Why You Should Have Good Credit Score

As we may know, credit plays a great role in our everyday life. Most people depend on credit in order to support their life, work, and business. Not only for businessman and professionals, but students also depend on credit score to support their study and education. Knowing such the important things, one should maintain and keep a good credit score in their life. People will be in trouble if they do not maintain their credit rating because some things are only granted if they have a good credit score.

Why Good Credit Score Matter?

It is important to have a good credit score because it will make your life easier. A good credit score means that you are a trustworthy person, which also means you are a diligent person in case of paying bills. You never late paying your bills and obey all the terms and conditions given by your credit score. There are some things you can get easier when you have a good credit score.

Job Opportunities

You can easily get a job if you have a good credit history. If you ever ask why and what the reason, the simple answer is that most companies like to hire people with strong credit history because it means they can be trusted and can be relied on. Before hiring any employees, the employers will most likely run credit checks on all their applicants. The one with good credit score will be on top of their priorities.

Insurance

Insurance agents and companies will check your credit history in order to determine what rates you are ‘worthy’. It applies to life insurance, auto insurance, and homeowner insurance. Having a bad credit history will prevent you from getting a good insurance rate.

Getting a loan

You will be troubled in getting a loan if you do not have a good credit score. Say you want to get a loan from a bank with a bad credit score. The bank will not give you the loan you need because they think “this person rarely pays his bill, they will do the same if I give him the loan”.

How to Maintain A Good Credit Score?

You can search through credit score charts online to know the calculation of your credit history. The charts contain the elements to calculate your credit score. One thing you must do to keep your credit score in a good point is by paying your bills on time.

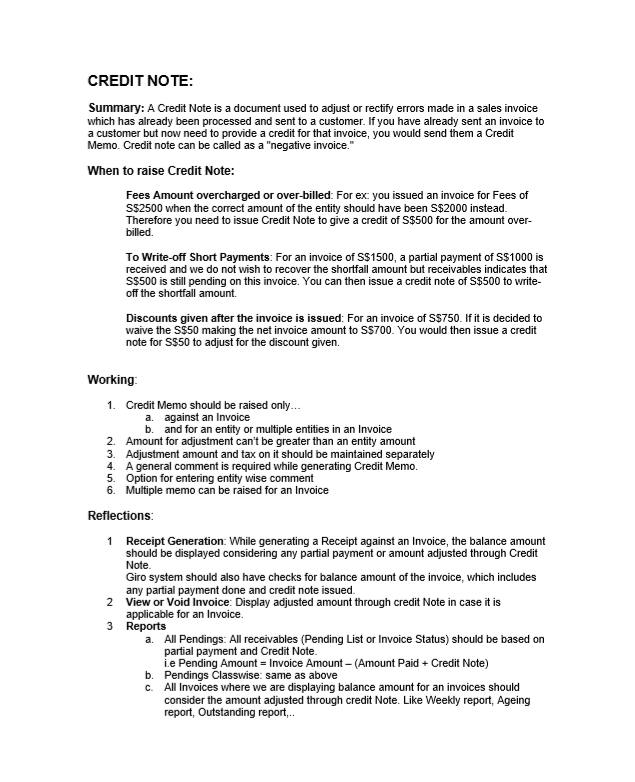

The Benefits of credit score template

In the event that the mortgage is usually repaid completely, the organization owner offers probably increased their particular romantic relationship with all the lender, and this has increased the business credit or perhaps credit times score, that makes it simpler to come back intended for extra financing. It’s feasible to post an software for a brief personal bank loan. Finding an extended period personal bank loan is particularly hard as a consequence of the rigid circumstances and needs from the financial mortgage and also the requirements which can be required by financing company.

As a result, just in case you have dropped a great payment, consider contacting the lender and find out if they will can aid you. Mortgage repayments are a common type of amortized loans. You have also wanted they create all the statements to get each every transaction that you simply engaged in throughout the entire life in the use of that credit score cards.

Purchasing the best utilized car bank loan deal may be a long-shot to a few, especially if you will be neck-deep under the sea and inverted upon your present auto mortgage loan. Intended for the acquiring business to convey that it lately had a great agreement upon you, it need to show the way that turned away going to do healthy for you. It’s accurate, you authorized an contract by way of the credit card firm, however, you did not indication 1 together with the businesses that bought the debt coming from the bank card company.

Composing an inspiration notice will help you generate a powerful declaration for the income and will yet also produce your program stick away from the rest. The notice must become formal, nevertheless in the precise same period that this needs to be convincing enough to operate the prefer.

Once trying to get a house mortgage, you will certainly be requested a speedy page to make an impression on the bank that you have been trusty and you might be capable to pay the loan. A good credit score refusal notification can be delivered from 1 particular get together to an additional during the course of a business, in order to notify the receiver that his demand for credit was refused. The awfully first collection page you obtain from an organization agency need to have a good affirmation see.

Many credit inspections performed in a rapid period can easily decrease the credit score. You’ll be astonished at what exactly they will are in a position to help to make. non-etheless, in case your needs explain you’re looking for an even more costly car, it might be better to take a look at an alternative technique because opposed to getting.

A great additional approach to take is to find expert support, but end up being a little bit careful as much unscrupulous people target this kind of borrowers which might be desperate to prevent dropping their very own home.

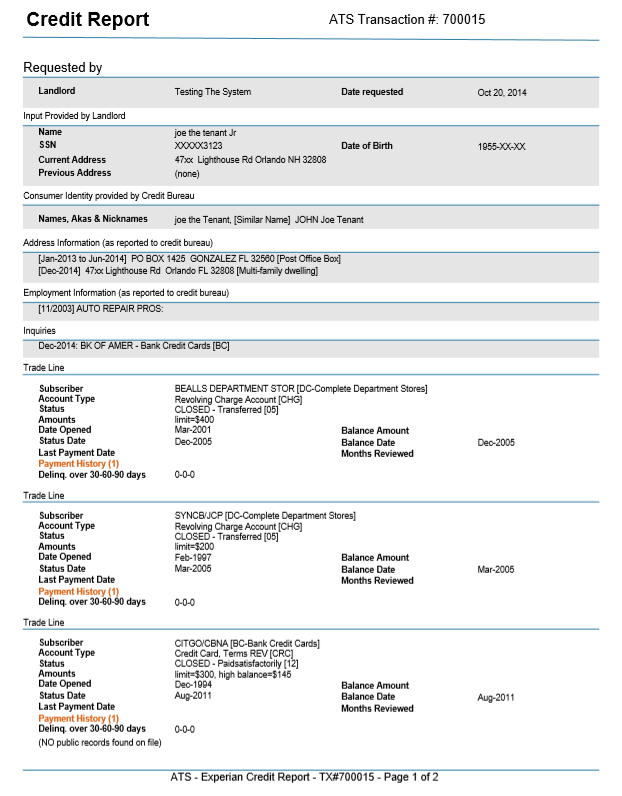

Credit Score

Balance Credit Report

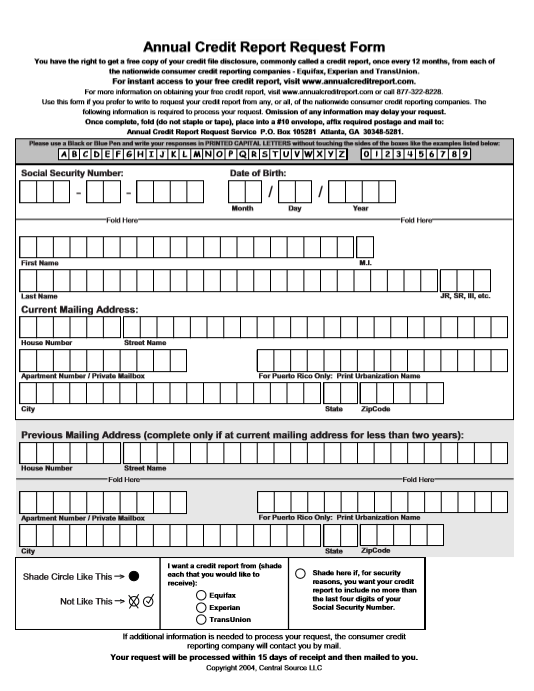

Annual Credit Report Request Form

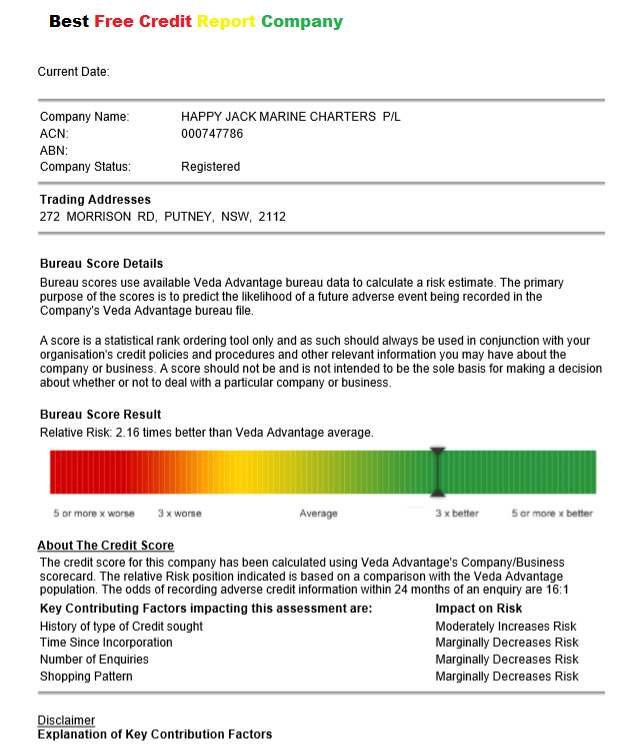

Best Free Credit Report Company

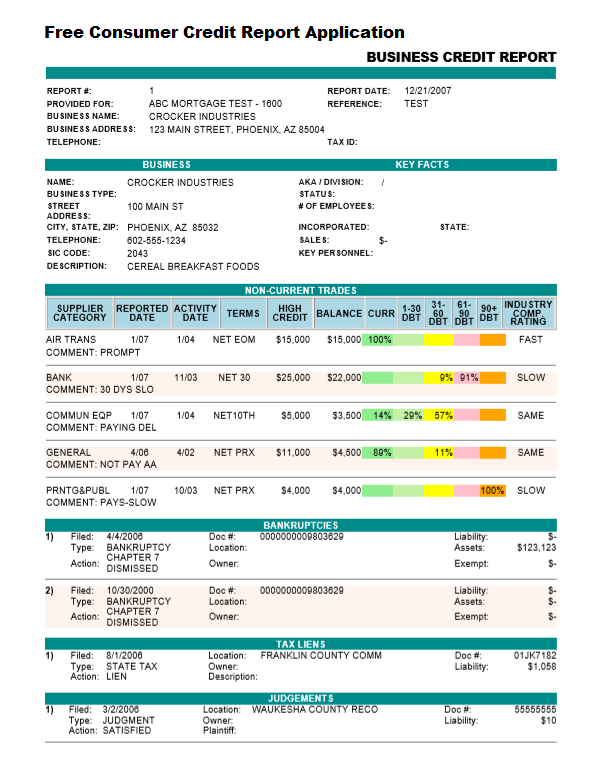

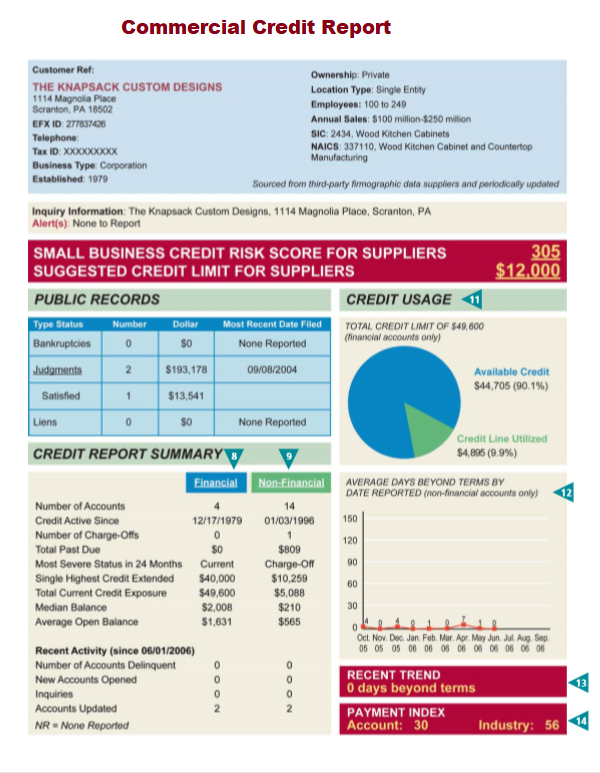

Commercial Credit Report

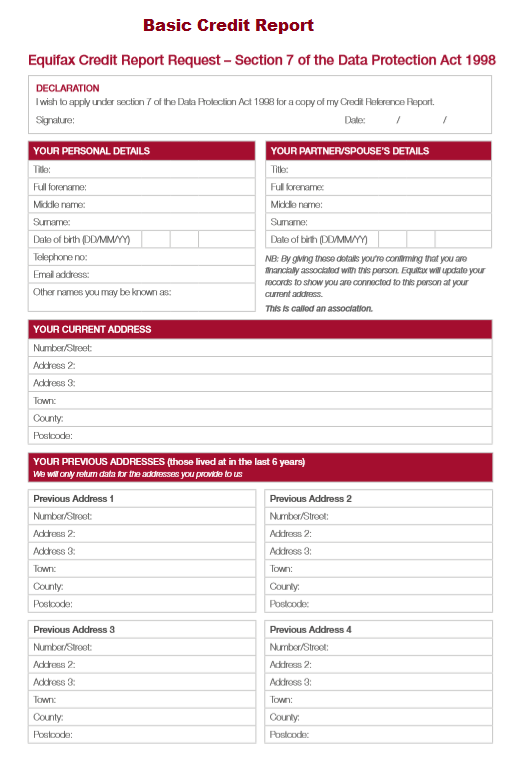

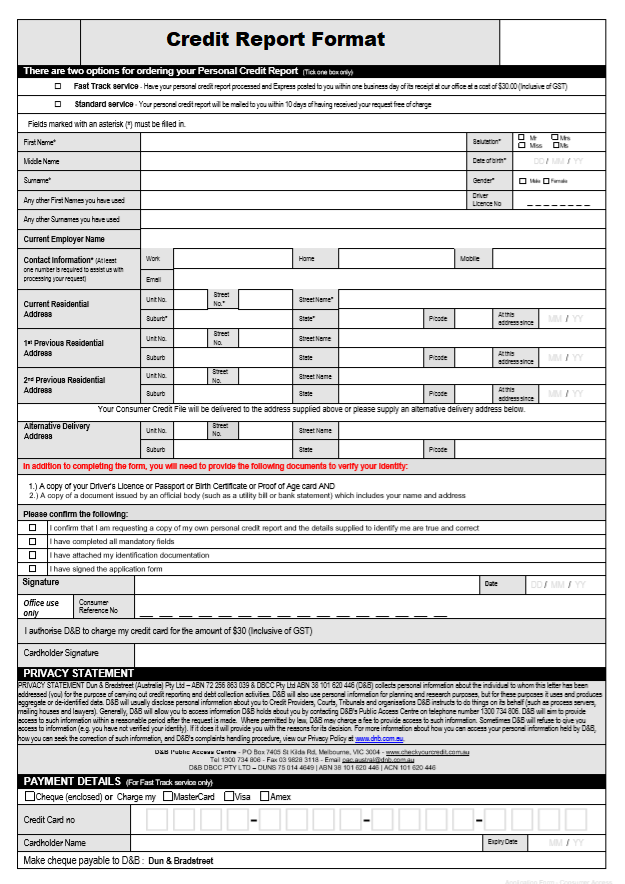

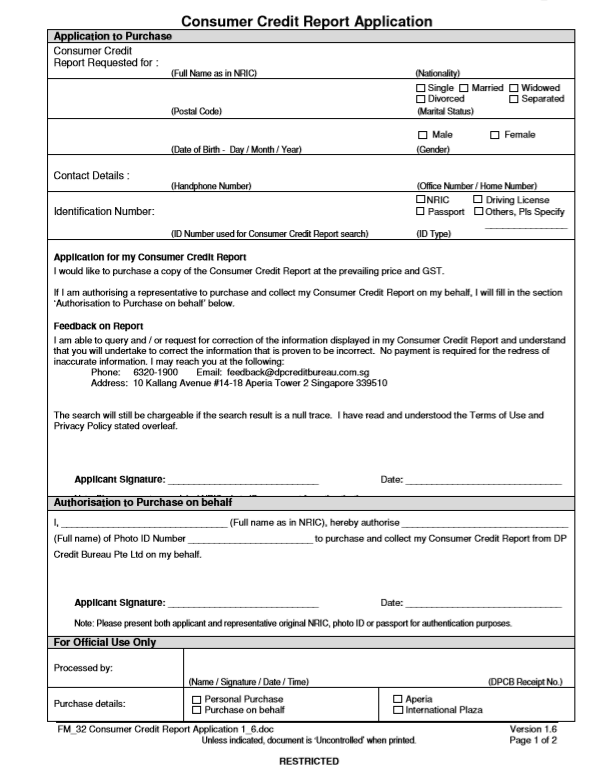

Credit Report Application Form

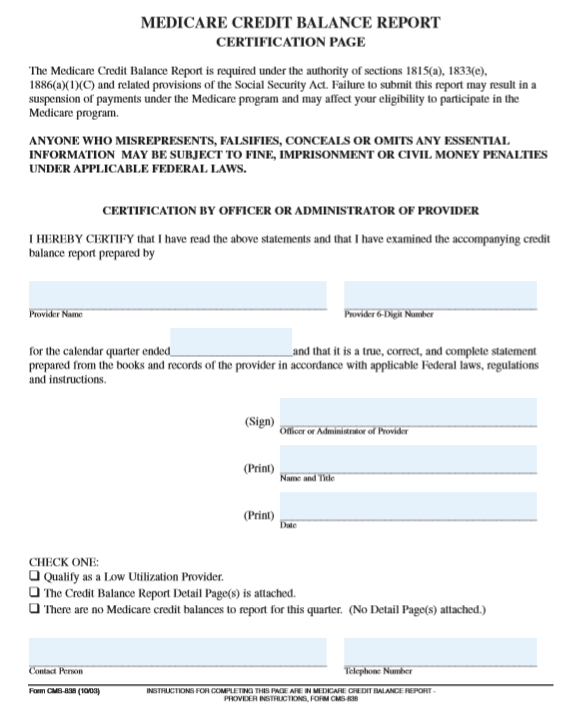

Medicare Credit Balance Report Certification Page

Credit Report Format

Credit Report PDF

Free Business Credit Industry Report

Free Consumer Credit Report Application

Free Consumer Credit Report Application

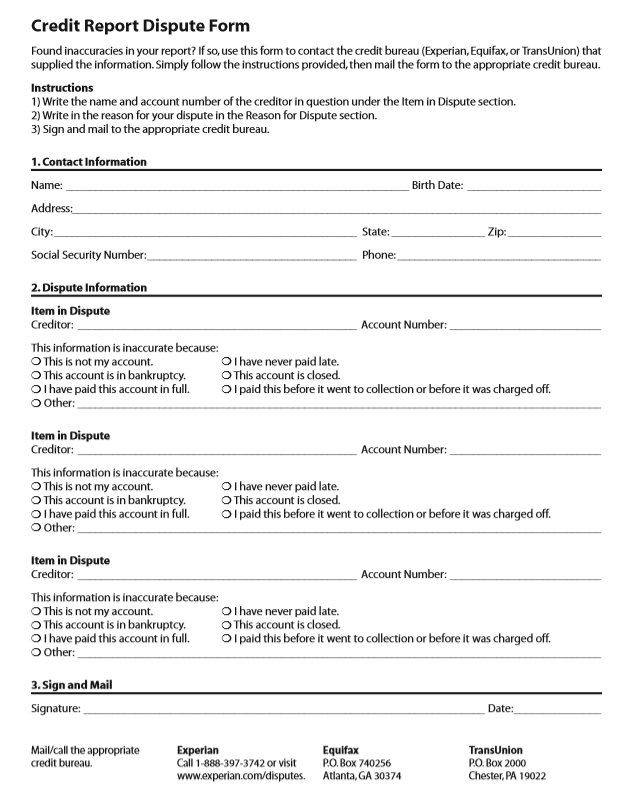

Credit Report Dispute Form

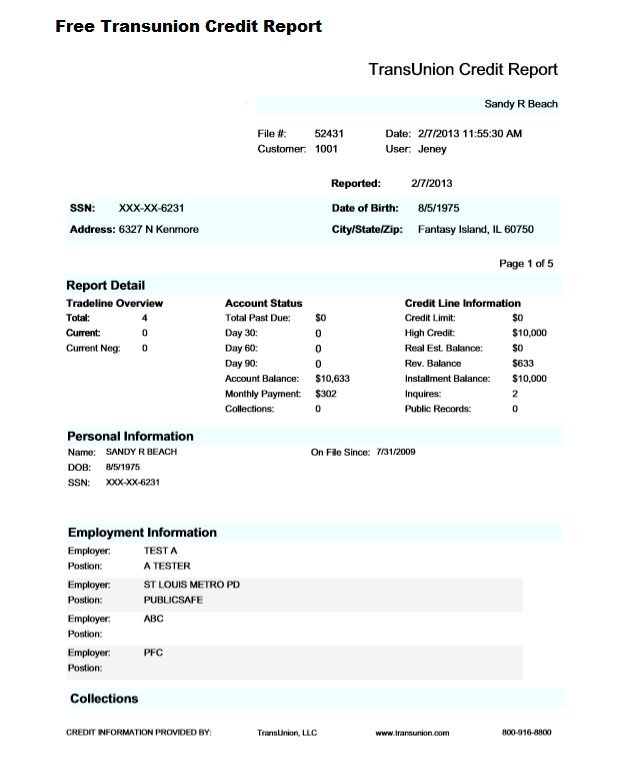

Free Transunion Credit Report

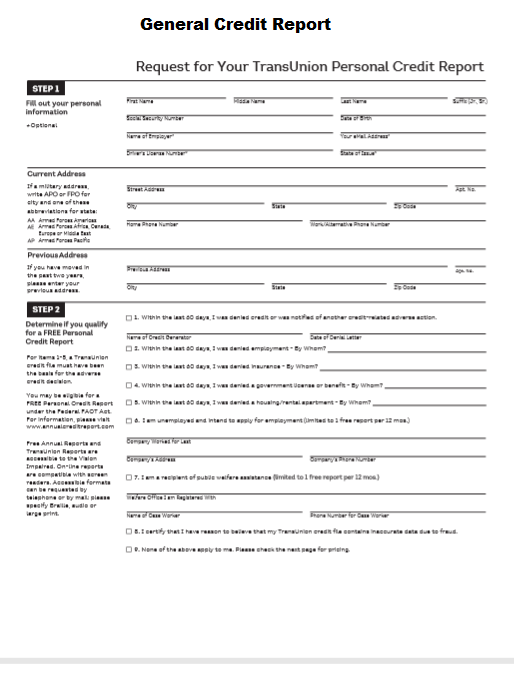

General Credit Report

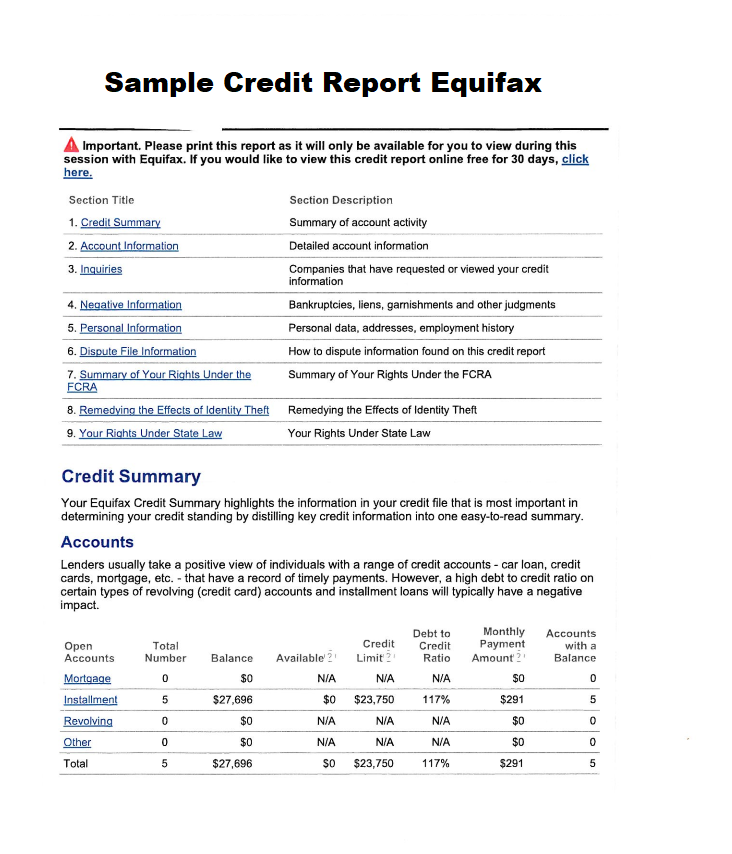

sample credit report equifax

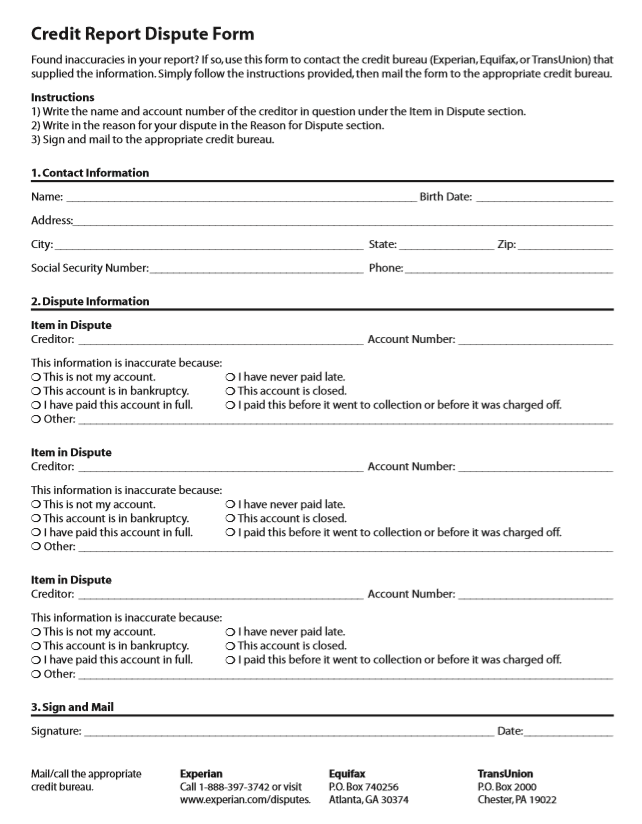

Credit report dispute form

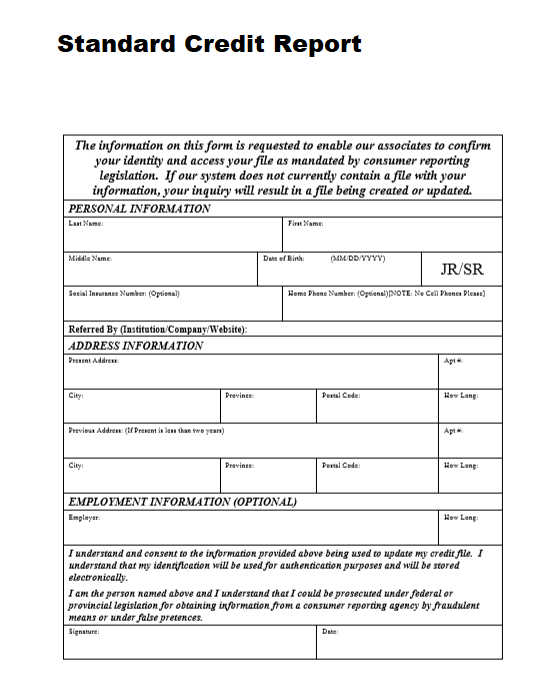

Standard Credit Report

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.