Choosing an amortization schedule for free

Your finance is always talking a bit about technically for all people who have learned about finance. That’s why many people hiring finance attorneys or representatives in order to address the finances, mortgages, interest, loans, extra payment, and so on. For example, if you purchase a house with a loan, then you have to prepare the amortization schedule. Although you cannot calculate the repayment period based on its schedule, then the finance representative will help you to calculate it easily. There are some free amortization schedule forms that you can use. You only need to edit it and you will get the calculation immediately.

So, what is the amortization schedule?

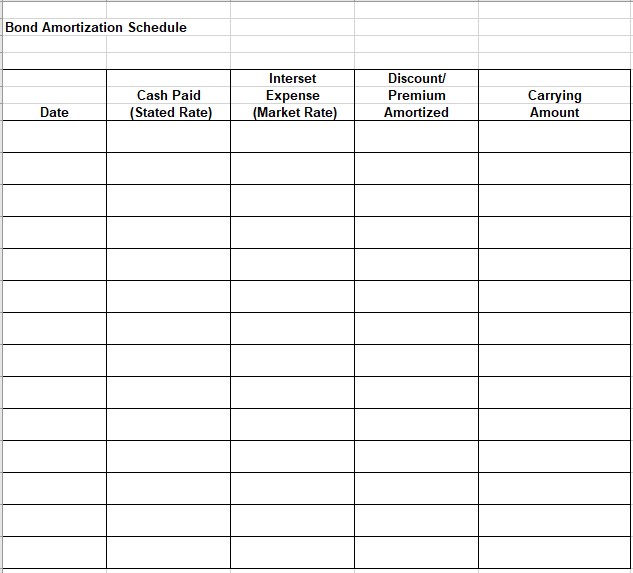

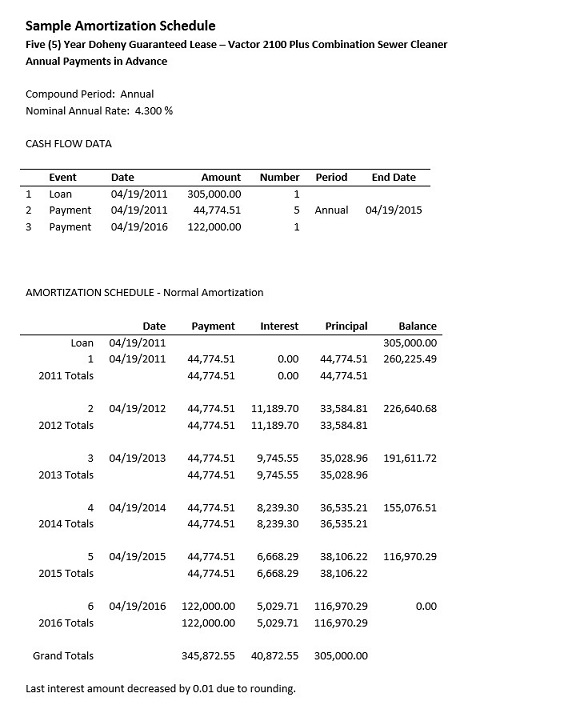

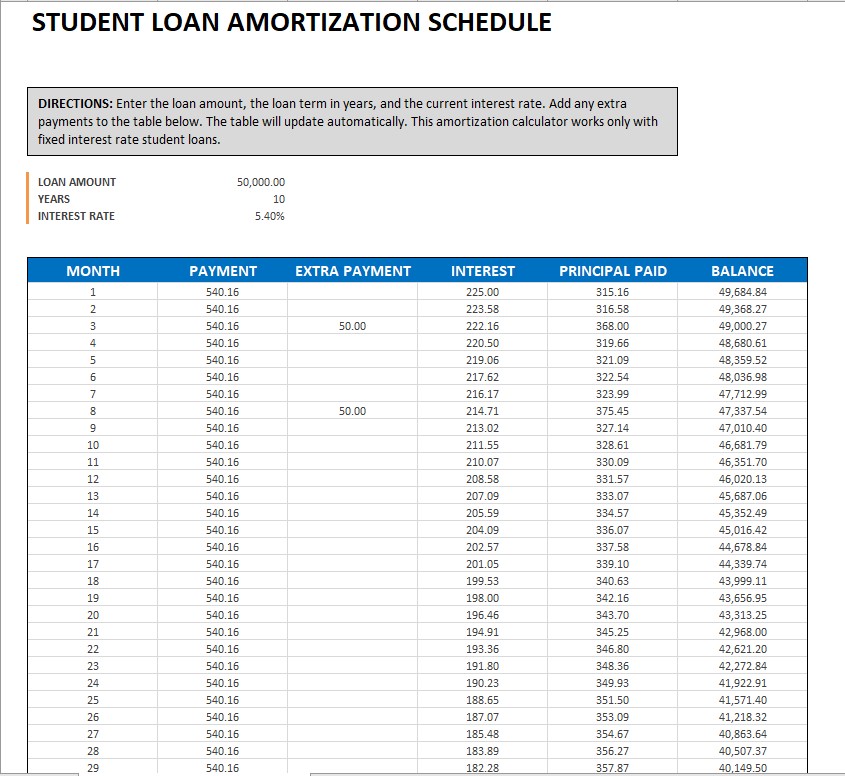

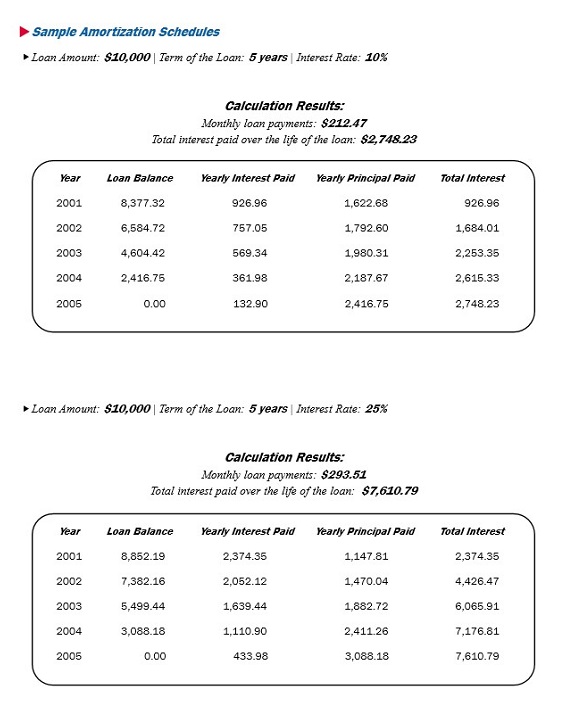

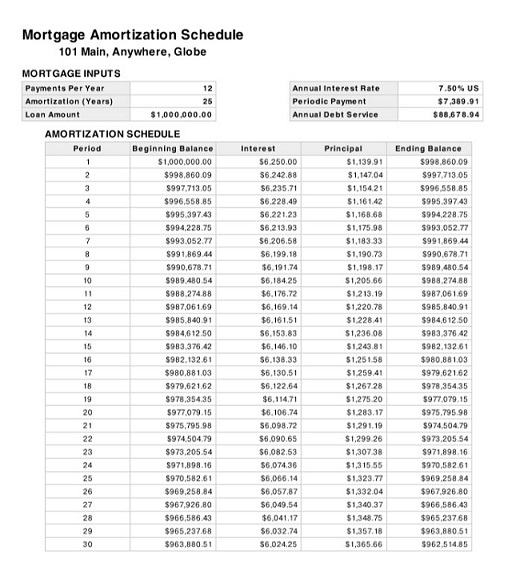

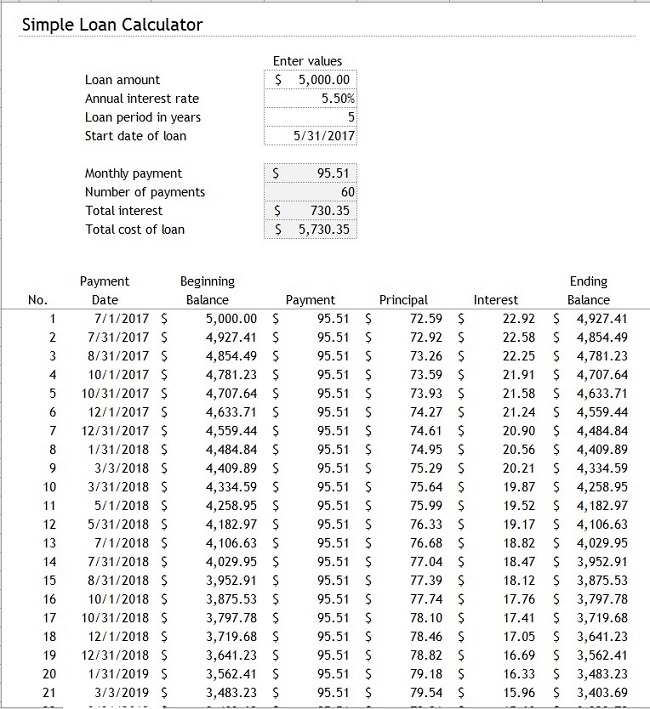

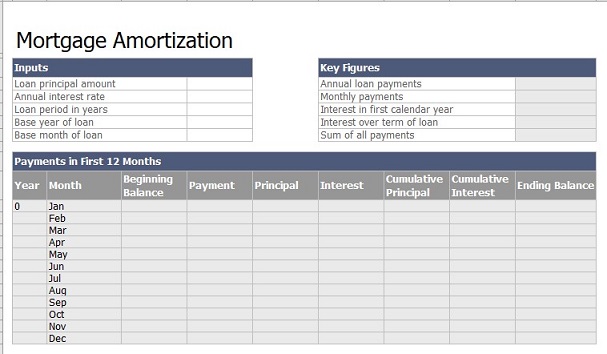

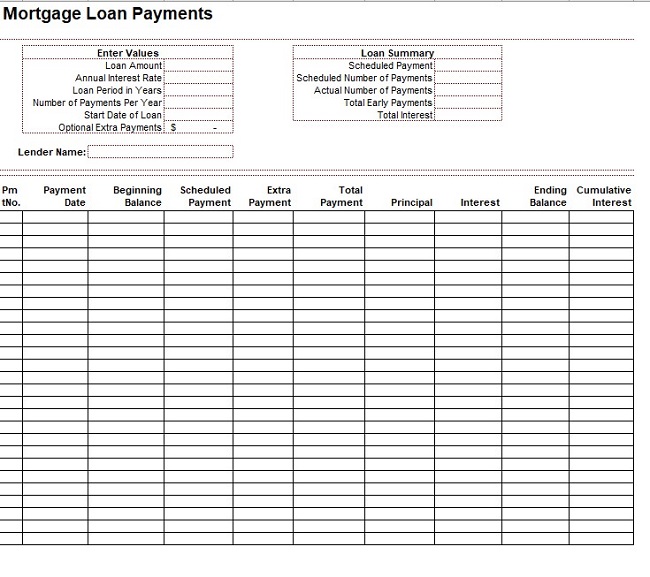

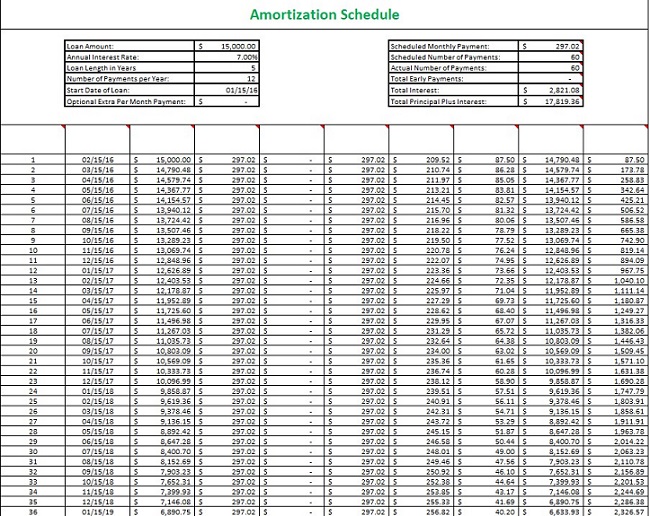

This is the schedule that shows you with the repayment period of the loan that you have got. Basically, this is the table which decides the principal amount along with the interest amount compromising in each payment. It will still continue and end up until your loan was paid off. You should know that the early majority amount is the interest while the later amount related to the principal loan include in the schedule.

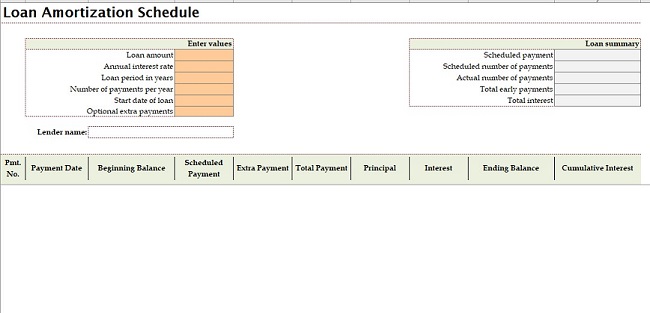

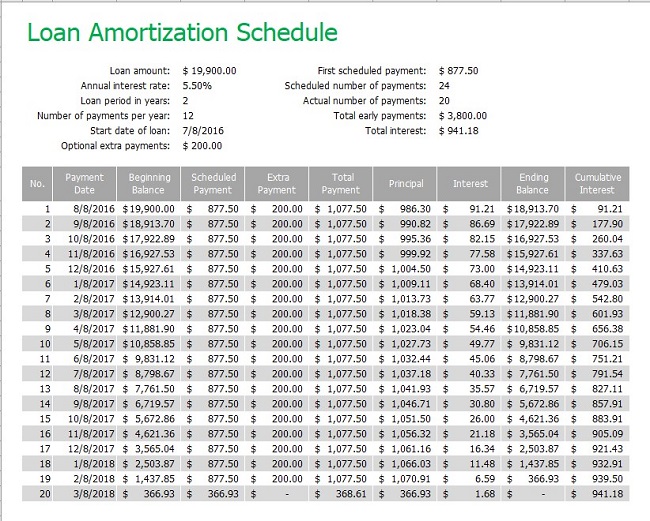

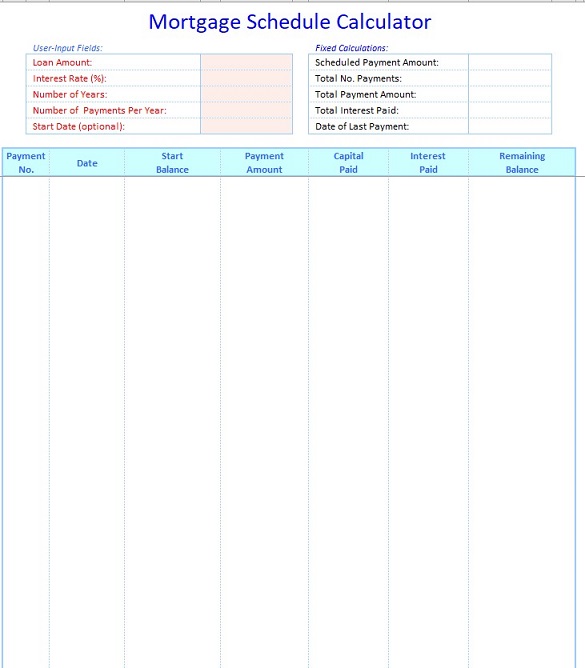

Here some types of Loan Amortization Schedule template samples

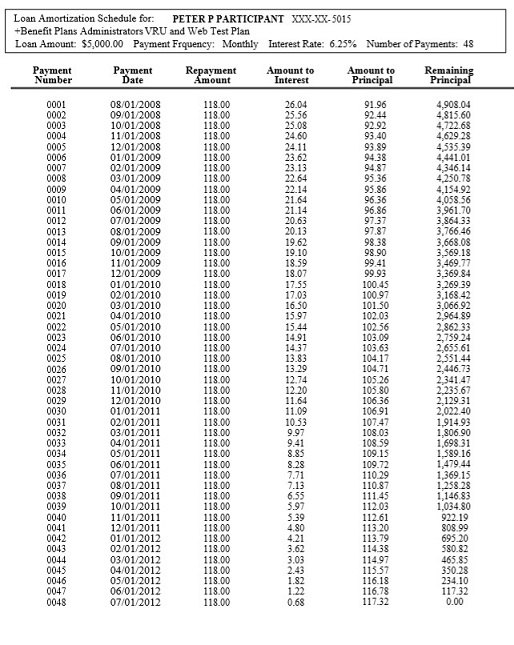

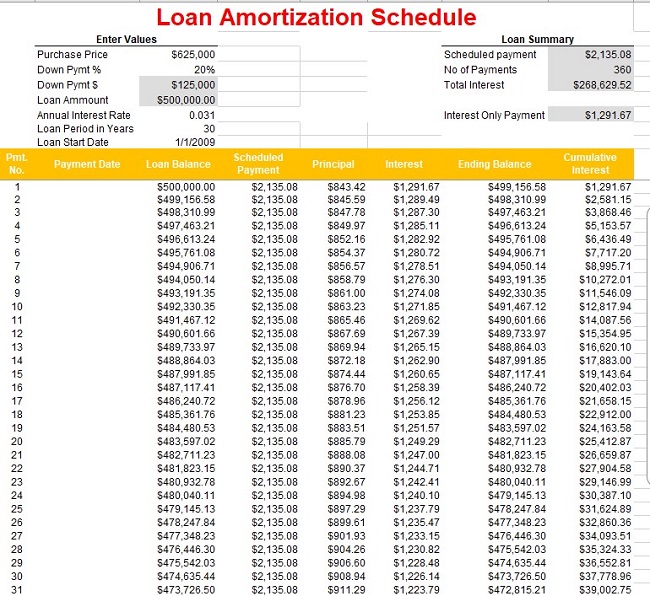

The monthly loan schedule

In this form, then the traditional multi-year medium-term loans show you with the monthly payment. In this type, you have to calculate the period of paying back in the monthly bases. This loan will show you with a separated set which will be agreed on your monthly payment.

Weekly loan schedule

As its name implied, then this weekly loan schedule should calculate your loan on a weekly basis. However, before taking a risk to work on it, then you have to pay attention to the frequency of your loan. Sometimes, the weekly payment may compound interest in the daily basis show offer you with the weekly payment option for your convenience. You can consider choosing an amortization schedule student loan.

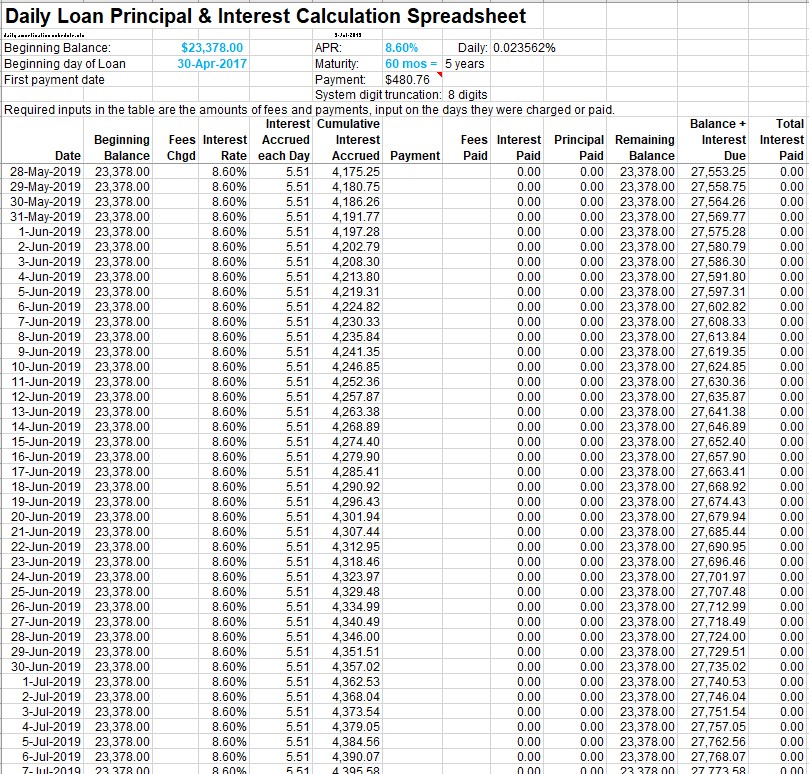

Daily Loan Schedule

The daily loan schedule is the short-term loan and it usually only takes around 3 to 18 months as well. the benefits of this loan were based on the factor level means that you have to pay back the rate of the borrowed amount. When you need to fill up the daily amortize of the loan, then the interests will be added on a daily basis.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.