Cohabitation agreement is worth to be considered if you are one of those many people who is living together with your partner, but not married yet. Even though it is not a good idea to plan or think about the end of your relationship, ignoring the possibility that you might break up with your partner will not make things any easier if the event happens. Whether you are planning on getting married or not someday, living together with your partner without any cohabitation agreement is pretty risky for both of you.

Just like a prenuptial agreement or also known as a prenup, a cohabitation agreement is also designed to overcome various personal, family, and financial issues that you will probably face when you and your partner break up. But this kind of agreement can be limited as vast as you and your partner choose. But it usually covers essential aspects of your financial and personal lives. For you who want to know more about cohabitation agreements, here are the details for you.

What is Cohabitation Agreement?

Cohabitation agreements is a contract designed for people who are living together in the same household but are not married yet. This agreement is not needed if you are living together with a roommate. In other words, a cohabitation is addressed for couples. Just like all types of contracts, cohabitation also have to fulfill several basic legal requirements so that a court is able to enforce the terms. Because the basic legal requirements are different and not explicitly clear in every country, you need to talk to a lawyer in the area where you live if you consider making the agreement.

Basic Requirements

While a big majority of countries allow a cohabitation, there are some other countries where their legality is not really clear about this kind of agreement. In the countries which recognize or allow a cohabitation agreement, the legal requirements can be different as well as the cohabitation agreement form, depends on where you live and your circumstances. So, you can look for the cohabitation agreement template that is regulated in your country where you live. However, the basic requirements are mostly the same despite your location.

Consideration

Unlike a prenuptial agreement that is usually regulated with laws which are specifically for it, a court sees a cohabitation agreement as a legal contract. In order to be enforceable legally, all kinds of contracts have to contain consideration or value exchange between the agreeing parties. For instance, in a car sale, the seller agrees to provide the car and the buyer agrees to provide money as the payment. Both of the parties agree to give a valuable thing to each other as consideration.

Determining or deciding what the consideration is in a cohabitation agreement can be a little bit tricky. Generally, the laws forbid any types of contracts for sexual favors. But, it can be understood that a couple who are living together is most likely to have sexual intercourse, you cannot have a cohabitation which exchanges residences, money, or any other valuable things for sex acts. However, you are still able to share expenses in exchange for a companionship or other consideration forms which are legally allowed in the area where you live.

Fair and Freely Entered

There is no one who can force you legally to sign a contract. In order to make a court able to enforce the terms of your cohabitation, you have to be able to show that you and your partner agree to choose to sign a cohabitation agreement with your own will without being forced, influenced, tricked, or anything.

In order to do this, you and your partner should have enough time to review and discuss the terms and consideration of the cohabitation agreement before both of you sign anything. It is suggested that each partner should have their own lawyer to advise and guide them in the making process of the agreement, even though it is not necessarily required by the law.

Knowing

For a court to find that your cohabitation agreement is enforceable and fair, it must be ensured that both you and your partner enter into the agreement with full understanding and knowledge about what you are agreeing to. In order to fulfill this requirement, each partner usually should express to the other what exactly they are getting into. It means, for instance, that you have to figure out about all of your financial aspects. You will likely have to create and include financial disclosures in details as a part of the agreement. Or at least, disclose to each other about your financial situation in full details before signing the agreement.

Revealing your assets, incomes, debts, obligations, and other important financial and personal lives of yours is a part of this process. And it will be better if it is done in writing. Some countries allow you to reveal this type of disclosure. But if you decide to do so, you have to make it clear that you are willing to reveal any disclosures by saying so in writing.

Benefits of Using a Cohabitation Agreement

While not always considered romantic, It can provide numerous benefits for couples. Here is why it can be a good idea:

- Protection of Individual Assets: It can specify who owns what assets, protecting individual property rights. It can be especially important in a breakup, as it can assist in avoiding disputes over who owns what.

- Financial Clarity: It can trace how the couple will handle financial matters while living together, such as who pays for what, how shared expenses are divided, and how savings and investments are managed. It can help prevent misunderstandings and conflicts over money.

- Planning for the Future: It can also include provisions for what happens if the relationship ends, whether due to a breakup or the death of one partner. It can provide peace of mind and security for both partners.

- Legal Recognition: While not the same as a marriage, It can provide some legal recognition for a couple. It can be important for matters such as hospital visitation rights or making medical decisions for a partner.

- Flexibility: It can be as broad or narrow as the couple wants. It can cover everything from property rights and financial matters to pet custody and household chores.

Financial Disclosure in Cohabitation Agreements

Financial disclosure is a critical aspect of cohabitation agreements. This transparency is essential for several reasons:

- Informed Decision Making: Full financial disclosure allows both parties to make informed decisions about the terms of the cohabitation agreement. It provides a clear picture of each party’s financial status, including assets, income, debts, and financial obligations. This knowledge can influence decisions about dividing expenses, handling joint purchases, and managing financial responsibilities.

- Fairness: Financial disclosure promotes fairness in the agreement. It ensures that both parties agree with a complete understanding of each other’s financial situation. It can help prevent disputes and misunderstandings down the line.

- Legal Requirements: In many jurisdictions, full financial disclosure is required for cohabitation agreements. Failure to disclose all relevant financial statements can challenge or invalidate the agreement in court.

It comes to what kind of financial information should be disclosed. It typically includes assets (both tangible and intangible), income sources, debts, and financial obligations. It can encompass everything from salaries, business income, and investment returns to property, savings accounts, and retirement funds.

Handling financial disclosures in a cohabitation agreement can be a sensitive process. It is recommended to consult with their lawyer to ensure they fully understand their rights and responsibilities. Having these disclosures documented in writing as part of the agreement to provide a clear record is also beneficial.

Example of Cohabitation Agreement Template

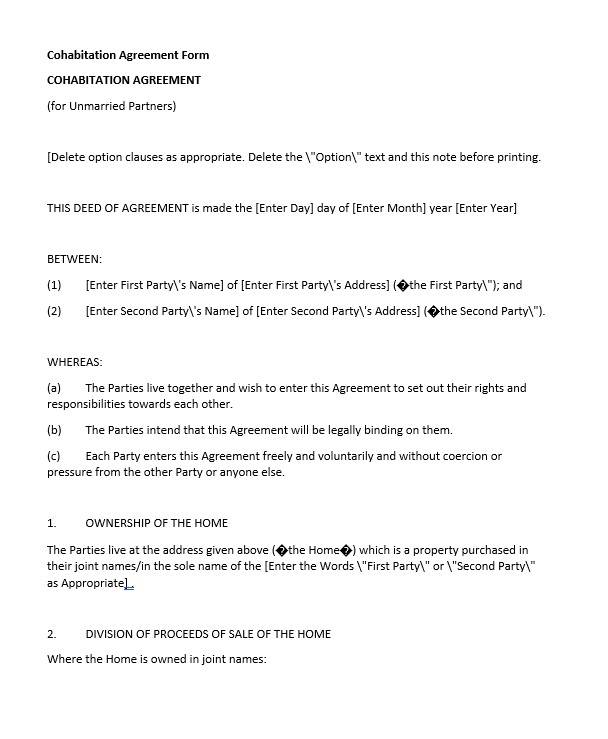

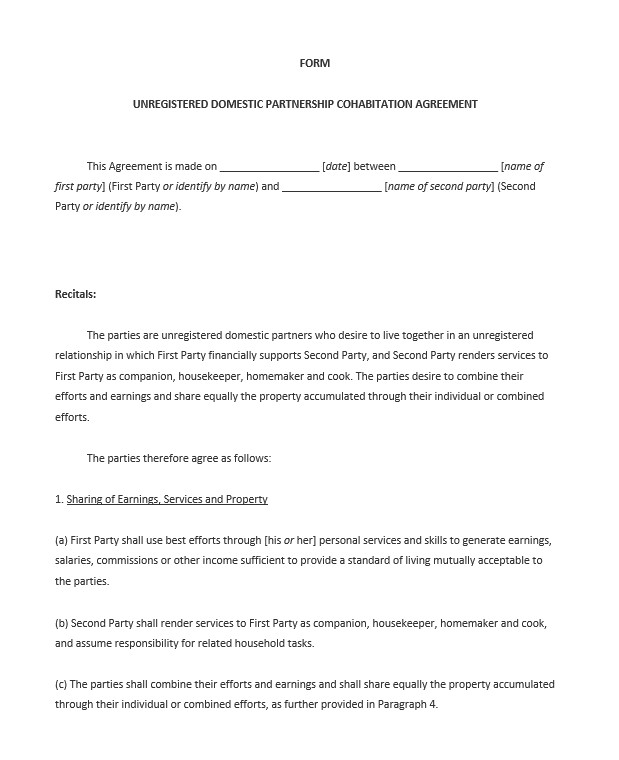

Here are some expanded points on the different types of cohabitation agreements:

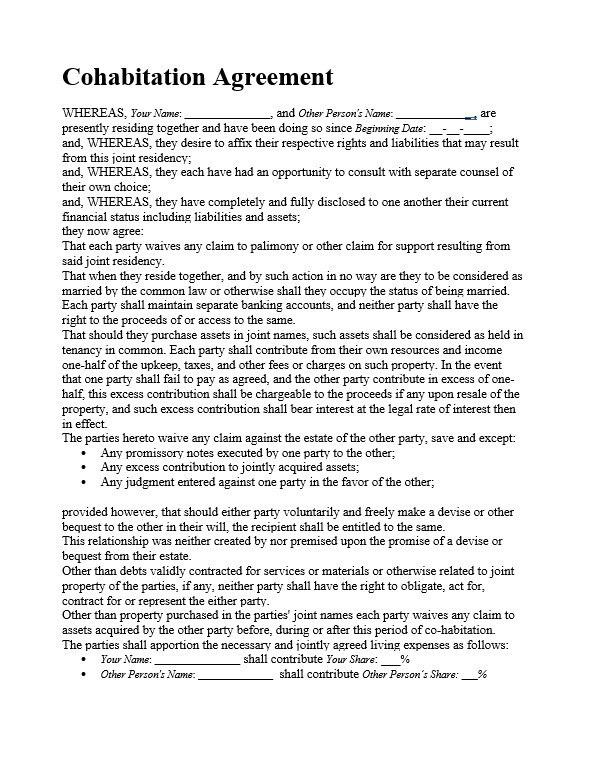

Simple Cohabitation Agreement Template

This basic template covers the essential aspects of a cohabitation agreement. It typically includes sections for property division, financial arrangements, and dispute resolution. This template type suits couples with straightforward financial situations who want a simple agreement.

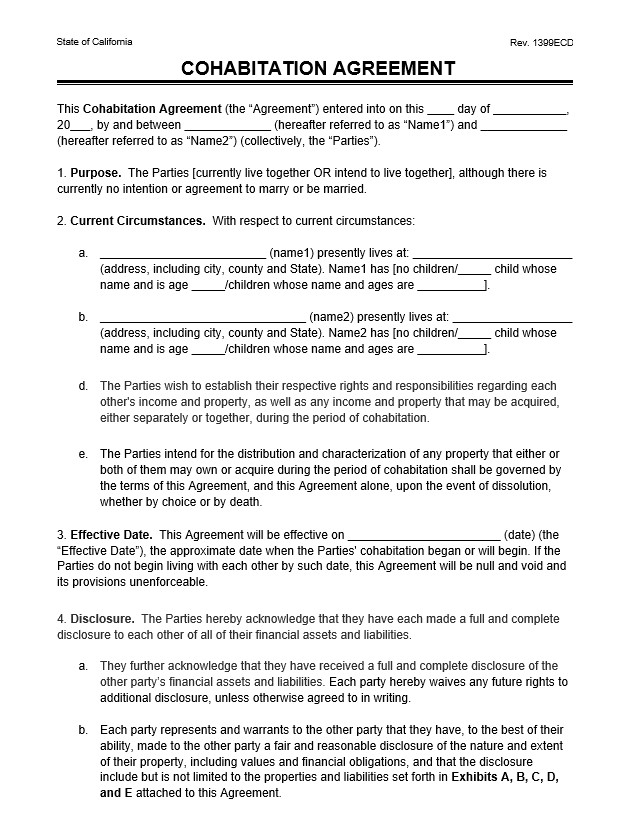

Cohabitation Form PDF

It is a downloadable PDF form couples can complete creating their cohabitation agreement. It usually includes fillable fields for all the necessary information, making it easy for couples to complete.

Cohabitation Agreement for Married Couples

While cohabitation agreements are typically used by couples who live together but are not married, some couples may also choose to use a cohabitation agreement. It can be particularly useful for couples who lived together before getting married and want to continue the financial arrangements they had in place during their cohabitation.

Cohabitation Property Agreement Template

This type of template focuses on how the couple’s property will be divided during a breakup. It can cover real property (like houses and land) and personal property (like furniture and vehicles).

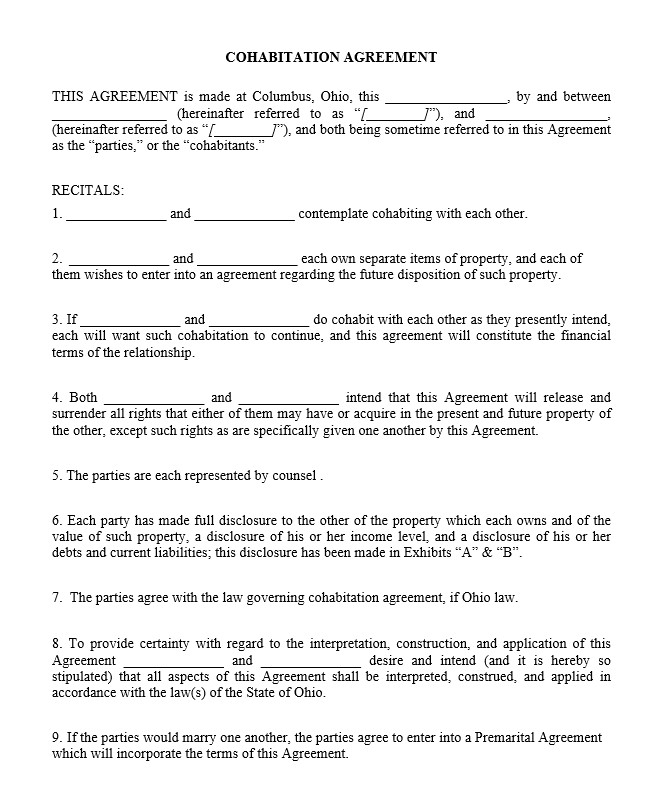

Cohabitation Agreements in Different Jurisdictions

The laws governing cohabitation agreements can vary by jurisdiction. Therefore, consulting with a legal professional in your area is important to ensure your cohabitation agreement is legally binding and meets all local legal requirements.

Here are some jurisdictions where cohabitation agreements are commonly used:

- Cohabitation Agreements Oregon

- Ontario

- BC

- Alberta

- California

- South Africa

- UK (United Kingdom)

- Scotland

- Texas

- and Florida

The laws and requirements for cohabitation agreements may differ in each jurisdiction. Therefore, seeking local legal advice is important when drafting a cohabitation agreement.

Cohabitation Agreement Forms

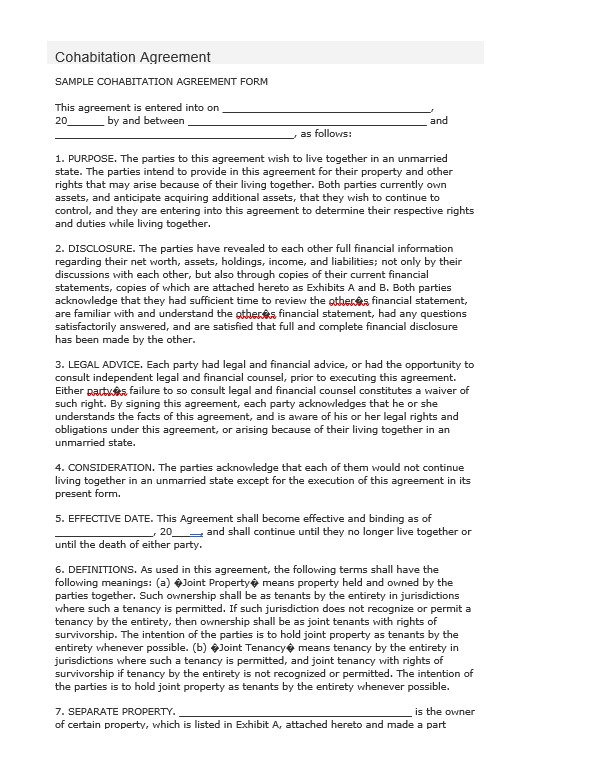

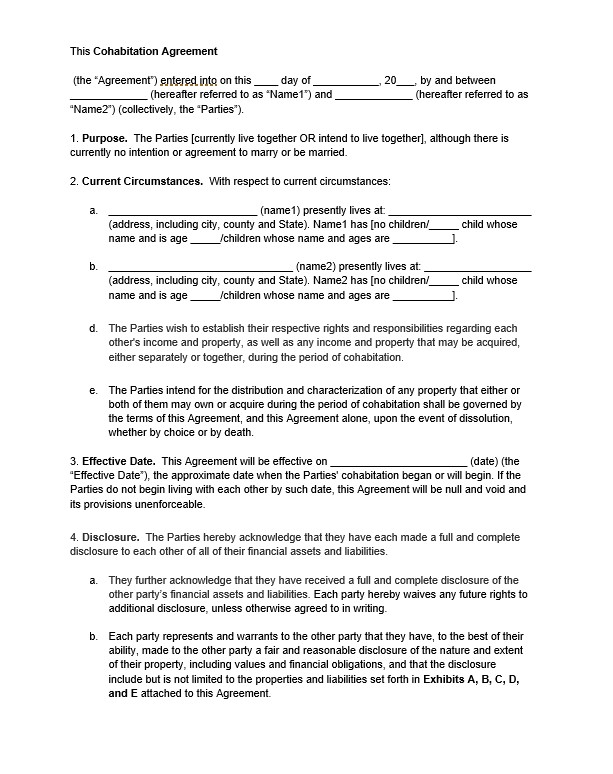

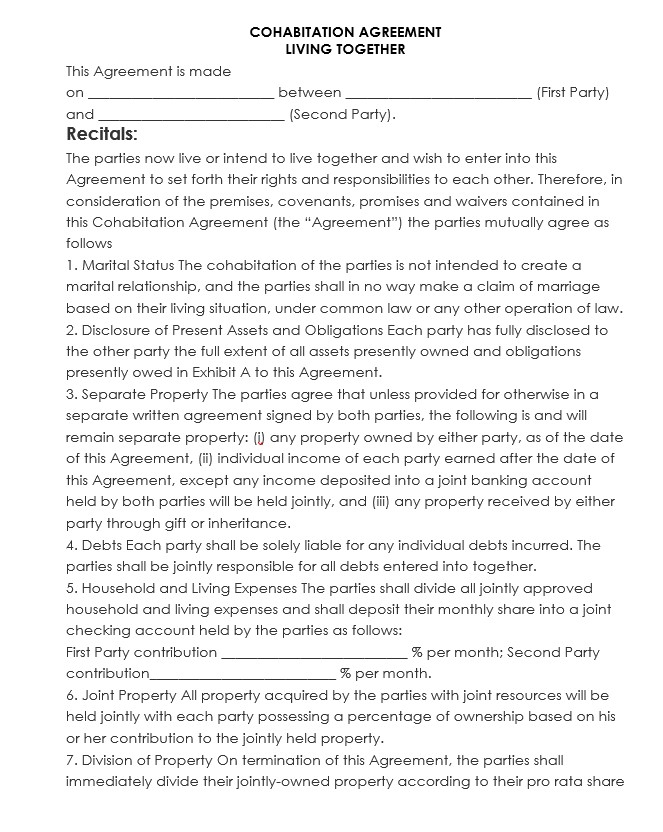

Sample Cohabitation Agreement

It is a sample agreement that couples can use as a guide when creating their cohabitation agreement. It provides an example of what a completed agreement might look like.

Cohabitation Property Agreement

This type of agreement outlines how a cohabiting couple will divide their property if they separate. It can cover real property (like houses and land) and personal property (like furniture and vehicles).

These templates can be a helpful starting point. Getting legal advice when creating a cohabitation agreement is always a good idea. It can help ensure the agreement is legally sound and accurately reflects your intentions.

What Impact Does Cohabitation Have on Debts?

Cohabitation can have significant implications on debts, depending on the agreement between the parties involved and the laws in your jurisdiction. Here are some key points to consider:

- Shared Debts: If you and your partner agree to take on a debt together, such as a joint credit card or a mortgage, you are typically responsible for repaying that debt. If one person fails to make the necessary payments, the other may be held responsible.

- Individual Debts: Generally, an individual’s debts remain their responsibility when they enter a cohabitation arrangement. If your partner has personal debts before moving in with you, you are usually not responsible for these debts. However, if you co-sign a loan or credit card with your partner, you could be liable for these debts.

- Debt Accumulated During Cohabitation: The responsibility for debts accumulated during cohabitation can be complex. It often depends on who incurred the debt and for what purpose. If the debt was incurred for the benefit of both parties (for example, household items or improvements to the shared home), both parties might be responsible for it.

- Cohabitation Agreement: It can specify how debts will be handled during the cohabitation and in the event of a breakup. It can provide clarity and prevent disputes down the line.

It is important to have open and honest discussions about debts and financial responsibilities when entering into a cohabitation arrangement. It is also advisable to seek legal advice to understand the potential implications fully.

Cohabitation Agreement VS Prenuptial Agreement

A prenuptial agreement is a contract that is made by a couple before they are getting married with the purpose of governing what will happen if and when the marriage dissolves. A prenuptial agreement is similar to a cohabitation agreement in several things. But still, there are some significant differences between these two kinds of agreements.

Specifically, most countries have specific laws or regulations which apply to a prenuptial agreement. On the other hand, cohabitations agreements are regulated by general laws for a contract.

If you want to make a prenuptial agreement by using a cohabitation agreement as the basis for your prenuptial agreement, it will be better if you talk to a family law attorney first in the area where you live so that you are able to know the best way to do this.

Getting Legal Advice: The Importance and Process

Therefore, seeking legal advice before entering such an agreement is crucial. Here is why and how:

- Understanding the Legal Requirements: Cohabitation agreements are legal contracts that must meet certain basic legal requirements to be enforceable. A lawyer can help you understand these requirements and ensure your agreement meets them.

- Ensuring Fairness and Free Will: For a cohabitation agreement to be enforceable, it must be entered into freely and fairly by both parties. Each partner should ideally have their lawyer to advise them during this process.

- Full Disclosure: A cohabitation agreement with full understanding and knowledge should be entered. It often requires each partner to disclose their financial situation to the other. A lawyer can guide you through this process and help ensure all disclosures are complete and accurate.

- Drafting the Agreement: While many templates are available for cohabitation agreements, it is often best to have a lawyer draft or review your agreement. It can help ensure the agreement is legally sound and accurately reflects your wishes.

- Future Changes: A lawyer can advise you on what to do if your circumstances change and you need to amend your cohabitation agreement.

It is not necessarily required by law to have a lawyer when creating a cohabitation agreement, and it is highly recommended.

A lawyer can provide valuable advice and guidance, helping to ensure that your agreement is fair, enforceable, and in your best interests.

When is it Suitable to Use a Cohabitation Agreement?

Cohabitation agreements are especially useful when:

- Sharing Expenses: A cohabitation agreement can outline how these costs are divided if a couple shares expenses. It can prevent disputes and ensure a fair distribution of financial responsibilities.

- Asset Protection: If one or both partners have considerable assets, It can help save these assets in the possibility of a breakup. The agreement can determine what happens to these investments and control them from being separated as common property.

- Debt Protection: If one partner has significant debt, It can protect the other from being held responsible for this debt in case of a breakup.

- Property Ownership: If a couple purchases property together, It can determine how this effect is separated during a breakup. It can prevent disputes and secure a fair division of property.

- Planning for the Future: Even if a couple plans to marry in the future, It can still be beneficial. It can serve as a foundation for a prenuptial agreement and support the partners in preparing for their economic future together.

It is essential to note that agreements’ enforceability and legal conditions can differ relying on the country or region. Therefore, seeking legal advice when considering it is recommended.

Topics to Address in Your Cohabitation Agreement

When drafting a cohabitation agreement, covering all relevant topics is crucial to protect both parties interests. Here are some key areas that should be addressed in a comprehensive cohabitation agreement:

- Financial Arrangements: This includes how bills, rent, and other expenses will be divided. It should also cover how savings and investments will be handled and what happens to these assets if the relationship ends.

- Property Ownership: It should clearly state who owns what property at the start of the cohabitation and how property acquired during the cohabitation will be divided in case of a breakup.

- Debt Responsibility: It is important to clarify who will be responsible for any debts incurred during cohabitation. If the relationship ends, this can prevent one party from being unfairly burdened with the other’s debts.

- Household Responsibilities: It can also outline who is responsible for certain household chores or maintenance tasks. It can help prevent disagreements down the line.

- Dispute Resolution: Including a clause about resolving disputes over the agreement is a good idea. It could involve mediation or arbitration, for example.

- Ending the Agreement: It should specify under what conditions it can be ended and the process for ending it.

Every cohabitation agreement will be unique to the couple it involves. It is important to consider your specific circumstances and needs when drafting the agreement. It is also highly recommended to seek legal advice to ensure the agreement is fair and legally sound.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.