Depreciation schedule example

A depreciation schedule is not something you are familiar with, especially if you are not studying accounting or working in a company. The term is very popular and is, in fact, in use by a lot of accounting departments in any company.

It is an accounting method that is used by accountants all over the world to count how much an asset will ‘depreciate’ in the future. ‘Depreciate’ here means decline or reduce, and the thing that can depreciate in an asset is its value. In short, businesses use this depreciation thingy to count how long the asset would be useful to a company.

It is a nice method to reduce business taxes, but that does not mean a business can depreciate its assets to its heart’s content no. There are several guidelines from their country’s tax agency that they need to follow when it comes to depreciating their assets.

Depreciation and how it is looked upon by accounting students

The general rule of depreciation has been mentioned in the intro, but you might be wondering how an accounting student handles depreciation. To make it simple, depreciation to an accounting student is as complex as it is to us. Even those who have studied accounting need help to count depreciation, thanks to its complex nature. One of the reasons why depreciation is complex is the fact that there is no real cash flow going on here. Depreciation is an assumption, a projected number that tells how long an asset can stay before its value declines.

What is a depreciation schedule?

A depreciation schedule is a schedule that contains several useful information when it comes to depreciation.

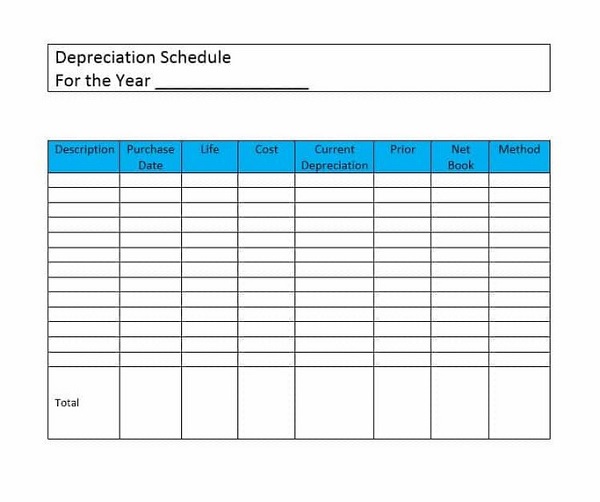

Normally, a depreciation schedule will have the information below:

- The name of the title and a brief description of it: useful for sorting purposes. A brief description is needed because each item has a different depreciation timeline. You may have got two items of the same kind, but you paid different amounts of money for them. The depreciation line will definitely be different for the two.

- The initial cost of the item: the base of future calculations.

- The lifetime estimate: this is the number that the tax agency will assign to an item. It can range from 3 to 39 years, depending on the item being depreciated.

- The salvage value: the value of the item when you sell it to other companies or individuals. It determines your net income.

- Purchase date: for ease of record-keeping.

- The depreciation period: again, to help you with record keeping.

- Those are the things that you will find in many depreciation schedule examples.

While each depreciation schedule template might contain different items, those items we mentioned above are the most important items to have in a template.

Depreciation Schedule Example

If you think this is too complex to understand, then you should not worry. A whole lot of people in the world do not know it as well, so you can rest easy knowing that you are not the only one confused. To make things easier, we will provide a quick example for you to learn. Say, for example, you have an asset that you pay $ 100,000 for. Now, you can either write the entirety of the cost in year one, or you can write the value of the asset in 12 years. Furthermore, say your company will scrap the asset for $50.000.

To find the amount of depreciation schedule example, you need to do a bit of math. First thing first, deduct the value of the asset with the scrap amount (in this case, it would be $100.000 – $50.000). When you have already got the result, divide it again by the number of years until you write the asset off (in this case, 12). Putting it to the formula, you will get ($100.000 – $ 50,000)/12. The answer to this is $4.200.

What does this mean? It means that your business will have to take $4.200 from its net income to be paid to the tax agency. It will reduce the amount of tax your business needs to pay and artificially increase your net income.

What are the things that can depreciate?

While depreciation is something that many people will need clarification with, looking at what are the things that can depreciate will help you. Below are the assets that can depreciate in the future:

- Machines: machines can deteriorate over time, so it is only natural for them to be able to depreciate. Robots, no matter how aware they are, count as machines, too. If you have a robot working for your company, you need to put it in the list of items that can depreciate.

- Cars and trucks: cars and trucks start to depreciate each time you are using it. Some people also claim that they will depreciate the moment you purchase it from a dealer.

- Furniture, office equipment, and other things related to offices: because all of them are used to gain net income, it is only right for a tax agency to tax them.

- Patents and copyrights: patents and copyrights are something that can depreciate, too. Patents and copyrights, after all, will make you liable to gain income from using it. If there is something that makes you get money, you can be sure the tax agency will sniff around it and tax it.

- Office buildings: the same rule applies. As long as you can make money with something, that certain something is depreciable and will be taxed according to the regulation. It includes building.

What are the things that you cannot depreciate?

Anything that lasts for a year or less, more or less. If you have exhausted it before a year has passed, then you cannot depreciate that item. Things like cash and supplies are not depreciable. You cannot depreciate lands, too, because lands – if there is no business building sitting on them – will only increase in price. While the lands are not depreciable, the buildings are viable for depreciation.

Benefits of Using Depreciation Schedule Examples

Depreciation schedules are like helpful charts for businesses. They help to know how much value things like cars, machines, or buildings lose over time. Let’s look at why using examples of these schedules is a good idea:

Easy to Understand

Real Examples: Examples show how to use depreciation schedules in real life, making it less confusing.

Simple Learning: Examples make hard topics easier to understand, no matter how good you are in accounting.

Fewer Mistakes

Avoiding Errors: With a clear example, there’s less chance of making mistakes when figuring out depreciation.

Right Reporting: It helps in reporting the correct financial details of a business.

Following Tax Rules

Saving on Taxes: It helps in reducing the amount of taxes a business has to pay.

Staying within Laws: Following the correct depreciation methods keeps the business in line with tax laws.

Planning Better

Budget Planning: Knowing how assets lose value helps in planning budgets and buying new assets when needed.

Taking Care of Assets: It helps in managing assets better, like knowing when to replace or fix them.

Saving Time and Effort

Quick Calculations: It comes with easy-to-use tools that do the math for you, saving time.

Organized Records: A well-made schedule keeps records tidy, making it easy to track the value of many assets.

Learning More

Learning and Growing: For anyone wanting to learn more about accounting, working with examples is very helpful.

Sharing Knowledge: It can be used to teach others and understandably.

Making it Your Own

Changing as Needed: Examples often can be changed to fit your needs or the needs of your business.

Growing with You: As your business gets bigger, the examples can be changed to keep up with more assets.

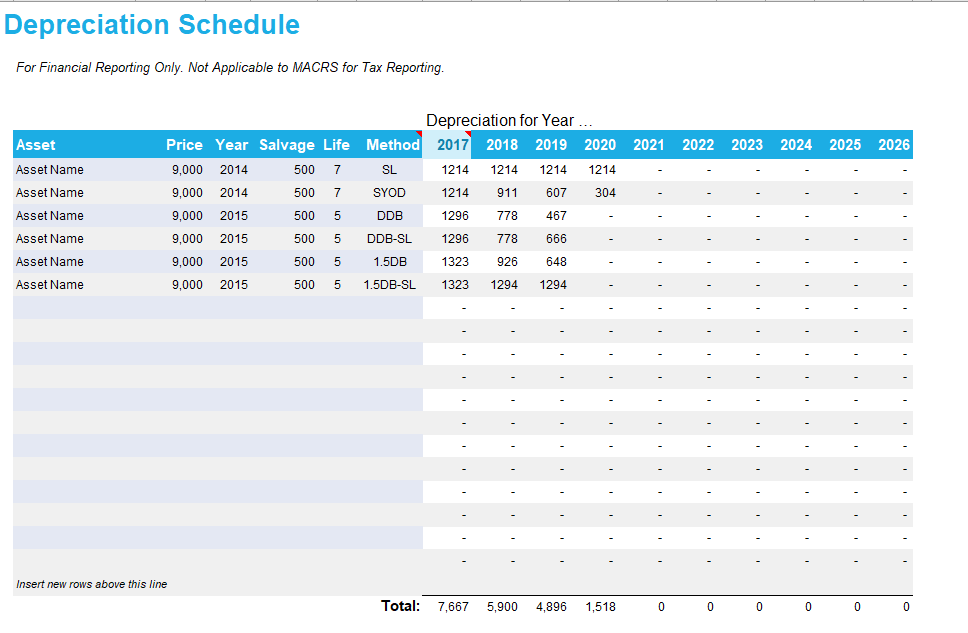

Depreciation Schedule

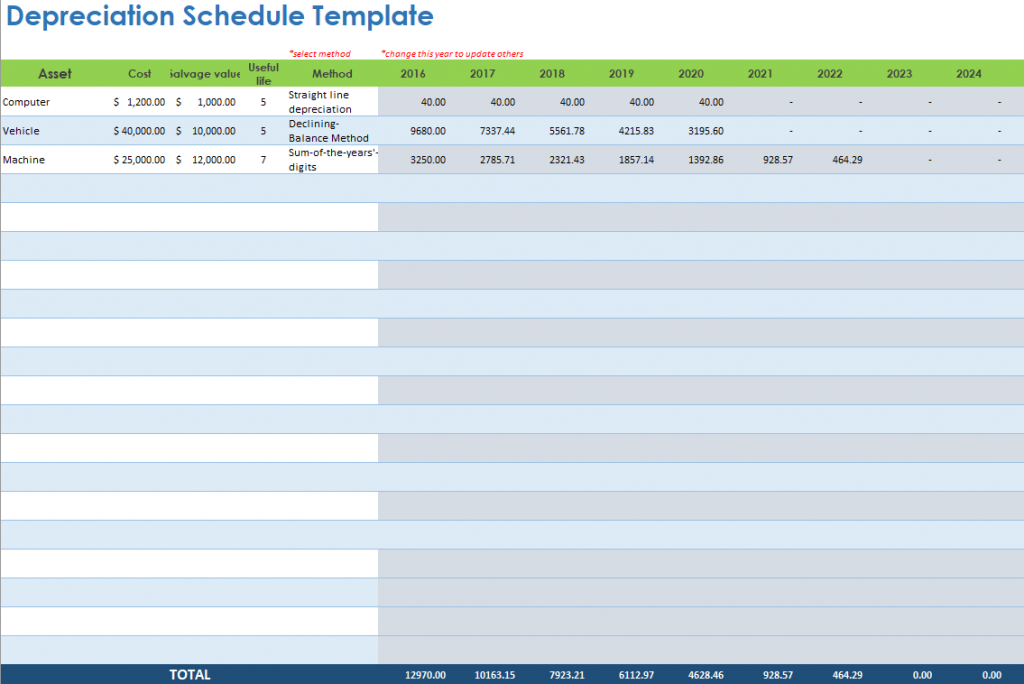

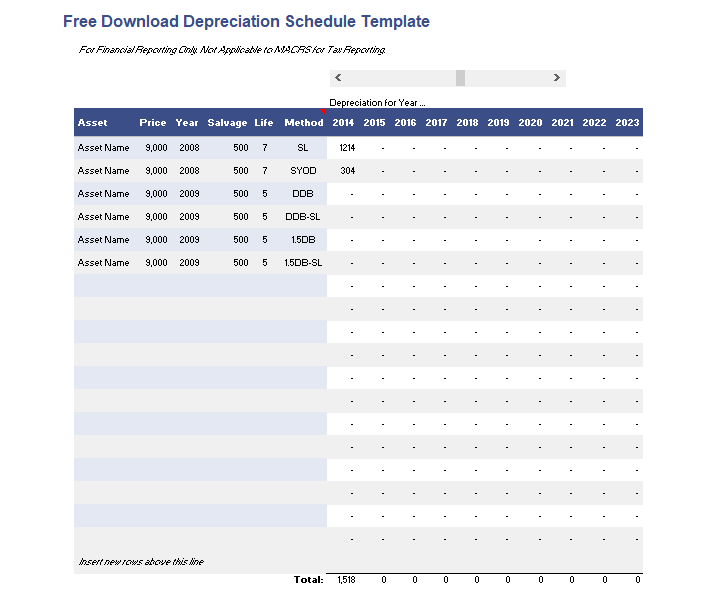

Depreciation Schedule Template

Think of a template as a helpful outline. It shows how to make a schedule. It’s like a coloring book waiting for us to fill in the colors.

Depreciation Schedule Excel

Excel is a computer tool that helps us make a schedule easily. It can do the math for us, so we don’t have to.

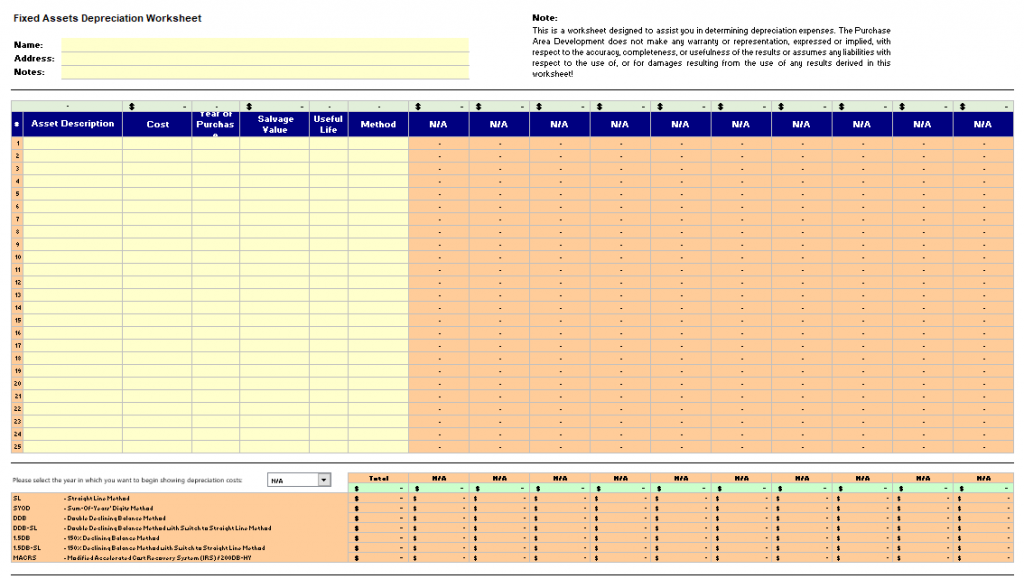

Fixed Assets Depreciation Schedule

It helps us see how much value big things like buildings or machines lose over time. It’s like a diary that keeps track of their aging.

Free Depreciation Schedule Template

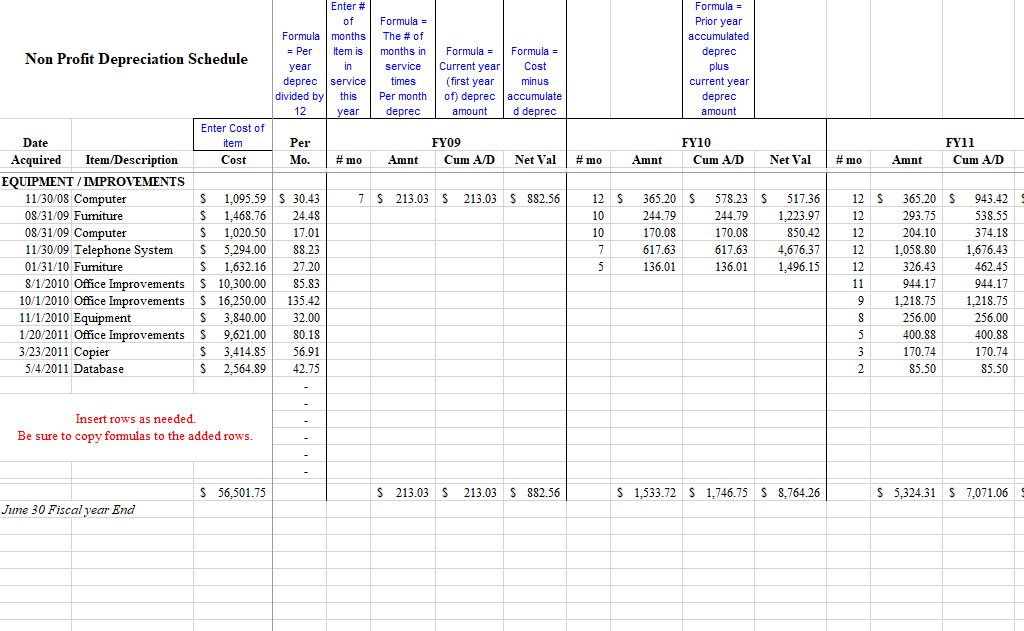

Non Profit Depreciation Schedule

Even groups that help people, like charities, need to keep track of how their stuff loses value. This schedule helps them do that.

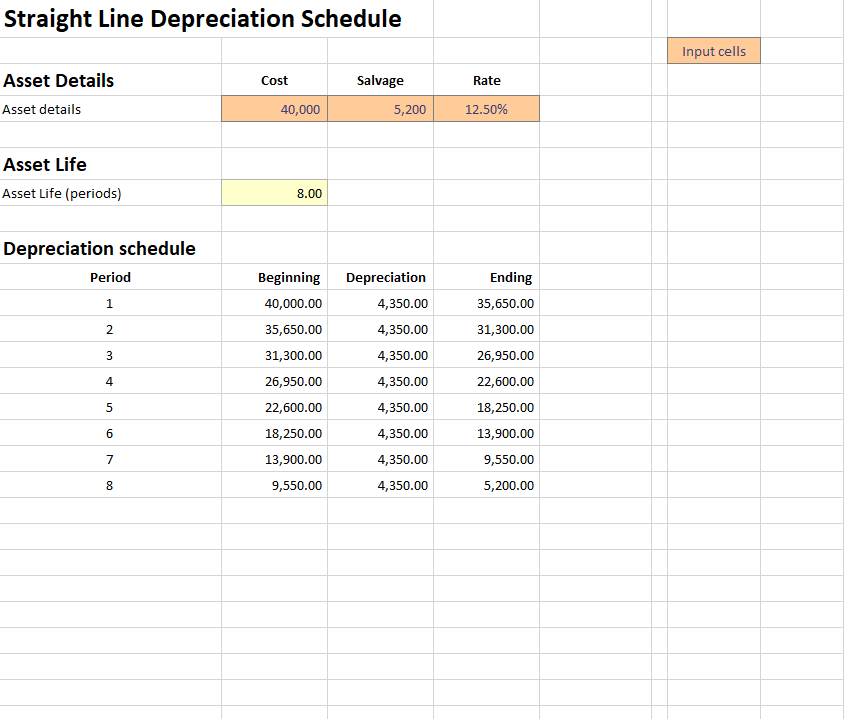

Straight Line Depreciation Schedule

It is a simple way to see how things lose value equally every year. It’s like slicing a cake into equal pieces over time.

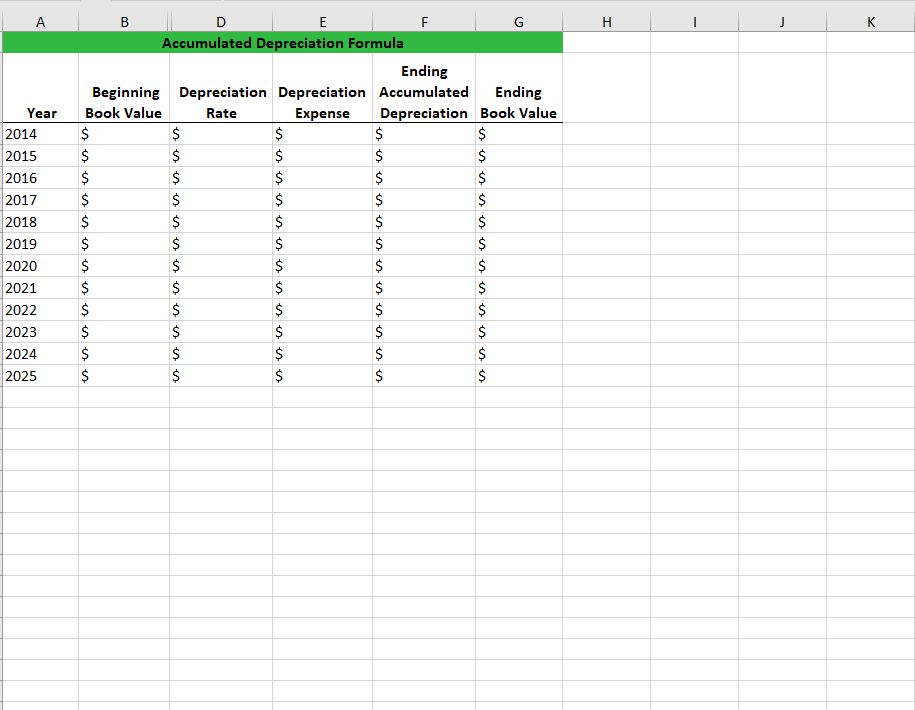

Accumulated Depreciation Formula

This fancy phrase means a way to add up all the value an item has lost over time. It helps us know what our stuff is worth now.

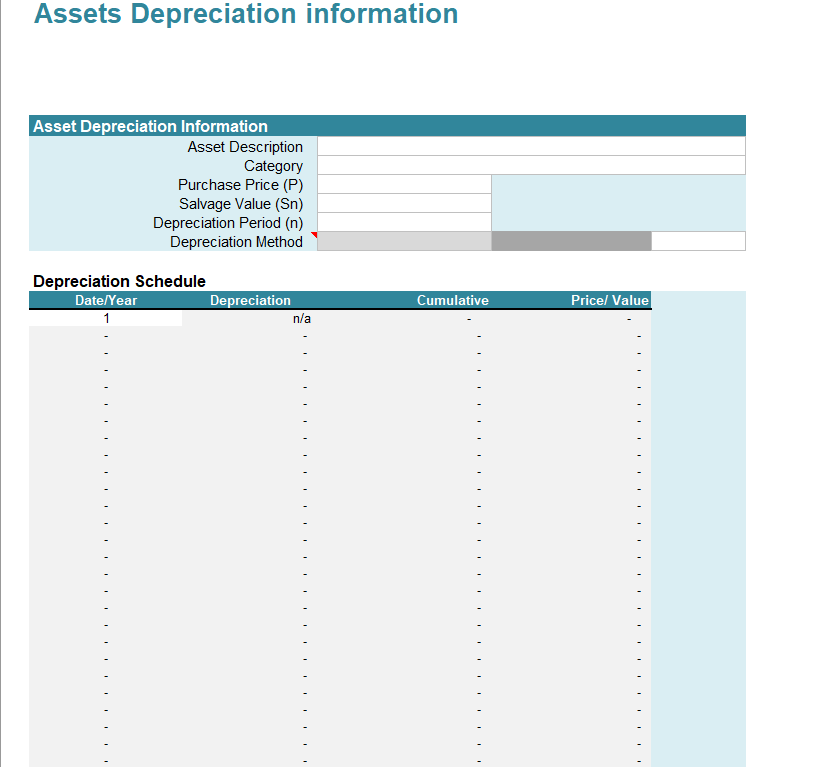

Assets Depreciation Information

This is all the important stuff we need to know to figure out depreciation, like when we bought the item and how much we paid for it.

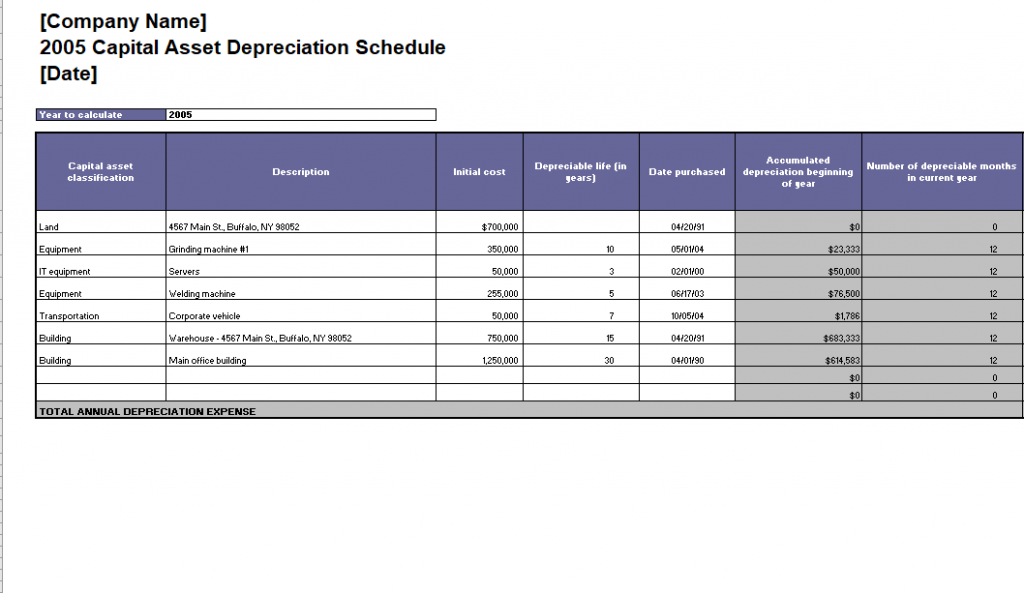

Capital Asset Depreciation Schedule Template

This is a special template for really big purchases like buildings. It helps us keep track of their value in a neat way.

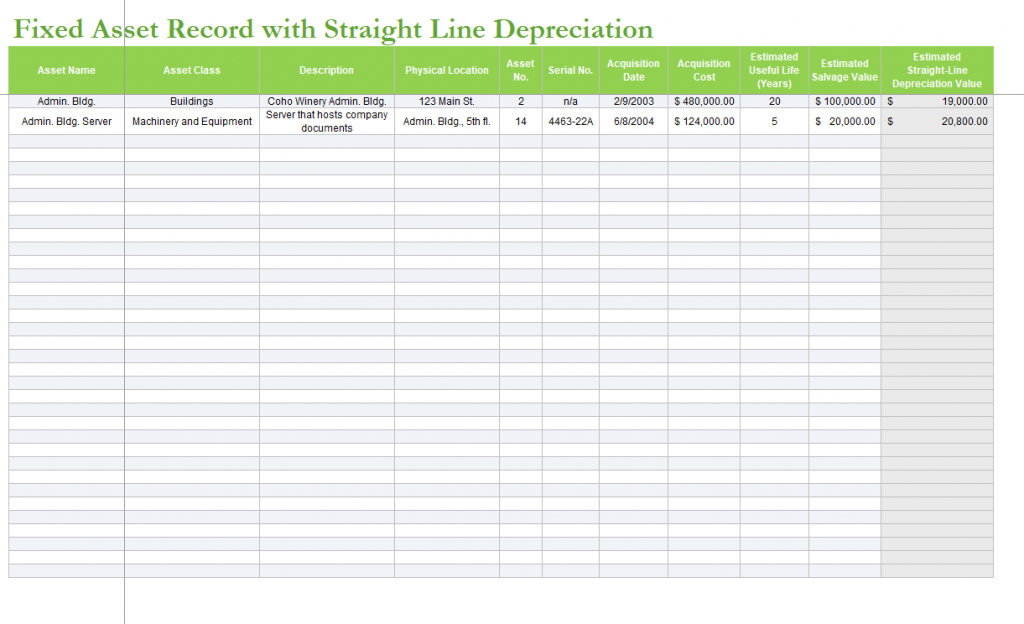

Fixed Asset Record With Straight Lice Depreciation

This is a list of big things we own and how much value they lose every year in a simple, straight-line manner.

Tips for Using Depreciation Schedules

Here are some tips to make the most out of them:

Start Early

Time-Saving: Starting a depreciation schedule as soon as you get new items can save you a lot of time later. It’s easier to keep up from the start than to catch up later.

Use Examples

Learning Fast: Using examples of depreciation schedules can help you understand how to make and use your schedule faster.

Get the Right Tools

Easy Calculations: Tools like Excel or special software can do the math for you. They make creating and updating the schedule much easier.

Keep It Simple

Avoid Confusion: Keep your schedule simple to avoid getting confused. A clear, easy-to-read schedule is always the best.

Check the Laws

Stay Legal: Different places have different laws about depreciation. Make sure to check the laws in your area to make sure your schedule follows them.

Ask for Help

Expert Advice: If you need help creating or understanding depreciation schedules, feel free to ask an accountant for help.

Regular Updates

Stay Accurate: Keep your schedule updated regularly to make sure it stays accurate.

Educate Your Team

Team Understanding: Make sure your team knows how to read and use the depreciation schedule. This can help everyone make better decisions.

Review Often

Catch Mistakes: Review your schedule often to catch any mistakes. It’s always better to fix mistakes as soon as possible.

Plan Ahead

Future Ready: Use your depreciation schedule to plan for the future.

FAQs

What items can be depreciated?

Items like cars, machines, buildings, furniture, and equipment that have been used for more than a year can be depreciated. Things like land, which doesn’t lose value, cannot be depreciated.

When should I start a Depreciation Schedule?

It’s a good idea to start a Depreciation Schedule as soon as you get a new item that can be depreciated. It will help keep your records accurate from the start.

Can I create a Depreciation Schedule myself?

Yes, you can create a Depreciation Schedule yourself. There are examples and tools like Excel or special software that can help you make and keep track of your schedule.

Do I need an accountant to manage Depreciation Schedules?

While you can manage a Depreciation Schedule yourself, having an accountant can be very helpful. They can make sure your schedule is correct, follows the law, and helps you save on taxes.

How often should I update my Depreciation Schedule?

It’s a good practice to update your Depreciation Schedule at least once a year. But if there are big changes, like buying many new items, you should update it as soon as possible.

What is salvage value?

Salvage value is the amount you think an item will be worth at the end of its use. It’s used to help calculate depreciation.

What if I correct my Depreciation Schedule?

If you make a mistake, it’s best to fix it as soon as you can. Ask an accountant for help to make sure it’s fixed correctly.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.