Anything You Need to Know about Deposit Slip

Are you looking for a deposit slip template? We have a lot of types of it for you. We also have related information about it to help you make up your mind which template you need.

About Deposit Slip

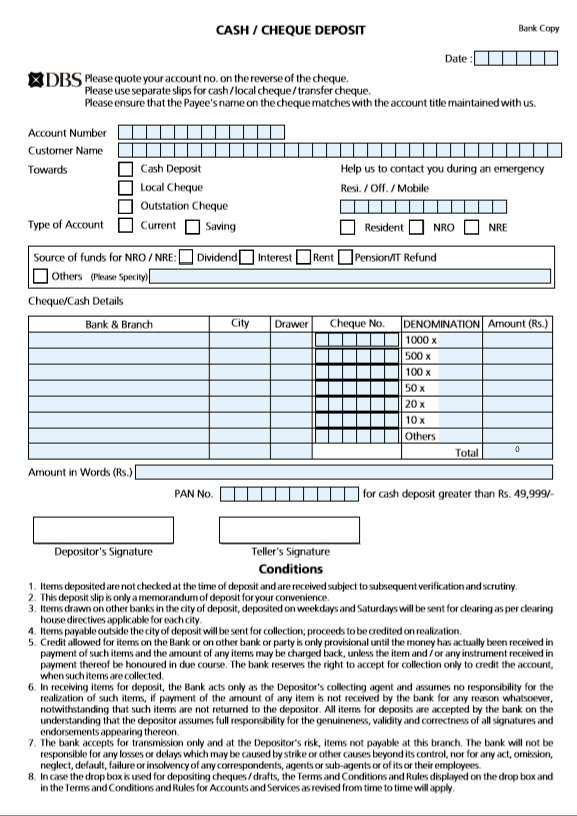

A deposit slip is commonly found in the bank. If you are familiar with a sample of the deposit, you will recognize that it is only a small form or document. It is used when you want to deposit money into a certain bank account. A template of bank deposit slip is a printed slip of paper issued by a bank to its clients or account holders.

A template of bank deposit slip is a piece of paper issued by a bank to its account holders or clients. The paper has relevant information related to the client’s money that they want to add to a certain account. Even though many banks have been using ATM machines, many people still find slips useful.

The slip size is quite small. It is a type of document issued to a depositor. A client can deposit money into someone else’s account or his or her own account. The information you can see in the slip are including name, account number, and type. It also contains information related to the money that the client wants to deposit. Here are the aims of these small documents.

The Aims of Deposit Slip

The most essential aim of this slip is actually to serve as evidence. By using the slip, you can confirm that the money from the depositor is meant for the certain account. It is an authentic proof which provides the depositor with the protection of financial issue. Once the depositor gives this small document to the teller, he or she will process the transaction. After that, the teller will give the slip to the depositor as confirmation proof.

Another aim of deposit slip templates is to make the process of depositing money much easier. Once a person wants to deposit his money, he needs to fill out a bank’s deposit sample. It would already have all the information that is needed. Because of this slip, the teller will not have to ask more questions related to the transaction. So, it will make the overall process quicker.

Depositors can also use the slip to track the record of the money they have deposited. Meanwhile, the copy of the slip can be useful for the back to track the record for every transaction done every day. In other words, the slip provides security and protection for both parties. These slips can also be evidence of payment including if you want to buy something from an online shop. Usually, you need to pay the merchant from a bank deposit. After that, once the payment is done, you need to send the deposit to the merchant as the evidence of payment. It usually contains the information related to the amount of money you already deposited as payment.

The information that includes in the payment is also the date. Once the merchant has checked its own account, it will start processing the good you have ordered. Nowadays, templates of bank deposit slip become quite out of date since ATM cards have become more famous. Because of this reason, people mostly feel that depositing through ATM cards is more comfortable and efficient.

People think by using their ATMs to do the transactions will be quicker. That’s why the use of the deposit slips is decreasing. But, it is quite unfortunate since there are different purposes when you use deposit. Even though quite out of date, those slips are still beneficial and useful. Here are the tips related to deposit you need to know so you understand each purpose.

Tips Related to Deposit Slips

If you go to a bank, you can see that there are various types of deposit slip examples. The types are based on the type of the account you are depositing your money into. The familiar types are those for savings and checking accounts. Here are the tips related to deposit.

You need to check your slip thoroughly before giving it out

The bank usually will confirm the slip by checking the details. That is why you need to be certain that everything you have written on the slip is true and correct. Your money would go into the account once the back process the transaction. The money will go to the account based on what you have written on the slip. Double check is what you should do since it would be quite hard to take the money back if you made a mistake and it turned out that the money you want to deposit goes into someone else’s account.

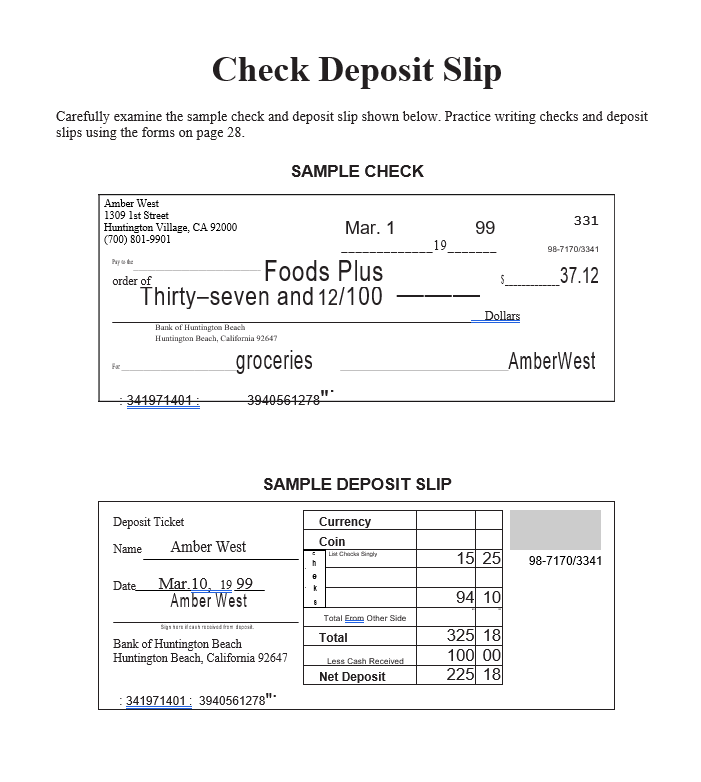

Slips for checking accounts are more complex

When you have to fill out a deposit slip, you have to write the information detail on the check. You also need to write down the amount of the net you want to deposit into the account.

You can use the slip in the bank only

When you want to make a deposit on your own, you can do that in a bank. If you want to try other ways to make deposits, you can do it with your ATM cards or simply send a check to your bank. Slips have been used for so many people. The reason is that is very useful and helpful to use.

How to Fill-Up the Template of Deposit Slip

Here is the step-by-step guide of how you fill out the slips. You should fill it up accurately and neatly.

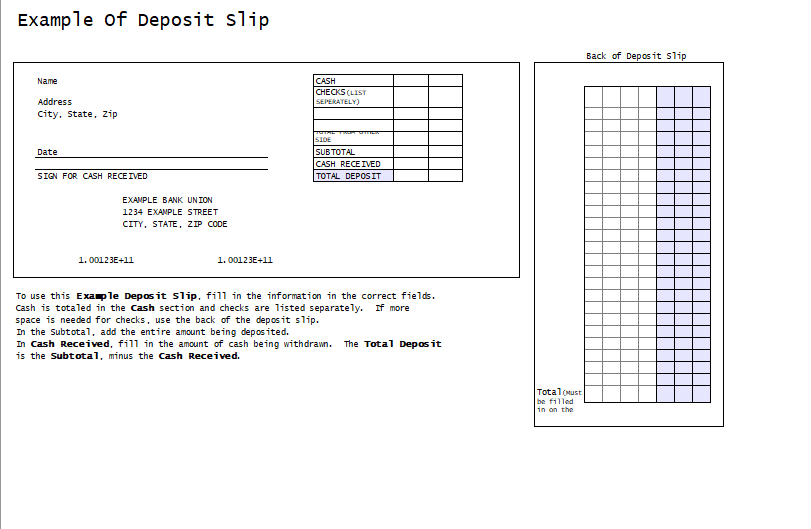

- First, you should write down the personal information written on the slip. That includes the account number and name. If you are using a pre-printed slip from the checkbook of yours, you can skip this step.

- Second, write down the information of the bank branch and the date if required

- Third, write the amount in cash of your deposit and all the amounts in total.

- Finally, sign the slip and give it to your bank to be processed.

In here, we have several types of deposit slip template. You can download the most suitable slip for your need. We hope that the tips can be useful. Good luck!

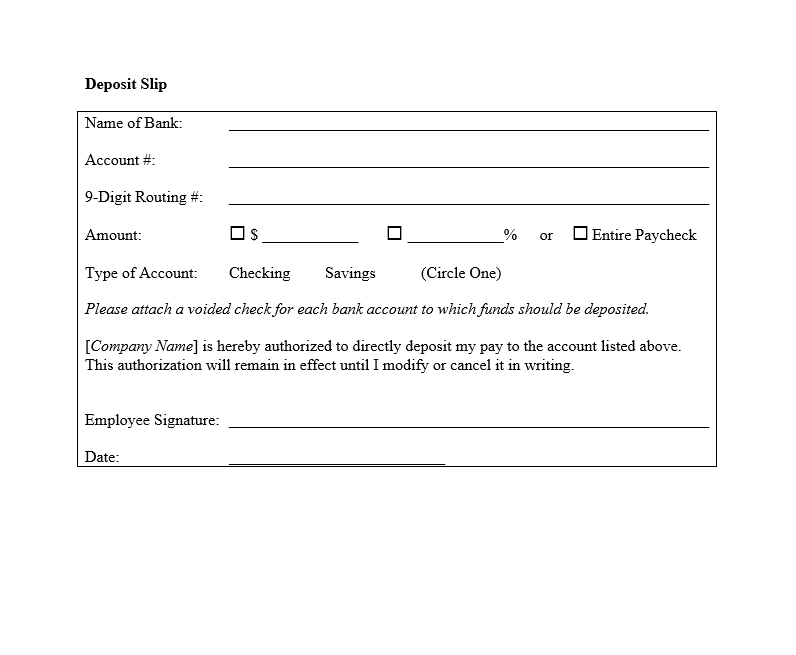

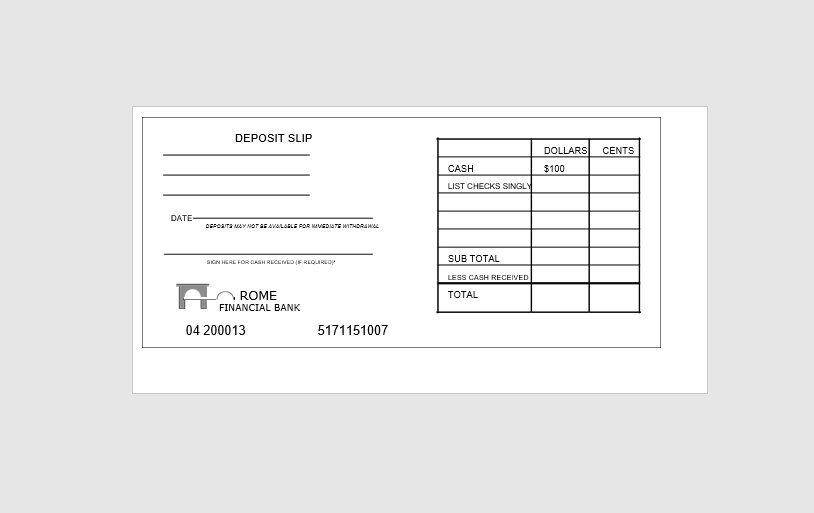

Deposit Slip

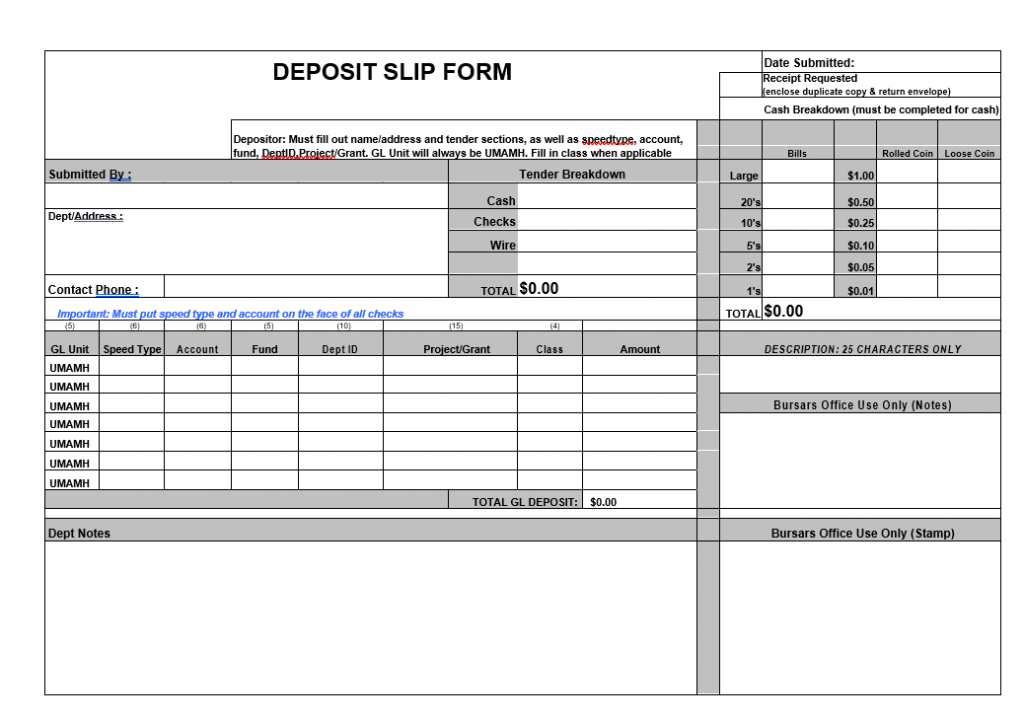

Deposit Slip Form

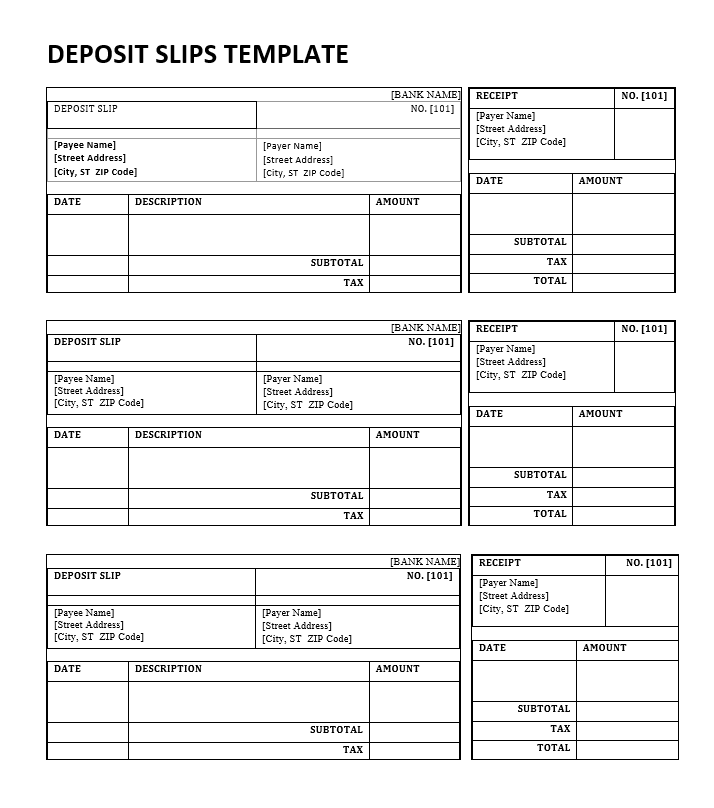

Deposit slip template

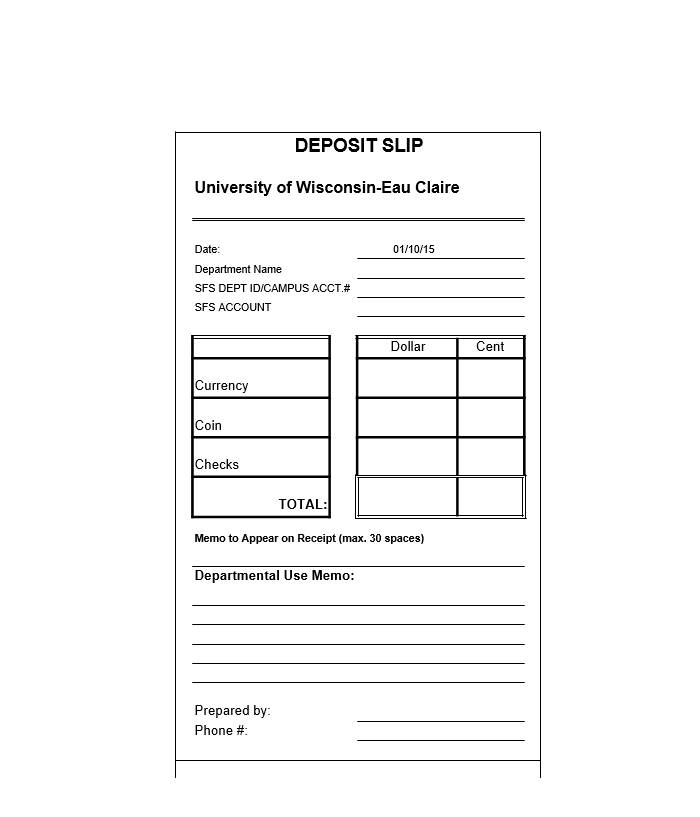

Deposit slip template word

Deposit ticket

Example of deposit slip

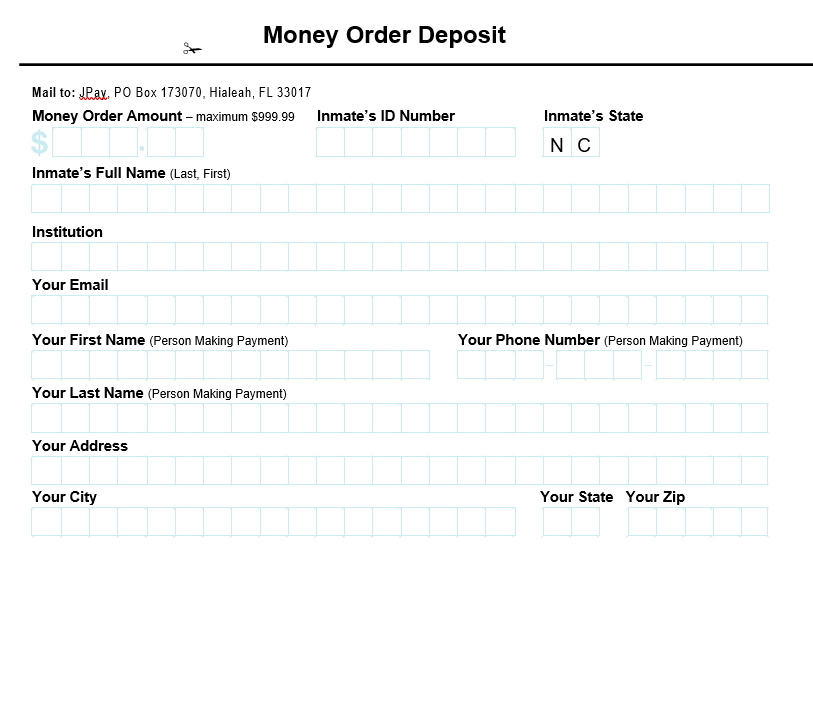

Money order deposit

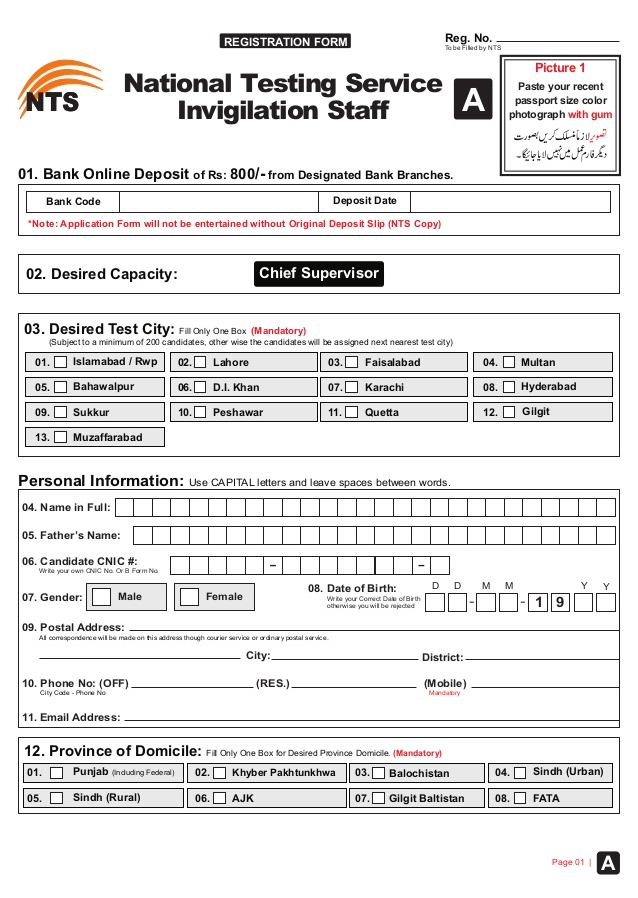

NTS registration form and bank deposit slip

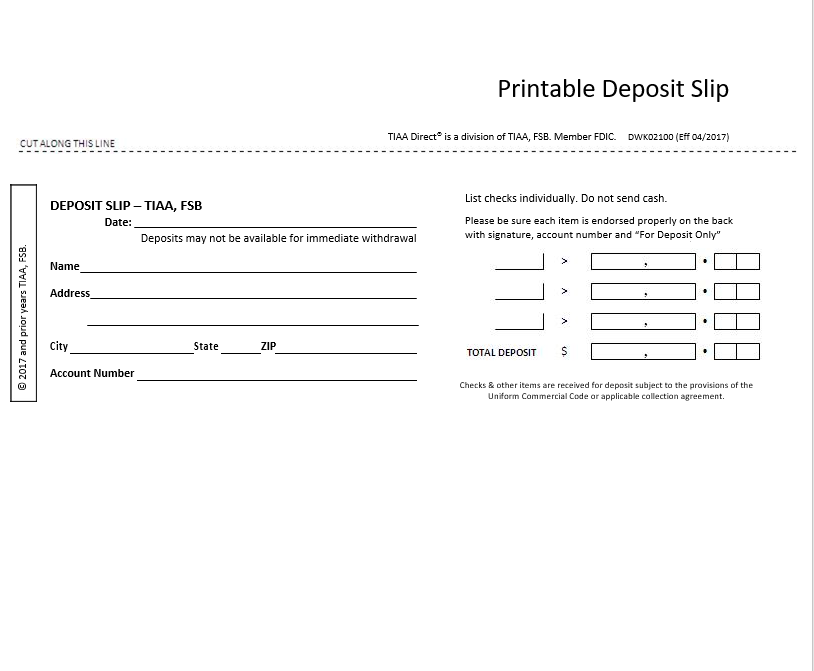

printable deposit slip

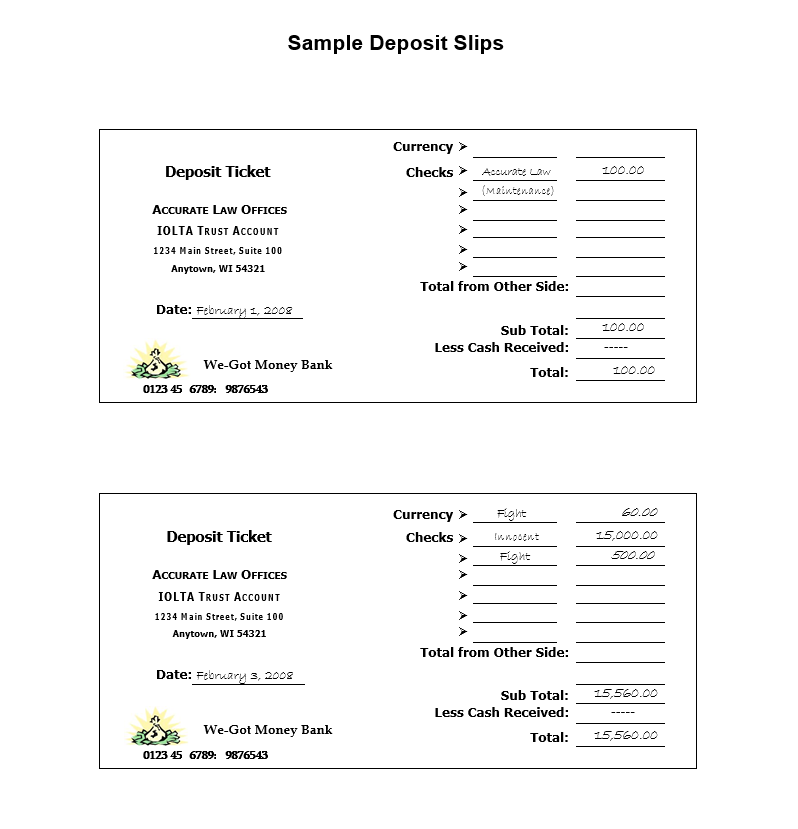

sample deposit slips

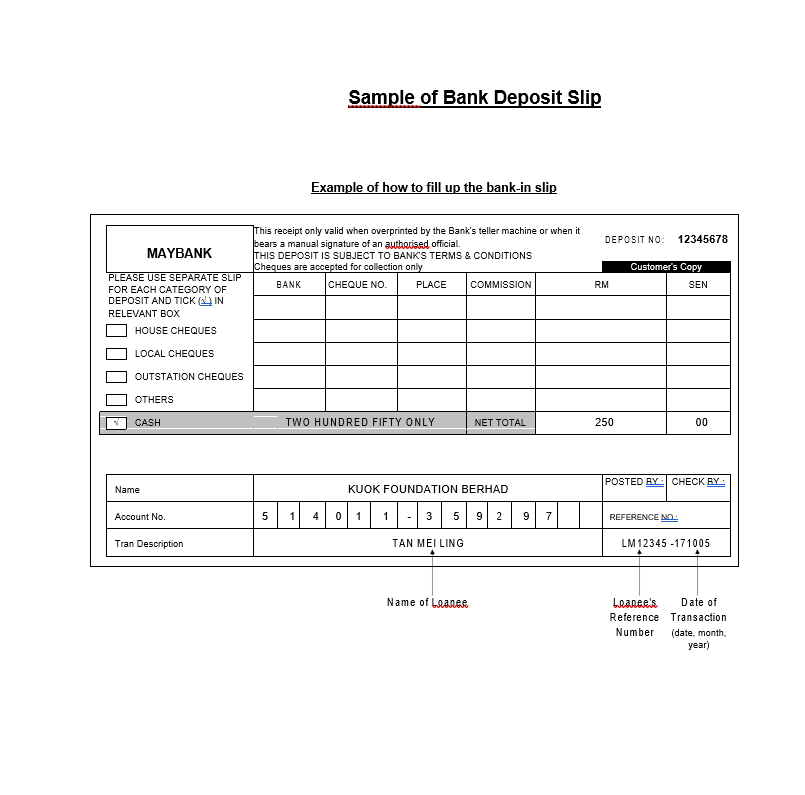

sample of bank deposit slip

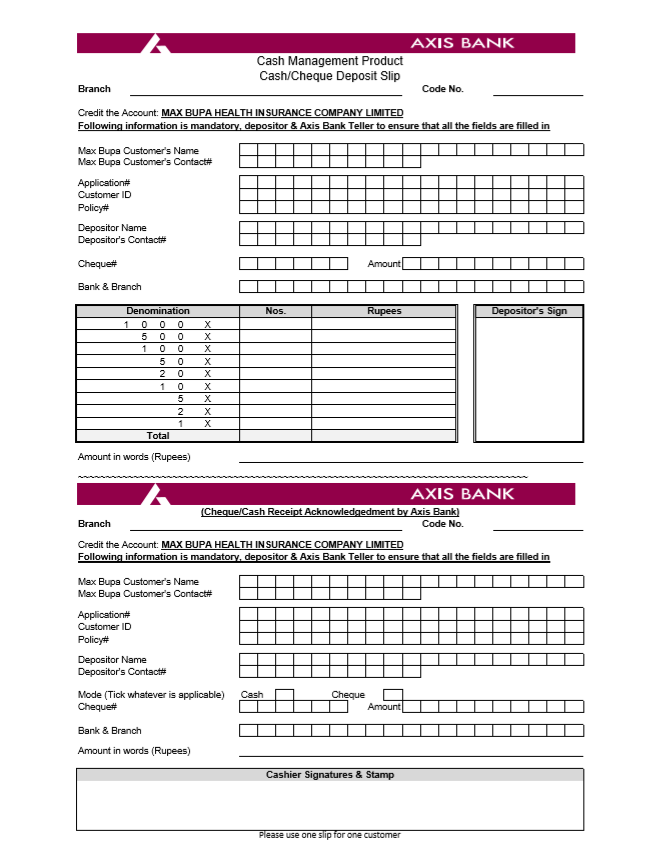

axis bank deposit slip

cash deposit slip

check deposit slip

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.