The realm of personal finance is intricate and full of subtleties. One such nuance, steeped in tradition yet relevant even in today’s digital world, is the concept of blank checks. This article aims to unravel the complexities associated with blank check examples and templates, illuminating the path toward achieving financial freedom.

The Definition of a Blank Check

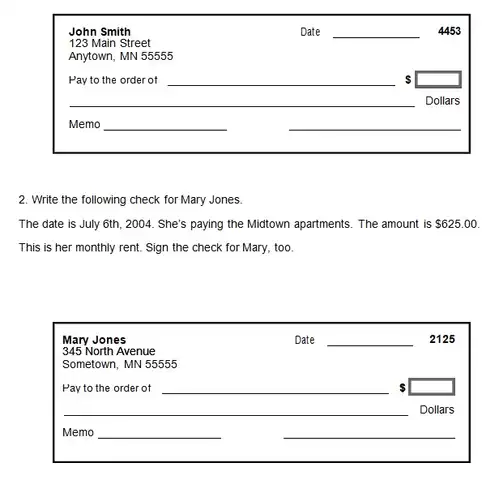

A blank check is one where some fields, often the payee line and the amount, are left empty. It enables the recipient to fill in the necessary details, providing a semblance of trust or urgency.

Why Do You Require a Blank Check?

At times, you may require it. Here are a few reasons why:

- Direct Deposit Setup: Many employers require it when direct deposits for paychecks. The check is used to gather necessary information like your bank account number and the bank’s routing number, not for making a withdrawal.

- Automatic Bill Payments: You might need to require a blank check for the same reason as the direct deposit setup. The company will set up an electronic association with your account.

- Financial Trust: In rare circumstances, you might give a blank check to someone you trust implicitly, like a family member or close friend, who will fill out the check amount later. It should be done with extreme caution due to the obvious risks involved.

These situations may require a blank check; it is important to remember that it can be dangerous if it falls into the wrong hands. It is like allowing someone to withdraw as much money as they want from your bank account. Therefore, it is crucial to have blank check examples in secure situations where your financial information is protected or when you trust the person you are giving it to.

The Legality Associated with Blank Checks

Blank checks have a prominent position in the legal and financial landscape, with a defined set of laws governing their use. However, they also carry significant risks that can have severe consequences.

Blank checks are not illegal per se. They are often necessary for various scenarios, such as setting up direct deposits or automatic bill payments. However, blank checks’ legality becomes questionable when used with fraudulent intent.

According to the United States Department of Justice, using blank checks to defraud someone can lead to substantial legal penalties, including fines and imprisonment (United States Department of Justice, 2020). Federal laws such as the Bank Fraud Statute (18 U.S.C. § 1344) criminalize schemes that aim to defraud financial institutions, which can include fraudulent activities involving checks.

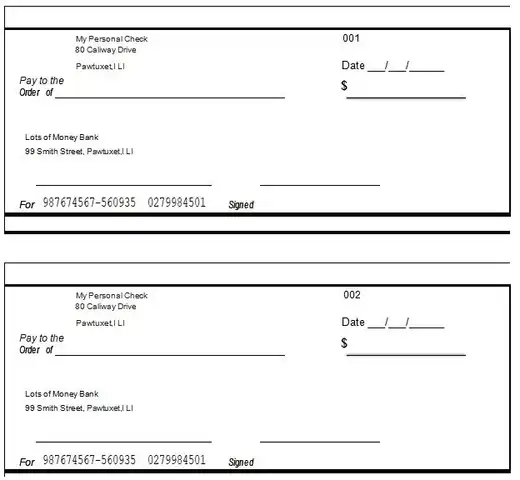

Blank Check Examples

The Potential Benefits of a Blank Check

Even though blank checks carry risks, they are not without their potential benefits when handled responsibly. This section will discuss some of the advantages that may come with the careful use of blank checks:

Flexibility:

Blank checks offer a significant amount of flexibility. For example, if you are sending someone to shop for you and are unsure of the total cost, a blank check allows that person to fill in the amount once the total cost is known.

Convenience:

Having a blank check on hand can be incredibly convenient, especially when electronic payments are not feasible. They can be used to pay for services or products when you need to know the final cost upfront.

Building Trust:

When you give a blank check, it often signals a significant level of trust. It can be an effective way to strengthen relationships where mutual trust is essential.

Useful for Emergencies:

A blank check can be a financial lifeline in emergencies where immediate cash is unavailable.

Business Transactions:

In the business world, especially with inter-company transactions, blank checks can be useful. They offer a means to settle payments or expenses that are unpredictable or fluctuating swiftly.

It is vital to reiterate that while blank checks have their uses, they must be managed carefully due to the associated risks. Always ensure that they are given to reliable and trustworthy individuals and keep a meticulous record of each issued check to prevent potential misuse.

The Potential Risks of a Blank Check

Here are some potential risks of a blank check:

Potential for Fraud

As mentioned, one of the primary risks of using blank checks is the high potential for fraud. A blank check is an open invitation to the holder to withdraw any sum from your bank account. The Federal Trade Commission (F.T.C.) regularly warns consumers about check fraud scams and their potential ramifications. Fraudsters can write out an exorbitant amount, causing the original check issuer to incur significant, unplanned costs (Federal Trade Commission, 2020).

Over-withdrawal

Another risk is the potential for over-withdrawal from the account, leading to significant financial loss or penalties.

Blank checks carry inherent risks, largely because they contain vital banking information. Here, we delve into more details on the potential threats.

Identity Theft

Blank checks can also lead to identity theft. They carry sensitive information such as your name, address, bank account number, and routing number. Criminals can exploit this data to impersonate you, gain unlawful access to your funds, or even open new accounts in your name.

Loss of Financial Control

Handing over a blank check can mean relinquishing financial control. You can avoid being drained with a specified amount, leading to potential overdrafts and associated fees. This uncertainty can lead to difficulties in financial planning and budgeting.

Difficulty in Tracking

If a blank check is cashed, it may be challenging to trace who cashed it, particularly if it was given to an individual instead of a reputable institution. It could complicate efforts to recover lost funds or prosecute fraud.

The risks associated with blank checks underscore the need for careful consideration and caution. Measures such as immediate communication with your bank if a check is lost or stolen, regular monitoring of your bank statements, and only issuing blank checks to trusted entities can help mitigate these risks.

References:

- Federal Trade Commission. (2020). Check Over payment Scams. https://www.consumer.ftc.gov/articles/0159-fake-checks

Different Kinds of Blank Checks

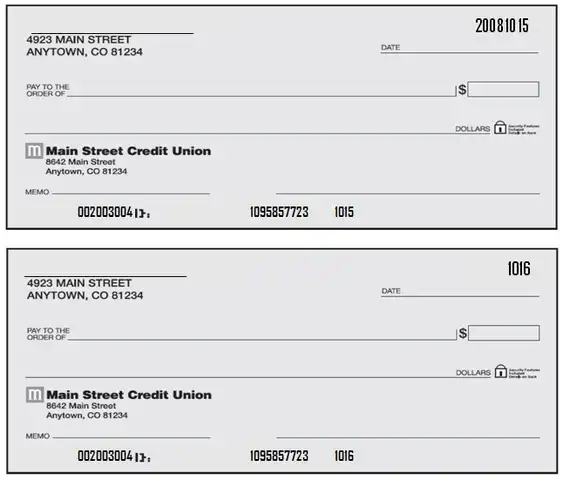

When we mention blank checks, it is crucial to understand that there are different types, each serving its unique purpose. Here are the most common ones:

Personal Blank Checks:

These are the most common blank checks issued by an individual from their checking account. These are typically used for personal transactions, such as gifting money or paying for services.

Business Blank Checks:

Businesses or corporations issue these. Businesses often use blank checks for various transactions, like payroll, vendor payments, or other corporate expenses.

Certified Blank Checks:

These are personal or business checks guaranteed by the bank. The bank verifies that the issuer has sufficient funds in their account and sets those funds aside. Certified checks are typically used for larger transactions where the receiver needs assurance that the funds are available.

Cashier’s Blank Checks:

These are issued directly by the bank. Rather than drawing from an individual or business account, the funds are drawn from the bank’s funds, providing an additional layer of security for the recipient.

Traveler’s Blank Checks:

A financial institution issues these checks, and can be used as a safe alternative to carrying cash while traveling. They can be replaced if lost or stolen, providing an added layer of protection.

Money Order Blank Checks:

A money order is a payment order for a specific amount of money. It is more trusted than a personal check as it is prepaid, guaranteeing the funds are available.

Blank Starter Checks:

The bank provides these when opening your account or waiting for your printed checks. They need the printed personal information found on regular checks.

Each type of blank check example serves a different purpose, and it is vital to use them appropriately to maintain financial security and integrity.

Instances Where Blank Checks are Necessary

Blank checks have utility in specific circumstances, primarily around trust and urgency.

When Trust is Established

In situations where a deep level of trust exists between the parties involved, a blank check can symbolize this trust, offering convenience and flexibility.

During Urgent Situations

Blank checks can also be invaluable in urgent scenarios, where immediate payment is necessary, and the check issuer is not present to fill in the details.

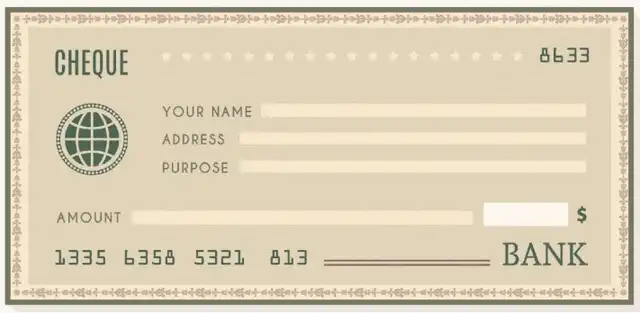

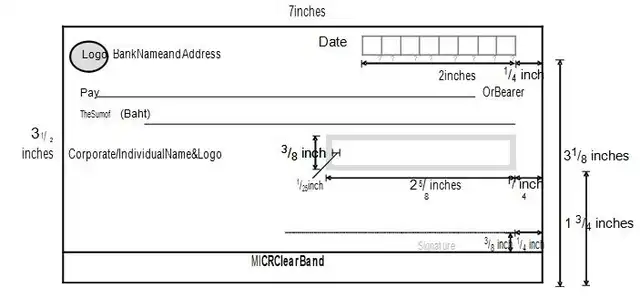

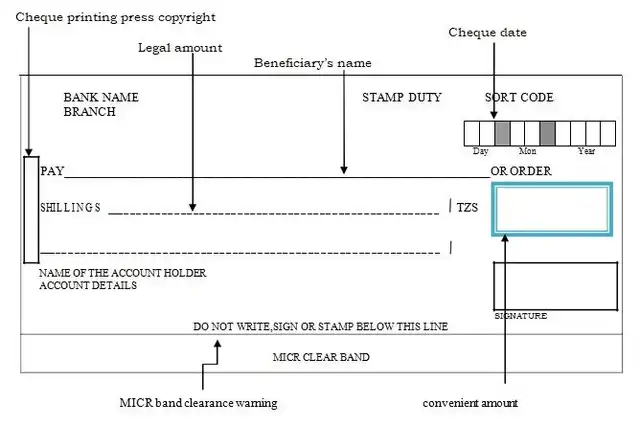

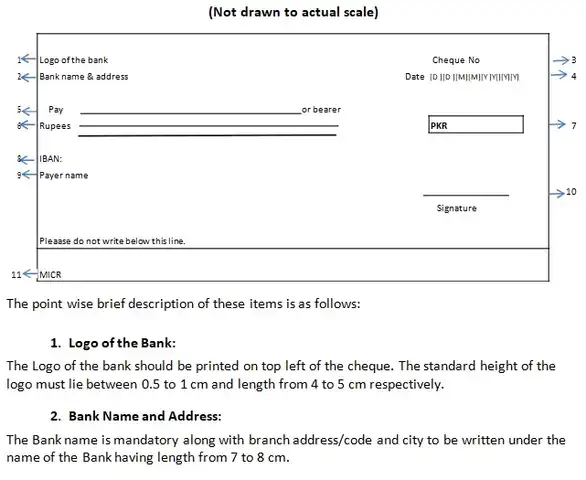

The Anatomy of a Check

It is essential to comprehend the various components that constitute it. Each element holds significance and is necessary for the check to function properly. Here is a breakdown:

Check Number:

Each check in your checkbook comes with a unique number. It allows you and your bank to keep track of individual transactions for easier record-keeping and to prevent fraudulent activities.

Routing Number:

It is a nine-digit code that identifies your bank. The American Bankers Association (A.B.A.) uses this number to direct the check to the correct financial institution.

Account Number:

This number is unique to your account within the bank. It directs the bank to which specific account the money should be drawn from.

Drawer’s Information:

This section includes your name and address, and occasionally your phone number. It signifies who is making the payment.

Payee Line:

Here, you write the name of the individual or company to whom you pay.

Dollar Box:

In this small box, you write the amount of the numeric check-in form.

Amount Line:

It is where you write out the payment amount in words. In case of a discrepancy between the numeric amount and the amount in words, the amount in words will legally prevail.

Memo Line:

Though not always required, this line can be used to note the reason for the payment or an account number the payment should be credited.

Signature Line:

It is where you sign the check. The check will only be processed with a valid signature, making this an important security feature.

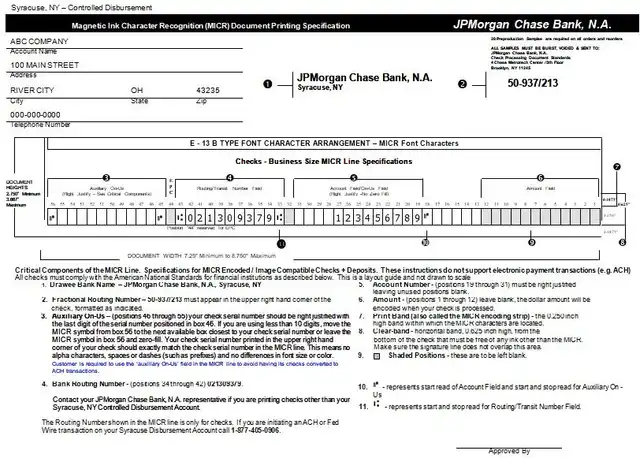

MICR Line:

The Magnetic Ink, Character Recognition line, includes the routing, account, and check numbers at the bottom of the check. Machines can read this line, facilitating the automated processing of checks.

Understanding these components is vital in correctly filling out blank check examples, ensuring it is valid and processed without issues.

The Importance of Each Component in a Check

- Payee’s Line

The payee’s line signifies who can cash or deposit the check, providing a control measure against unauthorized use.

- Numeric Amount Box

The numeric amount box indicates the sum the bank should release, ensuring the correct payment is made.

- Written Amount Line

The written amount line serves as a verification tool, providing a written backup of the numeric amount.

- Signature Line

The signature line serves as authorization from the account holder, making the check legal tender.

- Date Line

The date line is crucial in establishing the check’s validity, particularly post-dated scenarios.

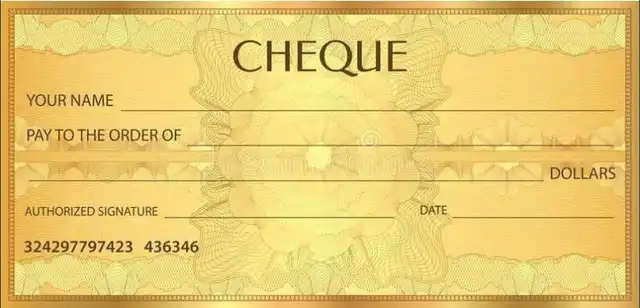

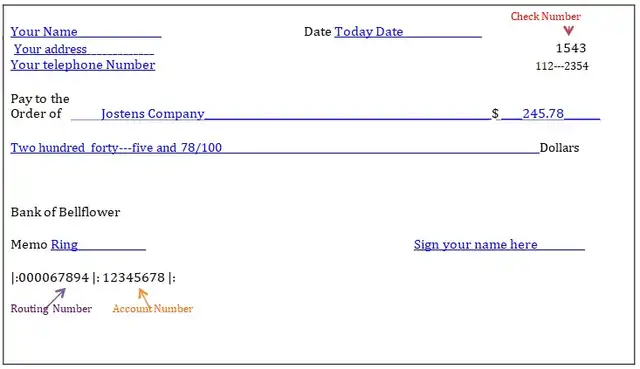

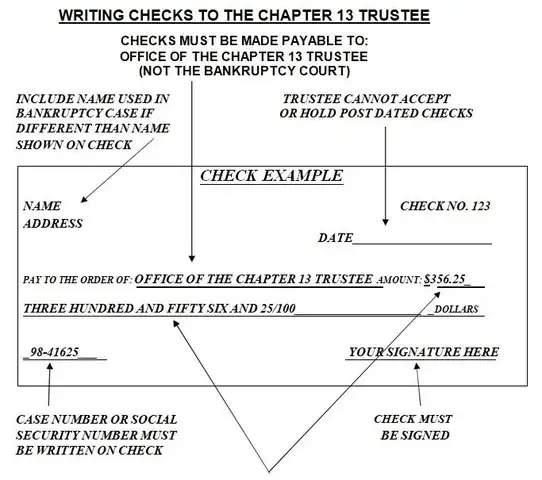

Step-by-Step Guide on How to Write a Check

Though seemingly straightforward, the procedure for writing a check needs attention to detail to confirm its validity. Let us break it down into a step-by-step process:

- Current Date: First things first. Inscribe the date on the top right corner of the check. Do take care to record the correct date. If you intend to post-date your check, ensure the recipient knows your intentions.

- Payee Information: Turn your attention to the line labeled “Pay to the order of.” Here, you must record the name of the individual or entity. The accuracy of spelling is crucial to sidestep potential complications while cashing or depositing the check.

- Numeric Amount: Adjacent to the payee line, you will find a box where you must specify the check amount in numerical form. For instance, if the check is intended for fifty dollars, you would fill in “50.00”. Position this as proximal to the dollar sign to eliminate any possibility of fraudulent additions.

- Amount in Written Form: The line beneath the payee field is reserved for the check amount. To illustrate, the figure of “50.00” would be expressed as “Fifty and 00/100”. Should the amount incorporate cents, record it as a fraction of 100. Utilize the remaining space to draw a line to the end of the field, effectively preventing any further insertion of words.

- Memo (Optional): On the bottom left of the check, you will notice a space allocated for a memo or note. This field is optional and is often used to make a note about the payment purpose or to jot down an account number for a bill.

- Signature: Your final step involves signing the check in the bottom right corner. Your signature must align with the one your bank has registered in its records. This final stroke verifies the check’s legitimacy and your consent to the payment.

It is crucial to remember that each filled-out check is like a contract, promising the stated amount to the payee. Handle it with care and double-check each detail before handing it over. Mistakes can be inconvenient at best and can lead to financial loss or fraud at worst.

Essential Safety Measures When Dealing with Blank Checks

Adopting safety measures when dealing with blank checks can mitigate these risks. These measures range from safe storage practices to vigilant monitoring of bank statements.

The Significance of Blank Checks in Today’s Digital World

Despite technological advancements in the banking sector, blank checks hold their ground in certain scenarios. Their relevance lies in their flexibility, personal touch, and crucial role in urgent situations.

Instances of Blank Check Misuse: Real-Life Examples

Real-life examples of blank check misuse serve as cautionary tales, emphasizing the importance of careful and responsible handling of blank checks.

Financial Literacy: Why Understanding Checks Matter

Understanding checks, including blank ones, is fundamental to financial literacy. It equips individuals with the necessary knowledge to navigate their financial landscape effectively and securely.

How to Handle Received Blank Checks

Receiving a blank check may feel daunting due to the responsibility it carries. Here are some steps to ensure you handle a received blank check appropriately:

- Verify the Issuer:

Always verify the person or entity issuing the check. If you are still getting familiar with the issuer, confirm their identity and legitimacy before cashing the check.

- Ensure All Necessary Fields are Completed:

If you have been responsible for filling out a blank check, ensure all necessary fields are filled out correctly. It includes the date, payee’s name, numeric and written amount, and the issuer’s signature. Errors could lead to the check being rejected by the bank.

- Confirm the Check Amount:

If you have been instructed to fill in a specific amount, ensure you confirm this amount with the issuer. Miscommunication can lead to disputes or even legal problems.

- Keep a Record:

It is advisable to keep a record of all transactions involving blank checks. Note the check number, date of transaction, the amount, and the issuer’s name for future reference.

- Be Prompt:

Try to cash or deposit the check as soon as possible to avoid potential issues with lost or stolen checks.

- Report any Suspicious Activity:

If you suspect a blank check is being used fraudulently or an issuer’s instructions seem suspicious, it is crucial to report this to the relevant authorities.

Handling a blank check requires meticulous attention and care, given the trust the issuer has given you. By following these steps, you can ensure you manage the blank check responsibly and professionally.

Quick Tips to Remember When Dealing with Blank Checks

Handling blank checks involves particular attention to safety and detail. Here are some crucial points to keep in mind:

- Use a Permanent Writing Tool:

When filling out a check, always use a pen, preferably one with black or blue ink. It prevents the details from being altered easily, ensuring increased security.

- Never Pre-sign Blank Checks:

Pre-signing a blank check leaves it open to fraudulent activities. Only signing a check is advisable when all the other fields are filled.

- Avoid Making Checks Payable to Cash:

When you make a check payable to “Cash,” anyone can cash it. If the check is lost or stolen, it could lead to financial loss.

- Record Every Check:

Make it a habit to record the details of every check you write. It includes the check number, date, payee, and amount. These records will help you monitor your finances and spot fraudulent activities early.

- Check for Errors:

Always double-check for errors before handing over the check. Mistakes could lead to delays or misunderstandings; in worst-case scenarios, they can allow fraudsters.

- Notify Your Bank of Discrepancies:

If you notice discrepancies in your account or any unauthorized transactions, notify your bank immediately. Quick action will limit any potential damage.

- Use Secure Mailboxes for Mailing Checks:

Use post office boxes or other secure mailboxes to mail a check. Regular mailboxes are easy targets for thieves.

- Store Your Checks Safely:

Keep your checks and checkbooks safe and secure, especially if you have blank checks. It reduces the risk of them being stolen or misused.

- Do not Leave Blank Spaces:

Never leave spaces before the payee’s name or the numeric amount when filling out a check. Spaces can allow a thief to alter the check.

- Use Online or Electronic Payments When Possible:

Electronic payments are generally more secure and easier to track than paper checks. Consider using these options, when possible, particularly for large amounts.

You will be better equipped to handle blank checks safely and effectively, reducing the risks and maintaining better control over your finances.

Blank Check Examples and Templates

The Role of Banks in Securing Your Checks

Banks play a vital role in maintaining the security and integrity of your checks, including blank ones. Here is how:

- Verifying Check Authenticity:

Banks are responsible for verifying the authenticity of checks. It is done by checking signatures, verifying account balances, and matching account numbers. They have strict protocols to ensure the check you are depositing or cashing is legitimate.

- Fraud Detection Systems:

Most banks have sophisticated fraud detection systems in place. These systems analyze patterns and look for irregularities in your transactions. For instance, if someone attempts to cash a check from your account that exceeds your usual transaction amounts, it could trigger the system and cause the bank to investigate.

- Check Clearing Process:

The check-clearing process, handled by banks, also serves as a security measure. When a check is deposited, the bank verifies that the check is valid and that the issuing account has sufficient funds to cover the check’s amount. The check is not cleared if either of these factors cannot be confirmed, preventing potential fraud.

- Secure Banking Technologies:

Banks use secure technologies to protect your data, including checking account information. Encryption and other security measures make it much more difficult for thieves to access your account details.

- Customer Alerts:

Many banks offer alert systems that notify customers of unusual activity on their accounts. If a check that seems out of the ordinary is cashed or deposited, you can be alerted to review the transaction.

- Account Locking:

If your checks are lost or stolen, your bank can lock your account or stop payment to prevent unauthorized use.

While banks play a significant role in securing your checks, it is important to note that customers also have responsibilities. Always protect your checks, bank details, and personal information to minimize the risk of fraud.

Blank Checks and Their Role in Establishing Credit

Interestingly, blank checks also have a role in credit-building. Certain credit card companies issue blank checks to their customers, providing another avenue for users to establish and build their credit.

The Future of Banking: Blank Checks Vs. Digital Transactions

As we move further into the digital age, the balance between traditional methods like blank checks and digital transactions will continue to shift. Understanding both aspects is key to being well-rounded in one’s financial journey.

Conclusion

Blank checks can be useful in certain situations, providing flexibility, convenience, and establishing trust. They are commonly used for direct deposit setup, automatic bill payments, and in rare cases, personal transactions among trusted individuals.

However, the risks associated with blank checks should be noticed. Misuse of blank checks can lead to fraud, over-withdrawal, identity theft, and loss of financial control.

It is crucial to handle blank checks responsibly, only providing them to trusted entities and keeping a record of each issued check.

Understanding the different types of blank checks and the components of a check is important for proper usage. Safety measures such as safe storage, monitoring bank statements, and reporting suspicious activity can help mitigate risks.

Banks are crucial in securing checks through verification processes, fraud detection systems, secure banking technologies, and customer alerts. By being informed and cautious, individuals can navigate the complexities of blank checks while safeguarding their financial well-being.

Frequently Asked Questions (F.A.Q.)

- What is a blank check? A blank check is a check that has been signed but does not have a specific dollar amount written on it. The amount can be filled in by the person to whom the check has been issued.

- Is it safe to give someone a blank check? Giving someone a blank check can be risky because they have the freedom to write in any amount. It may be safe to trust the recipient implicitly, but you should always be cautious.

- Is it illegal to write a blank check? No, it is not illegal to write a blank check. However, you could face legal issues if it leads to fraud or misuse.

- What are the parts of a check? The main components of a check include the payer’s name and address, the payee’s name, the date, the check number, the bank’s name and address, the account number, the routing number, and the signature line.

- What is a counter-check? A counter check is a bank-issued check that is printed for a customer who does not have personal checks. These checks can be blank because they do not have the customer’s name, address, or check number.

- What is a convenience check? A credit card company issues a convenience check that can be used to borrow against your credit line. They act like blank checks but draw from your credit rather than your bank account.

- How do I write a check safely? Always write checks with a permanent ink pen. Avoid leaving spaces before the numbers, and always draw a line after them to prevent anyone from adding extra digits. Only sign a check after it is filled out.

- What should I do if I receive a blank check? If you receive a blank check, contact the person who gave it to you to clarify the exact amount to be filled in. It is best to contact your bank for advice if it is from an unknown source.

- What precautions should I take with blank checks? Always store your blank checks in a secure location. Never pre-sign a blank check. Be cautious about whom you give a blank check to, ensuring you trust them completely.

- What are the benefits of a blank check? Blank checks offer flexibility and convenience, especially when the payment amount is unknown upfront or you cannot be physically present for a transaction. However, they should be used wisely due to the associated risks.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.