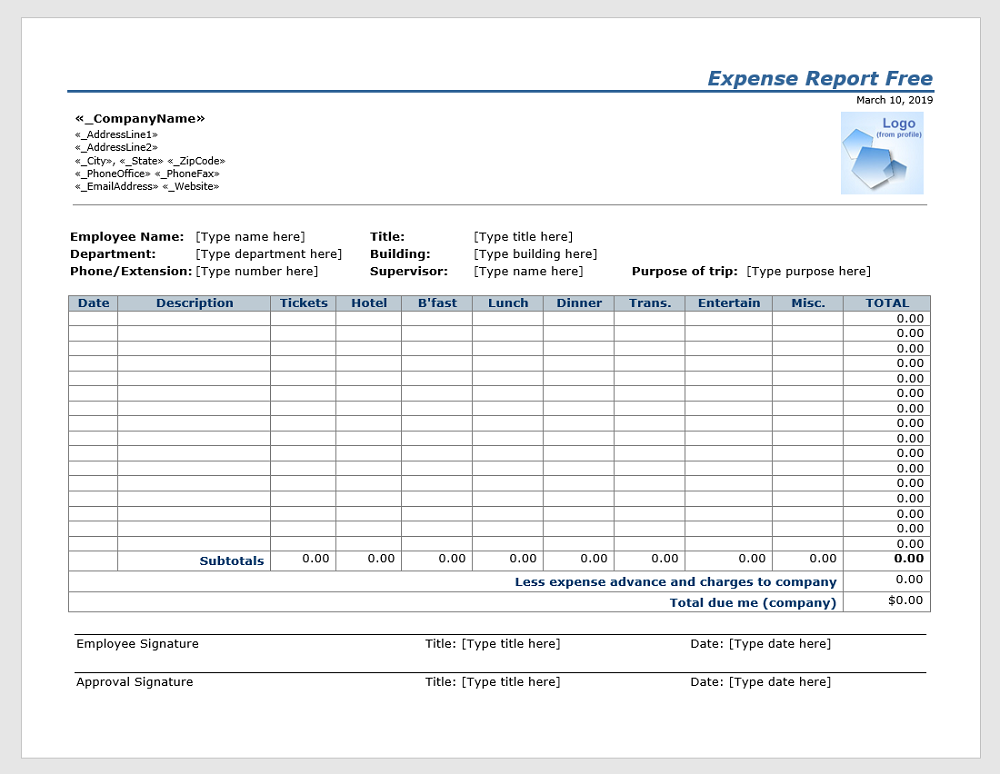

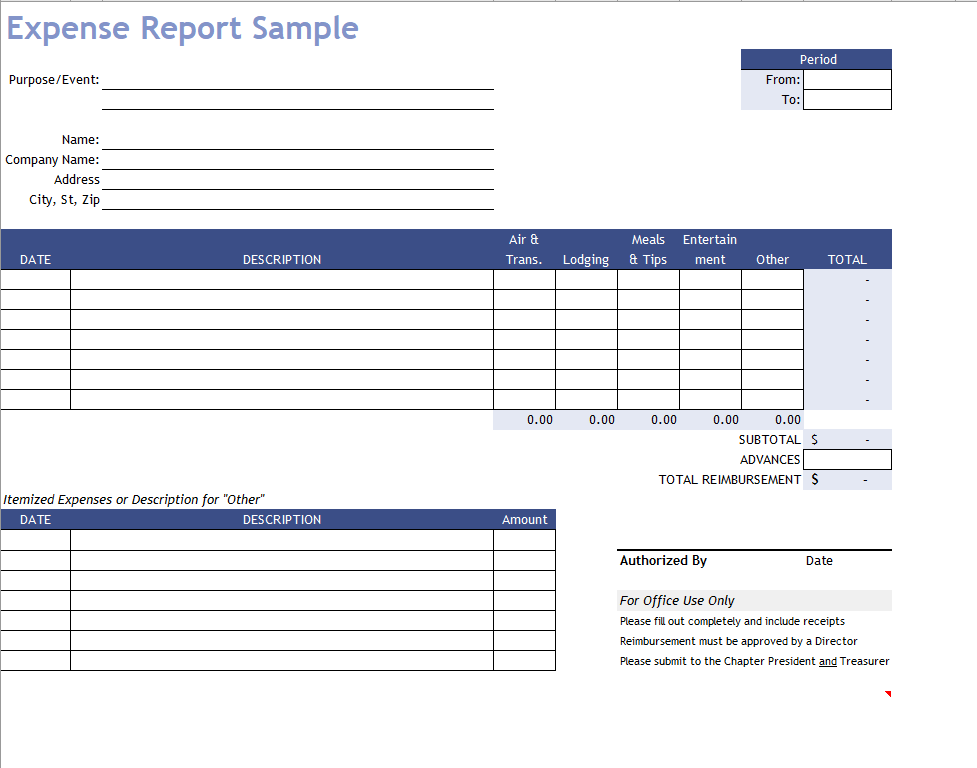

An expense report typically includes the following elements:

- Employee Information: This section includes the employee’s name, department or team, and role or position within the company.

- Expense Details: This section lists per expense the worker is informing. It has a report of the cost, the date it was incurred, and the full payment paid.

- Expense Category: It is categorized based on its nature. Common categories include travel, meals, accommodation, and supplies. Categorizing expenses helps in analyzing spending patterns and budgeting.

- Payment Method: This indicates how the expense was paid, such as through cash, credit card, or a company account.

- Receipts or Proof of Purchase: Employees must usually attach receipts or other proof of purchase for each expense. It serves as verification of the expense and is crucial for reimbursement.

- Total Amount: The sum of all fees detailed in the description. It’s the quantity the worker will be reimbursed or deducted from their advance.

Filling Out an Expense Report

The process of filling out an expense report involves several steps:

- Collect Receipts: Employees should keep all receipts or proof of purchase related to their work expenses. These will be needed when filling out the expense report.

- Fill Out Employee Information: The employee fills in their name, department, and role in the designated section of the report.

- List Expenses: The employee lists each expense, providing a description, the date it was incurred, and the amount spent.

- Categorize Expenses: The employee categorizes each expense based on its nature.

- Indicate Payment Method: The employee indicates how each expense was paid.

- Attach Receipts: The employee attaches the related receipt or proof of investment for each payment.

- Calculate Total Amount: The employee counts up all the costs to estimate the total charge for reimbursement.

Accuracy and validity are crucial when filling out an expense report. Inaccurate or invalid reports can lead to disputes, delays in reimbursement, or even disciplinary action. Therefore, employees should ensure that all information provided in the report is correct and that all expenses are valid and in line with company policy.

The Importance of Maintaining an Expense Report: Tracking, Prioritizing, and Succeeding

Maintaining an expense report is more than just a routine task or a formality. It plays a pivotal role in the financial management of a business and can have significant implications for both employees and employers. Let’s delve into the benefits of maintaining an expense report and how it can impact an employee’s standing within a company.

Benefits of Maintaining an Expense Report

- Meeting Financial Goals: Expense reports provide a clear picture of where money is being spent. This information can be invaluable in setting and meeting financial goals, reducing unnecessary spending, allocating resources more effectively, or planning for future expenses.

- Tracking Expenses: Expense reports serve as a record of all work-related expenses incurred by an employee. It makes it easier to track spending over time and identify any trends or patterns. For instance, if travel expenses are consistently high, exploring more cost-effective travel options might be worth exploring.

- Prioritizing Spending: By categorizing expenses, expense reports help prioritize spending. If a particular category of expenses is taking up a large portion of the budget, it might be necessary to prioritize it and allocate more resources.

- Transparency and Accountability: Expense reports create transparency and accountability for employee spending. They ensure that all expenses are recorded and justified, which can prevent misuse of company funds.

Impact on Employee’s Reputation and Benefits

Maintaining accurate and timely expense reports can positively impact an employee’s reputation within a company. It demonstrates responsibility, integrity, and respect for company resources, which can increase trust and potentially more opportunities within the company.

On the other hand, consistently inaccurate or late expense reports can harm an employee’s reputation. It can lead to doubts about the employee’s reliability and integrity, and in severe cases, it could even lead to disciplinary action.

Moreover, maintaining an expense report is often directly tied to an employee’s benefits. It’s usually the basis for reimbursement of work-related expenses, so an accurate or complete report could result in the employee not being fully reimbursed.

Types of Expense Report Templates: Finding the Right Fit for Your Needs

Expense report templates come in various formats and styles, each designed to cater to different needs and scenarios. Understanding the different types of templates available can help you choose the one that best fits your needs. Let’s explore some of the most common types of expense report templates and discuss when and why each might be used.

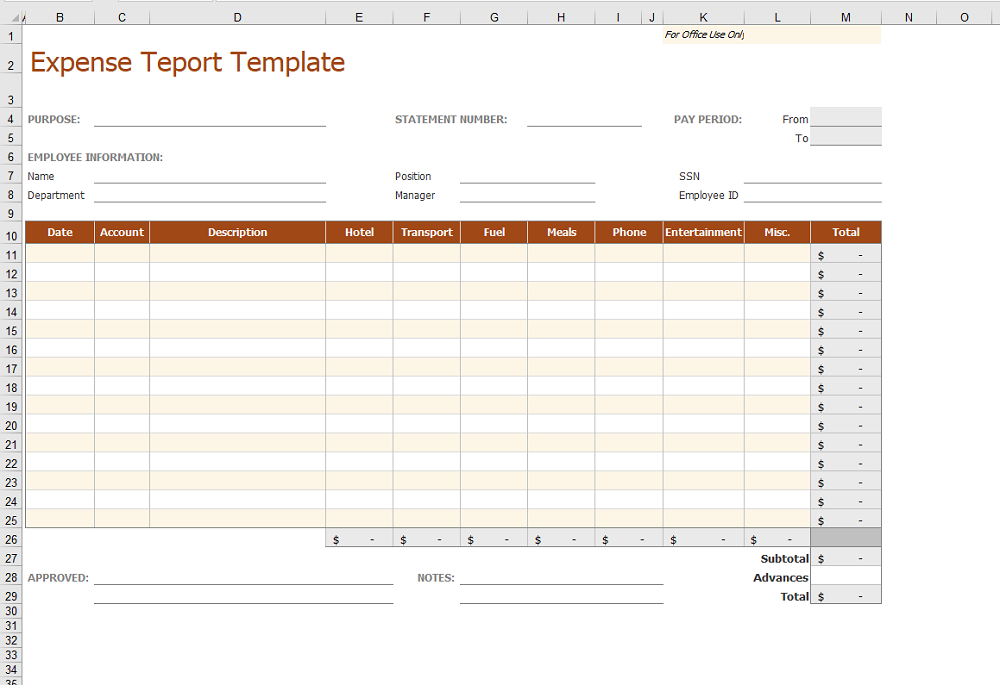

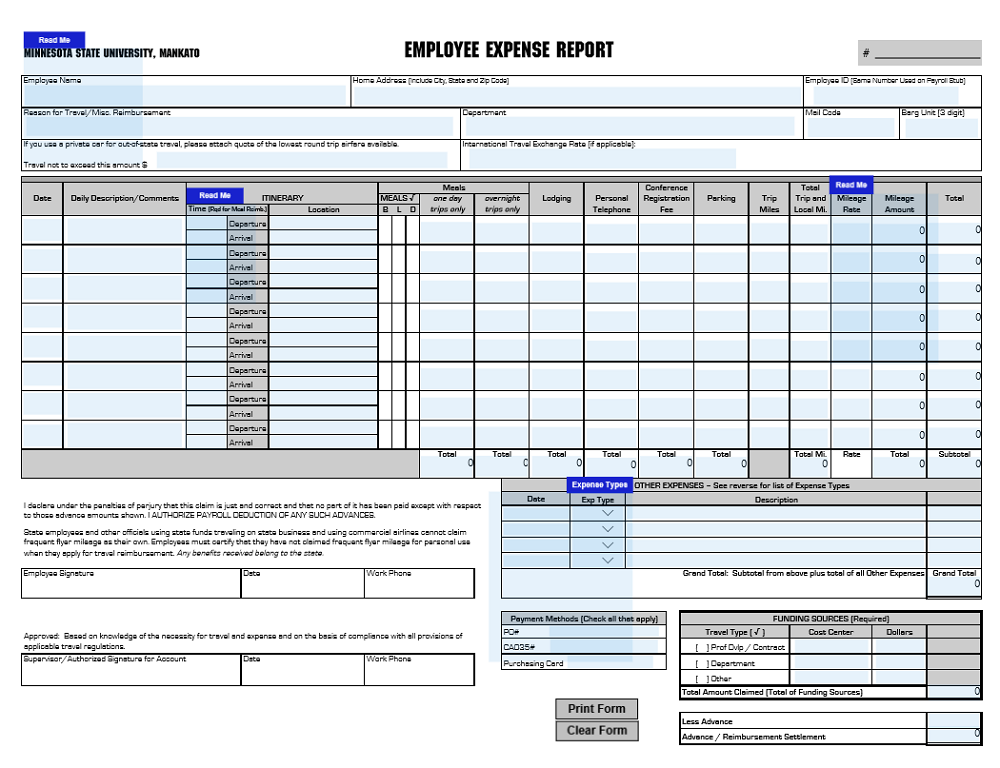

Employee Expense Report Templates

It is designed for individual employees to track their work-related expenses. They often include sections for employee information, expense details, and reimbursement information.

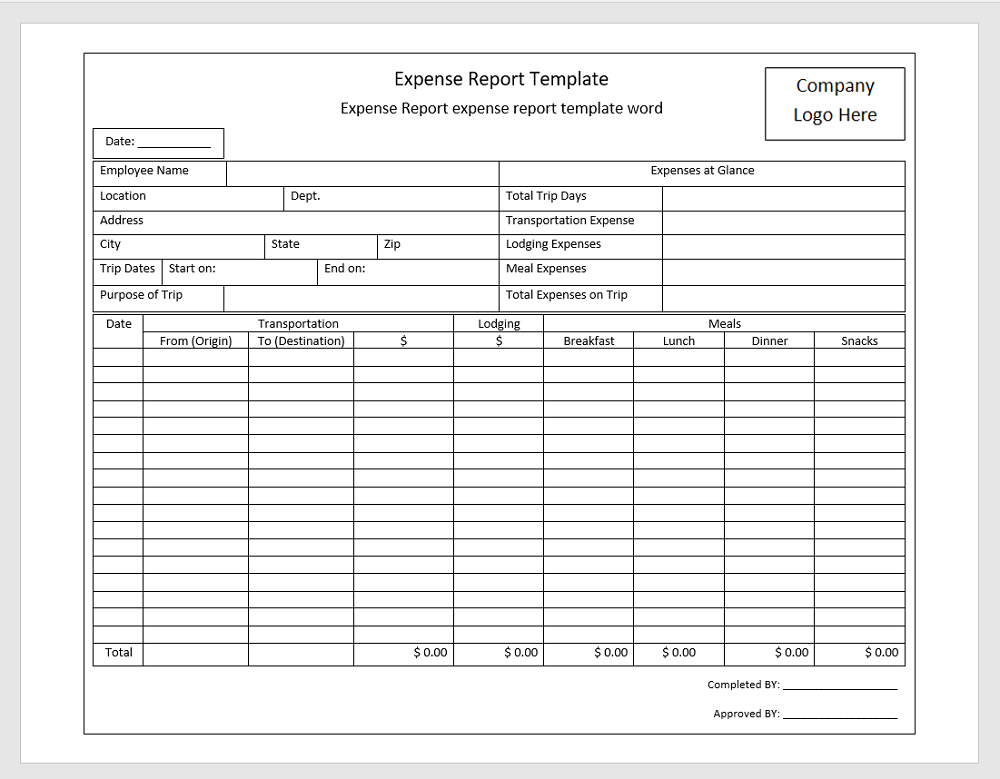

Word Expense Report Templates

Word templates are another common choice. They’re easy to use and can be quickly printed out, making them a good choice for those who prefer a physical copy of their expense report. They’re also excellent for those who require a simple, straightforward template without the need for automatic calculations.

Expense report template word

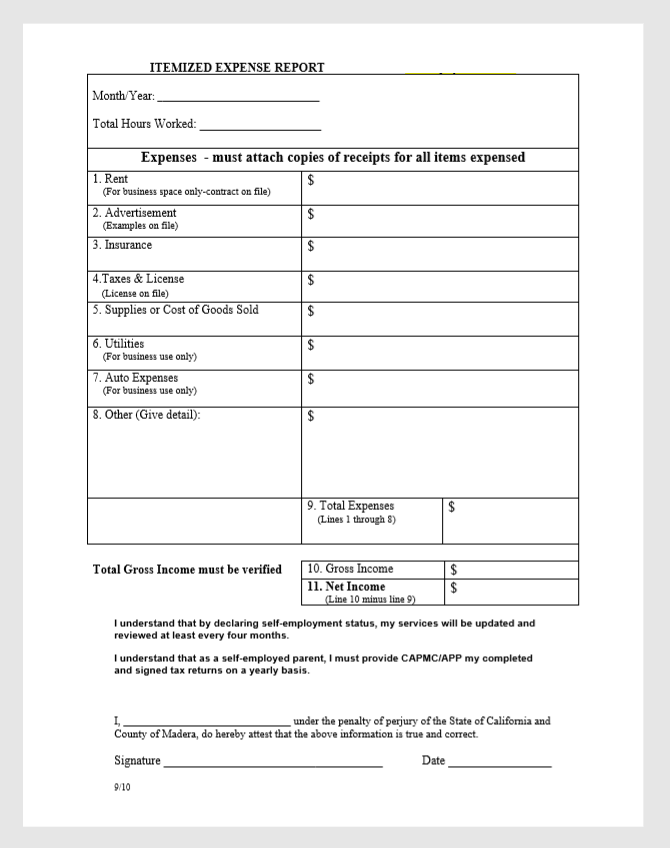

Itemized Expense Report Templates

It provides a detailed analysis of each payment. It is ideal for those who must track many other costs, as they allow each expense to be listed separately along with its category and amount.

Monthly, Weekly, and Daily

These templates are designed to track expenses over a specific period. It is ideal for long-term tracking and budgeting, while weekly and daily templates are excellent for short-term tracking and more careful cost control.

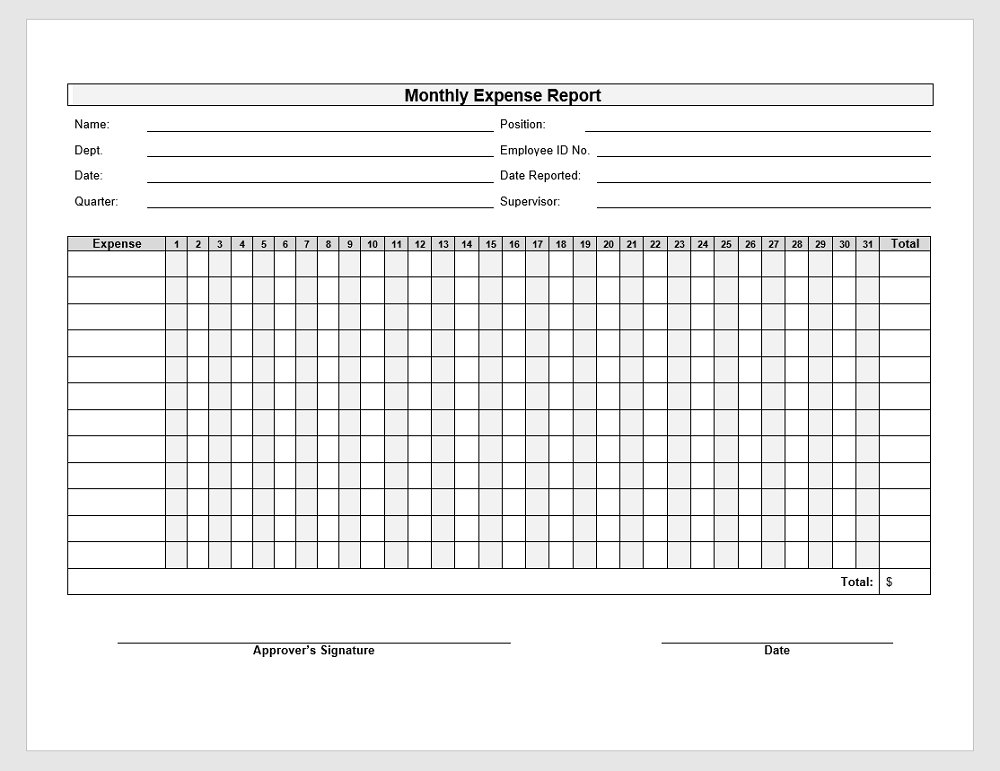

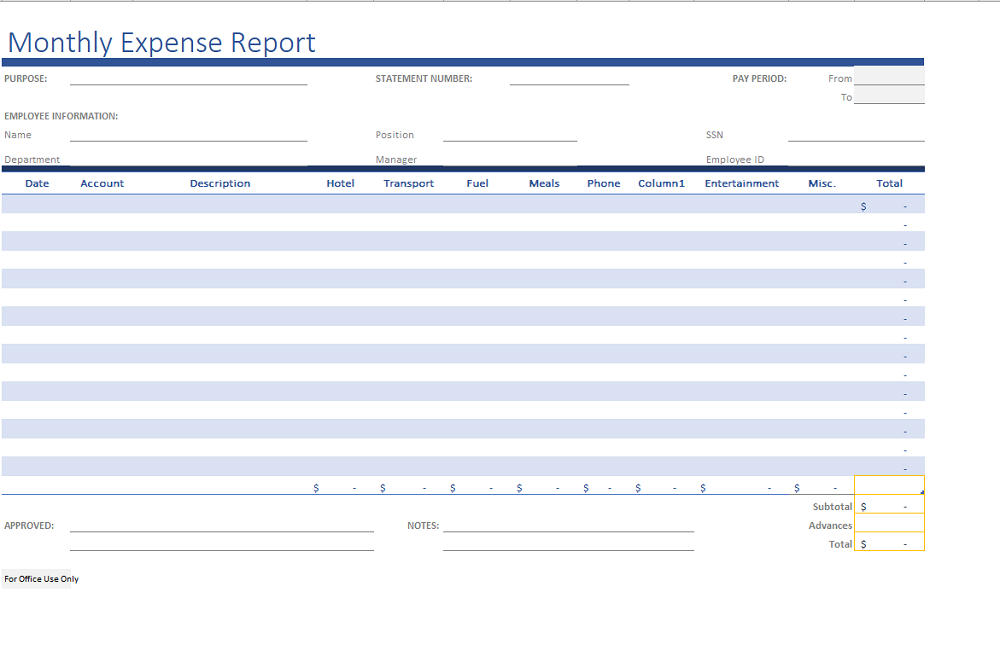

Monthly expense report template

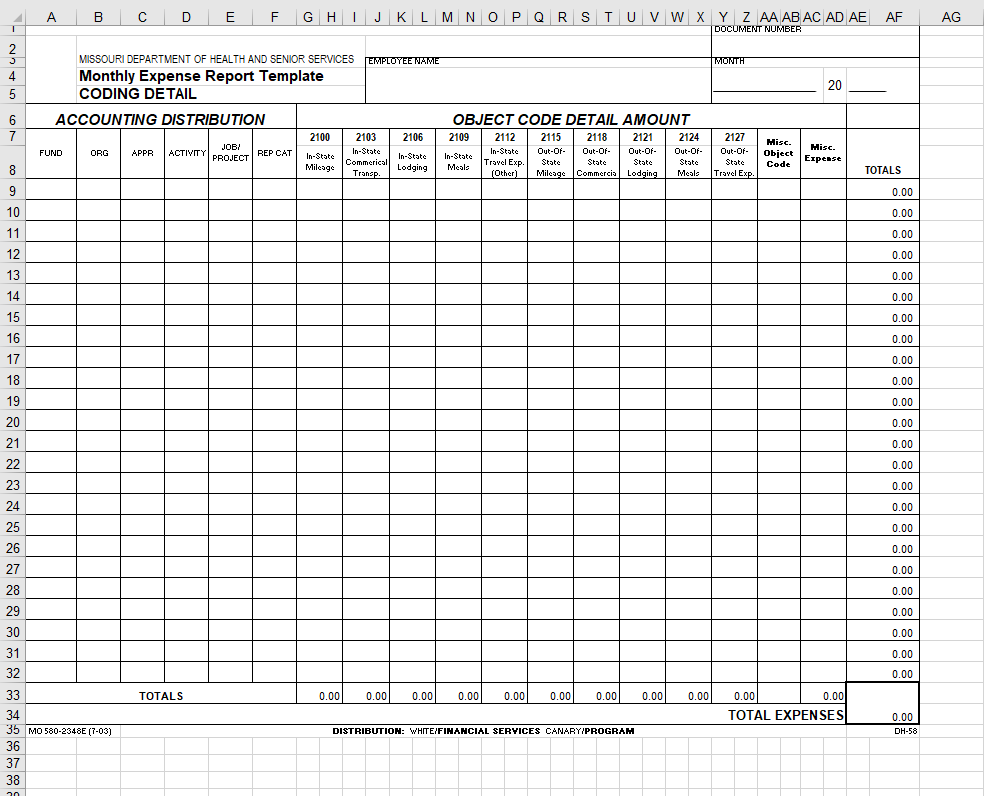

Monthly expense report template excel

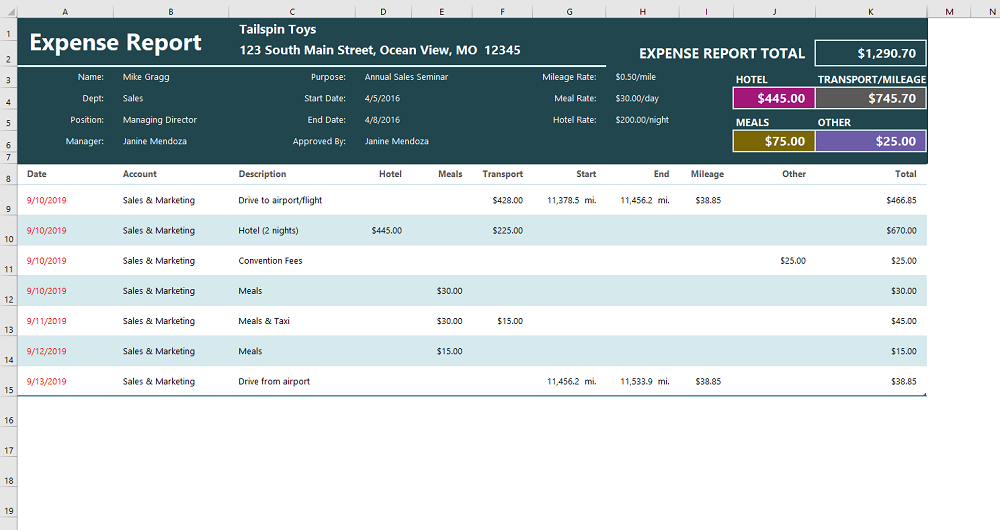

Travel Expense Report Templates

It is designed to track travel-related expenses, such as flights, hotels, meals, and transportation. They’re a must-have for employees who travel frequently for work.

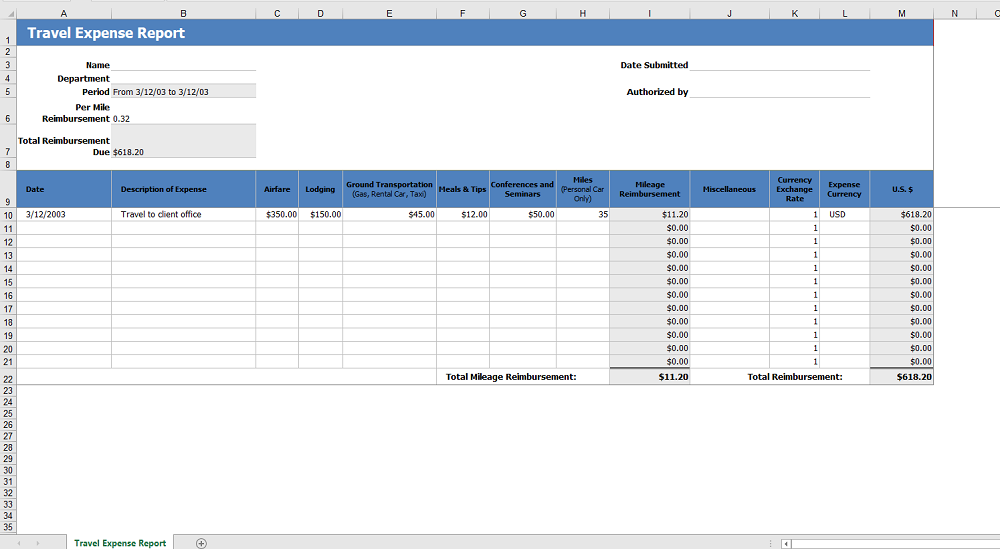

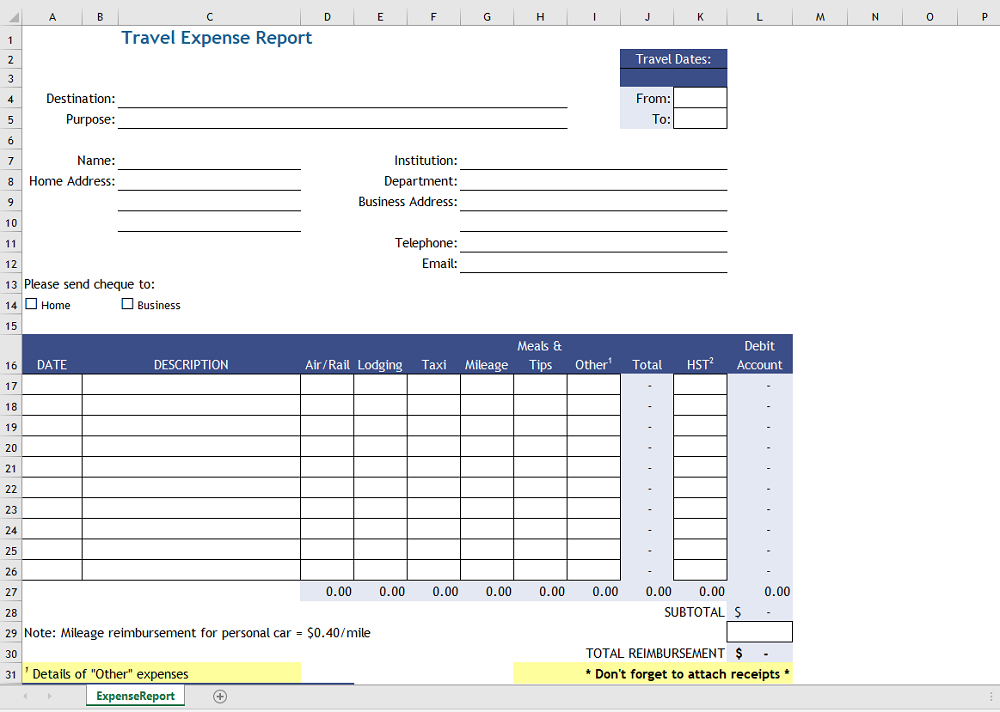

Travel expense report template excel

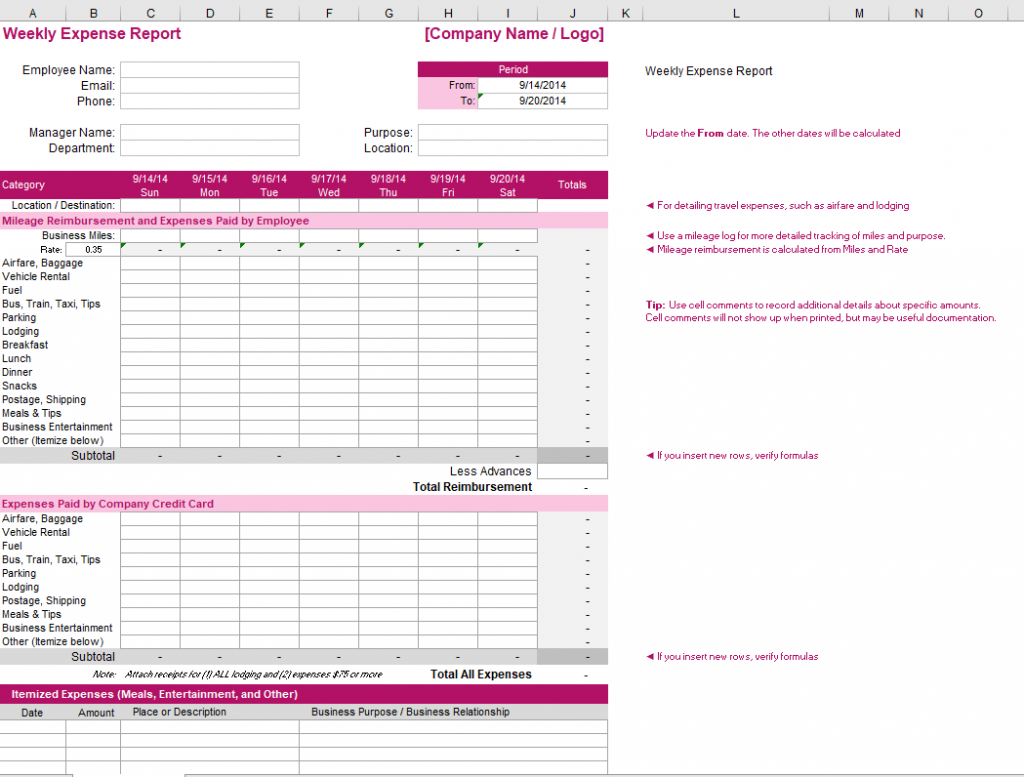

Weekly expense report

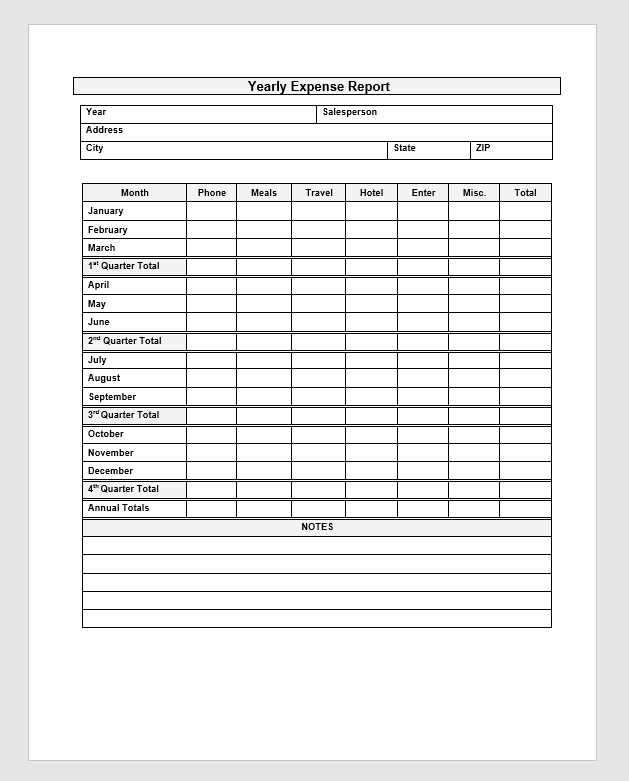

Yearly expense report

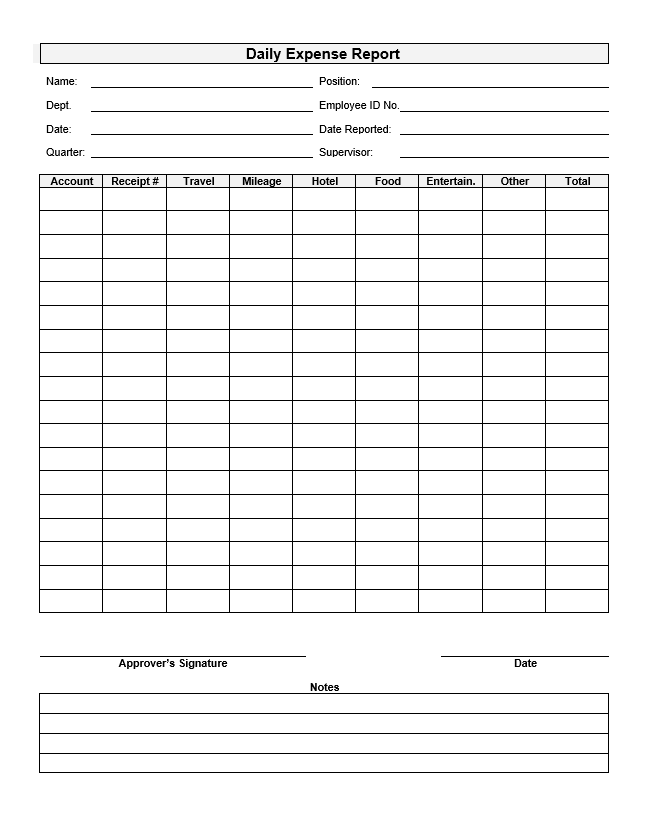

Daily expense report

Employee Expense Report Templates

It is designed for individual employees to track their work-related expenses. They often include sections for employee information, expense details, and reimbursement information.

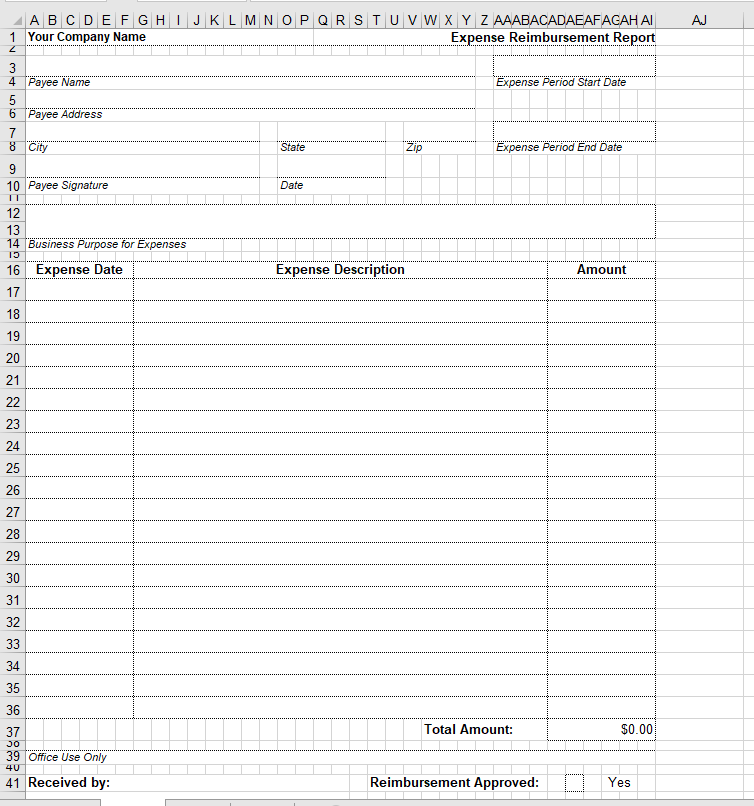

Expense Reimbursement Report

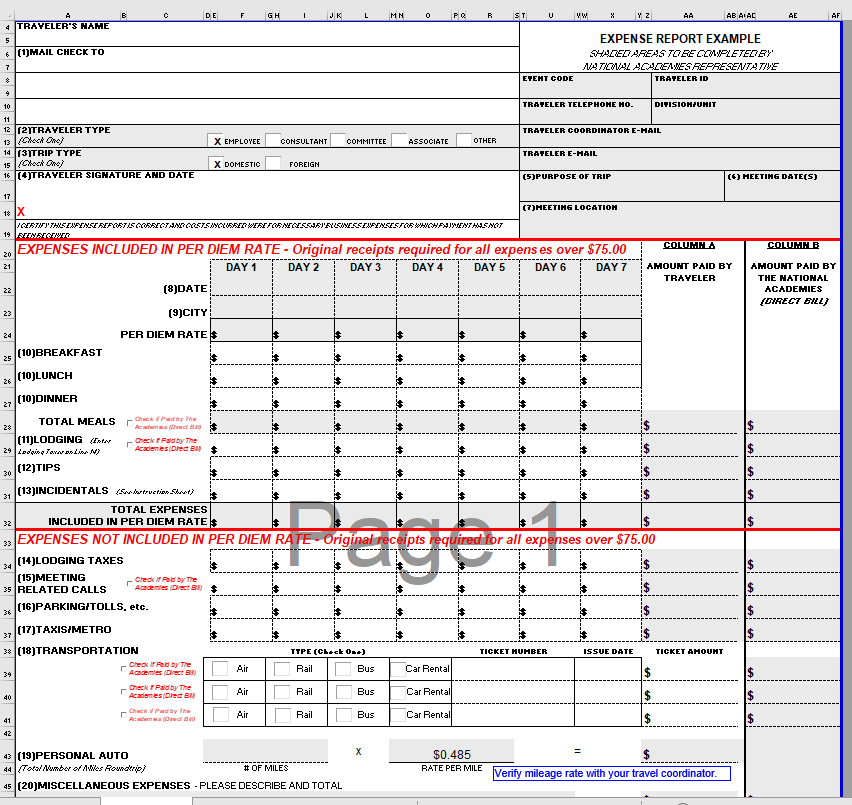

Expense report template free download

Expense report example

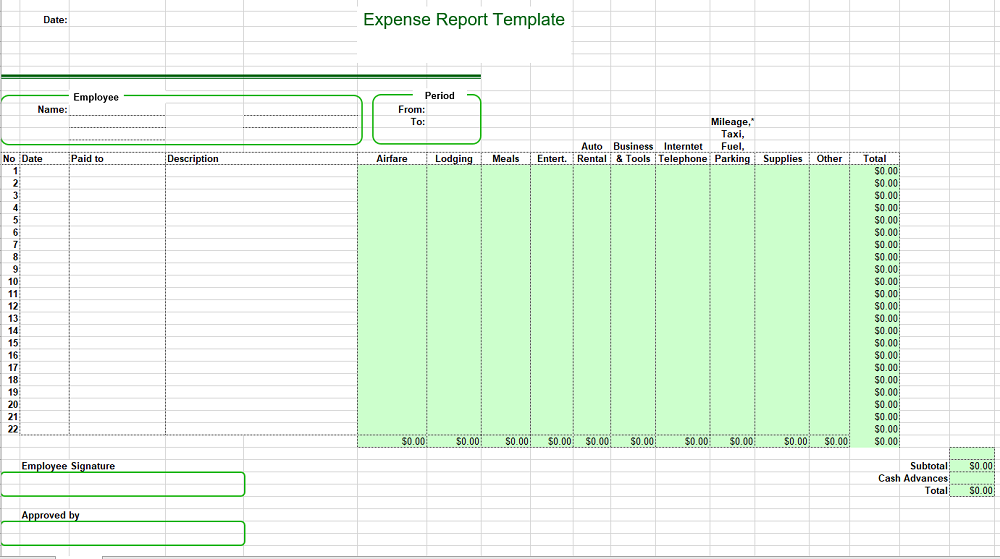

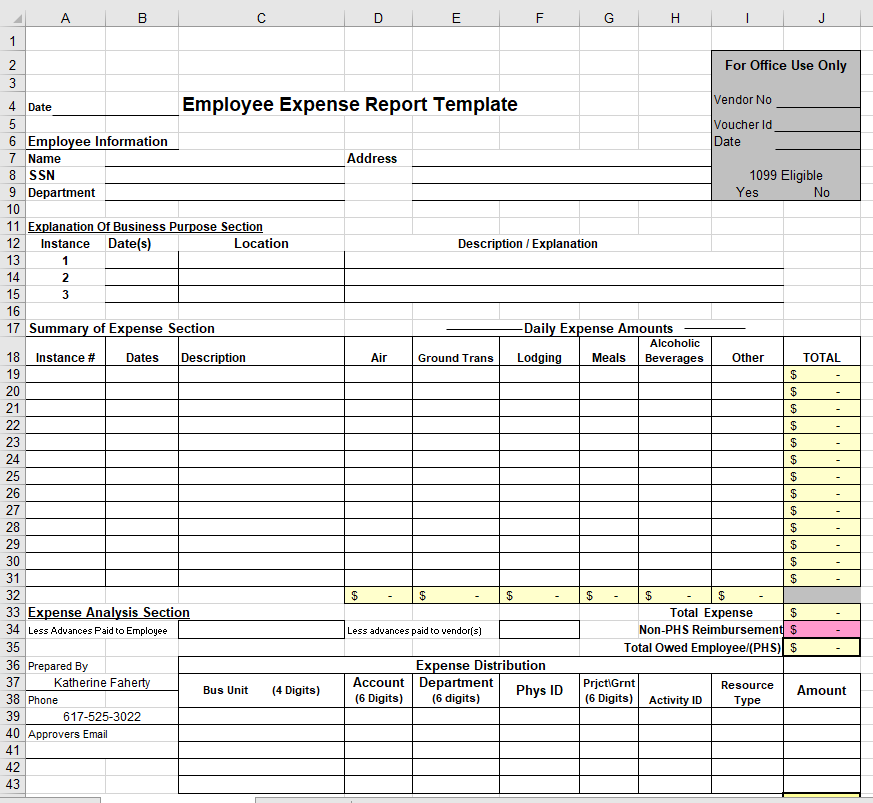

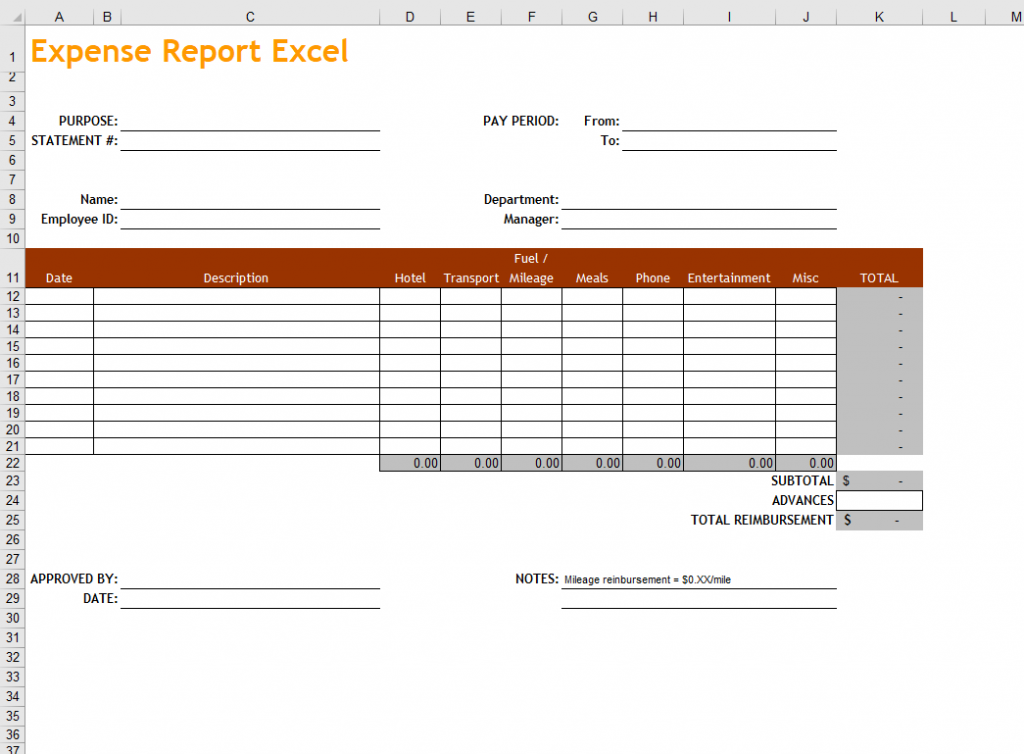

Excel Expense Report Templates

It is one of the most popular types. They offer a high level of customization and can automatically calculate totals, making them an excellent choice for those who require to pursue many expenses. They’re also ideal for those who prefer a digital format that can be easily edited and shared.

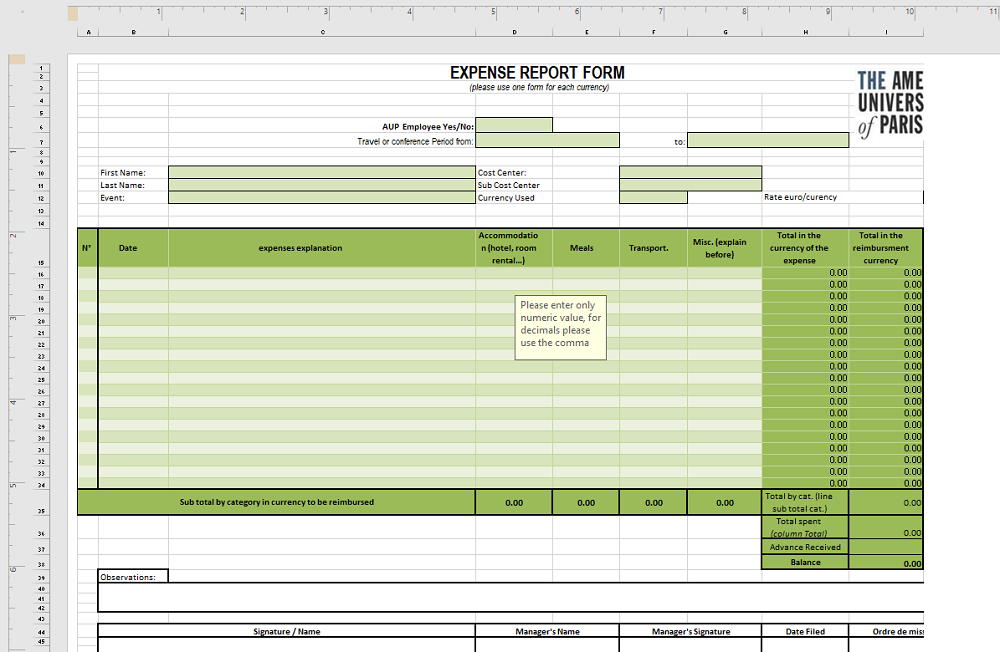

Expense report form

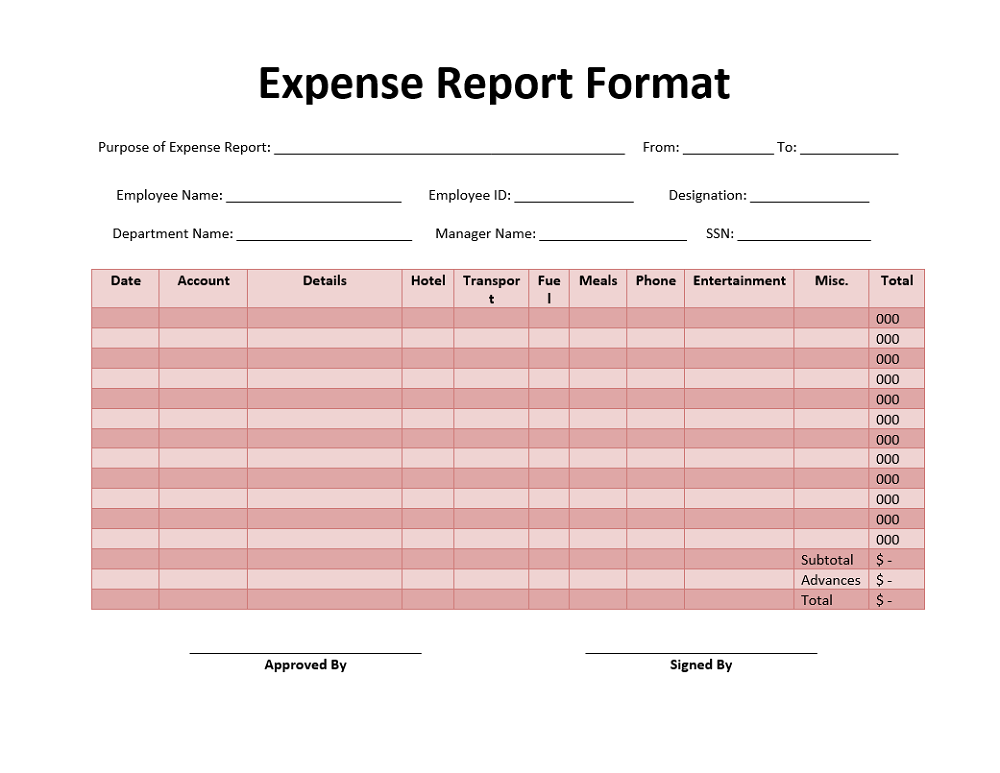

Expense Report Format

Expense report free

Expense report sample

How to Use an Expense Report Template: A Step-by-Step Guide

Using an expense report template can streamline tracking and reporting work-related expenses. However, knowing how to use these templates effectively is essential to make the most of them. Here’s a step-by-step guide on using an expense report template and some tips for filling it out accurately and efficiently.

Step 1: Choose the Right Template

The first action is to choose a suitable template for your needs. Consider the type you require to track, the period you’re tracking for, and your preferred format (such as Excel, Word, or PDF).

Step 2: Customize the Template

Most templates are customizable, allowing you to add or remove sections. For instance, add a section for specific types, or remove sections that aren’t relevant to your situation.

Step 3: Fill Out Your Information

Start by filling out your details, such as your name, division, and role. It is typically located at the top of the template.

Step 4: List Your Expenses

Next, list each of your payments in the designated section. Ensure to include a description of each payment, the date it was incurred, and the quantity. If the template has a category section, categorize each expense accordingly.

Step 5: Attach Receipts

If required, attach receipts or other proof of purchase for each expense. It could be in the form of physical receipts, scanned copies, or digital receipts.

Step 6: Calculate the Total

Most templates will automatically estimate the total for you. If not, add up all your costs to estimate the full payment.

Step 7: Review and Submit

Finally, review your expense report to ensure all information is accurate and complete. Then, submit it to the unit for acceptance and reimbursement.

Tips for Using an Expense Report Template

- Be Accurate: Ensure all information is accurate, including the description, date, and amount of each expense. Inaccuracies can lead to delays or issues with reimbursement.

- Be Timely: Fill out and submit your expense report promptly. It ensures prompt reimbursement and helps keep your financial records up to date.

- Keep Receipts: Keep receipts or other proof of purchase for your expenses. It is crucial for verification and reimbursement.

- Follow Company Policy: Ensure your company’s expense policy when filling out your expense report. It includes adhering to spending limits, expense categories, and submission procedures.

Following these steps and tips, you can use an expense report template effectively to track and manage your work-related expenses.

FAQs

Here, we address some common questions and misconceptions about expense report templates.

Q1: Are expense report templates necessary?

Yes, expense report templates are necessary for any business reimbursing employees for work-related expenses. They provide a standardized format for reporting expenses, ensuring consistency and accuracy. They also make tracking and managing expenses easier, which is crucial for budgeting and financial planning.

Q2: Can I customize an expense report template?

Most expense report templates are customizable. Add or remove sections, change the layout, or adjust the design to fit your needs. However, it’s crucial to ensure that any changes you make comply with your company’s expense policy.

Q3: Do I need a different template for each type of expense?

Not necessarily. While specific templates exist for certain expenses (like travel expenses), a general expense report template can accommodate various expense types. You can often add or remove categories to fit your situation.

Q4: Can I use an expense report template for personal expenses?

Absolutely! While expense report templates are typically used in a business context, they can also be an excellent tool for tracking personal expenses. They can help you keep track of your spending, create a budget, or prepare for tax season.

Q5: Do I need to keep receipts using an expense report template?

You should always keep receipts or other proof of purchase for your expenses, even using an expense report template. Receipts verify your expenses and are often required for reimbursement.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.