Get free broker of record letter templates and start switching insurance brokers today. Expert tips included for an easy process.

Looking for a broker of record letter template to simplify switching insurance brokers? You’re in the right place. A Broker of Record (BOR) letter streamlines the process, giving you control over your insurance relationships. In this guide, we’ll cover everything you need to know about BOR letters, including templates, guidelines, and best practices .

So What Exactly Is a Broker of Record Letter?

Think of it like your official form for switching insurance reps. It tells your insurance company, “This is my new broker in charge.”

It’s not super fancy, just a clear letter with all the important info, like your name, policy numbers, and new broker’s contact details.

Why Would You Need a Broker of Record Letter?

Let’s explore why you might need a Broker of Record (BOR) letter in the world of insurance:

A Better Deal:

Maybe you found a broker with way cheaper prices, covers more of what you need, or just explains things clearly. A BOR letter makes the switch official.

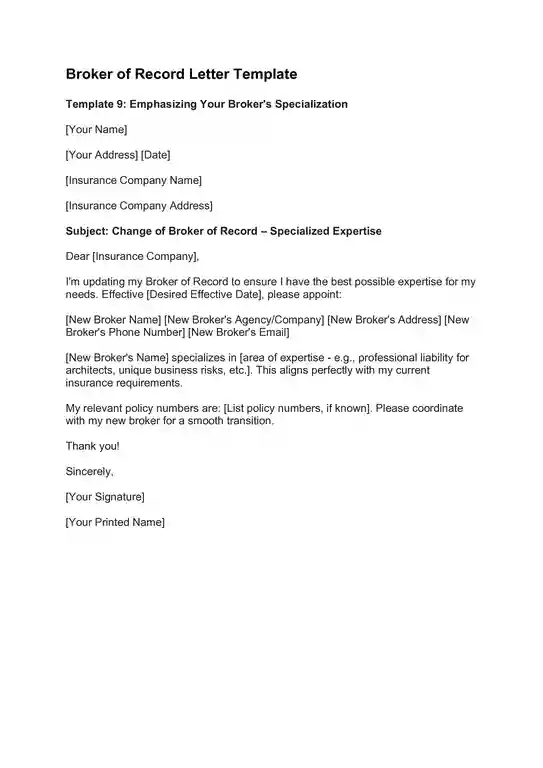

The Right Expert:

Some insurance is tricky – like if you’re a doctor, designer, or have a unique business. Certain brokers are pros at these areas. A BOR letter connects you to the specialist.

One Point Person:

If you’ve got different insurance types – business, home, etc. – it’s a headache juggling multiple brokers. A BOR letter picks your main contact, simplifying everything.

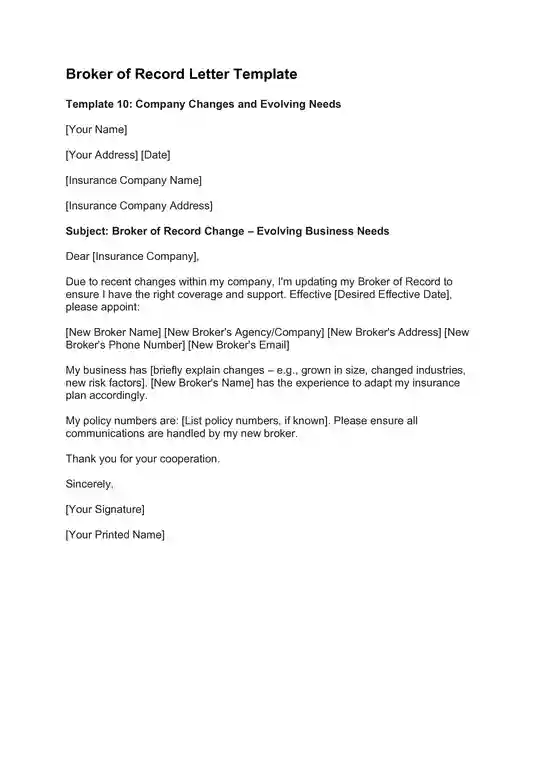

Your Business Changes:

Companies grow, shrink, or change direction. A BOR lets you switch to a broker who fits your business now.

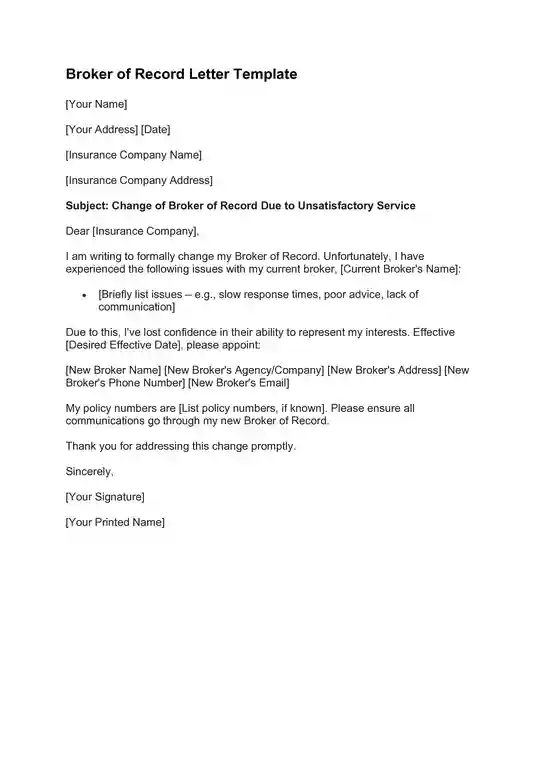

Unhappy Customer:

Poor communication, slow responses, bad advice…sometimes you need to ditch your current broker. A BOR letter gives you a fresh start with someone who cares.

Staying Organized:

Even if you like your broker, a BOR letter makes things clear for everyone. It ensures smooth payments, claims, and avoids confusion.

BORs for Business Insurance

- Multiple Stakeholders: If your business has several owners, discuss who will be the primary contact for your BOR.

- Complex Needs: Business insurance can get intricate. Look for a broker with experience in your industry and the specific coverages you need.

- Regular Reviews: As your business evolves, reassess your coverage with your BOR to ensure it remains adequate.

What is the difference between an AOR and a BOR?

While they sound similar, there are important differences between an AOR and a BOR:

- AOR (Insurance Agent of Record): Broader term for any insurance agent authorized to work with your policies. You might have multiple AORs if dealing with different types of insurance.

- BOR (Broker of Record): This is a specific type of AOR. Your BOR is your primary contact with your insurance company, handling all communication and changes to your policies.

Finding the Right Broker

- Specialization Matters: If you have specific needs (like business liability or unusual risks), seek a broker who specializes in your niche.

- Check Reviews & Reputation: Research the broker online. Look for client testimonials, ratings, and any red flags.

- Interview Them: Don’t be afraid to ask potential brokers about their experience, qualifications, and how they handle communication and claims.

What Happens When You Sign a Broker of Record Letter?

- Your insurance company gets the message and starts working with your new broker.

- All your policy stuff (questions, payments, etc.) now goes through this new person.

- Your old broker is out of the loop (unless you tell them about the switch yourself)

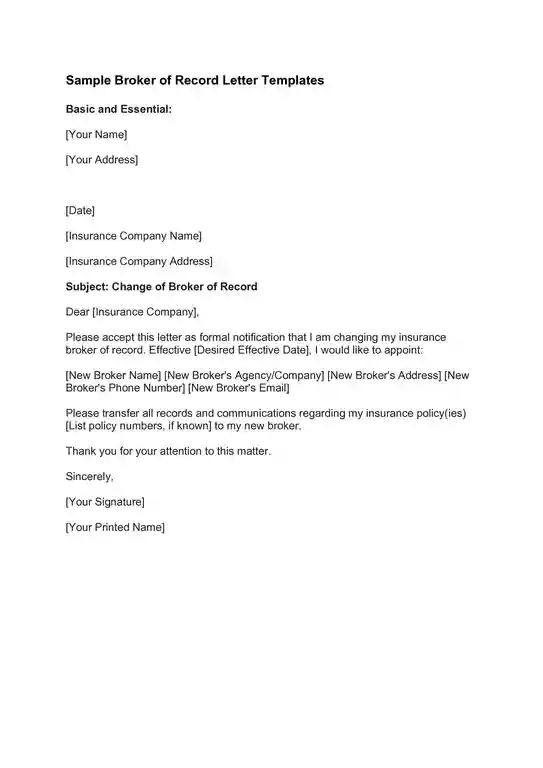

Essential Information for Your Broker of Record Letter

Think of your BOR letter as a quick checklist for changing your insurance team. Here’s what needs to be on it:

Policyholder information:

- Your full name (or your business name)

- Your address

- The name(s) of your insurance policy (or policies)

Current broker information:

- Name of your current broker

- Their insurance company or agency

New Team Captain:

- Name of your new broker

- Their insurance company or agency

- Their phone number and email

Effective date:

- The exact date you want the new broker to officially take over

Authorization:

- This makes the whole thing official!

Always double-check with your insurance company for any additional information they might specifically require.

When Should You Sign a Broker of Record Letter?

Think of a BOR letter as your tool for managing insurance changes. Here’s when it comes in handy:

- Switching Brokers: Found a better deal or someone who explains things clearly? A BOR letter makes the change official.

- Multiple Policies: Tired of juggling multiple brokers for home, business, etc.? A BOR picks one main contact.

- Need an Expert: Insurance can be tricky. A BOR letter connects you to a broker specializing in your specific needs.

- Bad Service: Slow responses or bad advice? A BOR letter lets you ditch a bad broker and find someone who cares.

- Your Business Changes: Companies change. A BOR letter lets you find a broker who fits your business now.

Extra Tip: Even if you like your broker, a BOR letter keeps things organized for everyone!

When Shouldn’t You Sign a Broker of Record Letter?

BOR letters are powerful tools, but there are times when they’re not the right fit. Here’s when to hold off:

- Minor Questions or Changes: Need to update your address on a policy, or ask a quick question? Call your broker directly – no need for a formal letter.

- Unsure About a New Broker: Before making the switch, research your new broker thoroughly. Check online reviews and their reputation to ensure they’re the right choice.

- Temporary Coverage Gaps: If you need super-fast coverage changes (like adding a car to your policy immediately), a BOR letter might cause delays. Talk to your current broker about urgent updates.

- Happy with Everything: If your broker is fantastic and your coverage meets your needs, there’s no need to rock the boat! A BOR letter is primarily for making changes.

Things to Consider with an Insurance Broker of Record

- Do Your Homework: Don’t sign anything until you’re confident in your new broker. Research them well!

- Read Carefully: Boring, but important! Double-check your BOR letter for typos or wrong info before you sign.

- It’s Not Forever: You can always change your mind later and submit another BOR letter with a different broker.

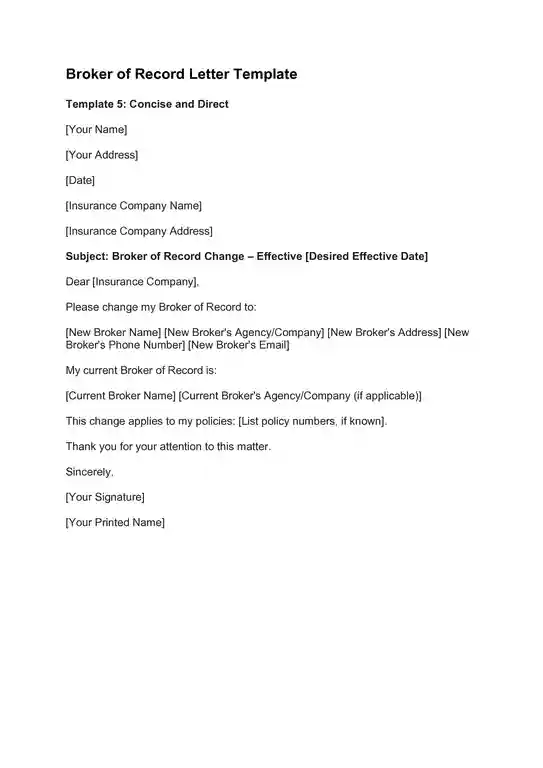

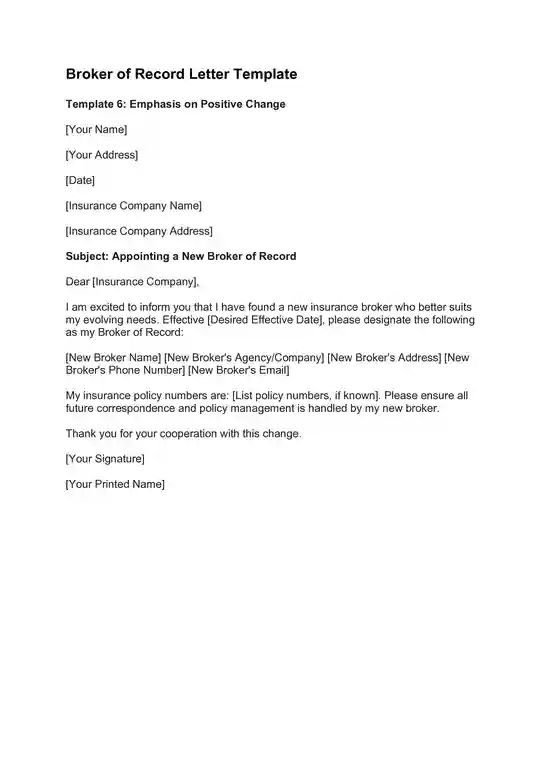

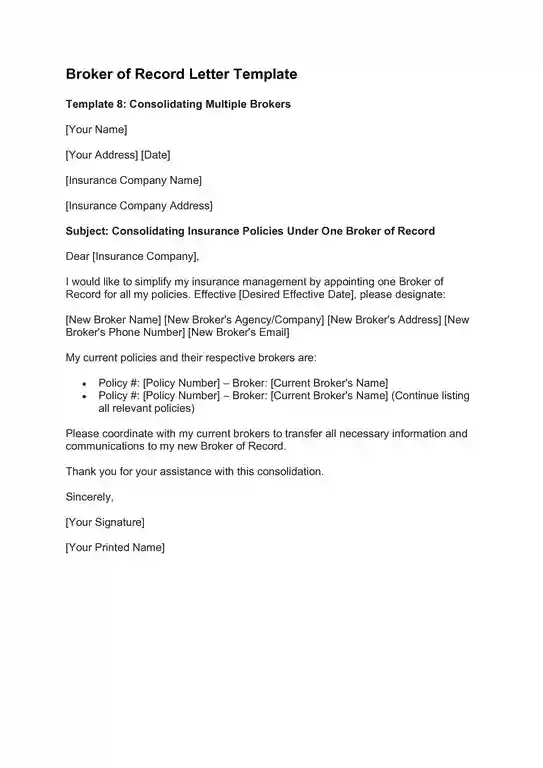

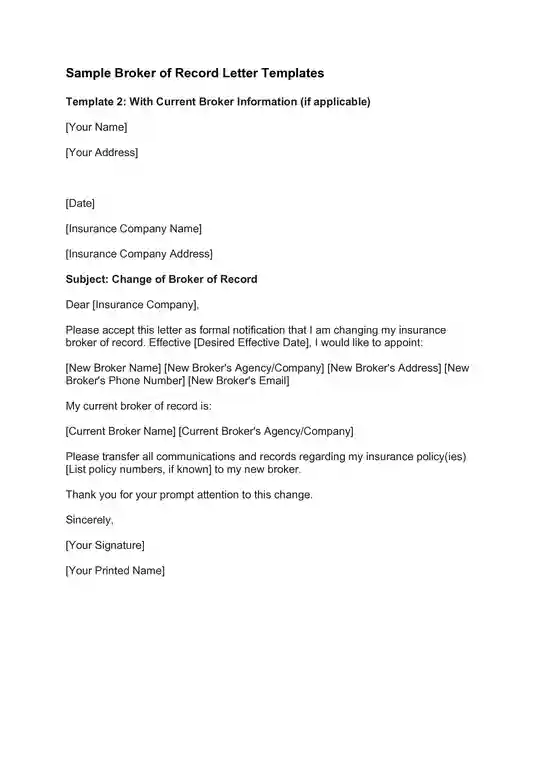

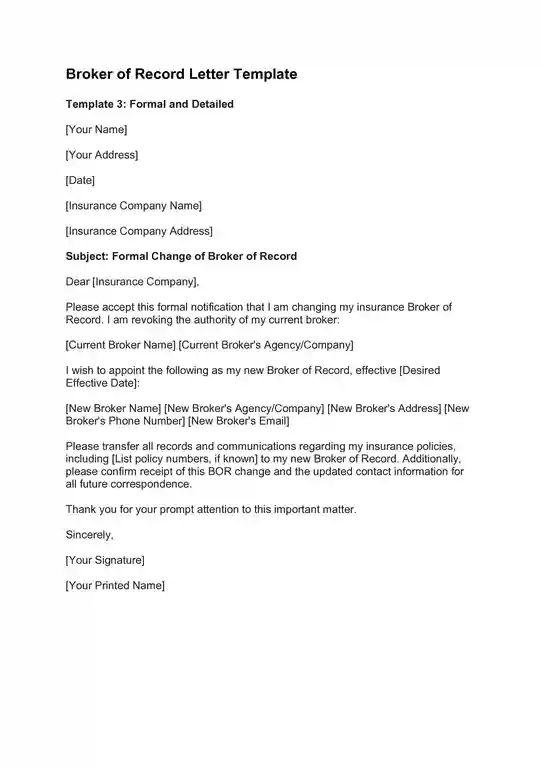

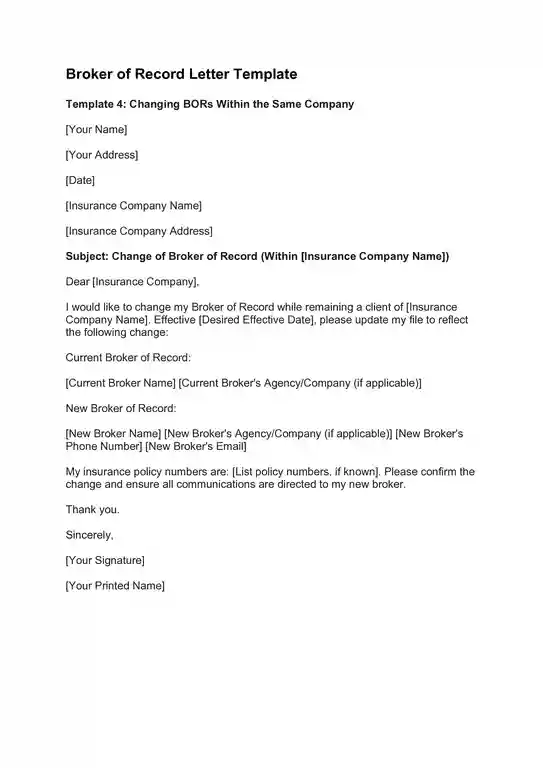

Broker of Record Letter Templates: Find the Right One for You

Using a broker of record letter template simplifies the process. Many insurance companies and reputable insurance-focused websites offer downloadable templates.

How to Submit Your Broker of Record Letter

The good news is that submitting your BOR letter is usually pretty straightforward. Here are the usual ways to do it:

- Email It: Most insurance companies accept BOR letters by email. It’s fast and convenient!

- Fax It: This old-school method still works if your insurance company prefers it.

- Mail It: Regular snail mail is an option, though it’ll be the slowest way.

How to Find Out FOR SURE:

- Check your policy: Sometimes the instructions are right there in your insurance documents.

- Call your insurance company: A quick call to customer service will clear things up.

- Check their website: Many insurers have info about BOR letters on their websites.

Always double-check with your insurance company for any additional information or submission preferences they might have.

BOR Letter Best Practices

- Accuracy is Key: Double and triple-check names, policy numbers, and dates before submitting your BOR letter.

- Know Your Carrier’s Rules: Contact your insurance company or check their website for any specific submission methods or formatting they prefer.

- Give Yourself Time: Don’t wait until the last minute. Let your insurance company process the BOR change to avoid gaps in coverage.

What If My Current Broker Finds Out?

- No Obligation: You’re usually not required to tell your old broker about a BOR change.

- Professional Courtesy: Informing them can ease the transition and avoid miscommunications.

- How to Break the News: A simple email or phone call explaining your decision is sufficient

Changing BORs During a Claim

- Contact Your Insurer First: They’ll guide you on the smoothest way to make the switch while your claim is active.

- Timing Matters: If possible, it’s often easier to wait until your claim is resolved before switching brokers.

- Communication is Key: Keep both your old and new broker updated on the claim’s status to ensure a smooth handover.

Common mistake and how to avoid

Here’s some common Broker of Record (BOR) letter mistakes and how to easily avoid them:

Common mistake

Missing Information:

One of the biggest mistakes is forgetting a key detail. Double-check that you’ve included your policy numbers, both brokers’ names and contact info, and the effective date for the change.

Incorrect Authorization:

Usually, only the policyholder needs to sign the BOR letter. Getting an unnecessary signature from the broker could slow down the process.

Typos and Poor Formatting:

A professional-looking BOR letter makes a good impression. Proofread carefully for errors, and stick to a standard business letter format.

Not Informing Your Current Broker (if applicable)

Letting your existing broker know about the switch is a courtesy and can help avoid any miscommunications during the transition.

Ignoring Deadlines:

Some insurance companies have processing times for BOR letters. Find out the timeline and submit your letter early to avoid delays in coverage.

How to Avoid These Mistakes

Use a Template:

Reputable templates guide you through all the essential information, minimizing the chance of forgetting something.

Double-Check with Your Insurance Company:

Every insurance carrier might have slightly different requirements or submission preferences. A quick call or website check can save you hassle.

Proofread!

Read your BOR letter aloud to catch any awkward phrasing or errors. Even better, ask a friend to quickly read it over as a fresh pair of eyes.

Be Proactive:

Don’t wait until the last minute to submit your BOR letter. Give yourself (and your insurance company) enough time to process the change smoothly.

Are There Any Specific Formatting Guidelines for a BOR Letter?

The good news is that BOR letters don’t need to be super fancy. The main focus is being clear and professional. Here’s the basic layout:

- Keep it Business-like: Treat your BOR letter like a formal business letter. If you have company letterhead, use it!

- Block Style: This means everything is lined up on the left side of the page, with spaces between paragraphs. Easier to read!

- Top Info: Include your name, address, and the date you’re writing the letter.

- Insurance Company Address: Add the name and address of your insurance company.

- The Main Content: This is where you list all the important info about switching brokers (we covered this in the previous section).

- Sign Off: End with “Sincerely,” then leave a few blank lines for your actual signature.

Can My Insurance Company Deny a BOR Change?

- Very Rare: Insurance companies generally must honor your BOR request.

- Possible Exceptions: Denials might happen in cases of unpaid premiums, suspected fraud, or if you violate your policy terms.

- If Denied: Contact your insurance company directly to understand the reason and explore potential solutions.

Glossary of Insurance Terms

- Policy: The contract between you and your insurance company.

- Premium: The amount you pay for your coverage.

- Deductible: The amount you pay out-of-pocket before your insurance kicks in for a claim.

- Coverage Limits: The maximum amount your insurance will pay for a covered loss.

Where to Find Reliable Sources on Insurance

- [Your State’s] Department of Insurance: Their website often has consumer guides and resources for understanding insurance.

- NAIC (National Association of Insurance Commissioners): (https://content.naic.org/) Provides trustworthy information on insurance basics and regulations.

- Reputable Insurance-Focused Websites: Look for sites ending in .gov or .edu, or those with well-known, established brands.

Tips:

- Prioritize Clarity: Avoid sites with excessive jargon, or ones trying to sell you something right away.

- Check the Date: Insurance regulations change, so ensure the information is up-to-date.

FAQ and Additional Considerations

Does the broker of record need to sign the letter?

Typically, only the policyholder’s signature is required.

How long does it take for a BOR letter to become effective?

Processing times vary by carrier. Contact your insurer for clarification.

Can I change my broker of record after submitting a BOR letter?

Yes, you can change insurance broker again by submitting a new BOR letter.

Where can I find reliable BOR letter templates?

Many insurance companies and reputable insurance-focused websites offer downloadable templates.

Is It Possible to Rescind a Broker of Record Letter?

Usually, yes. Since a BOR letter is typically a clause in insurance contracts, check your policy’s terms. Often, you can change your mind within a few days of signing. If unsure, contact your insurance company and explain the situation.

Can I Have Multiple Agents Working on My Behalf?

Yes, but proceed with caution! Here’s why:

- Coordination: Make sure all your agents clearly understand their roles and which policies they manage. This prevents confusion and conflicting advice.

- Communication: Keep all your agents informed of any changes you make with another agent. It avoids coverage overlaps or gaps.

- BOR Designation: You’ll still need a designated Broker of Record (BOR) as the primary point of contact for your insurance company. This ensures streamlined official communication.

The Takeaway

Don’t let insurance confusion hold you back! Broker of Record letter templates give you control over your insurance relationships. Use the tips and templates in this guide to find the right broker, streamline communication, and ensure your coverage always aligns with your needs.

Ready to find better insurance? Get a free broker of record letter template now! Start the process and discover the ideal broker and coverage for you.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.