Simple commercial lease agreement template word: Do you plan to rent a property? If yes, then you have to know that your business’s success depends on the terms and conditions of your lease agreement. Sometimes, the business owners need clarification on the commercial and residential leases. However, before you approach the landlord, you have to understand the difference between both parties and aspects to differ from one to another. Then, you can understand how to use the simple commercial lease agreement template word below. Let’s learn more about it!

What is the commercial lease agreement?

The Commercial Lease Agreement is the form of the agreement between the landlord and business with the terms and conditions highlighted for the rental property. Besides that, this type of agreement is only limited to the specific renters looking for business properties and commercial reasons. You must understand the terms and conditions of the rental property before you even start to take the risk to sign your lease document.

What Happens If the Lease Agreement is Broken?

Breaking a lease agreement is serious, and understanding the consequences is crucial for landlords and tenants. Here’s a comprehensive look at the implications of violating a lease agreement:

- Financial Penalties:

The most immediate consequence of breaking a lease is often financial. The specifics are usually outlined in the agreement, but can include:

- Loss of Security Deposit: The landlord might retain the security deposit to cover potential losses.

- Payment for Remaining Lease Duration: If a tenant leaves before the lease term ends, they might be obligated to pay for the remaining months.

- Legal Consequences:

If a tenant breaks the lease without legal justification (like a landlord’s failure to maintain the property), the landlord might take legal action. It can result in:

- Lawsuits: Landlords can sue for unpaid rent, damages to the property, or any other breach of the contract’s terms.

- Eviction: Landlords may initiate proceedings if a tenant violates specific lease terms.

- Impact on Credit Score:

Unpaid rent or debts resulting from a broken lease can be reported to credit agencies. This negative mark can impact the tenant’s credit score, challenging securing loans or other rental agreements in the Future.

- Difficulty in Future Rentals:

Breaking a lease can lead to a negative reference from a previous landlord. Future landlords might be hesitant to rent to someone with a history of lease violations.

- Potential for Mediation or Arbitration:

If both parties want to avoid court, they might turn to mediation or arbitration to resolve the dispute. This approach can be less adversarial and costly than traditional litigation.

- Mitigation of Damages:

In some jurisdictions, landlords must “mitigate damages.” They must reasonably try re-renting a property if a tenant breaks the lease. If they’re successful, the original tenant may only be liable for the rent when the property is vacant.

- Emotional and Stress Implications:

Breaking a lease can be stressful for both parties. The tenant might feel guilty or anxious about the consequences, while the landlord may feel betrayed and concerned about potential financial losses.

Benefits of Using a Commercial Lease Agreement Template

Using a template for this purpose brings several advantages. Here are some key benefits:

- Time-Saving:

A template provides a structured format, ensuring you pay attention to essential components. It speeds up the drafting process.

- Consistency:

A template ensures that all formats and styles for landlords with multiple properties. This uniformity helps in managing and reviewing multiple documents.

- Comprehensive:

A template covers all standard clauses and sections necessary for a commercial lease. It reduces the chances of missing out on crucial details.

- Cost-Effective:

Starting with a template can reduce the legal time (and cost) required to draft an agreement.

- Reduces Errors:

Using a template minimizes the risk of errors, as it typically reviews and refinements to ensure accuracy and clarity.

- Flexibility:

While templates offer a structured format, they are also customizable. Landlords and tenants can easily modify them to fit specific needs, terms, and conditions.

- Enhances Understanding:

A template often has clear headings, sections, and sometimes explanatory notes. This layout helps both parties understand the terms and conditions better.

- Provides Legal Protection:

It will address various scenarios and issues that might arise during the lease term, offering legal protection to both parties.

- Promotes Fairness:

A standardized template often incorporates industry-standard terms and conditions, ensuring that neither party is unfairly disadvantaged.

- Facilitates Negotiations:

Having a template in hand during negotiations can serve as a reference point. Both parties can review each section, discuss, and agree upon terms before finalizing.

The Essential Components

Here are the essential components that should be included in a typical:

- Title and Introduction:

A clear title, such as “Commercial Lease Agreement,” followed by a brief introductory paragraph that describes the agreement’s purpose.

- Parties Involved:

- Landlord: Full name and contact details of the property owner or managing entity.

- Tenant: Full name and details of the business or individual renting the space.

- Property Description:

Detailed description of the leased property, including address, square footage, specific location (e.g., unit number), and other relevant identifiers.

- Lease Term:

- Start Date: When the tenancy begins.

- End Date: When the tenancy concludes.

- Renewal Options: Terms under which the lease can be renewed.

- Rent Details:

- Amount: Monthly or annual rent.

- Payment Schedule: Due date and preferred payment method.

- Late Fees: Penalties for late payments, if any.

- Rent Increases: Conditions under which rent may be increased.

- Security Deposit:

Information about the required security deposit amount, its purpose, conditions for withholding, and return procedure.

- Maintenance and Repairs:

Details about who is responsible for maintaining and repairing different parts of the property.

- Insurance:

Any insurance requirements the tenant needs to uphold, such as liability coverage.

- Use of Property:

Clearly define the permitted uses of the property, ensuring the tenant uses the space appropriately for their business.

- Improvements and Alterations:

Conditions under which the tenant can or cannot make changes to the space, which covers costs and restoration obligations at the lease end.

- Utilities and Additional Costs:

Explanation of who pays for utilities like water, electricity, and other additional costs like common area maintenance (CAM) fees.

- Termination:

Outline conditions for early termination, notice requirements, and any penalties or procedures associated with ending the lease.

- Subleasing and Assignment:

The tenant can sublease the space or assign the lease to another party and any related conditions or restrictions.

- Default:

Describe what constitutes a breach of the agreement, consequences, and remedies available to both parties.

- Dispute Resolution:

Procedures to handle disagreements, whether through mediation, arbitration, or court proceedings.

- Miscellaneous Provisions:

Any additional clauses or conditions specific to the property, landlord, or tenant.

- Signatures and Dates:

Spaces for the landlord and tenant to sign and date, signifying their agreement to the terms. It’s often recommended to have witnesses or notary acknowledgment.

Why is Negotiation Possible in Commercial Leases?

Commercial leases differ from those you might see for homes or apartments. While home leases are usually the same for everyone, commercial leases can change based on the business’s needs. Every business is unique, so the space they rent should fit them just right!

What Can You Talk About?

There’s a lot you can discuss with the landlord. Some of the big ones include:

- Rent Amount: You can adjust how much you pay monthly or how often the rent increases.

- Lease Duration: Some businesses might want a short lease at first, with the option to extend later. Others might want a longer term right from the start.

- Renewal Choices: You should lock in the option to renew your lease when it ends so you can stay longer.

- Making Changes: If you want to paint, add partitions, or make other changes to the space, it’s good to discuss who will pay for these and if they need to be reversed when the lease ends.

Tips for Successful Negotiation:

- Be Prepared: Know what you want before you start talking. Have clear reasons for each request.

- Stay Open-minded: While you have things you want, be ready to listen to the landlord’s side, too. A good negotiation is where both sides find the middle ground.

- Get It in Writing: Once you’ve agreed on terms, make sure they’re written down in the lease. It avoids misunderstandings later on.

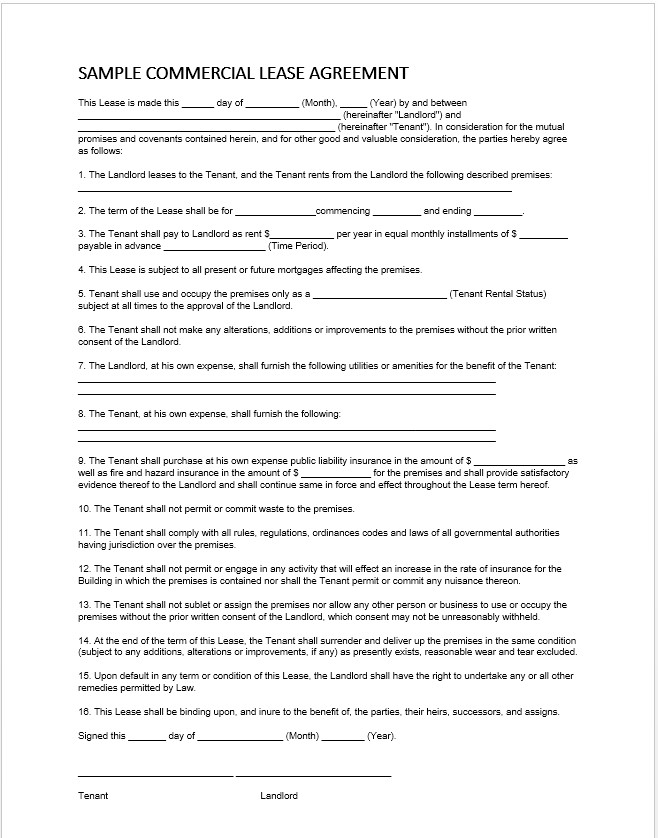

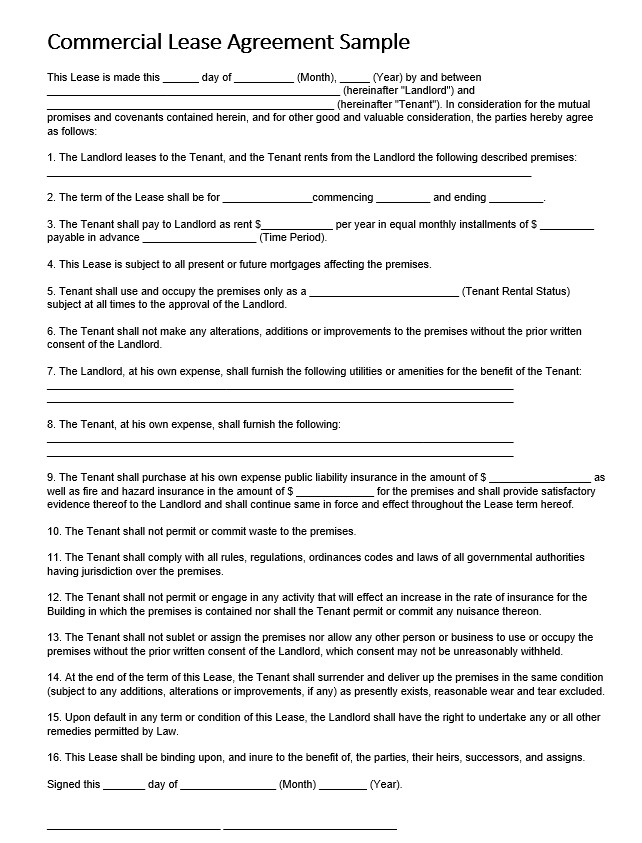

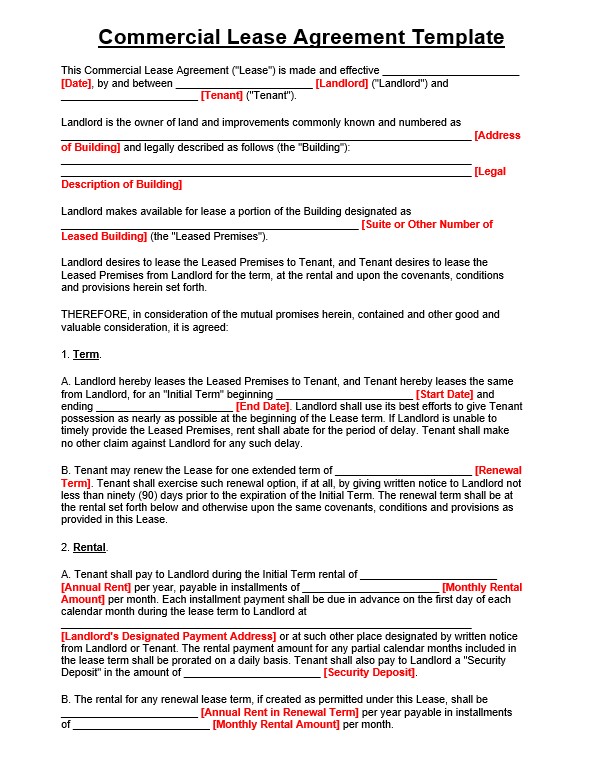

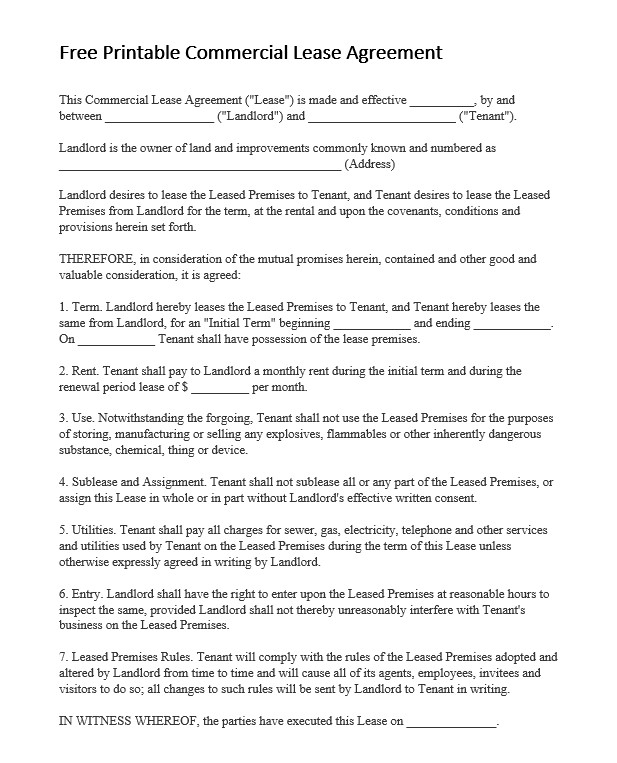

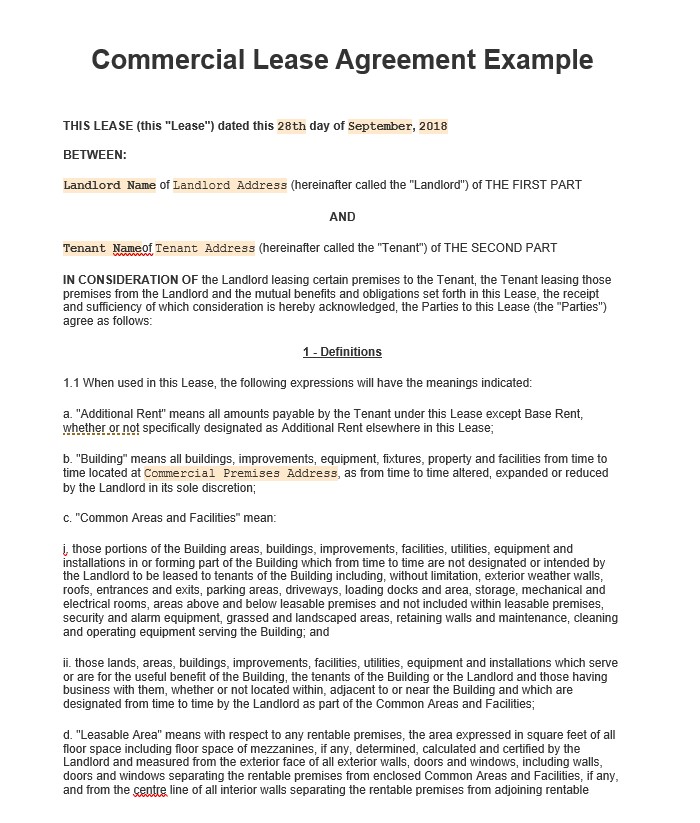

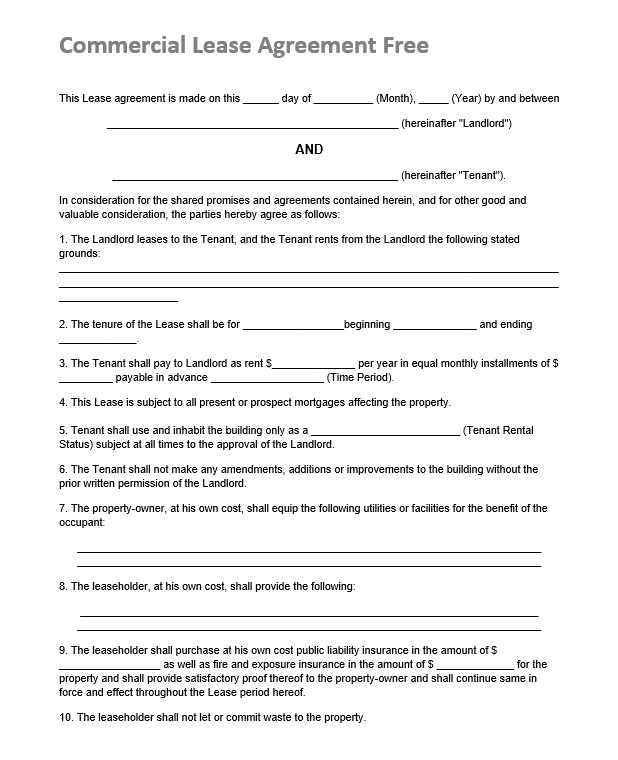

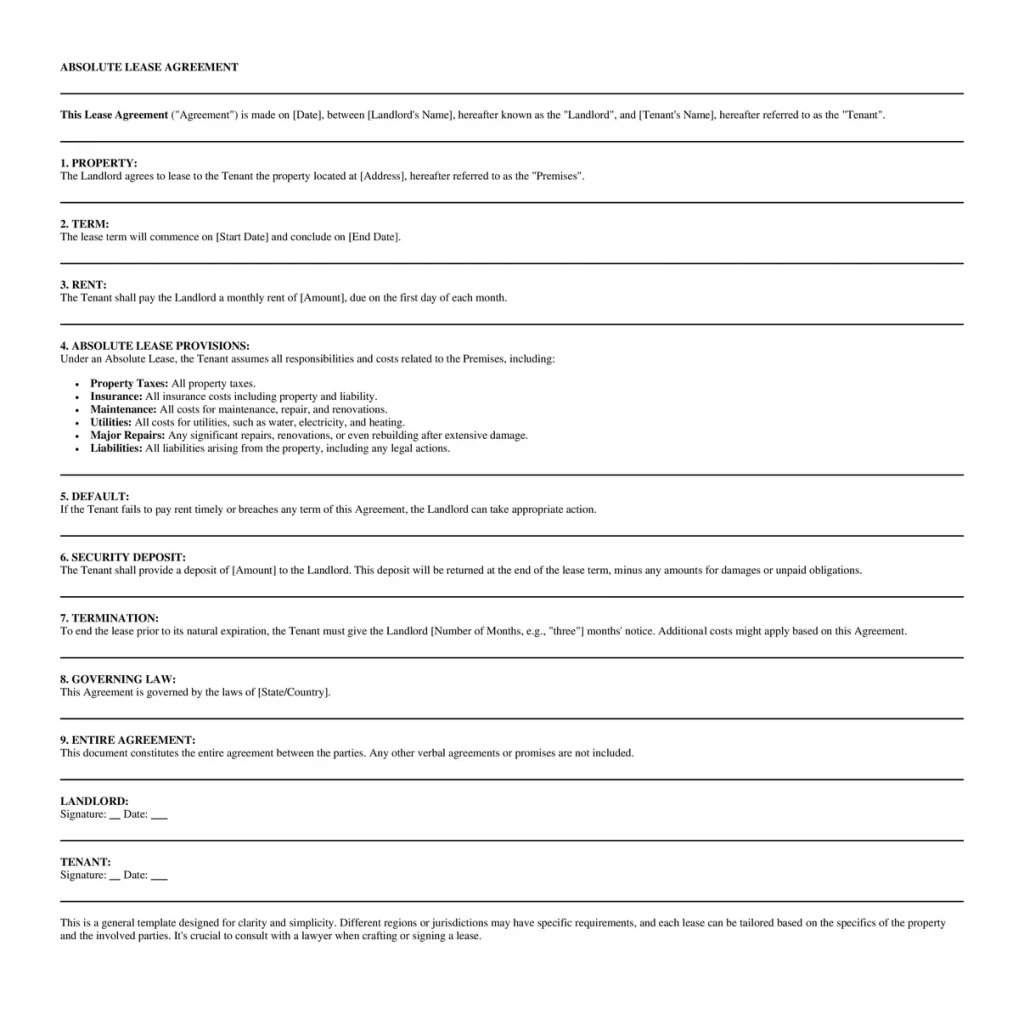

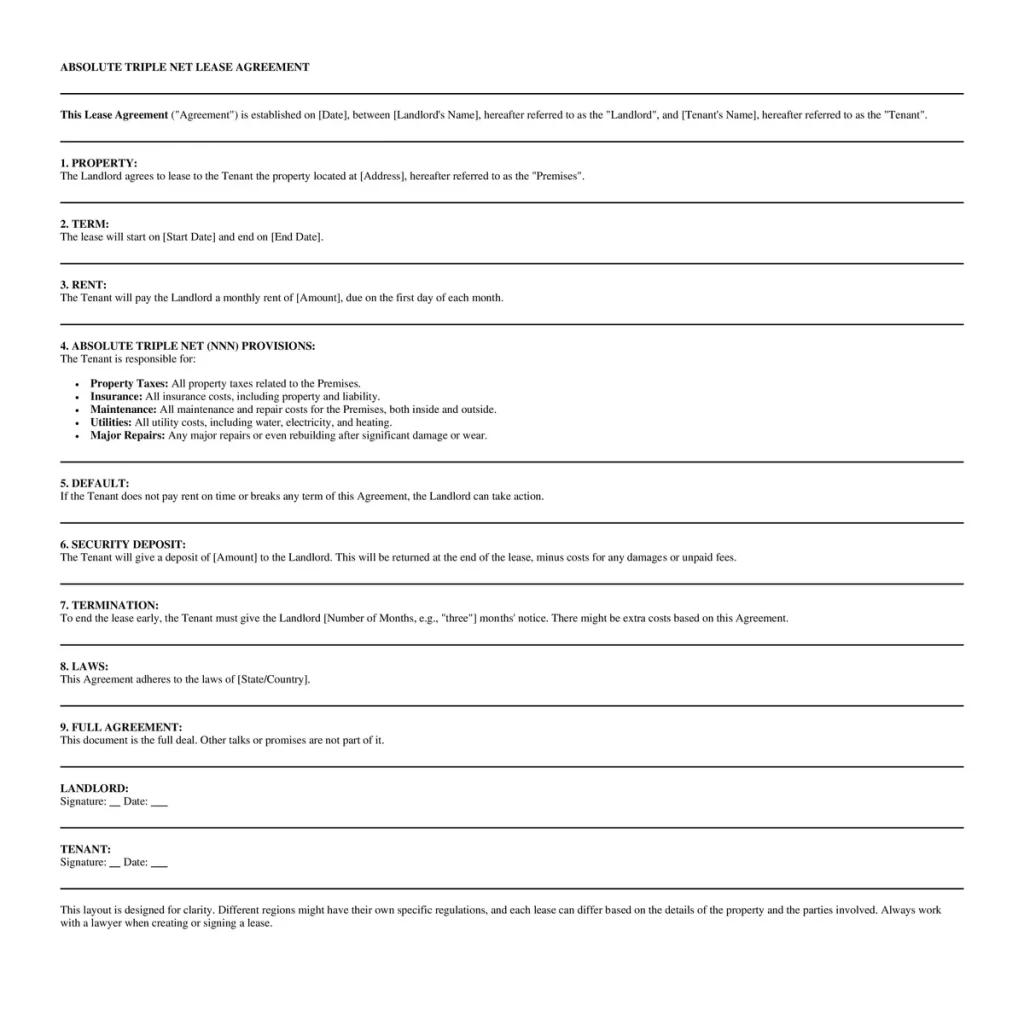

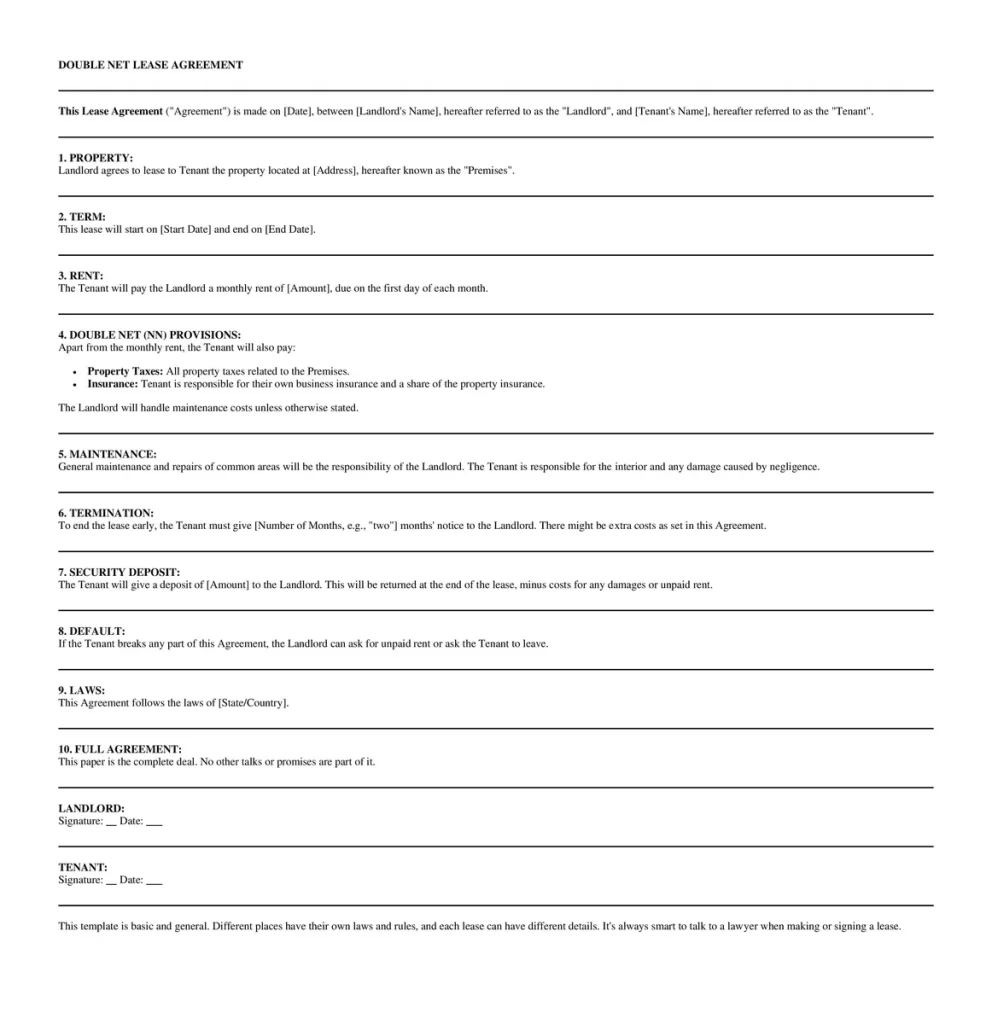

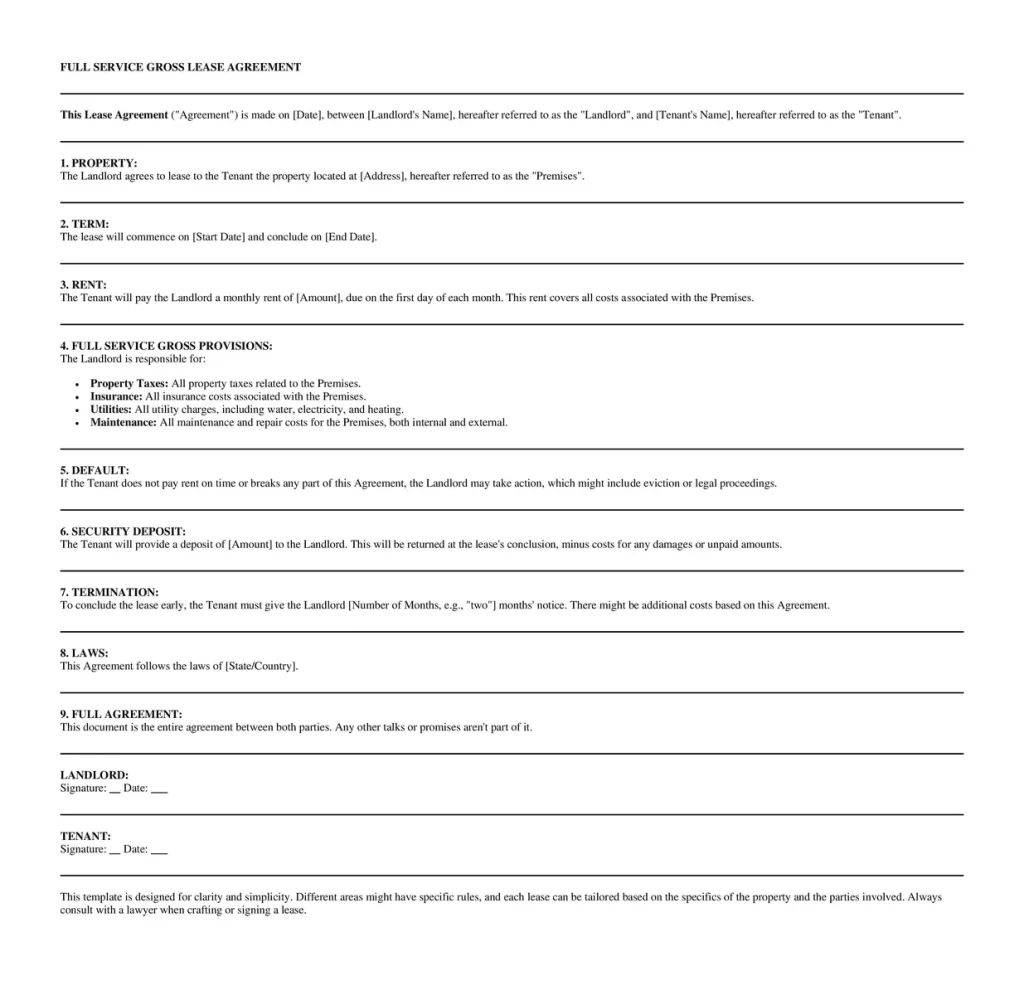

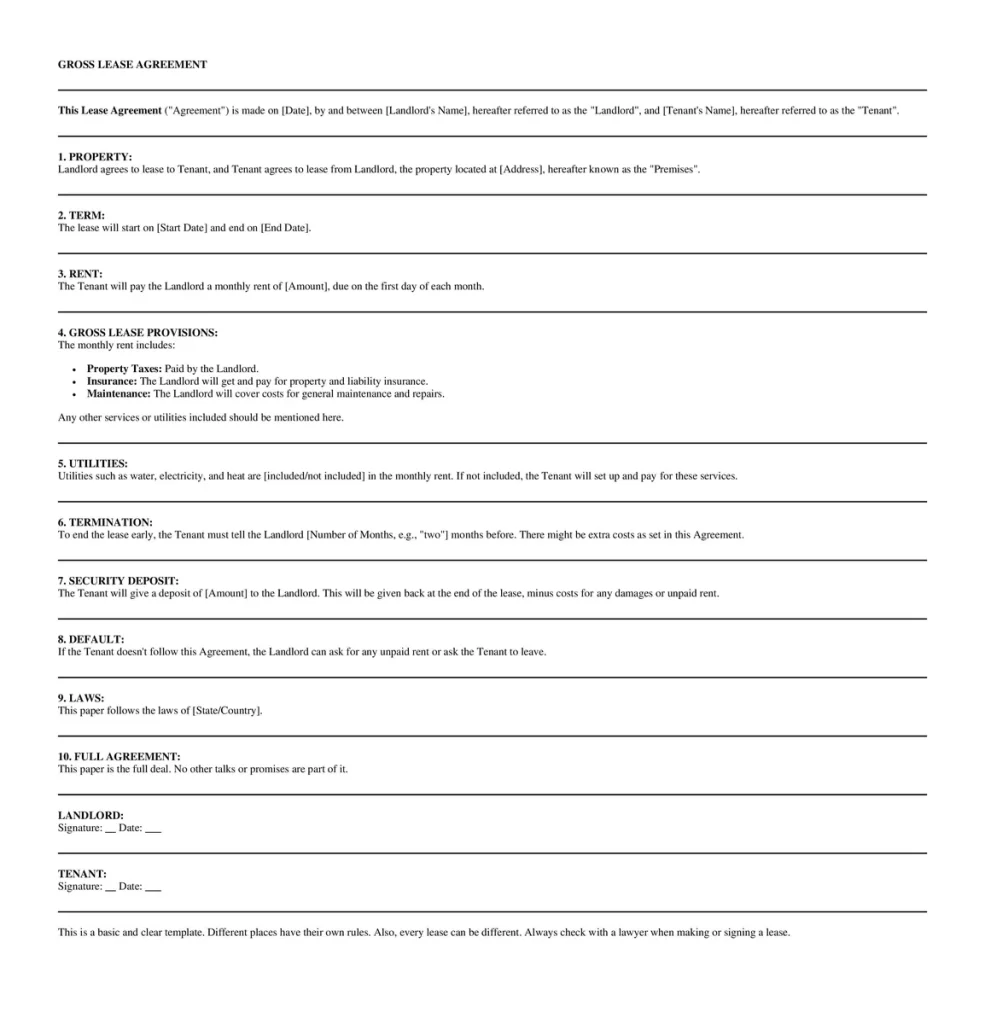

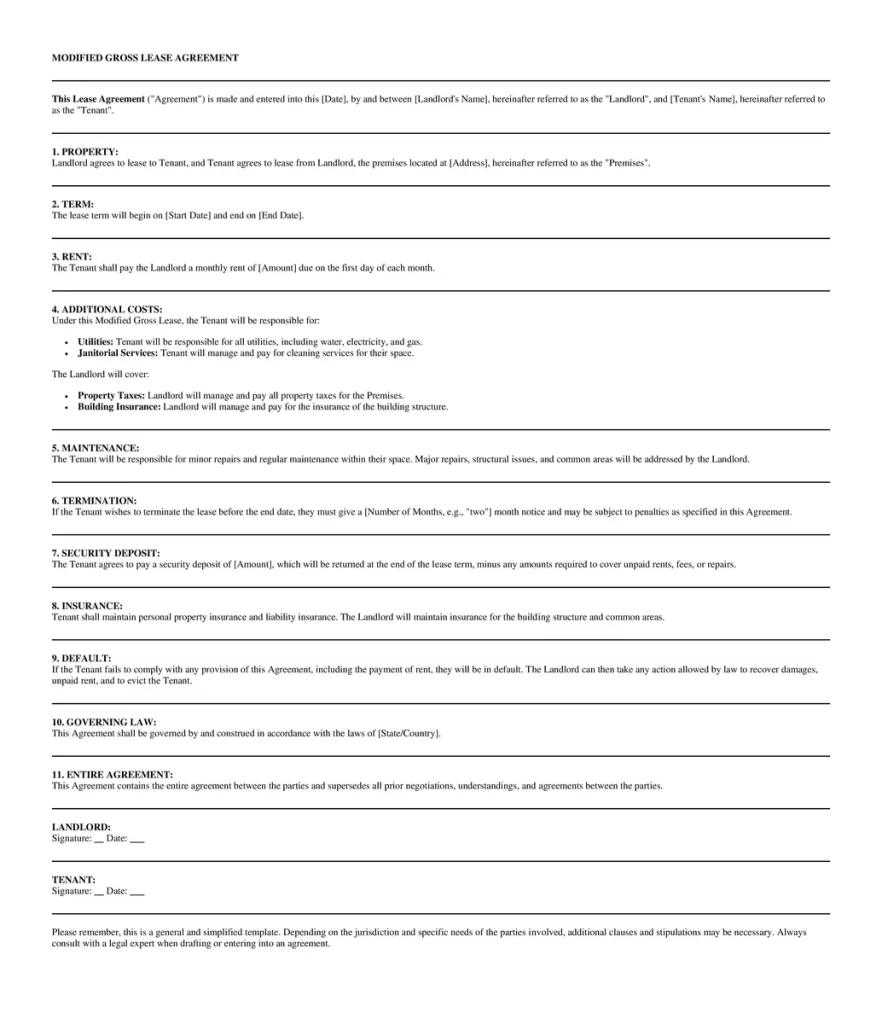

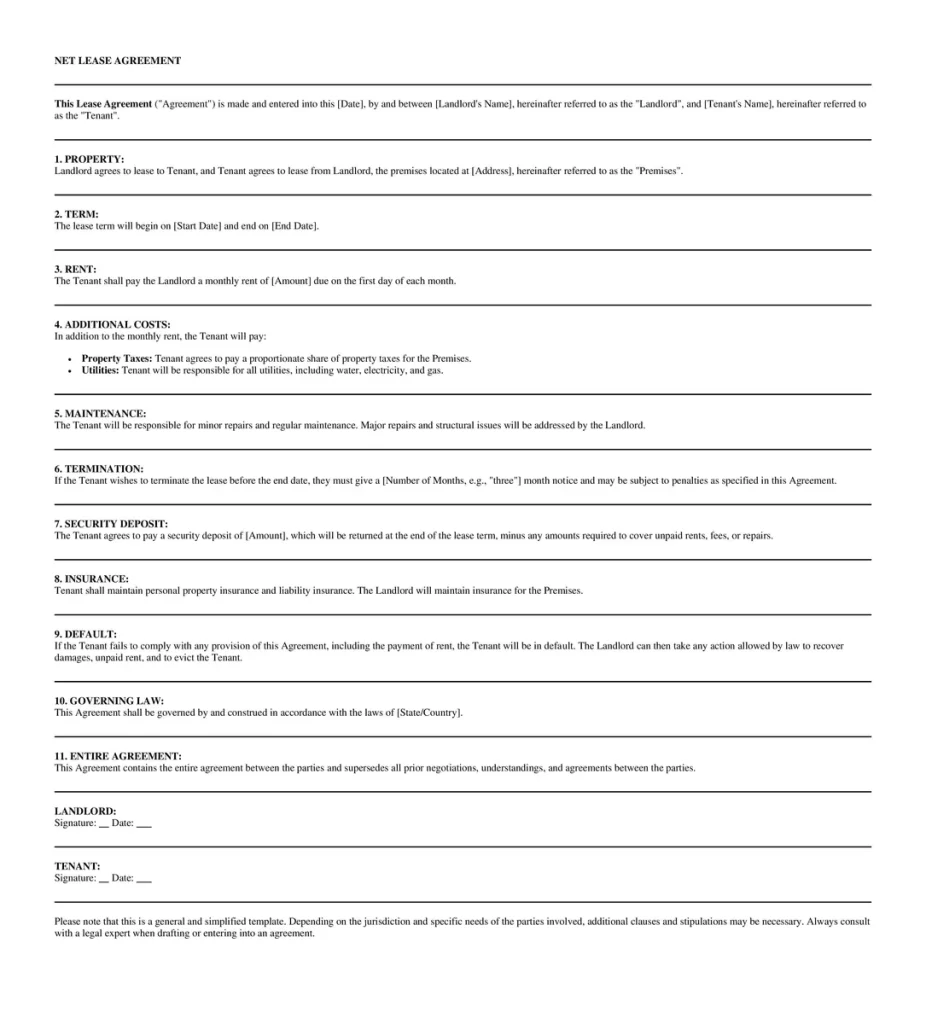

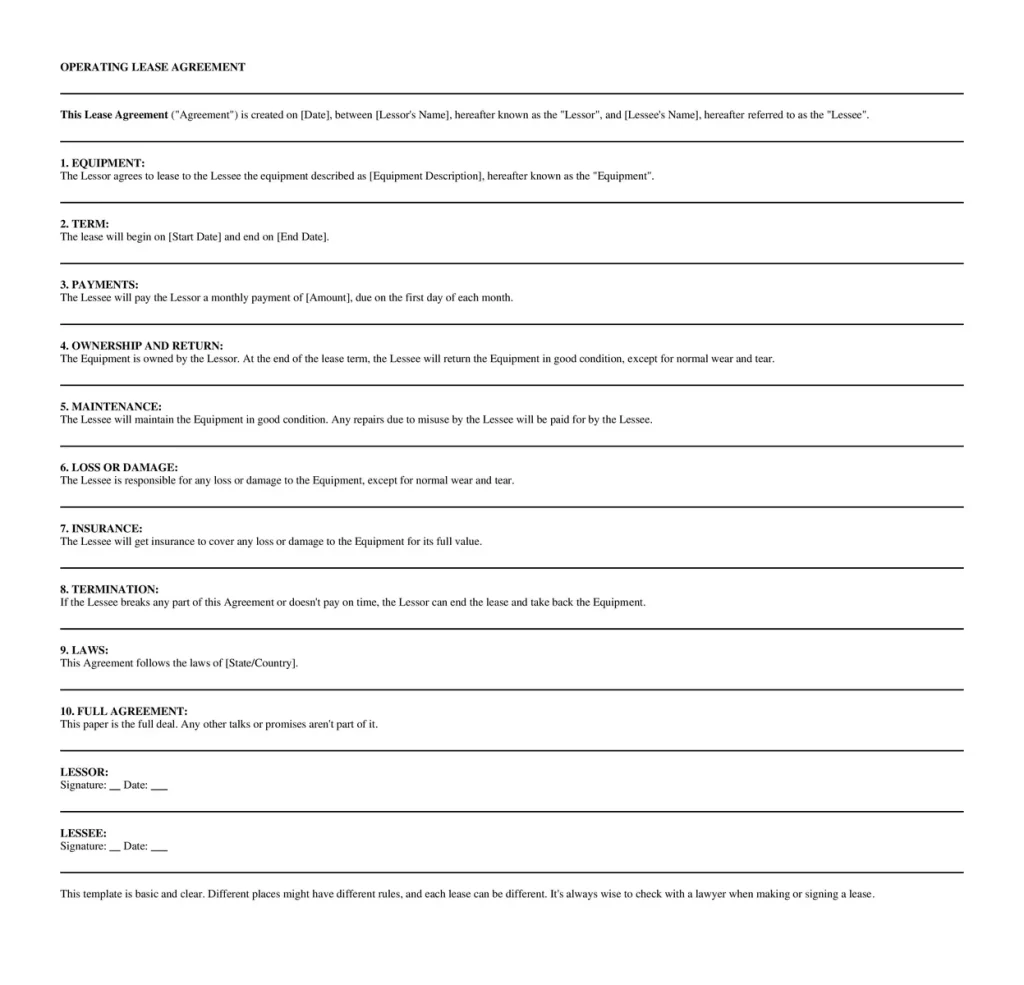

Simple Commercial Lease Agreement Template Word

Commercial Lease Agreement Sample

Terms and Conditions

Therefore, some common terms and conditions should be included in your document.

Understanding the amount for rent

It is an amount that the landlord should put forward in the first place. The owners should take responsibility for calculating the rent amount based on that place’s square footage. You have to ensure the footage used by the landlord for the amount of the rent. For example, suppose the property footage is related to the lift and interior walls. In that case, you have to decide why you should take responsibility for paying off the utilities, property taxes, repair insurance, etc.

Knowing the length of the lease

You should know that almost all of the business property sellers prefer to get long-term lease agreements. Sometimes, it could be better for the new buyer or business. If the homeowners do the same thing, you must ask them to lower the lease agreement term. You have to ask them to renew. Although it might increase the amount to a specific extent, this makes sense than just agreeing on the longer term.

Improvements and amendments

You should understand that the agreement will address the changes, modifications, and improvements that can be made to the rental property. If you plan to make some property changes, you must decide which party would be responsible for paying off the amendments and improvements.

Common Mistakes in Commercial Lease Agreements

Here are some common mistakes that businesses often make when entering into these contracts:

- Not Reading the Entire Agreement:

It might seem basic, but many tenants skim over the lease instead of thoroughly reading it. Overlooking any clause or detail can lead to unexpected issues down the line.

- Failing to Negotiate:

Many tenants assume that lease terms are set in stone. In reality, many aspects of commercial leases are negotiable. Not negotiating can mean missing out on more favorable terms.

- Overlooking Rent Increases:

Some leases have escalation clauses that allow landlords to increase rent annually. Failing to account for these increases can lead to unexpected costs.

- Ignoring Maintenance and Repair Responsibilities:

It’s crucial to understand who is responsible for repairs and maintenance. Some leases require tenants to handle everything from minor repairs to significant system overhauls.

- Not Planning for the Future:

Failing to consider the long-term needs of the business, like the option to renew the lease or expand the space, can restrict the business’s growth potential.

- Skipping Legal Counsel:

Not consulting a lawyer familiar with commercial real estate can be costly. Legal professionals can spot unfavorable terms or potential pitfalls.

- Not Clarifying Termination Terms:

It’s essential to understand under what circumstances the lease can be terminated, any penalties for early termination, and the notice period required.

- Overlooking CAM Charges:

Common Area Maintenance (CAM) charges can vary. Not understanding how these charges are calculated or what they include can lead to unexpected expenses.

- Not Verifying Permitted Use Clauses:

If the lease restricts the property’s use, it can limit your business activities, potentially hampering your operations.

- Failing to Secure an Exclusivity Clause:

Without this clause, landlords can rent nearby spaces in the same building or complex as your competitors.

- Not Accounting for Improvements or Modifications:

Failing to discuss who pays for improvements or how they should be handled at the lease’s end can lead to disputes.

- Ignoring Insurance Requirements:

Many commercial leases require tenants to maintain specific types of insurance. Not adhering to these requirements can lead to breaches of the lease.

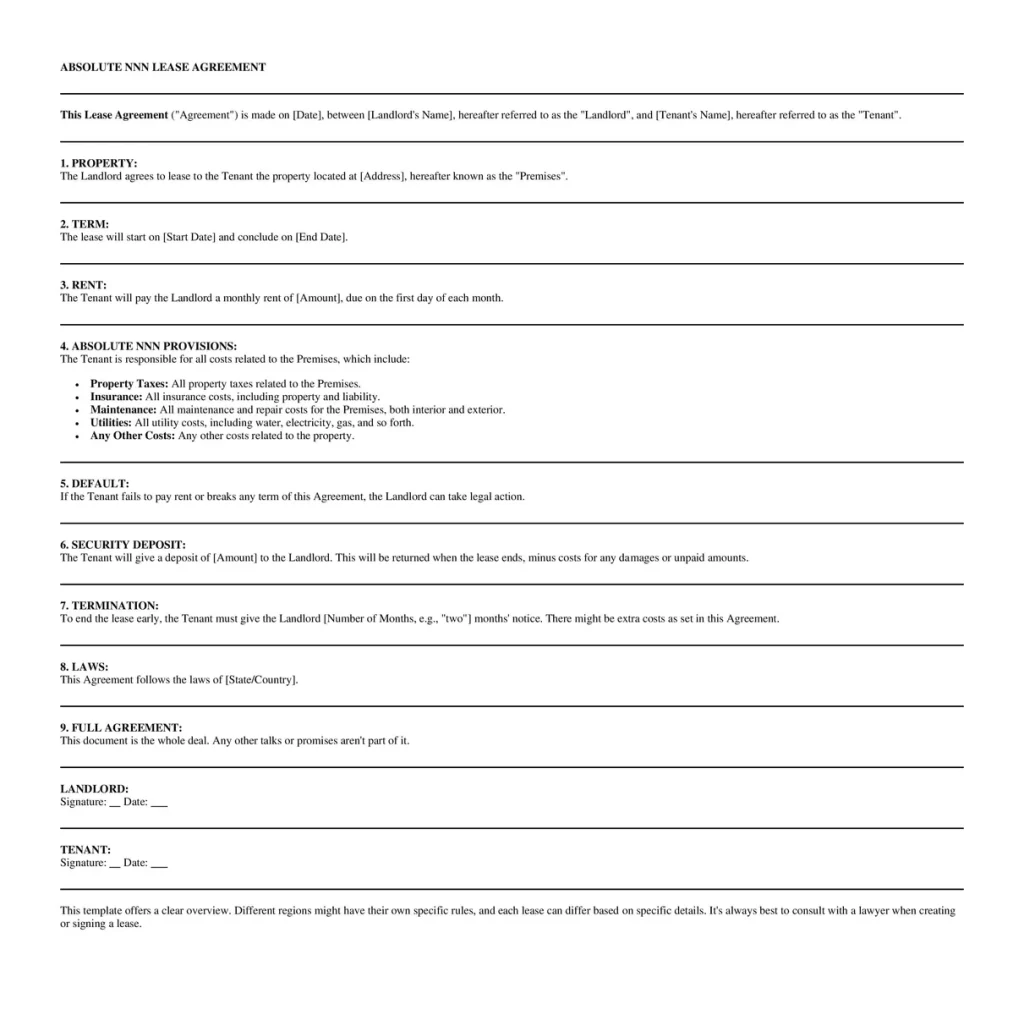

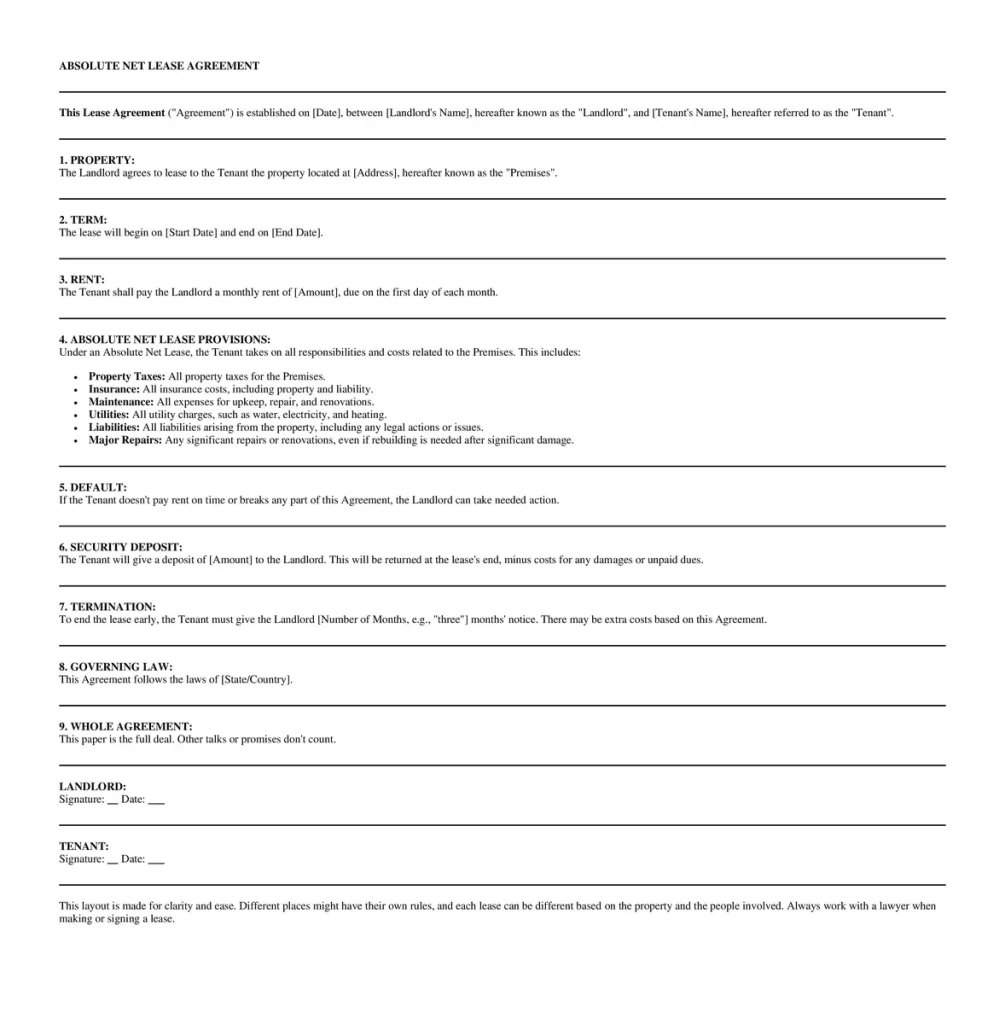

Types of Commercial Lease Agreements

Consider renting a space for your business. There are many ways to do it. Here’s a simple list to help you pick:

- Net Lease:

- What it means: You pay rent and some extra costs like taxes or water bills.

- Why it’s good: Landlords like it because they know how much money they’ll get. You might pay less rent.

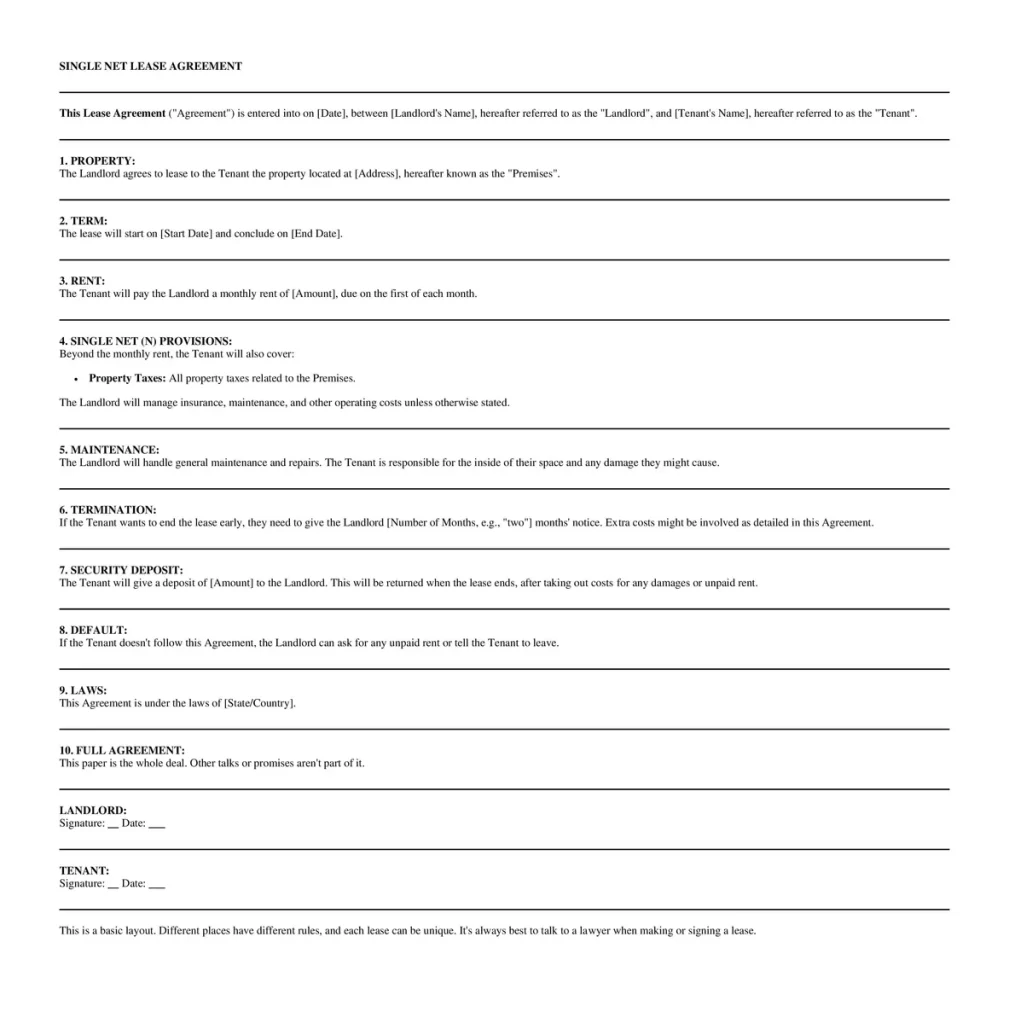

- Single Net Lease:

- What it means: You pay rent and one extra thing, usually taxes.

- Why it’s good: It’s simple. Only one extra thing to think about.

- Double Net Lease:

- What it means: You pay rent and two extra things, like taxes and insurance.

- Why it’s good: It’s fair. Both sides share the costs.

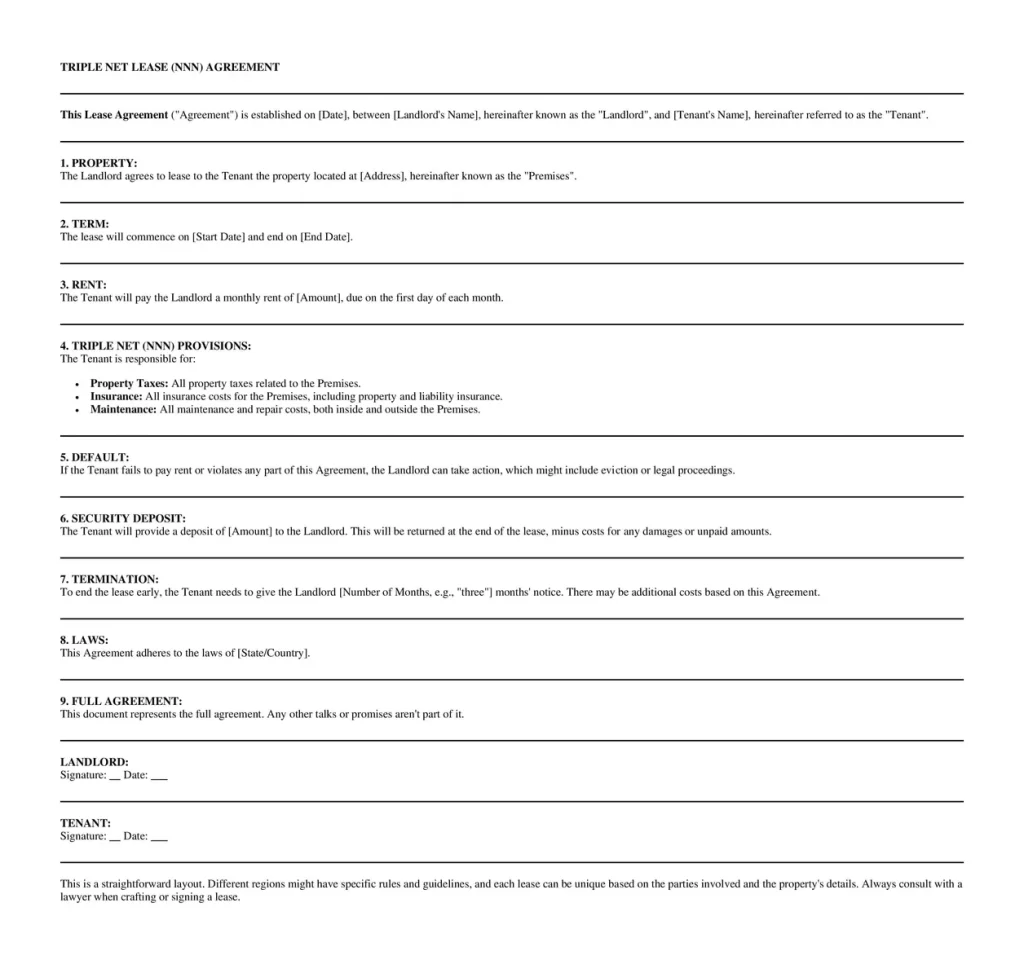

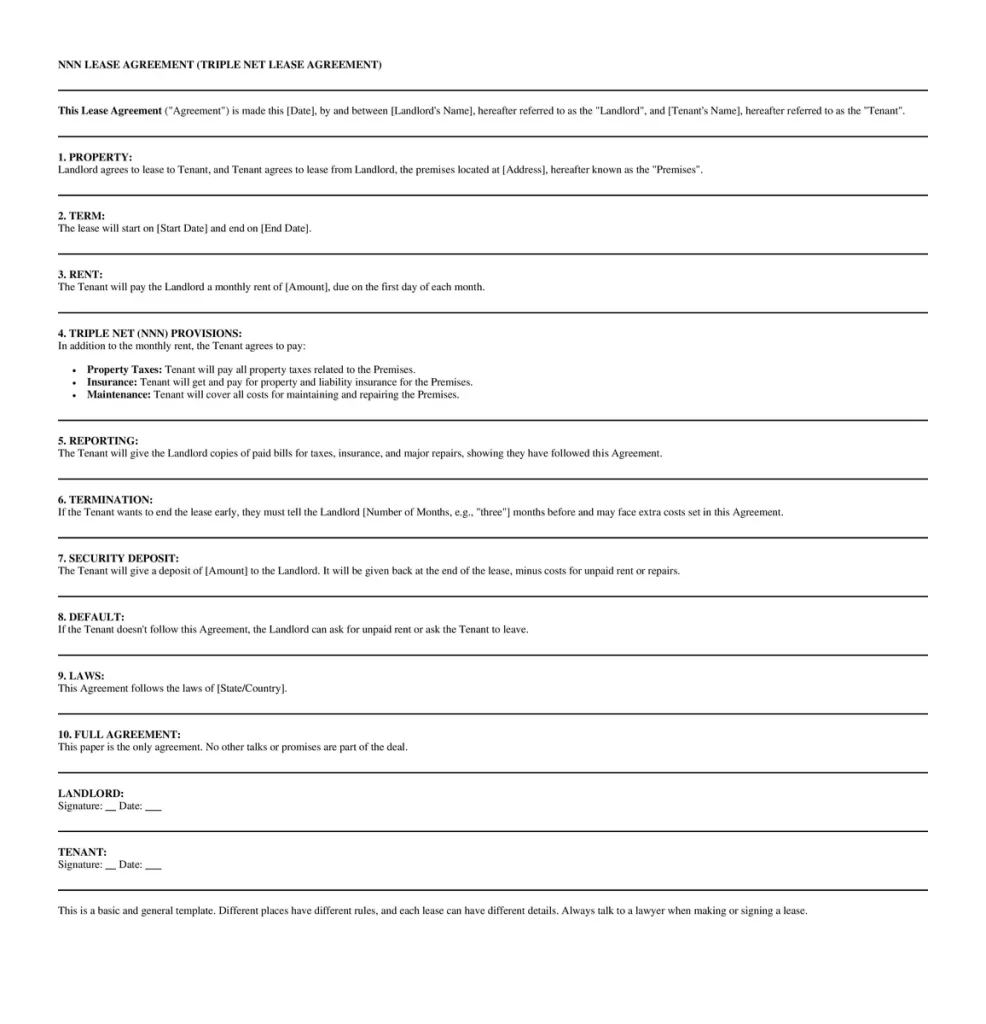

- Triple Net Lease:

- What it means: You pay rent and three extra things: taxes, insurance, and repairs.

- Why it’s good: Landlords like it because they have steady money. You might pay even less rent.

- Absolute NNN Lease:

- What it means: You pay for everything, even big fixes.

- Why it’s good: Landlords get their rent money without surprises.

- Gross Lease:

- What it means: You pay one amount. The landlord uses it for all costs.

- Why it’s good: It’s easy for you. No surprises.

- Modified Gross Lease:

- What it means: It’s a mix. You pay rent, and then you both decide who pays for what.

- Why it’s good: It’s flexible. Both sides can make changes.

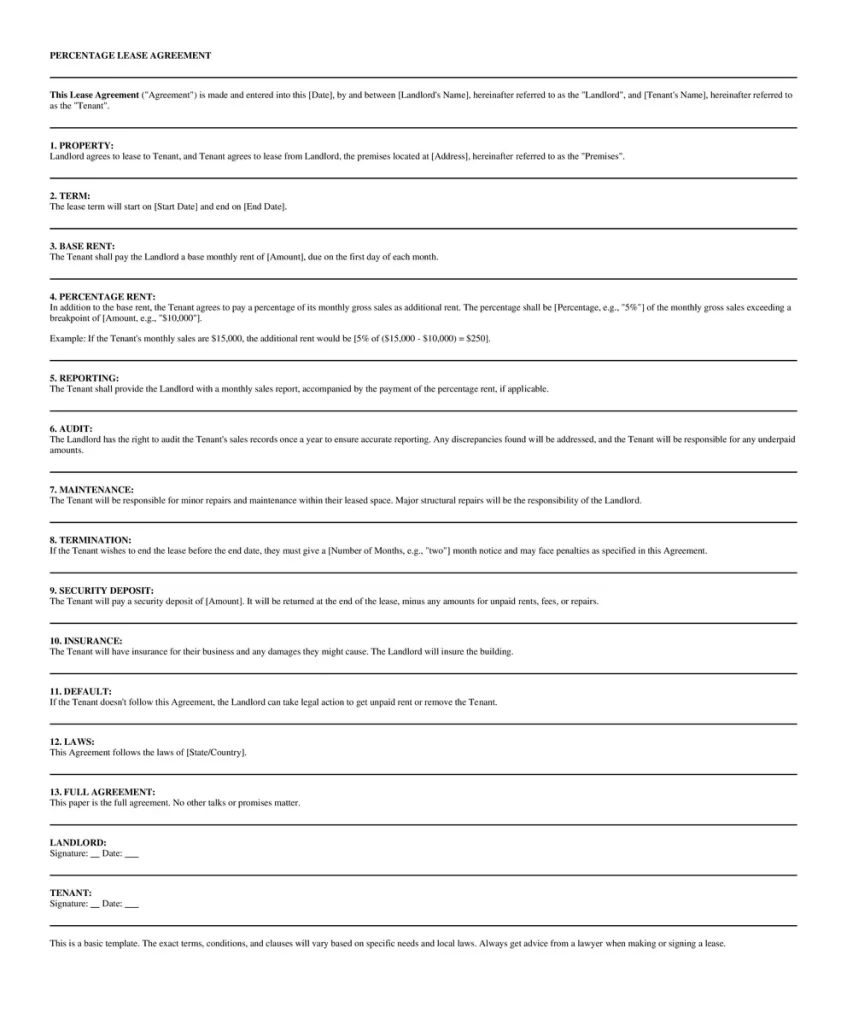

- Percentage Lease:

- What it means: You pay rent and a part of what you earn from sales.

- Why it’s good: Both sides benefit if your shop does well.

- Operating lease:

- What it means: It’s like renting tools or machines. Use them, then return them.

- Why it’s good: It’s short-term. Good if you want to avoid committing.

- Full Service Gross Lease:

- What it means: Just like a Gross Lease. One payment does it all.

- Why it’s good: No extra math. One payment, and you’re done.

Remember: Picking the right way to rent helps you and the landlord. Always know what you’re signing!

How is Rent Calculated in a Commercial Lease?

Renting a place for your business differs from renting a home for businesses. Here’s a breakdown of how rent is typically determined:

- What is Base Rent?

Base rent is the main part of your rent. Think of it like the main dish in a meal. You pay this every month. It’s usually a price for each square foot of the place you’re renting.

Example: Let’s say you want to rent a space that’s 1,000 square feet. If it’s $20 for each square foot, you’ll pay $20,000 annually. That’s about $1,667 each month!

- What are Percentage Leases?

In some places, like malls, you pay the base rent and some of what you earn from your sales. It can benefit you and the landlord, especially if your store gets many customers.

Example: If you earn $50,000 monthly and agree to give 5% as rent, you’ll pay an extra $2,500 along with your regular rent.

- What’s a Triple Net Lease (N)?

In this kind of lease, you pay less base rent and help pay for property taxes and repairs. It’s like sharing the property’s bills with others.

- And Gross Leases?

With a gross lease, you pay one fixed amount each month. It includes your base rent and other costs. It’s like buying a meal combo instead of separate items.

- Will My Rent Go Up?

Sometimes, rents can go up a bit each year. It is called an escalation.

- Are There Extra Costs?

Yes, sometimes there are! For example, there might be fees to help keep shared spaces clean and nice, like lobbies or bathrooms.

- Can Rent Be Reviewed?

For those who rent for a long time, the landlord should change the rent now and then to match what’s usual in the market.

How to Fill Out a Commercial Lease Agreement

Filling out a commercial lease agreement is crucial when renting a space for your business. Here’s a step-by-step guide to help you navigate the process:

- Gather Necessary Information:

Before you start, have all the necessary details on hand:

- Your business details (name, type, registration number).

- Landlord’s details.

- Property details (address, size, specific location).

- Identify the Parties:

- Landlord: The person or entity offering the property for lease.

- Tenant: The business or individual intending to rent the property.

- Specify Lease Term:

- Start Date: When the lease begins.

- End Date: When the lease expires.

- Option for Renewal: Extending the lease term is an option.

- Detail Rent Amount and Payment Terms:

- Rent Amount: Specify the monthly or annual rent.

- Payment Due Date: State the day of the month the rent is due.

- Late Fees: If there are any penalties for late payments, mention them.

- Define the Rentable Space:

Describe the specific area the tenant will be leasing. It could be an entire building, a floor, or a unit.

- Discuss Maintenance and Repairs:

Clearly state who (landlord or tenant) is responsible for what repairs and maintenance tasks.

- Security Deposit:

Mention the security deposit amount, the conditions under which it may be retained, and when it will be returned.

- Insurance Requirements:

State any insurance obligations the tenant must fulfill, such as liability insurance.

- Termination Clauses:

Outline conditions under which either party can terminate the lease early. It could include breach of agreement, damage, or other specified reasons.

- Specify Use of the Property:

Clearly describe what business activities are allowed on the premises. It ensures the tenant uses the property appropriately.

- Improvement and Modifications:

State if the tenant can make modifications or improvements to the space. If so, specify who covers the cost and if the space needs to be returned to its original condition at the end of the lease.

- Address Subleasing:

State whether the tenant can sublease the space and under what conditions.

- Discuss Renewal Terms:

Outline the terms under which the lease can be renewed, including any potential rent increases.

- Additional Provisions:

Include any other terms or conditions specific to the property or desires of the landlord and tenant.

- Signatures:

Once both parties agree to the terms, the landlord and tenant should sign and date the lease. It’s also a good idea to have witnesses or a notary present.

Always read the commercial lease agreement carefully, and consider consulting with a legal professional to ensure you understand all terms and conditions. Once signed, keep a copy for your records.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.