Bank reconciliation examples and solutions: When you deal with different transactions with your bank, it would be helpful for you to find out the different processes of the bank. Let’s take an example bank reconciliation.

So, what is it used for, and what should be included? Before jumping for bank reconciliation examples and solutions, let’s find out the definition first. In bookkeeping, this form is one process that explains any discrepancy in the specific date between the bank balance in the bank statement given by your bank.

So, it’s easy to solve the discrepancies by only seeing the latest transaction in the bank statement or accounting records and then checking if that combination matches that discrepancy, which needs more explanation. If that discrepancy cannot be explained this way, you must check all transactions in the bank or company’s records and match them from the latest reconciliation you have done.

What is Bank Reconciliation?

Bank Reconciliation is a fancy term, but don’t worry; it’s really simple. It means checking your bank statement against your records. You do this to make sure all the money adds up right. For example, if you think you have $100, but your bank says $90, you must figure out where the $10 is!

Why Is Bank Reconciliation Important?

You might think that checking your bank statements is enough, but there’s more to it than that. Bank Reconciliation is like a health check-up but for your money.

Know Where Your Money Is

First off, this process helps you know where your money is. Have you ever thought you had more money than what shows up in your bank account? That’s a failure. Bank Reconciliation helps avoid those kinds of surprises.

Avoid Overdraft Fees

People prefer paying extra fees. When you keep an eye on your balance, you can ensure you never go below zero. This way, you don’t have to pay any nasty overdraft fees.

Catch Mistakes Early

Mistakes happen. Maybe you were double-charged for something. Or perhaps the bank made an error. You’ll catch these errors early if you’re doing regular Bank Reconciliation. The sooner you find them, the quicker you can fix them.

Helps in Financial Planning

If you’re trying to save for something big, like a vacation or a new car, you need to know how much money you have. Bank Reconciliation helps you plan better.

Keep Business and Personal Expenses Separate

If you’re running a small business, things can get confusing fast. You may accidentally use your business card for personal expenses. With Bank Reconciliation, you can easily spot and set these mix-ups correctly.

Legal and Tax Benefits

Come tax time, or if you ever need to go to court for something related to your finances, you’ll want records that are as clean as a whistle. This process helps make sure everything is accurate and documented.

Peace of Mind

Knowing that your financial records are in order provides. Money can be a huge stressor, and regular Bank Reconciliation can help ease that stress.

Bank Reconciliation might seem like a chore, but it’s a super important one that can save you money and headaches in the long run.

The Process of Bank Reconciliation

Doing a Bank Reconciliation is like piecing together a puzzle. Each piece has to fit just right. Don’t worry, though; it’s easier than it sounds.

First, Get Your Bank Statement and Your Records

You first need your bank statement and personal or business financial records. These might be on paper or digital. It’s like gathering all the puzzle pieces before you start solving it. Ensure you have records covering the same period as the bank statement.

Next, Start Matching the Transactions

Go through each item on your bank statement and match it with an entry in your records. Put a checkmark next to each transaction that matches on both lists. It’s like pairing socks; both have to match!

Then, Find Transactions That Don’t Match and Figure Out Why

Uh-oh, found a sock without a pair? Don’t panic! Now you must play detective. For each transaction on your bank statement that doesn’t match your records, try to figure out why. It could be a fee you just remembered, or it could be an error. Finding these out will help you clear up any confusion.

Last, Update Your Records to Match Your Bank Statement

The final step is to update your records. If you find errors or missing entries, now’s the time to fix them. Add or remove transactions so that your personal or business records match your bank statement perfectly. It’s like the final piece of the puzzle.

You’ve just completed a Bank Reconciliation. Your finances are now up-to-date, and you can rest easy knowing everything is in its right place. Remember, the more often you do this, the easier it gets. So, make it a habit!

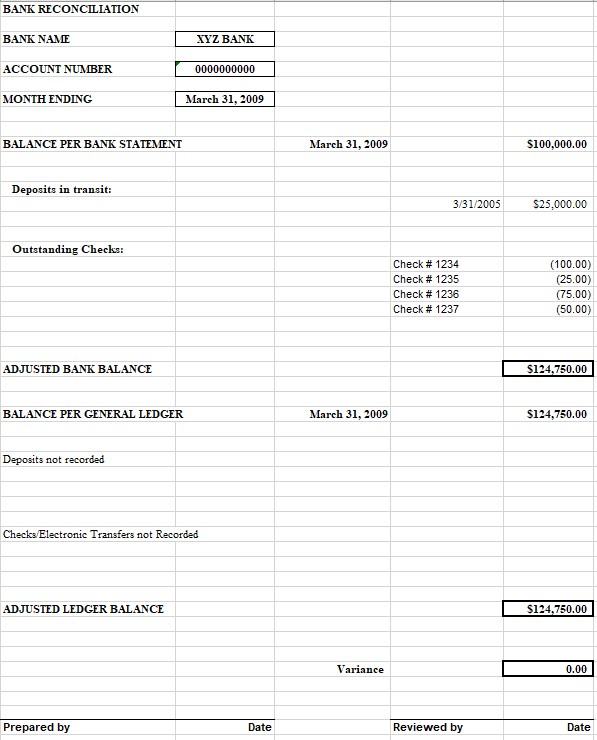

Bank Reconciliation Examples and Solutions

It is much easier when you have bank reconciliation examples and solutions to guide you. Below are some common scenarios you might face and how to solve them.

Example 1: Missing Deposit

Problem: Your bank statement shows a balance of $5,000, but your records say $4,500.

Solution:

- First, check if a deposit still needs to be cleared.

- If you find the deposit, update your records to match the bank statement.

Example 2: Unaccounted Expense

Problem: Your records show more money than your bank statement.

Solution:

- Look for any checks or payments you’ve made that still need to be deducted from your bank account.

- Update your records to include these transactions.

Example 3: Bank Fee Surprise

Problem: Your bank statement has a lower balance due to an unexpected bank fee.

Solution:

- Update your records to include the bank fee.

- If the fee is an error, contact the bank to resolve it.

Example 4: Double Counting a Deposit

Problem: Your records show a higher balance because a deposit has been counted twice.

Solution:

- Look for duplicate entries in your records and remove the extra ones.

- Double-check to make sure all other entries are correct.

Example 5: ATM Withdrawal

Problem: Your bank statement shows an ATM withdrawal you must remember making.

Solution:

- Review your activities and receipts to confirm the transaction.

- If you still don’t recognize it, contact your bank, as it might be a fraudulent activity.

Example 6: Wrong Amount Entered

Problem: A deposit is entered as $200 in your records but shows as $220 in the bank statement.

Solution:

- Check the deposit slip or transaction receipt.

- Update your records to reflect the correct amount.

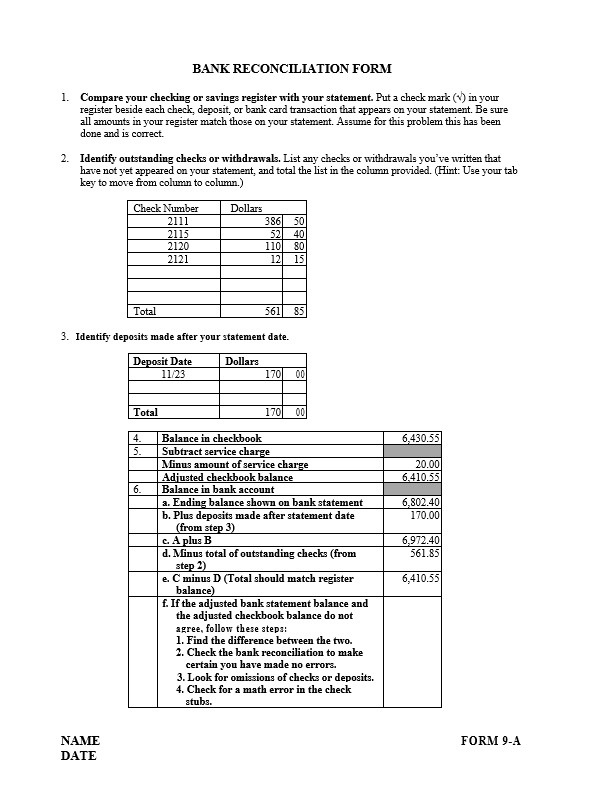

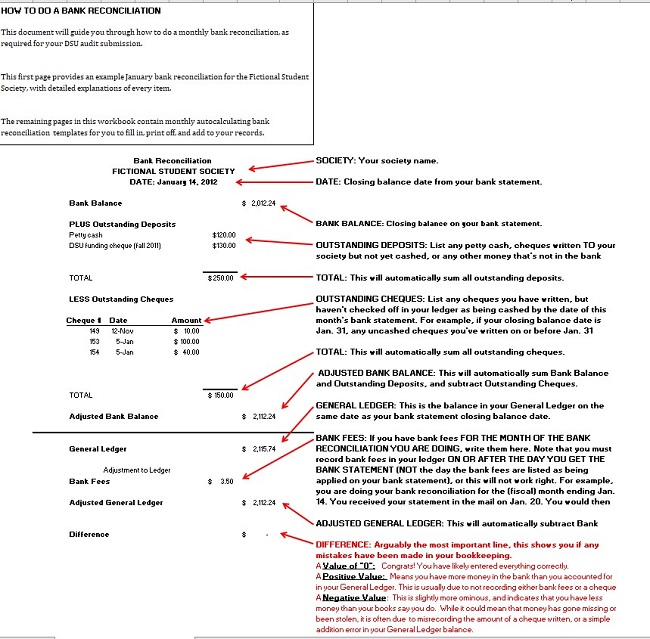

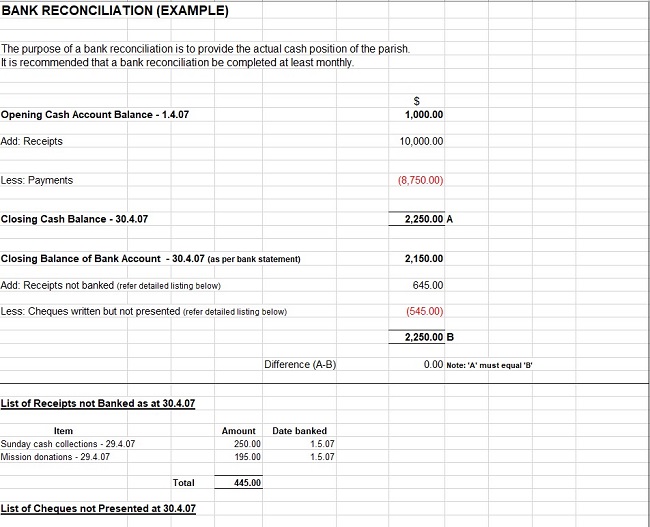

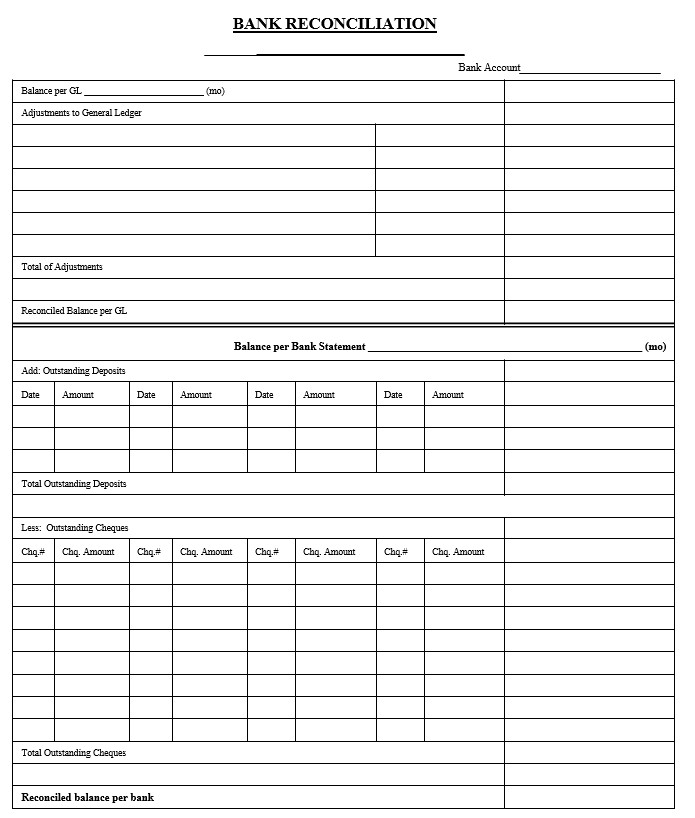

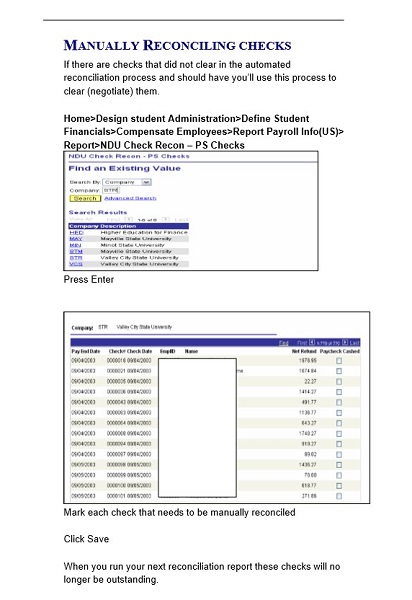

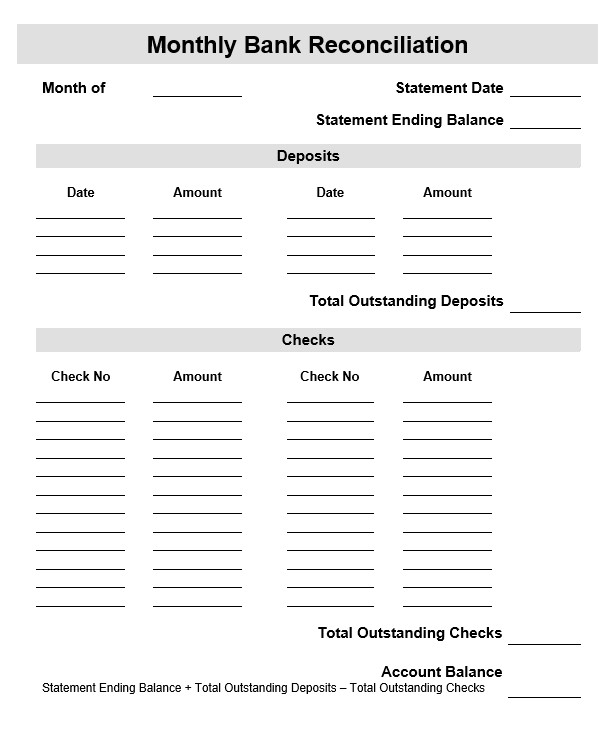

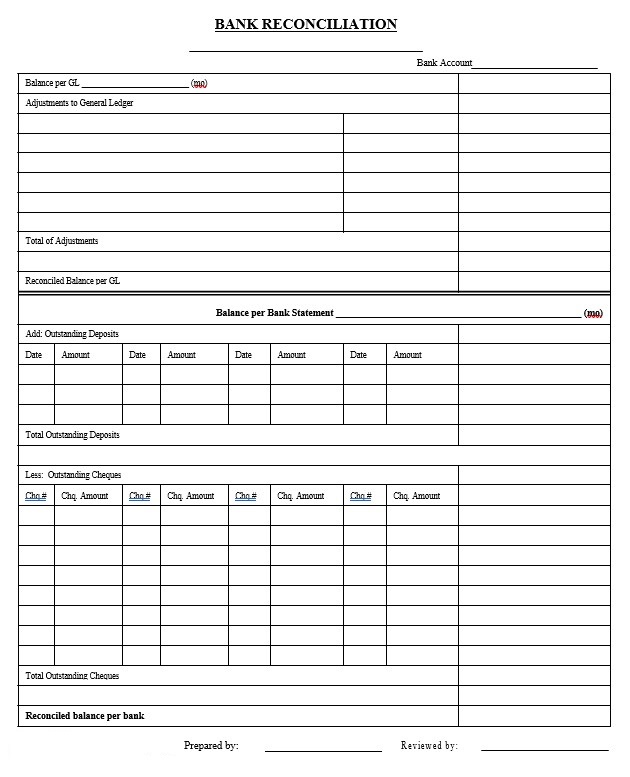

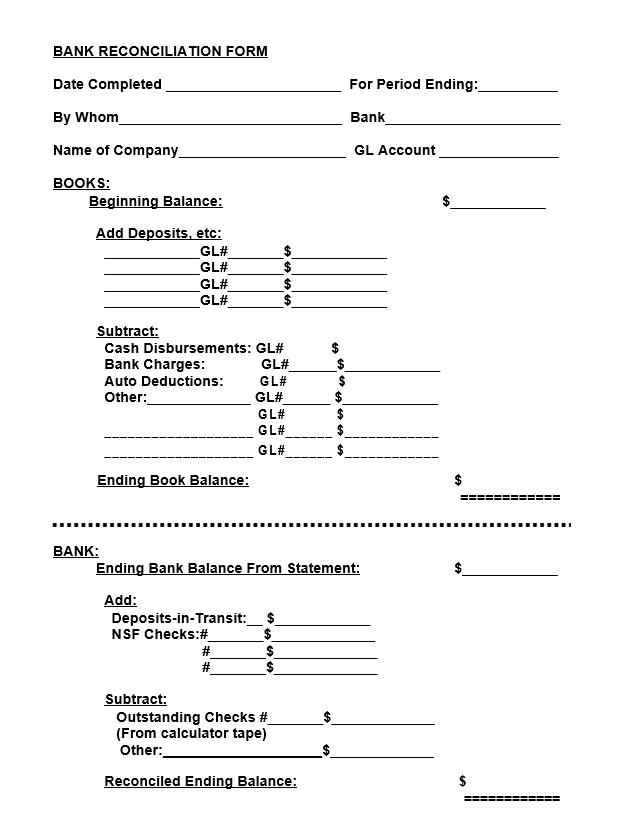

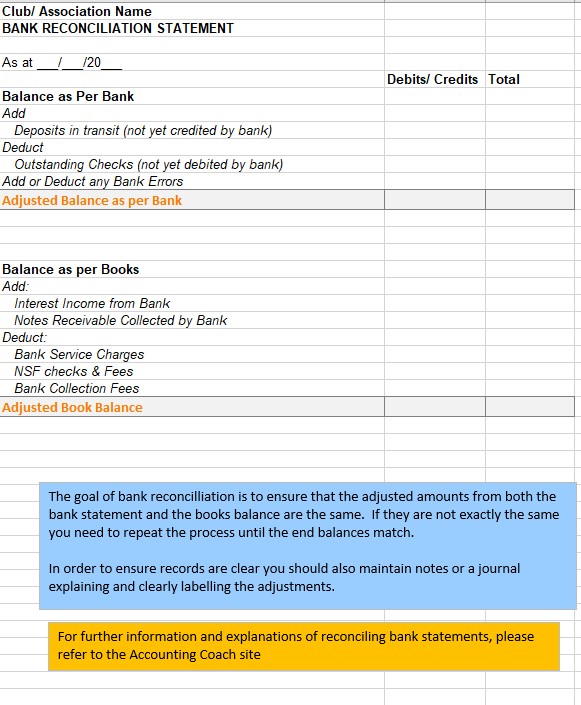

Free Bank Reconciliation Templates

You can find free templates that help make this process easy. These templates usually have spots for all your bank info and your records. You fill them in!

The Purpose of Bank Reconciliation Templates

So, why should you care about using a Bank Reconciliation Template? These templates can be like a superhero for your finances.

Update Your Balance with Ease

Firstly, a template is a magic tool for knowing your real money. Let’s face it: Sometimes, the numbers on your bank statement only show part of the picture. But if you use a template, you can plug in all your deposits, checks, and withdrawals. Boom! You get to see your real balance, the money you have. No more guessing!

Find Sneaky Issues Super Fast

Have you ever read your bank statement and thought, “Hmm, that doesn’t look right”? You’re not alone. Mistakes happen. Sometimes it’s the bank’s fault; sometimes it’s ours. You can spot these sneaky issues faster with a template than a cat chasing a laser dot. How? The template organizes everything for you, so it sticks out like a sore thumb if something is off.

Discovering Issues You May Not Be Aware Of

Even banks make mistakes sometimes! Or the slip-up may be on your end. These tiny errors can become big headaches if you don’t catch them. That’s where regular bank reconciliation swoops in like a superhero.

Be Your Money Detective

By being a money detective and doing regular bank reconciliation, you can find errors you didn’t even know existed. Just like a detective looks for clues, you look at each transaction. You match what you think you spent and received against what the bank says. And if things don’t add up, it’s clue time!

Types of Sneaky Errors

- Automation Errors: Sometimes computers goof up. An automatic payment double-charged you. Or your direct deposit didn’t go through. By checking regularly, you catch these robot mistakes quickly.

- Human Errors: Oops! Did you enter the wrong amount in your check? Or the bank teller keyed in the wrong number. We all make mistakes, but reconciliation helps you find them before they get messy.

So there you have it! Regular bank reconciliation is like having a safety net for your money. It helps you find automation and human errors before they become big problems. This way, you keep your money safe and sound, right where it should be!

Tools to Make Bank Reconciliation Easier

Doing bank reconciliation by hand is like building a sandcastle with a tiny spoon—it takes forever! But guess what?

Excel: Your Number Buddy

First up is Excel! Excel is like a magic wand for numbers. You can set up a sheet where one column is what you think you have, and the other is what the bank says you have. Then, you can use Excel’s formula magic to spot differences immediately. You can even color-code things to make it easy to see what’s what.

Smarter with Software

There are software tools that are like having a robot do your chores. These are designed to do all the number crunching for you. Here are some you might like:

- QuickBooks: This is like the Swiss Army knife of business tools. It does lots of things, including bank reconciliation.

- Xero: Another great choice for small businesses. It’s easy to use and makes bank reconciliation a piece of cake.

- FreshBooks: This is great for freelancers or small business owners. The procedure lets you concentrate on your work, not your numbers.

- Sage: This one is for bigger companies. It’s like having a whole team of number crunchers on your computer.

So, with the help of Excel and some smart software, you can make bank reconciliation as easy as pie. That means more time for you to do what you want and less time scratching your head over numbers!

Tips for Preparing Bank Reconciliation

Bank reconciliation might seem like a puzzle, but you’ll solve it quickly with these easy tips!

Start Early and Often

The sooner you start, the easier it will be. Try to do your bank reconciliation at least once a month.

Collect All Your Papers

Ensure you have all your bank statements, checks, and receipts before starting. You don’t want to play hide-and-seek with important papers when you’re in the middle of reconciling!

Double-Check Your Math

Even calculators can mess up sometimes! Double-check your math to make sure it’s right. It’s better to spend an extra minute now than a lot of time fixing errors later.

Take Breaks

Staring at numbers for too long can make your head spin! Take short breaks to clear your mind. Have a snack, do some stretches, or breathe.

Use Templates

Templates are like shortcuts for your work. They help you organize your numbers so you can see what’s going on. Excel has some great templates for bank reconciliation. You can also find templates online for free!

Highlight Unmatched Items

If something doesn’t match, highlight it. It makes it easier to spot errors and fix them.

Look for Hidden Fees

Banks sometimes charge fees you need to learn about. Check for any fees that could be messing up your numbers.

Keep Good Records

After you’re done, keep all your papers and records in a safe place. You’ll need them if you ever have to go back and fix something

FAQs

How Often Should I Reconcile My Bank Account?

It’s good to do it at least once a month. Some folks even do it every week! The more often you do it, the easier it is to catch errors and keep your money in check.

What Do I Need to Start?

You’ll need your bank statement and your personal or business records. These could be paper copies or digital ones. Just make sure they cover the same period.

Can I Use Software to Help Me?

You bet! Many software options are out there to help you with Bank Reconciliation. Some are simple and cheap; others are fancy and cost more. Choose what works best for you!

What If I Find a Mistake?

No big deal! Mistakes happen. If you find one, the first step is determining why it happened. Was it a bank error? Did you forget to record a transaction? Once you know the reason, you can fix it.

Is Bank Reconciliation Only for Businesses?

Nope! Anyone with a bank account can (and should) do so. It’s not just for businesses but anyone who wants to keep their money safe and organized.

What Are Some Common Errors to Look Out For?

Great question! Common errors can include double entries, missed transactions, or incorrect amounts. Always double-check these areas when you’re reconciling.

How Long Does It Take?

Well, that depends on how many transactions you have. For some, it might take 20 minutes; for others, it could be a couple of hours.

Do I Need to Keep Records?

Always keep your reconciled statements and updated records. They can be super helpful in the future, especially for things like taxes or if you spot another error later on.

Conclusion

There you have it! Bank reconciliation examples and solutions may sound fancy, but it’s just a simple, smart way to keep an eye on your money. So why not start today?

Additional Resources

- Free Bank Reconciliation Templates

- Recommended Software

Time to become a master at Bank Reconciliation. You’ve got this!

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.